Tugboat Market Size, Share & Industry Analysis By Application (Harbor Towage, Coastal Towage, and Terminal Towage), By Type (Conventional Tug, Tractor Tug, Azimuth Stern Drive Tug, Reverse Tractor Tug, and Others), By Power Capacity (Up to 1000 KW, 1000 to 2000 KW, 2000 to 3000 KW, and Above 3000 KW), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

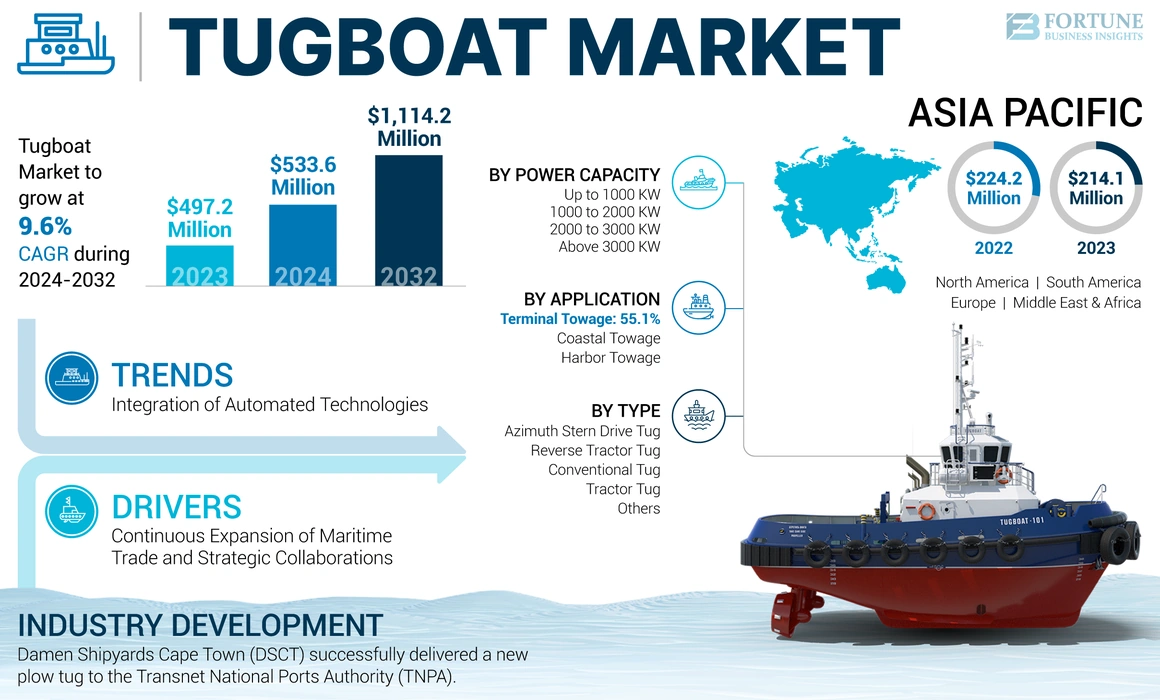

The global tugboat market size was valued at USD 497.2 million in 2023. The market is projected to grow from USD 533.6 million in 2024 to USD 1,114.2 million by 2032, exhibiting a CAGR of 9.6% over the forecast period. Asia Pacific dominated the tugboats market with a market share of 34.9% in 2023.

Tugboats are one of the most common types of boats that have been around for a while, with their primary operations as mooring, berthing, and escorting services for vessels around ports, for various port operations, along coastlines, and harbors. A tug is a class of boat that is used to help mega-ships, containers, and bulk carriers enter or leave ports. Tugs are also responsible for the movement of barges, oil platforms, rafts, salvage and rescue operations, and other similar operations.

The tugboat market is a highly volatile market with a variety of factors dictating the overall market growth. The market witnessed rapid changes, in terms of purchases, with the new tugboats. Consumers and small players are highly affected by the high cost associated with the purchase of new tugboats, thereby causing hesitation in buying new boats. However, the rise in demand from large ocean vessel operators is keeping the market afloat as major tugboat operators are focusing on expanding their fleets to address the growing need for docking and mooring operations with the global expansion of ports.

