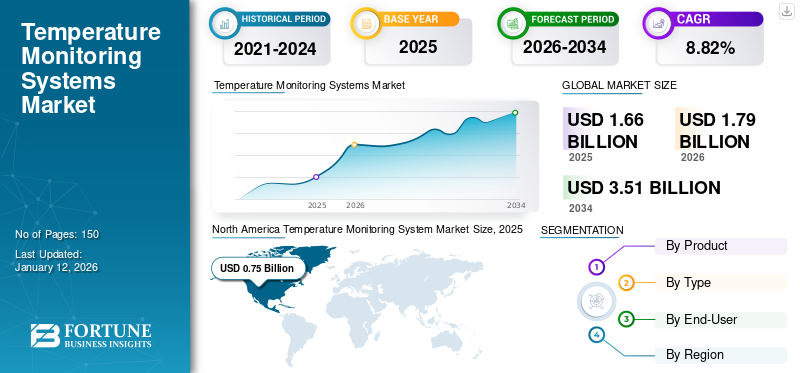

Temperature Monitoring System Market Size, Share & Industry Analysis, By Product (Analog Temperature Monitoring Devices and Digital Temperature Monitoring Devices), By Type (Contact and Non-Contact), By End-user (Healthcare Facilities, Home Care Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global temperature monitoring system market size was USD 1.66 billion in 2025 and is projected to grow from USD 1.79 billion in 2026 to USD 3.51 billion by 2034 at a CAGR of 8.82% during the forecast period. North America dominated the temperature monitoring system market with a market share of 45.54% in 2025.

A body temperature monitor is a medical device intended for checking and monitoring body temperature for adults and children aged two and above. Various forms of thermometers are used to monitor vital signs that include body temperature. Technological advancements in thermometers are expected to propel the growth of the temperature management market during the forecast period. Previously, thermometers were mainly controlled via manual measures but temperature monitoring devices are more precise and easier to use with digital technology. The integration of artificial intelligence, cloud platforms, and digitalization has revolutionized the field of temperature monitoring in recent years. Furthermore, the usage of remote temperature monitoring systems has been witnessing a greater adoption in the past few years.

The COVID-19 pandemic positively impacted market growth. With the increasing cases of COVID-19 across the globe, temperature monitoring systems witnessed a robust surge in demand. The growing adoption of these products for time-to-time patient temperature management had majorly boosted the demand for these products. Moreover, the increasing number of product launches further supported the market growth.

- For instance, in May 2020, DetelPro announced the launch of an infrared thermometer in India. The thermometer is a digital monitoring system and helps to record temperature from a distance of 3-5 cm with an aim to avoid cross-infection.

However, with the lowering cases of COVID-19, the market witnessed a slower growth in 2022 and 2023 and is expected to witness a steady growth over the forecast period.

Global Temperature Monitoring System Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.66 billion

- 2026 Market Size: USD 1.79 billion

- 2034 Forecast Market Size: USD 3.51 billion

- CAGR: 8.82% from 2026–2034

Market Share:

- Region: North America dominated the market with a 45.54% share in 2025. The region's growth is driven by the increasing prevalence of infectious diseases, such as COVID-19 and influenza, which boosts the adoption of temperature monitoring systems.

- By Product: Digital temperature monitoring devices held the leading market position in 2024. This dominance is attributed to timely product approvals, the easy availability of technologically advanced products, and a surge in demand for digital systems to support social distancing guidelines during the pandemic.

Key Country Highlights:

- Japan: The market is driven by technological innovation from major domestic players. For example, a partnership between Analog Devices, Inc., and Japan Advanced Semiconductor Manufacturing, Inc. aims to develop advanced sensor chips for these devices.

- United States: Growth is fueled by the high prevalence of infectious diseases, which created a strong demand for monitoring devices. For instance, in July 2020, around 3.8 million confirmed cases of COVID-19 were reported. The market is also supported by consistent U.S. FDA approvals for new products, such as Masimo's Rad-G with temperature monitoring.

- China: As a key country in the fast-growing Asia Pacific region, China's market is expanding due to increasing awareness about temperature management and a rising number of companies introducing innovative product portfolios to meet consumer demand.

- Europe: The market is advanced by an increase in funding for clinical trials of digital thermometers and a rising number of hospital admissions. Key players in countries such as France and Germany have been actively launching new contactless thermometers to meet regional needs.

Temperature Monitoring System Market Trends

Increasing Demand for Non-Contact Sensor Based Thermometers to Drive Growth

The COVID-19 pandemic drastically changed the landscape of temperature monitoring devices with a very high demand for non-contact sensor-based thermometers to contain the spread of the virus. This was majorly due to the various advantages offered by these devices over others. Infrared sensors-based thermometers facilitate precise non-contact temperature measurement in healthcare applications. The primary form of applications for this type of thermometer includes the measurement of forehead temperature, ear temperature, or skin temperature. The temperature detecting element comprises numerous thermocouples on a silicon chip to measure an object's infrared energy.

