Tributyrin Market Size, Share & Industry Analysis, By Type (Purity 45% and Below, Purity 45% - 99%, and Purity 99% and Above), By Application (Food Additive, Feed Additive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

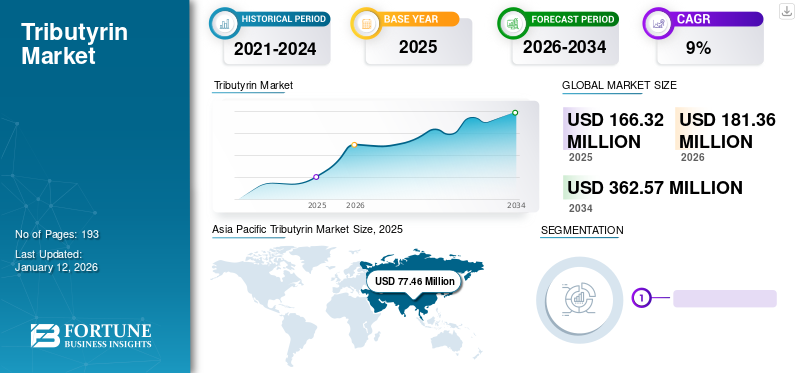

The global tributyrin market size was valued at USD 166.32 million in 2025 and is projected to grow from USD 181.36 million in 2026 to USD 362.57 million by 2034, exhibiting a CAGR of 9.00% during the forecast period. Asia Pacific dominated the tributyrin market with a market share of 47% in 2025.

Tributyrin is in high demand, particularly in animal feed manufacturing, and can serve as a prodrug of an anti-cancer agent, butyrate. It is utilized in animal feed products to enhance the gut health of animals. The growth of livestock farms, especially in developing countries such as China and India, is driving the consumption of animal feed. Moreover, developed regions such as Europe have prohibited the use of antibiotics in animal feed. Consequently, animal feed manufacturers are increasingly incorporating tributyrin complexes into the manufacturing process. This governmental support is expected to propel the market growth in the forecast period.

Global Tributyrin Market Overview

Market Size:

- 2025 Value: USD 166.32 million

- 2026 Value: USD 181.36 million

- 2034 Forecast Value: USD 362.57 million, with a CAGR of 9.00% from 2026–2034

Market Share:

- Asia Pacific held the highest share at 45% in 2025

- By type, the purity 45% and below segment is expected to hold a 32.6% share in 2025

- By application, the feed additive segment is projected to generate USD 122.9 million in revenue by 2025

Key Country Highlights:

- Japan: Tributyrin market is expected to reach USD 3.10 million by 2025

- India: Projected to witness a strong CAGR of 9.40% during the forecast period

- Europe: Anticipated to grow at a CAGR of 8.0%, driven by the ban on antibiotics in animal feed and push for alternatives

COVID-19 IMPACT

Halted Supply Chain and Logistic Restrictions Impacted Global Market during COVID-19

In 2020, the global lockdown restricted the flow of products and resources, significantly impacting the supply chain. Many countries imposed restrictions on the distribution and transportation of raw materials, disrupting the value chain of manufacturers. The emergence of COVID-19 significantly harmed companies' income generation. Firstly, developing countries such as China and India implemented trade restrictions, resulting in supply shortages for manufacturers between 2020 and 2021.

On the other hand, tributyrin finds applications in animal feed, food products, and medical drugs. During the pandemic, the food, feed, and medical industries were comparatively less impacted than others. The growing public awareness of sanitation, hygiene, and healthy food led to a higher demand for these products from the pharmaceutical and food industries. Tributyrin's role as an anti-cancer agent increased its demand in drugs. Additionally, the growing production of livestock globally during the pandemic had a positive impact on the market.

LATEST TRENDS

Growing Demand from the Pharmaceutical Industry Expected to Propel Market Growth

Tributyrin exhibits anti-cancer properties and serves as an effective solubilizer for docetaxel, positioning it as a potential candidate for cancer drug development. The pharmaceutical industry's demand for cancer treatment, especially for colon cancer, is notably rising.

- Asia Pacific witnessed a tributyrin market growth from USD 61.79 million in 2023 to USD 69.18 million in 2024.

Furthermore, the growing awareness about cancer, the emergence of novel treatments, and private and public organizations increasing their initiatives to spread awareness and promote new cancer drugs are propelling market growth. Additionally, factors such as the availability of effective drugs and the growing demand for efficient therapies also positively impact the market's growth rate.

Download Free sample to learn more about this report.

DRIVING FACTORS

Increasing Demand for Animal Feed is expected to Drive Market Growth

Animal feed improves immunity, promotes good health, and accelerates growth in animals. It is an important source of nutrition within the animal husbandry sector. Enriched with proteins, carbohydrates, fibers, minerals, acidifiers, enzymes, antioxidants, and antibiotics, this feed substantially enhances the quality of animal-derived products such as meat, eggs, and milk. Furthermore, it serves as a source of energy for the animals to support sturdy activity and sustain life processes.

Tributyrin is an essential feed additive that helps animals maintain healthy intestines and growth performance. It is particularly beneficial for young and vulnerable animals. It provides an appropriate diet, improving health and animal productivity.

In developing regions such as China and India, the surge in animal husbandry activities is a key driver propelling the demand for animal feed. Notably, China and India are the major feed-producing nations globally. The market’s growth in these regions is further bolstered by rising disposable income and the trend of urbanization, fostering a positive market environment during the forecast period. Moreover, the growing population in these countries fuels increased consumption of meat, poultry products, fish, and dairy products, further propelling the tributyrin market growth.

RESTRAINING FACTORS

Volatility in Raw Material Prices are Restraining Market Growth

Butyric acid and glycerol are used primarily as raw materials in the production of tributyrin. However, market growth is hampered by the instability in the prices of raw materials. The fluctuating prices of butyric acid are primarily attributed to supply chain constraints and the monopoly of Chinese manufacturers. Chinese entities partially control the market, leading to variations in import-export prices implemented by the Chinese government. These factors contribute to the volatility observed in raw material prices, consequently exerting a negative impact on the market’s growth trajectory during the study period.

SEGMENTATION

By Type Analysis

Purity 45% - 99% Segment to Dominate Market Due to Growing Use in Food & Beverage Industry

The market is segmented based on type into purity 45% and below, purity 45% - 99%, and purity 99% and above. The purity 45%–99% segment is projected to dominate the market by type in 2026, accounting for 50.44% of the total share with a market size of USD 91.48 million. This segment includes products with purities such as 55%, 65%, 75%, and 90%. These products are mainly employed in food and beverage and premium feed applications. By purity, the purity 45% and below segment is expected to hold a 32.6% share in 2025.

A purity of 45% and below of tributyrin is demanded in poultry feed products. The growing demand for poultry farms in developed and developing countries such as the U.S., China, India, and Brazil is expected to propel the segment's growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Feed Additive to Remain Largest Application Owing to Product Preference for Animal Health Benefits

The market is trifurcated based on application into food additive, feed additive, and others. The feed additive segment held the largest tributyrin market share in 2024 and is expected to remain the leader during the forecast period. Tributyrin, as a feed additive, enters the intestinal tract of animals and is slowly released as butyric acid and glycerol under the action of pancreatic lipase. It offers health benefits such as repairing the small intestinal villi of animals and inhibiting harmful intestinal bacteria. It can effectively reduce diarrhea and weaning stress in young animals, increase their survival rate, and aid in daily weight gain. By application, the feed additive segment is projected to generate USD 122.9 million in revenue by 2025.

The food additive segment is expected to hold a notable share in the market during the forecast period. The increasing demand for the product as a flavoring agent in food and the rising R&D activities in the food industry are boosting market growth. The feed additive segment is expected to lead the market by application in 2026, contributing 73.94% of the total share with a market size of USD 134.1 million.

REGIONAL INSIGHTS

Asia Pacific Tributyrin Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 69.18 million in 2024 and USD 77.46 million in 2025. Tributyrin finds extensive application in meat production in the region. The region’s meat production is notably propelled by densely populated countries such as China and India. Notably, China’s livestock sector has witnessed significant growth in recent years, accompanied by a shift within its population toward animal-based protein consumption. Remarkably, China stands as a dominant producer of livestock products and the largest manufacturer of animal feed globally.The Japan market is projected to reach USD 3.41 million by 2026, the China market is projected to reach USD 67.11 million by 2026, and the India market is projected to reach USD 4.38 million by 2026.

- In Asia Pacific, the food additive segment is estimated to hold a 21.9% market share in 2024.

North America market’s expansion is anticipated to propel by the growing healthcare and feed additive industries. The growth is further fueled by shifts in consumer purchasing patterns, heightened market awareness, and elevated demand for advanced anti-cancer medications. The US market is projected to reach USD 38.32 million by 2026.

The growth of the European market is closely linked to the rapid expansion of the animal feed segment in Germany. The region’s prohibition of antibiotics in animal feed has prompted governmental bodies to promote antibiotic alternatives, thereby positively influencing market dynamics. Europe is anticipated to grow at a CAGR of 8.0% during the forecast period. The UK market is projected to reach USD 3.05 million by 2026, while the Germany market is projected to reach USD 6.27 million by 2026.

The Latin American market’s growth is due to increased industrialization and the increased adoption of antibiotic substitutes in animal feed and food additives. Meanwhile, the Middle East and Africa region is poised for significant market growth, primarily driven by Saudi Arabia’s heightened product consumption within the food and feed industries.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Perstorp Leads Europe, While Competitors Bolster Regional Presence and Expand Product Offerings

Perstorp, Hubei Horwath Biotechnology Co., Ltd, Vetagro S.p.A., and Zhejiang Esigma Biotechnology Co., Ltd., are the key players in this market. Notably, Perstorp holds a strong presence in Europe and has expertise in tributyrin production. The company is a leading manufacturer of specialty chemicals and advanced raw materials within the region. Similarly, other market participants have established a substantial regional foothold, fortified distribution channels, and diverse product offerings.

LIST OF KEY COMPANIES PROFILED:

- Perstorp (Sweden)

- Hubei Horwath Biotechnology Co.,Ltd (China)

- Vetagro S.p.A. (Italy)

- Zhejiang Esigma Biotechnology Co., Ltd. (China)

- Guangdong VTR Bio-Tech Co., Ltd. (China)

- Beijing Challenge International Trade Co., Ltd. (China)

- Singao Co., LTD (China)

KEY INDUSTRY DEVELOPMENTS:

- October 2022: Perstorp was acquired by the Petronas Chemicals Group Berhad (PCG) for USD1.54 billion, based on an enterprise value of USD 2.18 billion. Post-acquisition, PCG said it intends to continue preserving and growing the value of Perstorp. The plans include expanding the company's global presence by strengthening its position in the Asia Pacific through PCG’s industrial know-how and substantial customer base.

REPORT COVERAGE

The market research report provides detailed market analysis and focuses on crucial aspects, such as type, application, and leading companies. It provides quantitative data in terms of value, research methodology for market size estimation, and insights into the latest market trends. It highlights vital industry developments and the competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors contributing to recent market growth.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9% from 2026 to 2034 |

|

Unit |

Value (USD Million), Volume (Kiloton) |

| Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 166.32 million in 2025 and is projected to reach USD 362.57 million by 2034.

Registering a significant CAGR of 9%, the market will exhibit rapid growth during the forecast period of 2026-2034.

By type, purity 45% - 99% is expected to be the leading segment in the market during the forecast period.

Increasing demand from feed industry is expected to drive market growth.

China held the largest share of the market in 2025.

Perstorp, Hubei Horwath Biotechnology Co.,Ltd, Vetagro S.p.A., Zhejiang Esigma Biotechnology Co., Ltd., Guangdong VTR Bio-Tech Co., Ltd., Beijing Challenge International Trade Co., Ltd., Singao Co., LTD are the major players in the market.

The rising demand from the food additive industry will drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us