The COVID-19 pandemic resulted in significant changes in the maritime industry. The increase in restrictions on road and freight transportation, created a heavy demand for cargo delivery in the maritime trade industry, which increased the demand for tugboats for various port and terminal operations, resulting in an increase in market growth in 2020.

GLOBAL TUGBOAT MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 497.2 million

- 2024 Market Size: USD 533.6 million

- 2032 Forecast Market Size: USD 1,114.2 million

- CAGR: 9.6% from 2024–2032

Market Share

- Asia Pacific led the global tugboat market in 2023, holding a 34.9% share. Growth is driven by heavy tugboat utilization in nations such as China, India, Japan, and South Korea, with strong port expansion and high maritime traffic.

- By application, terminal towage dominated the market in 2023 and is expected to grow at the fastest CAGR, fueled by rising demand for tug services at container terminals, oil and gas terminals, and bulk cargo ports.

Key Country Highlights

- India: Implemented Make in India mandates for tugboat procurement at major ports. Delivered multiple 50-ton Bollard Pull Tugs by Hindustan Shipyard Ltd.

- China: Major shipyards such as Jiangsu Zhenjiang Shipyard are central to the global tug supply, supporting both domestic and export demands.

- Hong Kong: Cheoy Lee Shipyards completed its 50th tugboat based on RAmparts 3200-CL design in 2024.

- Bangladesh: Mongla Port Authority expanded its tugboat fleet with new vessels managed locally but built abroad.

- UAE: Players such as Astro Offshore actively support offshore oil and gas-related towing operations in the Gulf region.

- Netherlands: Damen Shipyards remains a global leader in tugboat innovation and supply, with deliveries worldwide, including Africa and South America.

- U.S.: Cashman Equipment Corp. continues to offer marine support services and maintain high quality standards through ISO 9001:2015 certification.

Tugboat Market Trends

Integration of Automated Technologies to Fuel Market Growth

The maritime industry is evolving immensely as a variety of subsectors within it are experiencing rapid technological development. The industry is focused on pursuing sustainability, actively addressing its carbon emissions, integrating environmentally friendly solutions, and introducing technologies offering a higher fuel economy in the vessels.

The industry players are also highly motivated to introduce innovation in fuel systems and propulsion systems for vessels. The manufacturers are exploring the possibilities of alternate fuel systems and battery-powered tugboats to reduce the dependency on traditional diesel-powered tugboats. Some of the other trends that revolve around the maritime industry and port construction include demand for high-performance vessels, expansion in the tugboat services, increasing safety systems, and port automation technology. These are some of the secondary factors that are likely to fuel innovation in the emerging technologies, directly affecting the tugboat industry.

Download Free sample to learn more about this report.

Tugboat Market Growth Factors

Increasing Maritime Trade and Strategic Collaborations to Drive Market Growth

The seaborne trade continues to expand, bringing benefits to consumers across the world through competitive freight costs. The growing efficiency of shipping as a mode of mooring and berthing operations, coupled with increased economic liberalization, are essential aspects of the industry’s growth. For instance, according to the reports, traffic on the Northern Sea Route is expected to rise to 80 million tons of shipments per year by 2025 across Arctic shipping. This rapid development generates economic, environmental, political, and social challenges that are at the center of attention for multiple governments.

Increasing demand for tugboats in the Asian and Indian water bodies has led to more significant market expansion in the past years. For instance, in February 2022, the Indian Ministry of Shipping directed all major ports to procure or charter tug boats that were only made in India. All procurements undertaken by major ports would now need to be carried out as per the revised ‘Make in India’ Order. The contract for the construction of 50-ton Bollard Pull Tugs was concluded, with the final fourth tug delivered on 24 January 2022 from M/s Hindustan Shipyard Ltd. Thus, expansion in maritime trade and favorable government initiatives towards the expansion of ports is expected to drive the market in the coming years.

RESTRAINING FACTORS

Cyclic Nature of Shipbuilding Industry Raises Concerns Regarding Annual Shipbuilding Capacity

The shipbuilding industry, being cyclic in nature, puts excess capacity pressure on tugboat manufacturers during the peak, which affects their operational activities and profitability. Owing to this cyclic nature and inflation in raw materials, especially steel, the majority of manufacturers have faced losses over the past few years. This has resulted in inflated prices of tugboats, which has caused consumers to be unwilling to buy new tugboats.

