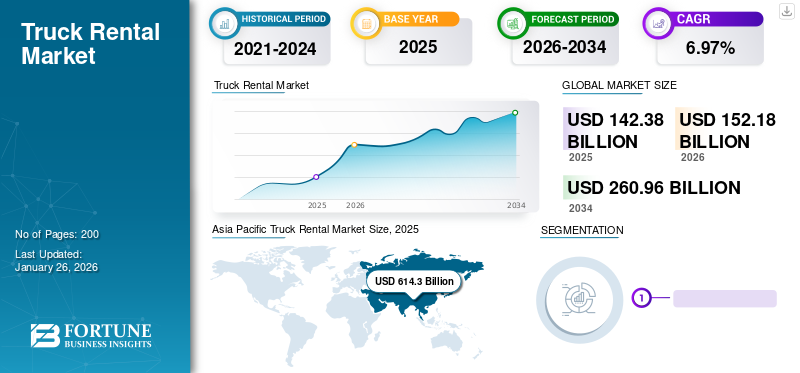

Truck Rental Market Size, Share & Industry Analysis, By Truck Type (Light Duty, Medium Duty, and Heavy Duty), By Duration (Short Term and Long Term), By Propulsion (ICE and Electric), By Service Provider (Rental and Leasing Companies, OEM Captives, and Third Party Service Providers), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global truck rental market size was valued at USD 142.38 billion in 2025. The market is projected to grow from USD 152.18 billion in 2026 to USD 260.96 billion by 2034, exhibiting a CAGR of 6.97% during the forecast period. Asia Pacific dominated the global market with a share of 43.15% in 2025.

Truck rental involves hiring a truck for a specific period to transfer goods from one location to another. It's a service offered by rental companies that allow individuals or businesses to use trucks without needing long-term ownership or commitment. These services are often used for transportation, logistics, moving homes, and other businesses. The primary purpose of rental services is to provide a cost-effective and flexible solution for moving goods, equipment, and other materials without the commitment and costs associated with owning and maintaining a fleet of trucks.

The rapid growth of e-commerce has led to increased demand for efficient transportation and delivery services. Companies need trucks to transport goods from warehouses to distribution centres and directly to customers, driving demand for short-term truck rentals. Renting trucks allows businesses to scale their fleet up or down based on demand without being tied to long-term ownership costs. This can be more cost-efficient regarding maintenance, insurance, and depreciation. Construction and infrastructure projects require heavy-duty trucks for materials transport. As these projects vary in duration, truck rentals offer a practical solution without needing a permanent fleet. All these factors are contributing to the truck rental market growth.

The COVID-19 pandemic had a mixed impact on the global truck rental market. While the initial lockdowns and economic slowdown led to a temporary decline in demand for truck rentals, the subsequent recovery and increased demand for essential goods transportation bolstered market growth. However, ongoing supply chain disruptions, labor shortages, and uncertainty pose challenges, hindering the market's full recovery and growth potential.

Truck Rental Market Trends

Growing Popularity of Autonomous Truck Rental Services Supports Market Growth

The growing demand for autonomous truck rental is gaining popularity in transportation and logistics. Autonomous trucks have the potential to transform the way goods are transported over long distances. Advances in AI, machine learning, and sensor technology have made autonomous vehicles, including trucks, more viable. These advancements have increased confidence in the reliability and safety of autonomous trucking solutions. Autonomous trucks maximize fuel efficiency and can be programmed to research the route’s state. Moreover, vehicle rental companies are partnering with software companies to support autonomous trucks and scale their operations. For instance, in August 2021, Ryder System, Inc., one of the leaders in fleet management solutions, partnered with Waymo Via, the trucking and local delivery unit of leading autonomous driving developer Waymo, announced a partnership focused on providing maintenance for Class 8 autonomous trucks, on ensuring the reliability required to scale operations and to maximize vehicle uptime.

Truck rental companies are adopting technologies to streamline business operations, maximize revenue, and improve customer experiences. Technologies, such as GPS tracking, real-time monitoring, and telematics, are becoming prevalent to enhance visibility safety, reduce operation costs, and improve vehicle performance and efficiency. For instance, in November 2022, ATrack Technology Inc., a leading vehicle telematics device manufacturer, had 4G fleet management products, including the AX300 OBD tracker and AK500 telematics gateway for trucks and heavy machinery applications. These both facilitate logistics operators in reducing operating costs and improving management efficiency.

Download Free sample to learn more about this report.

