Streaming Analytics Market Size, Share & Industry Analysis, By Component (Software and Managed Services), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Deployment (Cloud-based and On-premises), By Application (Supply Chain Management, Sales & Marketing, Fraud Detection, Predictive Asset Management, Risk Management, and Others), By Industry (BFSI, IT & Telecom, Healthcare, Retail & Ecommerce, Media & Entertainment, Energy & Utilities, Manufacturing, and Others), and Regional Forecast, 2026-2034

Streaming Analytics Market Size

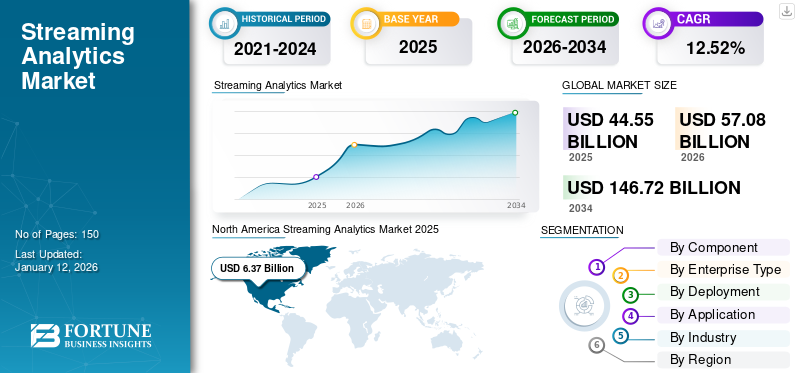

The global streaming analytics market size was valued at USD 44.55 billion in 2025 and is projected to grow from USD 57.08 billion in 2026 to USD 146.72 billion by 2034, exhibiting a CAGR of 12.52% during the forecast period. North America dominated the streaming analytics market with a market share of 14.30% in 2025.

Streaming analytics, also known as event stream processing, involves analyzing large amounts of data records continuously rather than in batches. Typically, these analytics are useful for types of data sources that send data in small sizes. This data is analyzed in real time and further reduces the need for long-term data storage. It involves using specialized software and algorithms to extract valuable information, detect patterns, make decisions, and act on continuously flowing data. This data can come from sensors, financial markets, social media, or any other source that produces a constant stream of information. These analytics are important in various applications, including fraud detection, network performance monitoring, IoT (Internet of Things) data analytics, and more, where timely and dynamic analysis of data is essential.

The streaming analytics market is driven by several factors including incorporation of advanced technologies, such as Machine Learning, Artificial Intelligence, and Big Data, among others. For instance, in September 2023, Confluent launched a fully managed service on Confluent Cloud and introduced Apache Flink to aid businesses in the real-time data processing space. The company also launched an AI data streaming initiative to accelerate the development of real-time AI applications by utilizing the data streaming expertise. Also, the COVID-19 pandemic caused a surge in the demand for these analytics as organizations needed real-time data insights to adapt to rapidly changing conditions. These analytics were majorly used in industries, such as healthcare, e-commerce, and entertainment.

Streaming Analytics Market Trends

Increasing Adoption of Streaming Analytics Platforms to Provide Faster Insights and Actions Will Fuel Market Growth

Consumers and enterprises are increasingly generating huge volumes of data at an unprecedented rate. The volume and variety of data circulating within an organization can often be enormous. Understanding the data context is essential for improving customer relationships, enhancing operational efficiency, minimizing risk, and discovering new opportunities. These analytics extract business value from a large amount of data, while traditional analytics tools use data at rest.

These real-time analytics help companies of all sizes by providing instant alerts when consumer experience deteriorates or fraud is identified. For instance, in October 2023, 21CS acquired IBM Streams to expand into the streaming analytics market. The launch of 21CS Streams will help translate enormous amounts of data in real-time to deliver rapid and effective responses. Moreover, information obtained from real-time analytics can be used to recognize business anomalies and changes (sudden increases in demand for products/services or defaults in manufacturing) as they occur. Such information allows businesses to act immediately and seize opportunities that they might miss. Thus, this factor will promote streaming analytics market growth.

Download Free sample to learn more about this report.

Streaming Analytics Market Growth Factors

Strategic Shift toward Detailed Projections in Real Time to Drive Market Growth

Streaming analytics offers insights through data visualization and provides real-time predictions for streaming data. It uses predictive modeling deployed for customers to support accurate decision-making in real time. This entire iterative process involves rigorous testing with complex data sets and tracking Key Performance Indicators (KPIs), metrics, and important data points related to a specific department. Such a model is made to calculate economic results with the help of a constant data stream that is fed to it. Therefore, these analytics are used to improve business processes and decision-making, and achieve the ability to optimize, automate, and direct decisions as per the company’s needs to achieve its organizational goals. Thus, these factors will boost the growth of the streaming analytics market in the coming years. For instance, in August 2023, Striim, Inc. launched Striim Cloud 4.2, a real-time data integration and streaming platform. This launch provided customers with features including real-time streaming analytics using cloud-based data pipelines and integrating AI-based models with generative AI for in-line event expansion.