While some users prefer buying a second-hand tugboat, some consumers are upgrading the existing fleet with new power upgrades and components to save costs. Along with the minor players, major shipbuilders such as Korea Shipbuilding & Offshore Engineering Co. (KSOE), Samsung Heavy Industries, and Daewoo Shipbuilding & Marine Engineering Co. are facing losses over the past few years. Thus, the higher cost and cyclic nature of the industry have severely affected the market expansion.

Tugboat Market Segmentation Analysis

By Application Analysis

Higher Demand for Towage Services to Create High Demand for Terminal Towage

Based on application, the market is divided into harbor towage, coastal towage, and terminal towage.

Terminal towage accounted for the largest market share in 2023 and is expected to grow at the fastest CAGR over the forecast period. The market demand is attributed to the higher demand for tugboats and the towage services they offer in terminal facilities, such as container terminals, bulk terminals, oil gas terminals, and other specialized facilities. Terminal towage operations are focused on maneuvering vessels within confined spaces within the terminal area, including docks, quays, and loading/unloading facilities.

The coastal towage segment also accounted for a decent market size in 2023 and is expected to grow at the second fastest growth rate of 9.6% CAGR over the forecast period. The growth in this segment is attributed to the increasing demand for towing operations from one port to another, along with demand for shipping, offshore oil and gas operations, and rescue & salvage operations, which is driving the market growth of this segment.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Easier Maintenance and Greater Consumer Preference Leads to Adoption of Conventional Tugs

The market by type is categorized into conventional tug, tractor tug, azimuth stern drive tug, reverse tractor tug, and others.

The conventional tug segment accounted for the biggest tugboat market share in 2023. The segment is expected to maintain its dominance and develop at the fastest growth rate over the forecast period. Conventional tugboats, is one of the oldest boat designs and have been proven reliable for towage applications. Furthermore, the higher reliability and ease of availability of these types of tugboats further contribute to the significant market share of this segment.

The azimuth stern drive tug segment accounted for a significant market size in 2023. Higher directional stability in speed, along with optimized towage operations and lower maintenance costs, propels the segment growth. Furthermore, the better bollard pull of these tugboats is driving consumers to opt for such tugboats.

By Power Capacity Analysis

Higher Affordability Leads to Wide Usage of Tugboats with 1000 to 2000 KW Power Capacity

Based on power capacity, the market is segmented into up to 1000 KW, 1000 to 2000 KW, 2000 to 3000 KW, and above 3000 KW.

The 1000 KW to 2000 KW segment accounted for a majority market share in 2023 and is anticipated to expand its market share at a rapid growth rate throughout the forecast period. Increasing demand for power capacity tugboats drives the growth of this segment for various escorting and hulling operations near ports, harbors, and terminals. Tugboats ranging in this segment offer sufficient power for towage applications, thereby driving the segment’s market share.

The 2000 KW to 3000 KW segment is expected to grow at the fastest growth rate of over the forecast period. The growth is attributed to the increasing focus from various tugboat and marine vessel operators towards modernizing their existing vessel fleet with high-power output tugboats suitable for handling very large cargo shipments and bulk containers. These few factors are expected to drive the overall tugboat market growth.

REGIONAL INSIGHTS

Based on regional segmentation, the market is divided into four regions: North America, Europe, Asia Pacific, the Indian Subcontinent, the Middle East, Africa, and the Rest of the World.

Asia Pacific Tugboat Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region accounted for the major market share in 2023. Asia is one of the major hubs for the marine industry, with a strong penetration of major players and heavy demand from consumers. The region is home to some of the major countries that have a large number of tugboat fleets and heavy usage frequency, which contributes to such a primarily dominated market share.

Europe accounted second dominant position in the market in 2023 and is expected to grow at a steady pace during the forecast period. Marine vessel fleet operators are increasingly focusing on purchasing new tugboats to address the growing need in the European market.

The North American market is decently sized and is estimated to expand over the forecast period. The increasing demand for large tugboats for towage and maneuvering applications is expected to drive market growth in the region.