Truck Rental Market Growth Factors

Growing Demand for E-commerce Services to Drive the Market Growth

The rapid e-commerce and online shopping boom has propelled the demand for last-mile delivery services. Truck rental companies have been adapting to this trend by offering specialized vehicles and services to cater to the logistics needs of the e-commerce industry. For instance, according to the Census Bureau of the Department of Commerce, the U.S. retail e-commerce sales for the first quarter of 2023 were valued at USD 272.6 billion, an increase of 3.0% from the fourth quarter of 2022. In turn, the growth in the logistics sector will enhance vehicle rental services.

Rising digitalization has increased the availability of instant booking of vehicle rental services through company websites, applications, and online platforms, which are expected to fuel market growth over the forecast period. Supportive government initiatives to reduce carbon emissions is fueling the demand to develop electric trucks. Development in lithium-ion batteries has enhanced the range of electric trucks for long-distance transportation. The increasing adoption of electric trucks in rental services is expected to generate lucrative opportunities for market growth over the forecast period.

RESTRAINING FACTORS

Rising Fuel Prices and Strict Regulatory Compliance May Restrain Market Growth

The global truck rental market faces significant restraints due to rising fuel prices and stringent regulatory compliance requirements. Fuel costs denote a large portion of operating expenses for truck rental companies, and fluctuations in fuel prices directly impact profitability. According to the U.S. Energy Information Administration (EIA), diesel fuel prices in the United States averaged USD 3.88 per gallon as of January 2022, marking a countable increase compared to previous years. Higher fuel prices squeeze profit margins for truck rental companies, making maintaining competitive pricing and profitability challenging.

Additionally, truck rental companies must adhere to strict regulatory compliance standards imposed by government agencies. Regulations related to emissions standards, vehicle safety, driver qualifications, and hours-of-service restrictions require significant investments in equipment upgrades, training programs, and administrative resources. Non-compliance with such regulations can result in fines, legal liabilities, and reputational damage. Implementing stricter emissions standards, such as Euro VI in Europe and Tier 4 in the United States, further increases truck rental companies' compliance costs and operational complexities.

As a result of these challenges, truck rental companies may face difficulties in expanding their fleets, attracting customers, and achieving sustainable growth. To mitigate these restraints, industry players are exploring alternative fuel options, investing in fuel-efficient technologies, and enhancing operational efficiency through digitalization and automation initiatives. However, the challenges posed by rising fuel prices and regulatory compliance requirements continue to impede the growth trajectory of the global truck rental market.

Truck Rental Market Segmentation Analysis

By Truck Type Analysis

Light Duty Truck Segment Holds Highest Market Share Owing to Versatility and Low Rental Cost

Based on truck type, the market is trifurcated into light duty, medium duty, and heavy duty.

The light duty segment held the largest market share of 100% in 2026. The positive market outlook can contribute to its lower rental and maintenance costs than medium and high duty trucks. Light duty trucks are efficient, highly versatile, and often used for personal purposes such as transporting small goods and moving household items. They are also employed in commercial settings for deliveries in urban areas or as service vehicles. Growing relocation activities due to growing urbanization and demand for rental truck services in SMEs for various transportation activities are expected to support the segment growth.

The heavy duty segment is anticipated to register a significant CAGR over the forecast period. These trucks transport heavy products and equipment in emerging countries worldwide. Most contractors rent heavy duty trucks as it allows them to avoid high upfront and maintenance costs associated with the ownership. Moreover, certain construction and mining activities require specific types of heavy duty trucks that are not part of a company's regular fleet. The rise in construction activities, supported by a sharp increase in capital expenditure to enhance its infrastructure globally, is anticipated to propel the demand for rental services. For instance, in February 2022, the Indian government announced a budget of over USD 900 million for improving the overall multimodal logistics infrastructure. Renting heavy duty trucks allows companies to access the right equipment without investing. Such factors are anticipated to bode well for segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Duration Analysis

Short Term Segment Leads Owing to its Cost-effectiveness and Higher Flexibility

Based on duration, the market is categorized into short term and long term. The short term segment held the largest market size contributing 62.26% globally in 2026. Short-term rental, considered less than six months, provides greater flexibility to rent a truck for a few days or months and respond quickly to fluctuating demand or requirements. It allows businesses to test different truck models and brands without making long-term commitments to purchase. This allows for evaluating performance, compatibility, and suitability with their operations.