RESTRAINING FACTORS

Lack of Streaming Analytics Solutions Integration with Older Systems May Hinder Market Growth

Many companies rely on the existing infrastructure, which contains critical business logic gathered over years of coding, development, and real-world applications. These legacy systems often contain critical data and processes that are still essential to an organization's operations. However, integrating these legacy systems with newer big data technologies and analytics solutions can be difficult. Legacy systems are built with outdated technology and may not be able to handle the volume, velocity, and variety of data that analytics requires. They may not have the API or data integration capabilities needed to integrate with these analytics solutions seamlessly. This lack of connectivity can make it difficult for organizations to get the most out of their existing systems and incorporate real-time operational data from these analytics, thereby hindering the growth of the market.

Streaming Analytics Market Segmentation Analysis

By Component Analysis

Software Segment’s Dominance Driven by the Rise of Real-Time Data Analysis

Based on component, the streaming analytics market is segmented into software and managed services. The software segment dominates the market with a share of 44.89% in 2026. The increasing emphasis on KPI monitoring, real-time data analysis and actionable comprehension is driving the segment’s dominance in the market. Real-time data analysis allows companies to adapt proactively to varying market conditions, new trends, and consumer behavior, enabling them to remain competitive in volatile marketplaces. Enterprises can evaluate their success and performance by continuously tracking KPIs, thereby allowing quick adaptations to strategy and operations. Thus, this factor will boost the global streaming analytics market growth.

The managed services segment is predicted to record the highest CAGR during the forecast period. The adaptability of these services, including professional & managed services, enables businesses to identify the solution to their specific requirements and successfully solve industry-specific problems. Therefore, these factors will play a vital role in driving the growth of the segment.

By Enterprise Type Analysis

Cloud Adoption Fuels Large Enterprises' Embrace of Streaming Analytics for Enhanced Customer Engagement

By enterprise type, the streaming analytics market is bifurcated into large enterprises and small & medium enterprises. The large enterprises segment dominated the market contributing 43.94% globally in 2026. The implementation of these services and software among large-scale enterprises is higher owing to the growing adoption of cloud solutions. The segment is estimated to continue to grow during the forecast period as well. These analytics carry great potential for large businesses as poor presentations can increase their risk of losing customers, eventually affecting their brand name. Thus, this factor is boosting the segment’s growth. For instance, in September 2023, Cloudera launched Cloudera Streaming Analytics 1.9.0 on CDP Private Cloud Base 7.1.8 and 7.1.7 SP2. The launch included advancements in Flink 1.15.1 and in SQL Stream Builder, thereby enhancing the user experience and removing hurdles in the sales cycle.

The small & medium enterprises segment is expected to record the highest CAGR during the forecast period due to several factors, such as rising awareness about the benefits of these analytics software, increasing focus on improving consumer experience, and accessibility to cost-efficient software in the market. These factors will play a vital role in driving the segment’s growth.

By Deployment Analysis

Cloud Segment’s Ascendancy Led by Transforming Analytics with Swift Integration and Cost-Efficient Maintenance

On the basis of deployment, the streaming analytics market is bifurcated into cloud-based and on-premise. The cloud-based segment holds the largest market with a share of 54.04% in 2026. Quick integration and inexpensive maintenance are some of the advantages of the cloud deployment model. These solutions are easier to execute and set up than the traditional on-premises solutions, permitting businesses to benefit from their data analytics activities quickly.

The on-premise segment is expected to record a significant CAGR in the coming years. Organizations use on-premises analytics platforms to detect fraudulent transactions in real time. This can help companies reduce their losses and improve customer protection. Thus, this factor is driving the segment’s growth.

By Application Analysis

Sales & Marketing Segment Leads with Innovative Stream Processing Solutions Focused on Customer Engagement

By application type, the streaming analytics market is categorized into supply chain management, sales & marketing, fraud detection, predictive asset management, risk management, and others.

The sales & marketing segment captured the highest market by contributing 16.62% globally in 2026. This is due to the growing usage of event stream processing solutions in delivering better consumer engagement by employing campaign management, customer profiling, demographic analysis, and other such techniques. Several businesses are also using these solutions more frequently to understand their target market's preferences and customer behavior. Thus, this factor is promoting the segment’s growth.

The predictive asset management segment is expected to record the highest CAGR during the forecast period. These analytics help identify patterns and data that can be used to predict future asset failures. This allows organizations to take preventive actions, such as scheduling maintenance or replacing components before they fail. Therefore, these factors will play an important role in driving the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Industry Analysis

IT & Telecommunications Segment Leads with Customer-Centric Analytics

On the basis of industry, the streaming analytics market is segmented into BFSI, IT & telecom, healthcare, retail & e-commerce, media & entertainment, energy & utilities, manufacturing, and others. The IT & telecommunications segment held a larger market share in 2024. The segment’s growth is attributed to the customer-centric approach adopted by this sector and their rising focus on providing customized, feature-rich products at competitive pricing or via subscription models. Companies in this sector are using these analytics to examine huge amounts of operational data to serve their customers better. Thus, the adoption of these analytics in the IT & telecommunications sector is expected to boost segment’s growth.

