Thermal Management System Market Size, Share & Industry Analysis, By Type (Active, Passive, and Hybrid), By Application (Automotive, Consumer Electronics, Data Centers, Industrial Equipment, Renewable Energy, Aerospace & Defense, Telecommunication, Medical Devices, and Others), By Technology (Liquid Cooling, Air Cooling, Thermoelectric Cooling, Phase Change Materials, Heat Pipes, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

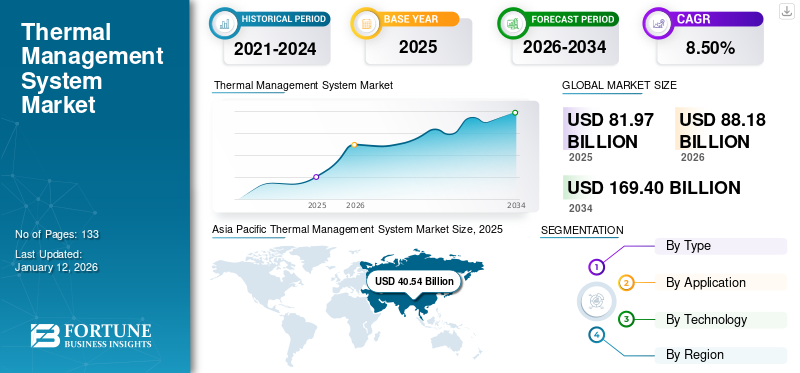

The global thermal management system market size was valued at USD 81.97 billion in 2025 and is projected to grow from USD 88.18 billion in 2026 to USD 169.4 billion by 2034, exhibiting a CAGR of 8.50% during the forecast period. The Asia Pacific dominated global market with a share of 49.40% in 2025.

The growth of the global thermal management system market is driven primarily by the growing demand for efficient heat dissipation in applications such as data centers, electric vehicles, consumer electronics, and industrial equipment. As the power densities and performance demands are growing, along with them, sophisticated technologies such as liquid cooling, heat pipes, and phase change materials are being increasingly adopted.

Download Free sample to learn more about this report.

Major players such as Honeywell International, Vertiv Holdings, and Aavid Thermalloy (Boyd Corporation) are spearheading innovation in the form of component design, strategic OEM collaborations, and application-specific cooling solutions that continue to fuel TMS market expansion.

In the future, the TMS market is expected to grow strongly, backed by the fast rise of electric vehicles, 5G networks, and AI computing. Emerging technologies such as immersion cooling and two-phase systems are likely to change traditional methods. Market leaders Laird Thermal Systems and Advanced Cooling Technologies are shifting their strategies more and more toward modular, energy-efficient, and space-saving systems in order to gain more market share in emerging applications.

IMPACT OF GENERATIVE AI

Increasing Proliferation of Generative AI Technologies to Boost Market Development

The increasing proliferation of generative AI technologies, particularly large language models and image creation tools, is heavily driving thermal management system market growth. They demand huge computational power, resulting in heat concentration in data centers and edge computing facilities. Consequently, more demand is created for sophisticated cooling solutions such as liquid cooling, cold plates, and immersion cooling solutions to provide hardware efficiency and reliability. This increase in generated thermal load caused by AI processing is redefining infrastructure needs and growing the TMS market share in both traditional data centers and emerging AI compute facilities.

IMPACT OF TARIFFS ON THE MARKET

Rising Cost Pressures Owing to Reciprocal Tariffs are Hindering Market Expansion

The imposition of reciprocal tariffs between major economies has disrupted global supply chains, which has directly impacted the cost and availability of key thermal management components such as heat sinks, liquid cooling units, and advanced materials. Many major thermal management system manufacturers are dependent on cross-border sourcing of specialized parts, and the imposed tariffs have increased procurement costs and reduced margin flexibility, and have also delayed production timelines. It has led to slowed project deployments, especially in sectors such as automotive, data centers, and consumer electronics, ultimately hindering the pace of TMS market growth and thus impacting the market share of globally operating players.

MARKET DYNAMICS

Thermal Management System Market Trends

Advancements in Cooling Technologies to Augment Market Growth

The rapid advancement, coupled with widespread adoption of artificial intelligence (AI) and machine learning (ML) technologies, is creating significant market opportunities for data centers. As chip and rack server densities in data centers are growing, demand for more effective cooling solutions has become a top priority in digital infrastructure. Post-pandemic, liquid cooling technology has made significant advancements, especially for high-performance computing (HPC) and Artificial Intelligence (AI) applications. In addition, technological advancements such as two-phase liquid cooling using dielectric fluid with low boiling points are driving demand for efficient cooling systems.