The long term segment is anticipated to register the highest growth rate over the forecast period. Long-term rental is considered for up to 6-12 months. Long-term rental eliminates the significant upfront capital investment required for purchasing or leasing vehicles. Rental companies often provide ongoing maintenance costs, ensuring the trucks are well maintained and reducing downtime and operational costs. Moreover, long term rentals provide better rates than monthly or weekly rates. It also offers increased flexibility in fleet delivery and access to newer truck models.

By Propulsion Analysis

Electric Segment to Grow at the Highest CAGR Owing to its Environmental Benefits and Supportive Government Initiatives

Based on propulsion, the market is segmented into ICE and electric.

The electric segment is anticipated to exhibit the highest CAGR throughout the forecast period, accounting for 92.79% market share in 2026. There is growing interest in the electric segment as an alternative fuel as it offers the potential to reduce emissions and operating costs, making it a viable option for companies looking to adopt sustainable transportation solutions. Moreover, several government initiatives, such as subsidies, tax credits, and grants, to promote and support the adoption of electric vehicles, including electric trucks will support the segment growth.

In 2023, the ICE segment held the largest market share. IC Engines (ICE) are the most common engines used in trucks and other commercial vehicles. They generally provide longer driving ranges compared to electric propulsion technology. ICE-powered trucks can carry heavy loads, provide sufficient torque for towing and hauling, and have a well-established infrastructure for refueling with diesel or gasoline.

By Service Provider Analysis

Rental and Leasing Companies Held a Higher Market Share due to Easy Renting Policies and Accessibility to Wider Range of Fleets

Based on service provider, the market is segmented into rental and leasing companies, OEM captives, and third party service providers.

Rental and leasing companies segment slated the highest market share of 47.4% in 2026. Most companies opt for truck rental & leasing owing to transparent pricing. Renting directly from the rental company can provide more transparent pricing. Third-party service providers can potentially increase the overall cost for the customer by increasing their markup price. Moreover, renting directly from the rental company provides easy accessibility to their wide range of fleet inventory. Direct communication with the rental company may lead to more opportunities for customization and tailored solutions.

OEM captives segment is anticipated to register a significant CAGR over the forecast period. OEMs, including Volvo and Daimler, provide rental and financial services to their customers to diversify their revenue stream, enhance customer experience, and increase brand visibility. Offering heavy and light commercial vehicle rental services allows OEMs to diversify their revenue streams beyond just selling trucks, especially when new truck sales might be slower. Renting out the latest truck models allows OEMs to showcase their newest models, technology, and features to potential customers. Renters may become interested in purchasing those trucks after experiencing their capabilities during the rental period.

REGIONAL INSIGHTS

Asia Pacific Held a Major Market Share due to Rise in Construction and Industrial Activities

Based on region, the market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Truck Rental Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held the largest truck rental market share in 2024 and is expected to maintain its dominance over the forecast period. Many Asia Pacific countries have been experiencing robust economic growth, leading to increased industrial and commercial activities. Businesses often seek flexible transportation solutions as they expand, making medium & heavy duty commercial vehicle rentals attractive. Rising regional urbanization has led to higher demand for transportation services within cities and metropolitan areas. Moreover, increasing spending on construction activities will further surge the demand for rental services. For instance, in April 2023, the Chinese government announced to increase spending on large construction projects by USD 1.8 trillion, with new projects spanning the industrial park, transport, and energy sectors. Such trends are anticipated to bode well for regional market growth. The Japan market is projected to reach USD 9.35 billion by 2026, the China market is projected to reach USD 18.06 billion by 2026, and the India market is projected to reach USD 15.33 billion by 2026.

North America

North America held a significant market size in 2024. A well-established manufacturing sector is driving the market in the region. Small and mid-scale industries are opting for rental services for their transport-related operations across the region. Small & medium transport companies are also utilizing rental services for their business operations. The presence of major regional players is the market's supporting factor. Strong transportation infrastructure in the region further increases the demand for trucking as a preferred mode of transport. The U.S. market is projected to reach USD 27.05 billion by 2026.

Europe

Europe is anticipated to witness an upward trajectory over the forecast period. The region has a well-established transportation infrastructure, which is suitable for trucking. With increasing awareness of environmental issues, some businesses are exploring alternative fuel options or electric trucks. Renting allows them to experiment with these technologies without committing to a long-term investment. The UK market is projected to reach USD 3.66 billion by 2026, while the Germany market is projected to reach USD 6.33 billion by 2026.