Moreover, rise in COVID-19 cases, along with social distancing norms boosted the use of these devices. This factor has led to a surge in the demand for non-contact infrared sensor-based thermometers across the globe. Thus, to meet the potential demand for thermometers, several companies opt for inorganic strategic partnerships to manufacture digital infrared thermometers. For instance, in April 2020, Shoppemex announced its latest product launch, an infrared digital thermometer that can deliver ultra-fast body and surface temperature readings without contact.

Download Free sample to learn more about this report.

Temperature Monitoring System Market Growth Factors

Increasing Technological Advancements in Temperature Monitoring Devices to Propel Market Growth

The increasing demand for temperature monitoring systems across the globe, especially during the COVID-19 pandemic, has augmented the growth of this market. Several companies have manufactured digital thermometers for precise and accurate body temperature measurements due to the growing demand for such devices. These devices are incorporated with novel technologies to eliminate fluctuated readings and minimize errors coupled with better user handling facilities. Such developments are projected to augment the thermometers market value during the forecast period. For instance, in January 2021, Fitgo announced the launch of a new infrared thermometer in India and other countries. The device can be used for elders, infants, and adults.

Launch of Cutting-edge Temperature Monitoring Products to Bolster Market Development

With the high demand for thermometers, manufacturing companies are shifting their focus to the integration of advanced technologies and novel features in their products. The introduction of novel temperature monitoring products is expected to have a significant impact on the healthcare industry. Several advantages associated with these innovative products also support their increasing adoption. Some of these advantages include reduced response times, ease of usage, continuous monitoring, and others. For instance, in May 2020, French brand ZOOOK, a pioneer in innovative consumer technology products, announced the launch of a contactless thermometer developed as per the requirements in the wake of COVID-19. These factors may drive the temperature monitoring system market growth.

RESTRAINING FACTORS

High Contamination Risks Associated with Mercury-based Thermometers May Limit Industry Growth

Despite the high demand for thermometers globally, certain factors are limiting the market growth. Among them is the risk of mercury poisoning from mercury-based thermometers. The silver ball in the thermometer is very toxic to humans if the glass of the device breaks or is not cleaned correctly. Therefore, due to the high risk associated with contact thermometers, individuals are less likely to adopt contact thermometers, resulting in market growth limitations.

Temperature Monitoring System Market Segmentation Analysis

By Product Analysis

Rising Adotpion of Digital Monitoring Devices Led the Dominance of Digital Temperature Monitoring Devices

Based on product, the market is divided into digital temperature monitoring devices and analog temperature monitoring devices.

The digital temperature monitoring devices segment marked the leading position with a share of 70.97% in 2026. The strong position of the segment is attributed to timely product approvals, along with the easy availability of technologically advanced products. Moreover, the surge in demand for devices amid the COVID-19 pandemic led to increased sales volume of the digital systems due to social distancing guidelines implemented to lower infection rates.

Additionally, the demand for digital thermometers is anticipated to remain dominant during the forecast period registering a higher CAGR. The rising preference among the population towards digital monitoring systems is leading to increasing focus of the companies to launch more innovatie products to cater to the demand.

- In June 2020, DetelPro announced the launch of its digital thermometer. The company has launched this product to accelerate the penetration of digital thermometers to every household amid the pandemic.

Analog temperature monitoring devices are expected to grow and to witness slower growth than digital devices due to the shift of individuals toward the adoption of digital systems. However, the robust efforts of the companies to develop and introduce technologically advanced products in the market is expected to fuel the growth of the segment.

- In February 2024, Analog Devices, Inc., extended its partnership with Japan Advanced Semiconductor Manufacturing, Inc., with an aim to integrate the companies’ technology and develop advanced sensor chips for the devices.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Non-Contact Thermometers Dominated the Market Backed by Rising Partnerships

By type, the market is classified into contact and non-contact thermometers.

The non-contact thermometer segment dominated the market with a share of 66.61% in 2026. This factor is due to the increasing number of partnerships among various companies to manufacture such devices. For instance, in May 2020, Segun Life, a well-known brand in healthcare devices and wearables, partnered with TCL to launch infrared digital thermometers to aid the battle against COVID-19 in India.

The contact-based thermometer segment is anticipated to exhibit significant growth over the forecast period. This is majorly due to the increasing prevalence of COVID-19 cases, leading to strict social distancing and home quarantine measures. Therefore, the adoption of thermometers for timely monitoring of the body temperature is likely to contribute to the segment growth.