Furthermore, advancements in modern materials and phase-changing cooling materials are increasingly needed for effective cooling in commercial electric vehicles. Looking forward, the advancements in liquid cooling solutions designed to operate in the extremely heat-generating computing and processing operations are proliferating future innovation trends across data center thermal management and cooling solutions. For instance,

- In March 2025, Vertiv expanded and launched the Vertiv CoolLoop Trim Cooler, designed to support liquid and air cooling needs for AI and HPC applications in diverse climate conditions. The system offers up to a 70% decrease in yearly cooling energy consumption and 40% space savings while accommodating supply water temperatures up to 40°C and cold plate functionality at 45°C for modern AI factories.

Market Drivers

Rising Energy Consumption and Increasing Data Consumption Proliferate Demand for Thermal Management Solutions

Rising energy consumption, along with an exponential increase in data generation, is considerably increasing the demand for thermal management solutions across diverse industries, including automotive and consumer electronics. Furthermore, the rapid expansion of 5G infrastructure, data centers, electric vehicles, and high-performance computing systems has made effective heat management critical in order to maintain performance, reliability, and energy efficiency. As devices and systems become more compact and powerful, they generate higher heat densities, necessitating advanced thermal technologies. This rise in energy and data demands is making a direct contribution to the growth of the thermal management system market, as companies are seeking innovative solutions to prevent overheating, reduce energy loss, and optimize operational efficiency.

Market Restraints

Complexity of Integration and High Initial Investment Costs to Hinder Market Growth

Modern thermal management solutions provide an enhanced and effective solution to the modern AI data center's thermal challenges. However, the implementation of data center cooling solutions is often complex owing to the expertise and knowledge required. These requirements pose a major barrier for the thermal management solution adopters, especially small and medium-sized enterprises (SMEs) and organizations that have limited resources and funds for infrastructure facilities.

Market Opportunities

Growing Adoption of DLC Technology to Offer Ample Growth Opportunities

Cold plates, often called direct liquid cooling plates or liquid cold plates, are highly engineered components designed to minimize temperature at the source by using metals with very high thermal conductivity, such as aluminum and copper. This DLC technology is used in modern energy vehicles, such as Electric Vehicles (EVs), Hydrogen Fuel Cell Vehicles (FCVs), and Zero Emission Vehicles.

These technologies offer key benefits to thermal management systems, including higher performance and increased lifespan for key components, such as motors, batteries, and CDUs. Cold plates improve power electronics and electric motor efficiency in EVs. Due to high thermal conductivity and large surface area, cold plates and phase change cooling are more desirable for effective heat transfer. For example,

- In March 2023, Columbia Staver Limited launched a highly developed cold plate for electric vehicles that is capable of reducing the delta temperature between individual battery cells. These isothermal cold plates feature the inlet and outlet at the same end of the plate and are available in customizable specifications according to customer requirements.

SEGMENTATION ANALYSIS

By Type

Active Segment Dominates the Global Market Owing to Its Critical Role in High-performance Applications

Based on type, the market is divided into active, passive, and hybrid.

The active segment dominates the global market, driven by its critical role in high-performance applications requiring precise temperature control, accounting for a 68.38% market share in 2026. They are also forecasted to showcase the highest CAGR from 2026 to 2034, owing to advancements in cooling technologies such as liquid and forced-air systems.

Passive systems hold the second-highest market share and are expected to record a robust CAGR from 2026 to 2034. Their cost-effectiveness and reliability in low- to medium-heat applications, supported by improved materials, ensure consistent demand in energy-efficient solutions.

Hybrid systems represent a smaller segment but serve specialized needs. By combining active and passive technologies, they offer potential for growth in targeted high-value applications despite slower expansion.

To know how our report can help streamline your business, Speak to Analyst

By Application

Automotive Segment Leads the Market Due to Rising Adoption of Electric Vehicles

Based on application, the global market is segmented into automotive, consumer electronics, data centers, industrial equipment, renewable energy, aerospace & defense, telecommunication, medical devices, and others.

The automotive segment holds the highest share of the thermal management system market, driven by the rising adoption of electric vehicles (EVs), accounting for a 30.44% market share in 2026. Within this segment, EVs are estimated to record the highest CAGR within the automotive segment over the forecast period. The shift toward electrification and advanced vehicle technologies continues to drive demand for efficient thermal management systems to ensure battery and component performance.