The rest of the world is anticipated to register a moderate growth rate during the forecast period. The positive market outlook can be attributed to its growth in the e-commerce & logistics sectors. The significant growth of e-commerce has fueled the need for efficient and reliable logistics and transportation services. Vehicle rental companies can cater to the fluctuating delivery demands of e-commerce businesses during peak seasons and promotions. Moreover, many Middle Eastern countries have been investing heavily in infrastructure projects such as building bridges, roads, and airports. These construction activities demand vehicle rental services to transport materials to and from construction sites.

List of Key Companies in Truck Rental Market

Focus on Inorganic Growth Strategies by Market Players to Gain Competitive Edge

Various regional and international players consistently develop advanced strategies for competitive advantage. Many companies are adopting mergers & acquisitions and partnership & collaboration strategies to enable market growth.

- For instance, in May 2022, United Rental, Inc. announced an agreement with Ford Pro to purchase all-electric vehicles for its North American rental fleets. The vehicles purchased by United Rentals will be used on industrial and construction job sites and by the company's sales and delivery personnel.

Similarly, in February 2019, Budget Truck Rental partnered with a self-service truck startup, Fetch, to make Budget box trucks, pickup trucks, and cargo vans available for rent through Fetch’s mobile marketplace. The partnership was aimed at expanding its footprint across North America.

List of Key Companies Profiled:

- United Rentals, Inc. (U.S.)

- Amerco (U-HAUL) (U.S.)

- Enterprise Truck Rental (U.S.)

- Ryder System, Inc. (U.S.)

- Europcar (France)

- PENSKE Corporation, Inc. (U.S.)

- ORIX Australia Corporation Limited (Australia)

- HERC Rentals Inc. (U.S.)

- Rush Enterprises (U.S.)

- Avis Budget Group (U.S.)

- Premier Truck Rental (U.S.)

- Barco Rent-A-Truck (U.S.)

- Driving Force (Canada)

- IDEALEASE (U.S.)

- Sixt S.E. (Germany)

- TIP Group (Amsterdam)

- Asset Alliance Group (U.K.)

- PACCAR Leasing Company (U.S.)

- Nishio Holdings Co Ltd (Japan)

- Kris Way Truck Leasing (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 - Ryder System, Inc., a leader in the supply chain, dedicated transportation, and fleet management solutions, acquired Cardinal Logistics. This will enable growth and strengthen Ryder’s position as a leading customized dedicated contract carrier in North America. The Cardinal acquisition will further advance Ryder’s strategy to accelerate profitable growth in its dedicated business.

- February 2024 - Daimler Truck announced launching its first truck rental business in Brazil. The Mercedes-Benz brand already operates a bank and an insurance brokerage in Brazil, in addition to producing trucks and buses that compete with Brazil's truck producer VWCO. In the current scenario of higher vehicle prices due to stricter pollution norms and high interest rates, renting options may find a more affordable option.

- January 2024 - Vac2Go, a leading vacuum truck rental services company, opened its newest facility in Sanford, Florida. This is the company's eighth location, aiming to serve the greater Orlando area with various equipment solutions, including industrial vacuum trucks, hydro excavators, and combination units. This latest expansion underscores the company's ongoing commitment to providing high-quality vacuum truck rental services to a growing customer base.

- April 2023 – PENSKE announced an agreement to acquire Star Truck Rentals Inc., a transportation service company, to serve existing and new customers in North America. The acquisition will help PENSKE to expand its rental fleet and strengthen its market share in the region.

- March 2023 – British truck rental company, Asset Alliance Group, ordered 75 electric trucks from DAF, a Dutch Truck manufacturing company. The electric trucks are from the newest DAF XF, X.G., and XG+ vehicles and range up to 500 km.

- September 2022 – Enterprise Truck Rental expanded its presence in North America by opening 500 locations across the U.S. and Canada. The expansion will aid the company in meeting the rising demand for seasonal projects, e-commerce delivery rentals, and vehicles for personal truck rental needs.

REPORT COVERAGE

The truck rental market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Moreover, the report offers insights into the market trends and highlights key industry developments. In addition, the report encompasses several factors that contributed to the growth of the market in recent years.

An Infographic Representation of Truck Rental Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.97% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Truck Type

|

|

By Duration

|

|

|

BY Propulsion

|

|

|

By Service Provider

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 142.38 billion in 2025.

The market will likely grow at a CAGR of 6.97% over the forecast period (2026-2034).

The light duty segment is expected to lead the market due to easy accessibility and lower rental cost.

Growth in e-commerce activities is a major factor driving market growth.

Some of the key market players are U-HAUL, PENSKE, United Rentals, and Enterprise Truck Rental.

Asia Pacific dominated the market in 2025.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic