Telecom Cloud Market Size, Share & Industry Analysis, By Deployment Model (Private, Hybrid, and Public), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Function Type (Virtual Network Function and Cloud-native Network Function), By Service Type (SaaS, IaaS, and PaaS), and Regional Forecast, 2026 – 2034

Telecom Cloud Market Size

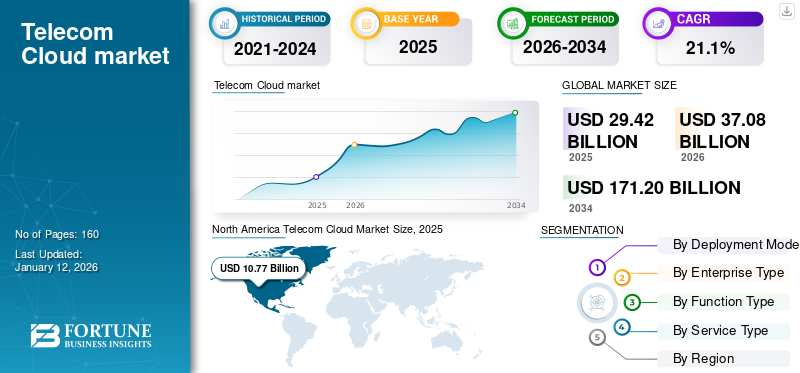

The global telecom cloud market was valued at USD 29.42 billion in 2025. The market is projected to be worth USD 37.08 billion in 2026 and reach USD 171.2 billion by 2034, exhibiting a CAGR of 21.1% during the forecast period. North America dominated the global market with a share of 36.6% in 2025.

Advances in information and communication technology are bringing significant changes to the way businesses operate across the globe. Various governments and public enterprises rely on important information infrastructure services. Additionally, enterprises are increasingly interested in cloud services to meet the growing demand from business operations. Increasing demand for over-the-top cloud services, reduction in operational and management costs, and increasing awareness among enterprises regarding communications cloud are expected to drive the market growth.

With the increasing demand for cost-effective and easy-to-use browser-based communication solutions, many prominent vendors are considering the implementation of industry-specific WebRTC solutions, thereby driving market growth. Nevertheless, the risk of cyber threats is a major hindrance to market growth, as cyber-attacks on telecommunication operators can interrupt the service to telephone and internet customers, and paralyze businesses and government operations.

Further, the increasing number of mobile users drives private cloud demand in the telecommunication sector. Similarly, advanced cloud communication with 5G technology is expected to boost demand for telecom cloud. For instance,

- In February 2023, Tech Mahindra announced an expansion agreement with Microsoft Corporation to support service operators in hosting and operating 5G virtualized network functions using Azure Operator Nexus. Microsoft Cloud enhances the telecommunication industry's network service portfolio and footprints.

Some of the key software included in the market study are Open Telekom Cloud, Huawei Telco Cloud Solution, Cisco Telco Cloud, VMware Telco Cloud Service Assurance, AWS for Telecom, IBM Cloud Pak, and Oracle Cloud for Telcos, among others.

The outbreak of the COVID-19 pandemic has upended industrial operations and organizational work. The rise in remote working employees using conferencing and communication collaboration services increased network traffic. Amid the pandemic, the demand for robust and efficient architecture in the telecom industry has surged. According to the TeleNet data, 71% of U.S. employees were on hybrid or remote work models during the pandemic, thus driving the telecom cloud demand.

Telecom Cloud Market Trends

Rise of Cloud-native in the Telecommunication Industry to Drive Market Growth

The rapid growth in the industry and other technologies is expected to fuel the demand for cloud-native network functions. The lesser automation and agility with the cloud through traditional virtual network functions impacts its effectiveness. Thus, cloud-native with open-source software offers reliable cloud communication. Delegated governance, disposability, system immutability, independent lifecycle, and more provide successful cloud services.

Furthermore, 5G technology and cloud-native network function have offered a game-changing experience and various opportunities for the telecommunication industry. Companies are largely investing in understanding the technology thoroughly and its applications in the sector. This is expected to boost the telecom cloud market share.

Download Free sample to learn more about this report.

Telecom Cloud Market Growth Factors

Increasing 5G Technology to Drive Market Growth

The 5G rollout is growing at an exponential rate across the globe. With its next-generation cellular network, the technology offers the potential to revolutionize the telecommunication sector. According to the PWC and CTIA report, U.S. operators invested up to USD 275 billion. The assured low latency and higher speed capabilities of 5G are expected to boost the demand for the cloud. This is expected to create various opportunities for service providers and end-users. For instance,

- In June 2023, prominent companies in China, such as China Unicom, China Telecom, China Broadnet, and China Mobile, announced a joint agreement to introduce the first 5G inter-network roaming service trial. The companies are integrating 5G networks and the cloud to support digital transformation.

Thus, considering operational perspective and customer requirements, unified communication services, and cloud computing is expected to gain efficiency with 5G, along with its improved cloud availability and benefits of cloud communication. Thus, the rise in 5G pushed the market growth.

RESTRAINING FACTORS

Potential Risk in Data Security to Hamper Market Growth

The cloud expansion of the telecommunication sector might increase the risk of cybersecurity. This increases additional complexities for the vendors and operators. The technology contains robust data that can get compromised by a single error in the security system. Thus, industries must adhere to strong security solutions and vigilantly address each alert. The risks, such as inside threats, third-party risks, and more, are increasing globally. For instance,

- In May 2021, a cloud-based hosting service provider, TPG Telecom, witnessed a cyber-security breach as the customer’s data was compromised.

Thus, rising threats are expected to hamper the market growth.

Telecom Cloud Market Segmentation Analysis

By Deployment Model Analysis

Rapidly Changing Digital Technology to Boost Public Cloud Demand

The market is segmented based on the deployment model into private, hybrid, and public.

Public segment to hold the highest market share during the forecast period. Its scalability and flexibility to meet the constantly changing business needs are expected to drive its adoption. The Public segment is projected to dominate the market with a share of 49.2% in 2026.

The hybrid segment to grow at a significant CAGR during the forecast period owing to its capabilities of offering both the public and private cloud. According to Flexera's 2022 report, 80% of multi-cloud enterprises are approaching hybrid infrastructure. Also, increasing desktop virtualization is expected to propel hybrid cloud demand.

Private will gain a steady growth rate owing to a higher assurance of data security.

To know how our report can help streamline your business, Speak to Analyst

By Enterprise Type Analysis

Large Customer Base to Propel Large Enterprises Investments in the Market

Based on enterprise type, the market is bifurcated into large enterprises and small & medium enterprises.

Large enterprises segment to gain dominant segment share during the forecast period. The demand for more data storage, computation, efficient mobile network, and more is driving the demand for cloud across large enterprises. The Large Enterprises segment is projected to dominate the market with a share of 64.59% in 2026.

Small & medium enterprises segment is expected to witness rapid growth rate, owing to the rise in new opportunities and avenues of exploration. With the rising demand for unified communication and a higher focus on cloud technology, small and medium enterprises are keen on investing in the solution.

By Function Type Analysis

Rising Demand for Enhanced Communication Services to Fuel Virtual Network Function Demand

Based on function type, the market is categorized into Virtual Network Function (VNF) and Cloud-Native Network Function (CNF).

Virtual network function segment to hold the largest market share during the forecast period owing to its capabilities to provide improved communication. The industries invest in this function to enhance vendor independence with lower energy consumption. The VNF (Virtual Network Function) segment will account for 58.8% market share in 2026.

Cloud-native network function is expected to witness a rapid growth rate. It has been significantly deployed along with VNF to offer easy orchestration and scalability. This is expected to boost the telecom cloud market growth.

By Service Type Analysis

Easy Access to Flexible Software to Drive SaaS Demand

By service type, the market is categorized into Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS).

Software-as-a-Service to gain the largest segment share during the forecast period. Its built-in software-defined services help in digitizing enterprise operations. The SaaS helps lower the complexities in cost-effective ways. Thus, businesses are significantly investing in technology. The SaaS segment is expected to account for 40.78% of the market in 2026.

Infrastructure-as-a-Service will showcase a rapid growth rate during the forecast period. The technology helps with flexible infrastructure with minimal cost.

Similarly, the platform-as-a-service segment showcases a steady growth rate, considering its real-time ready-to-use capability.

REGIONAL INSIGHTS

North America

North America to gain dominant revenue share during the forecast period, owing to the rapid growth in 5G technology adoption. The presence of the key telecom industry and top cloud computing players is expected to bolster the market growth in the region during the forecast period. The U.S. is expected to gain maximum segment share owing to increasing and rapidly changing digital data. The U.S. market is estimated to reach USD 9.57 billion by 2026.

North America Telecom Cloud Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific will witness a rapid growth rate during the forecast period. The increasing mobile audience is expected to propel market growth in China and India. With growing opportunities after the 5G rollout in India, the telecommunication service and infrastructure providers are keen on addressing the cloud. This is expected to boost the country's digital transformation and build a strong economy, thus boosting the Asia Pacific market. Similarly, in South Korea, various collaborations are taking place in the telecommunication sector, owing to future opportunities. The Japan market is forecast to reach USD 1.85 billion by 2026. The China market is poised to reach USD 2.14 billion by 2026. The India market is set to reach USD 1.73 billion by 2026.

Middle East & Africa

The Middle East & Africa to gain significant growth rate after Asia Pacific. The focus is on digitalization and advanced communication to boost market growth.

Europe

Europe to showcase a steady growth rate due to rising business opportunities and increasing digital customers. The UK market is expected to reach USD 0.94 billion by 2026. The Germany market is anticipated to reach USD 1.11 billion by 2026.

Rest of The World

South America will grow steadily due to various foreign investments in the telecom industry. For instance, in May 2023, China Telecom introduced eSurfing cloud services in Brazil in collaboration with its subsidiary China Telecom do Brasil (CTB). The expansion of cloud solutions and the sector is expected to boost the market share.

Key Industry Players

Partnership and Strategic Engagement by Key Players to Propel Market Growth

Key market players are entering into significant strategic partnerships with telecommunication providers and cloud companies. Through this strategy, the players gain capabilities to help offer enhanced and efficient client solutions. The players invest in research & development to understand future needs and technological advancements. Market players are introducing new solutions for clients across the globe that help integrate 5G technology, accelerate customer satisfaction, and boost revenue generation.

List of Top Telecom Cloud Companies

- VMware, Inc. (U.S.)

- IBM Corporation (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Cisco Systems, Inc. (U.S.)

- Google LLC (Alphabet LLC) (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Amazon Web Services, Inc. (Norway)

- Microsoft Corporation (U.S.)

- Oracle Corporation (Munich)

- Deutsche Telekom (Japan)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Dell Technologies announced updated solutions designed to help communications service providers (CSPs) accelerate network cloud and achieve improved economics and agility while keeping network reliability. Dell leverages its years of experience in digital transformation and deep industry partnerships to help CSPs simplify deployment, automate operations, and simplify support and the lifecycle management of distributed network and cloud infrastructure.

- June 2023: Nokia Corporation strategically announced a collaboration with Red Hat, Inc. to integrate open-source solutions such as Red Hat OpenShift and Red Hat OpenStack Platform into its network application. The collaboration supports Nokia testing and development, and the Red Hat cloud offers flexibility and deployment options.

- February 2023: A data cloud company, Snowflake Inc., launched Telecom Data Cloud to deliver industry-specific data insights that can help clients drive enhanced decisions. The new solution is helping modernize the telecommunication network, and operational efficiency helps maximize revenue.

- February 2023: Dell Technologies introduced its new collaboration of Dell Telecom Infrastructure Blocks for Red Hat to help sectors with open network architecture. The new solution helps implement 5G technology and its radio access network.

- February 2023: Google LLC introduced three unified cloud solutions for the telecommunication industry: telecom data fabric, telco subscriber insights, and telecommunication network automation. The new telco cloud products aim to support communication service providers with hybrid cloud principals, helping collect data and improving customer experience.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading product types of telecom cloud. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.1% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Model

By Enterprise Type

By Function Type

By Service Type

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 171.2 billion by 2034.

In 2025, the market was valued at USD 29.42 billion.

The market is projected to grow at a CAGR of 21.1% during the forecast period.

The software-as-a-service segment is expected to lead the market.

Growing 5G technology is driving market growth.

VMware, Inc., IBM Corporation, Telefonaktiebolaget LM Ericsson, Cisco Systems, Inc., Google LLC, Huawei Technologies Co., Ltd., Amazon Web Services, Inc., and Microsoft Corporation are the top players in the market.

North America is expected to hold the highest market with a share of 36.6% in 2025.

By deployment model, the hybrid segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us