Middle East also accounted for a minimal market size in 2023 and is expected to grow at the fastest growth rate during the forecast period. The heavy focus from the Middle Eastern countries on expanding maritime trade and cargo ports in the region is driving the demand for cargo transportation.

Similarly, Africa and the rest of the world markets also accounted for a minimal share and are expected to grow at a steady CAGR over the forecast period. The regions are expected to witness the expansion of tugboat fleets, as various countries in the region strongly rely on maritime trade operations.

KEY INDUSTRY PLAYERS

Companies are Focusing on Partnerships to Remain Competitive

The competitive landscape for the tugboat market is consolidated, with key players operating in this industry. Key players offer different types of tugboats with varying payload capacities, along with other maritime services. The top five players in the industry are Damen Shipyards Group, Cashman Equipment Corp., Jiangsu Zhenjiang Shipyard Co. Ltd., Mazagon Dock Shipbuilders Limited, and Cheoy Lee Shipyards Ltd.

Damen Shipyards Group topped the list of top tugboats in the market due to its eminent global presence and growing revenue in the past years. Additionally, new product launches initiated by the company, in addition to the pre-existing flagship products that numerous users prefer, and the affiliated after-sales support, are major contributors to the company's ranking. The increasing focus from fleet operators on expanding their services and offering their tugboats in various ports is driving the new purchase of tugboats. Manufacturers are focused on introducing tugboats with high-capacity engines to further offer ease in towage and mooring operations of large marine vessels.

List of Top Tugboat Companies:

- AMSBACH MARINE (S) PTE LTD (Singapore)

- ASTRO OFFSHORE PTE LTD. (UAE)

- Cashman Equipment Corp.(U.S.)

- Cheoy Lee Shipyards Ltd (Hong Kong)

- Cochin Shipyard Limited (India)

- Damen Shipyards Group (Netherlands)

- Hongkong Salvage & Towage Services Limited (Hong Kong)

- Jiangsu Zhenjiang Shipyard Co. Ltd. (China)

- Mazagon Dock Shipbuilders Limited. (India)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Cheoy Lee Shipyards, based in Hong Kong, completed its 50th harbor tug to Robert Allan Ltd's exclusive RAmparts 3200-CL design in February 2024 and is now docked at its home port. The Mongla Port Authority in Bangladesh manages both tugs, Joymoni and Keel Komol, which were built in China. Following a decade of refinement, this design’s completion was a milestone in RAmparts tug construction.

- December 2023: The first 62 T Bollard Pull Tug was delivered by Udupi-Cochin Shipyard Limited (UCSL), a wholly-owned subsidiary of Cochin Shipyard Limited. Adani Harbor Services Limited, which owns around 100 tugs, is the largest tug owner and operator in India.

- September 2023: MDL announced the launch of the fourth Stealth Frigate of Project 17A MAHENDRAGIRI. With the launch of this mighty frigate, MDL continues its triumphant march towards self-reliance, turning Aatmanirbhar Bharat into a reality. This ship was built using the integrated construction methodology, which involves hull blocks with parallel outfitting. The construction has been carried out at different geographical locations, and integration/erection on the slipway at MDL has been done.

- June 2023: Damen Shipyards Cape Town (DSCT) has successfully delivered a new plow tug to the Transnet National Ports Authority (TNPA). Based on a standardized and successful Damen Design, this vessel is well-suited to various maritime tasks, operating efficiently in shallow and deeper waters with unrestricted sailing capability.

- July 2022: Cashman Equipment Corp. (CEC), a global provider of ocean deck barges and marine equipment, unveiled that it has been awarded ISO Certification for its systems and processes under ISO 9001:2015. The International Organization for Standardization (ISO) has developed and published the internationally recognized quality management standard ISO 9001:2015.

REPORT COVERAGE

The market research report provides an in-depth market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 9.6% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

|

|

By Type

|

|

|

By Power Capacity

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the global market size was USD 497.2 Million in 2023.

The market is likely to record a CAGR of 9.6% during the forecast period.

The terminal towage segment leads the market due to the development of high-performance application types.

Some of the top players in the market are AMSBACH MARINE (S) PTE LTD., ASTRO OFFSHORE PTE LTD., Cashman Equipment Corp., Cheoy Lee Shipyards Ltd., and others.

Asia Pacific dominated the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us