By End-user Analysis

Healthcare Facilities Segment to Show the Highest CAGR Backed by Growing Adoption

Based on end-user, the market is divided into healthcare facilities, home care setttings, and others.

The healthcare facilities segment is expected to lead the market, contributing 64.01% globally in 2026, owing to the growing adoption of the thermometers with an aim to enhance patient care. For instance, due to the sudden emergence of COVID-19 infection in March 2020, the demand for infrared thermometers peaked. Further, increasing patient visit in the hospital settings is likely to boost the growth of the segment in the forecasted timeframe.

The home care settings segment is anticipated to exhibit significant growth during the forecast period owing to the increased usage of thermometers by the individual user for personal use. Furthermore, the growing geriatric population requiring healthcare at home also supports the segment growth.

REGIONAL INSIGHTS

By region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Temperature Monitoring System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 0.75 billion in 2025. The dominance of the region is attributable to the increasing prevalence of infectious diseases, such as COVID-19, influenza, and others, thereby boosting the adoption of temperature monitoring systems. For instance, according to the Centers for Disease Control and Prevention (CDC), in July 2020, around 3.8 million confirmed cases of COVID-19 were reported in the U.S. Moreover, the presence of key players operating in the region will further boost temperature monitoring system sales. The U.S. market is projected to reach USD 0.75 billion by 2026.

Asia Pacific

The market in the Asia Pacific is likely to witness the highest CAGR over the analysis period. the growth of the region is owing to the increasing awareness pertaining to temperature management among the population during the COVID-19 pandemic coupled with the increasing number of companies with innovative product portfolio. For instance, in June 2020, Secureye launched a non-contact thermometer under its MediSec product range in India. The Japan market is projected to reach USD 0.12 billion by 2026, the China market is projected to reach USD 0.1 billion by 2026, and the India market is projected to reach USD 0.04 billion by 2026.

Europe

The market in Europe is anticipated to witness considerable growth owing to an increase in funding for clinical trials of digital thermometers. The rising prevalence of infectious diseases and growing hospital inpatient admissions for various conditions in the countries such as U.K., Germany, and others is a major factor contributing to the growing demand of temperature monitoring devices in the region. The growing demand along with increasing product approvals and launches in the region are expected to boost the growth of the region during the forecast period. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Latin America, and the Middle East & Africa

Latin America and the Middle East & Africa markets are anticipated to account for a lower temperature monitoring system market share. This is due to the comparatively lower adoption of these devices.

Key Industry Players

Launch of Devices by Prominent Players to Maximize Product Offerings

The market structure is fragmented due to the strong product portfolio of temperature monitoring system manufacturers and the remarkable distribution network of major companies in developed and emerging economies. Moreover, the number of companies focusing on the launch of non-contact thermometers has increased exponentially during the pandemic, resulting in the availability of a number of brands. This factor led to an increase in the adoption of temperature monitoring systems by the population, thereby contributing to revenue growth of companies. Thus, emphasis on the launch of advanced temperature monitoring devices is one of the strategies adopted by key players.

LIST OF TOP TEMPERATURE MONITORING SYSTEM COMPANIES:

- Koninklijke Philips N.V. (Netherlands)

- Masimo (U.S.)

- Omron Healthcare (Japan)

- Geratherm (Germany)

- Braun Healthcare (Germany)

- A&D Company Ltd. (Japan)

- Toshiba Inc. (Japan)

- 3M (U.S.)

- Exergen Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 – Metropolitan Wireless International introduced the temperature monitoring wireless sensors in the Indian market.

- August 2023 - E+E Elektronik launched HTS801 – a high-sensitivity humidity and temperature sensor.

- April 2023 – Masimo received the U.S. FDA approval for its Rad-G with temperature, a handheld monitor that provides clinically proven SET® pulse oximetry, respiration rate from the pleth (RRp®), and other important parameters alongside non-contact infrared clinical thermometry.

- May 2020 – Neptune Wellness Solutions Inc. announced the launch of Neptune Air, a non-contact infrared thermometer (NCIT).

- May 2020 – ZOOOK announced the launch of the infra-temp contactless medical-grade thermometer.

REPORT COVERAGE

The research report offers a detailed or in-depth analysis of this market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.82% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to reach USD 3.51 billion by 2034.

In 2025, the North America market value stood at USD 0.75 billion.

Growing at a CAGR of 8.82%, the market will exhibit steady growth during the forecast period.

The digital temperature monitoring devices segment is the leading segment in the market during the forecast period.

The increasing number of COVID-19 cases across the globe is driving the growth of the market.

The global market value in 2025 was USD 1.66 billion.

In terms of share, North America dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us