The retail & e-commerce segment is expected to record the highest CAGR during the forecast period. Companies from the retail sector have access to multiple data streams, such as inventory reorder times and tracking client activity and business trends, to offer personalized products to clients. Thus, the retail industry is using real-time analytics to detect and prevent fraudulent transactions by analyzing real-time data, helping safeguard the e-commerce platform from financial losses. Thus, this factor boosts market growth.

REGIONAL INSIGHTS

In terms of region, the global streaming analytics market is divided into North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further segmented into different countries.

North America

North America Streaming Analytics Market 2025

To get more information on the regional analysis of this market, Download Free sample

North America holds the largest share in the market. North America dominated the global market in 2025, with a market size of USD 6.37 billion.The region’s growth is attributed to the increasing adoption of IoT devices. These analytics are crucial for monitoring and making sense of the continuous data streams generated by IoT devices. Moreover, North American companies deal with vast amounts of data. These analytics help process this data in real time, allowing for immediate insights and responses. In addition, companies, such as Facebook and Twitter in North America use these analytics for real-time sentiment analysis and content moderation. As a result, North America holds the largest streaming analytics market share. The U.S. market is projected to reach USD 3.97 billion by 2026.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow rapidly during the forecast period. With the rapid expansion of e-commerce in India and China, these analytics are used for real-time order processing, inventory management, and customer insights. Hence, the growing adoption of technology in this region will act as a catalyst for the regional market’s expansion. The Japan market is projected to reach USD 2.91 billion by 2026, the China market is projected to reach USD 3.74 billion by 2026, and the India market is projected to reach USD 4.51 billion by 2026.

Europe

Europe is expected to showcase steady growth over the forecast period. European governments are using these analytics for various public sector applications, such as traffic management, public safety, and environmental monitoring. The high adoption of these analytics in Europe is driven by the need to remain competitive in various industries by leveraging real-time data insights. Thus, the region's focus on data privacy and security also makes analytics a valuable tool for compliance and risk management. The UK market is projected to reach USD 2.2 billion by 2026, and the Germany market is projected to reach USD 2.17 billion by 2026.

South America

Similarly, South America is showing significant growth in this market, with more advanced countries, such as Brazil, Chile, and Argentina leading the way. The streaming analytics technology is becoming increasingly relevant in the region as businesses and governments seek to harness real-time data for better decision-making and resource management. In addition, the Middle East & Africa (MEA) streaming analytics market is expected to witness healthy growth in the coming years due to increased investment in and government funding for digitization.

Key Industry Players

Industry Giants Drive Market Growth through Innovation and Collaborations

Top industry participants are poised to employ merger and acquisition tactics to broaden their operations. Global market leaders are strategically elevating their global footprint and market share by emphasizing product advancements, partnerships, and robust marketing strategies. Their focus remains on devising effective solutions to both bolster and sustain their market presence. The escalating demand for streaming analytics solutions across diverse sectors is forecasted to yield profitable openings for these market contenders.

List of Top Streaming Analytics Companies:

- Microsoft Corporation (U.S.)

- Google (U.S.)

- Software AG (Germany)

- StreamSets (U.S.)

- Cloud Software Group, Inc. (U.S.)

- Confluent (U.S.)

- IBM Corporation (U.S.)

- AWS (U.S.)

- Informatica (France)

- Impetus (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Streams Charts, a live-streaming analytics platform, launched MIRAI, an influencer advertising and marketing agency. The agency offers consulting services, creator partner program, end-to-end campaign management, market insights, and analysis.

- November 2023: ADA, a data and digital transformation company, partnered with Databricks, a data and AI company, to accelerate business value by unifying Artificial Intelligence (AI) and data. The partnership enabled ADA to integrate its data and AI expertise with Databricks, thereby unifying data science, data engineering, machine learning, and streaming analytics in a comprehensive platform.

- September 2023: Timeplus announced that it has licensed Proton open sources for developers globally. Through this, companies can seamlessly create ad hoc reports over large datasets, using both live streaming and historical data and achieve faster results at a smaller cost than with other streaming frameworks.

- August 2023: Microsoft declared the acquisition of Activision Blizzard, Inc. to bring more resourceful and inventive games to performers everywhere and on any device. The acquisition with Activision Blizzard, Inc. focused on driving efforts to further strengthen the company’s culture and accelerate business growth.

- August 2023: Confluent, Inc. entered a partnership with Google Cloud. The expanded partnership helped more consumers transform their enterprises with real-time data and modernize their data platforms with a dependable bridge from their on-premise, multi-cloud data architectures to Google Cloud.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.52% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Enterprise Type

By Deployment

By Application

By Industry

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 146.72 billion by 2034.

In 2025, the market was valued at USD 44.55 billion.

The market is projected to record a CAGR of 12.52% during the forecast period.

The retail & e-commerce segment is expected to lead the market.

Strategic shift toward detailed projections in real time is the key factor driving the market growth.

Microsoft Corporation, Google, Software AG, StreamSets, Cloud Software Group, Inc., Confluent, IBM Corporation, AWS, Informatica, and Impetus are the top players in the market.

North America is expected to hold the highest market share in the streaming analytics sector.

By component, the managed services segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us