The data centers segment, particularly hyperscale facilities, exhibits the strongest CAGR among all applications, owing to the rapid expansion of cloud computing and AI infrastructure. This segment also benefits from increasing demand for advanced cooling solutions to manage high heat loads in large-scale facilities.

The consumer electronics segment remains a stable contributor due to consistent demand for compact, high-performance devices such as smartphones and laptops. Industrial Equipment benefits from steady demand for reliable thermal solutions in heavy machinery.

The renewable energy segment grows with the adoption of solar and wind systems requiring efficient heat dissipation.

The aerospace and defense segment maintains steady but gradual growth due to the sector's specialized cooling needs.

Telecommunications supports the segment growth through expanding network infrastructure, while Medical Devices sees niche demand for precise thermal control in sensitive equipment.

The others category, encompassing diverse applications, contributes steadily with broad but less specialized needs.

By Technology

Air Cooling Segment Dominates the Global Market Due to Its Widespread Use

Based on technology, the global market is segmented into liquid cooling, air cooling, thermoelectric cooling, phase change materials, heat pipes, and others.

The air cooling segment commands the highest market share due to its widespread use in a variety of applications, from consumer electronics to industrial systems. Its cost-effectiveness, simplicity, and reliability make it a preferred solution for heat management, accounting for a 42.66% market share in 2026.

Liquid cooling exhibits the highest growth during the forecast period from 2026 to 2034. This rapid growth is propelled by increasing demand for effective cooling in EVs, data centers, and advanced electronics, where liquid-based systems provide a superior heat dissipation efficiency.

Thermoelectric cooling serves niche applications requiring precise temperature control, with modest growth.

The phase change materials segment is also showcasing strong growth due to its energy-efficient heat storage capabilities. Heat Pipes are experiencing a steady demand from the compact electronics sector, where heat dissipation is important.

The others segment, which constitutes new technologies such as microchannel cooling and nanofluids, adds diversity to the market but is expected to grow at a moderate rate during the study period.

THERMAL MANAGEMENT SYSTEM MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Thermal Management System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the global thermal management system market by value and volume, driven by high-density electronics manufacturing clusters, extensive EV ramp-up, and hyperscale data center construction across China, India, South Korea, Taiwan, and Southeast Asia, with the market valued at USD 40.54 billion in 2025. High local content in power electronics, batteries, and semiconductors drives the adoption of advanced materials (graphite, TIMs, and phase-change) and liquid cooling. Government-supported industrial policies and rapid product cycle updates in consumer electronics maintain sustained demand, making the region the fulcrum for world supply and innovation. The Japan market is projected to reach USD 8.72 billion by 2026, and the India market is projected to reach USD 7.45 billion by 2026.

China is the Asia Pacific's largest country, with significant vertical integration from TIMs and heat exchangers to complete EV battery thermal systems. Vast BEV production, fast inverter/charger installation, and AI data-center construction are driving volume and technological upgrades in the country. While local suppliers are scaling rapidly through collaboration on next-gen materials, thus maintaining price-performance leadership and short design cycles. The China market is projected to reach USD 16.48 billion by 2026

North America

North America is majorly driven by electrified transportation, AI/ML data centers, and aerospace/defense, with significant pull for liquid and two-phase solutions. Policy tailwinds (onshoring incentives, EV tax credits) and high reliability requirements benefit higher-spec thermal components and drive-unit integrated battery cooling. The regional market emphasizes performance and system integration, with tier-1s and specialist material suppliers gaining from long-term programs and retrofit opportunities.

The thermal management system market in the U.S. is expanding due to a rise in EV adoption, expanding infrastructure for data centers, and advancements made in the consumer electronics sector. The U.S. market is projected to reach USD 12.22 billion by 2026. Furthermore, supportive governmental policies for clean energy and technological advancements are strengthening the country’s position in the global market.

Europe

Europe's market is shaped by stringent efficiency and sustainability regulations, compelling OEMs to adopt low-GWP refrigerants, recyclable components, and miniaturized heat-pump topologies. The automotive sector remains crucial, especially with thermal integration for BEV platforms, while industrial automation and renewables (inverters, storage) contribute steady volume. Supply chains are re-balancing toward regionalization, underpinning premium, regulation-led growth despite macro softness. The UK market is projected to reach USD 5.86 billion by 2026, while the Germany market is projected to reach USD 3.66 billion by 2026.

Middle East and Africa

MEA is poised to showcase the highest CAGR globally over the forecast period, driven by cooling needs due to extreme climates, accelerating hyperscale and edge data-center investments, and higher volumes of infrastructure/industrial projects. The emergence of local manufacturing, along with digital-economy initiatives, is driving expansion beyond HVAC into high-value electronics and mobility.

South America

Expansion in the South American region is fostered by automotive manufacturing recovery, electrification of mining, and growing telecom/data-center infrastructure, most notably in Brazil and Mexico's nearshore electronics region and Southern Cone. High energy prices and heat loads are driving upgrades from air to liquid and next-generation circuits in power electronics and industrial drives. Currency and capex cyclicality moderate market growth; however, retrofit and maintenance markets are providing resilience.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Players Focus on System Integration to Boost Their Product Portfolio

Top thermal management players in the global market are positioning themselves as system integrators rather than component suppliers. They provide comprehensive, multi-technology portfolios and secure early design-ins with OEMs through simulation-driven co-development, IP breadth, and meticulous qualification. They manufacture globally with selective vertical integration for securing key materials and ensuring supply robustness. Their R&D focuses on liquid and two-phase cooling for increased heat flux, low-GWP coolants and recyclable materials, and embedded sensing/controls.

MAJOR PLAYERS in the THERMAL MANAGEMENT SYSTEM Market

To know how our report can help streamline your business, Speak to Analyst

Johnson Control, Schneider Electric, Daikin Industries, Trane Technologies, and Mitsubishi are the largest players in the market. The global thermal management system market is slightly consolidated, with the top 5 players accounting for around 36%-41% of the market share.

List of Companies Studied

- Tark Thermal Solutions (U.S.)

- Wiwynn Corporation (Taiwan)

- Stulz GmbH (Germany)

- Vertiv Holdings (U.S.)

- Daikin Industries Ltd (Japan)

- Honeywell International Inc (U.S.)

- Johnson Controls International Plc (U.S.)

- CoolIIT Systems (Canada)

- Asetek Inc. (Denmark)

- Trane Technologies (Ireland)

- Parker Hanifin (U.S.)

- Boyd (U.S.)

- Liquid Stack (U.S.)

- Siemens AG (Germany)

- Mitsubishi Electric Corporation (Japan)

- AAF International (U.S.)

- GIGA-BYTE Technology Co., Ltd. (Taiwan)

- ZutaCore (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Vertiv, a global provider of critical infrastructure solutions, announced a strategic collaboration with Tecogen Inc., a clean power heating and cooling solution provider. The partnership is expected to expand Vertiv's portfolio of cooling solutions and help data center operators overcome power constraints and energy usage.

- November 2024: Mitsubishi Heavy Industries, NTT Communications, and NEC Networks & System Integration started testing to enhance the cooling capacity of existing data centers by introducing high-performance servers with two-phase direct-to-chip cooling systems.

- October 2024: Wieland acquired Onda S.p.A., an Italian producer of advanced heat exchangers, with the objective of expanding its presence and strengthening its position in the heat exchanger and data center cooling market. Onda would integrate into Wieland’s Thermal Solutions unit, boosting its portfolio in sustainable cooling and advanced heating technologies.

- June 2024: Laird Thermal Systems, a global provider of thermal management solutions, introduced an effective thermoelectric assembly series that has advanced semiconductor materials. This advancement boosted the cooling performance by up to 10% compared to their previous models.

- May 2024: Stulz introduced a new coolant management and distribution unit (CDU) called the CyberCool CMU to enhance heat exchange effectiveness in liquid cooling systems. The CyberCool CMU delivers high energy efficiency, reliability, and flexibility in a compact design while enabling precise control of the entire liquid cooling system.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, technology, types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Technology

By Region

|

Frequently Asked Questions

The market is projected to reach USD 169.4 billion by 2034.

In 2025, the market was valued at USD 81.97 billion.

The market is projected to grow at a CAGR of 8.50% during the forecast period.

By technology, the air cooling segment leads the market.

Rising energy consumption and increasing data consumption are the key factors driving market growth.

Johnson Control, Schneider Electric, Daikin Industries, Trane Technologies, and Mitsubishi are the top players in the market.

The Asia Pacific dominated global market with a share of 49.40% in 2025.

By application, the data centers exhibit the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us