Twin Turboprop Leasing Market Size, Share & Industry Analysis, By Twin Turboprop (Light, Small, Medium, & Heavy), By Light (Air Tractor {AT0402B & AT0502B}, Daher-Socata TBM 900, Cessna 208 Caravan), By Small (Pilatus PC-6 Porter, Beechcraft King Air C90GTx & 360), By Medium (S2R0T34, Air Tractor AT-802, Dornier 228), By Heavy (De Havilland Canada DHC-6 Twin Otter, ATR 72, Bombardier Dash 8 Q400, Antonov An-24/An-26), By Lease Type (Dry & Wet Lease), By Application (Regional Passenger Transport, Aerial Survey & Mapping, Emergency Medical Services, Cargo & Other), & Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

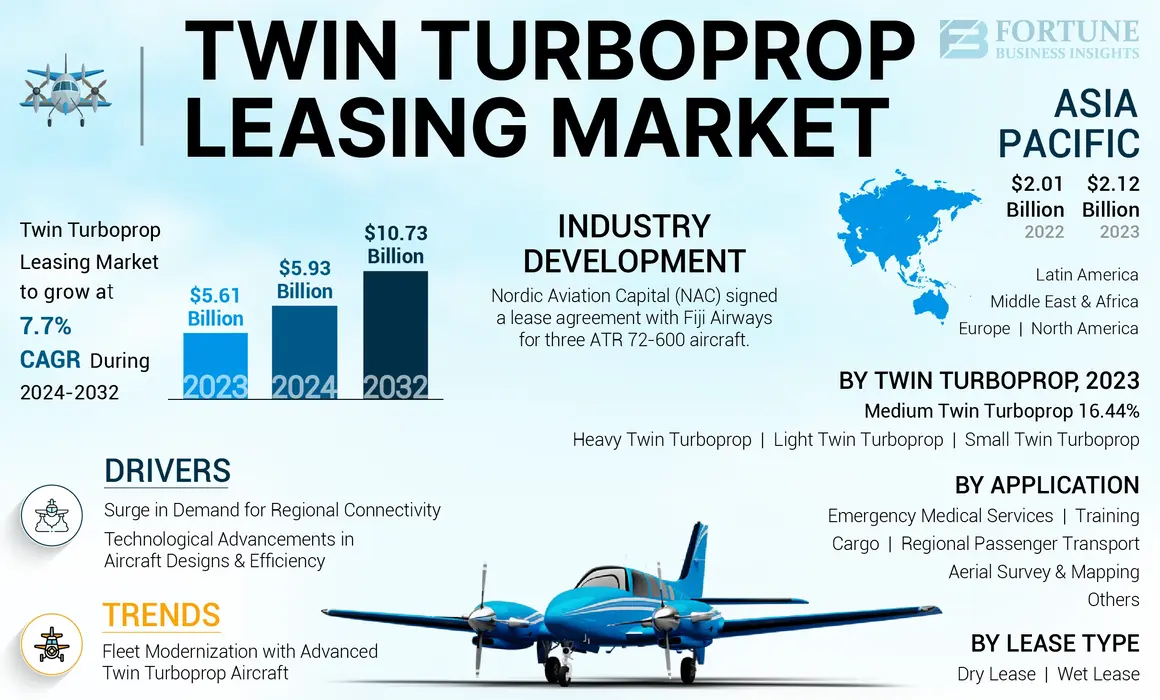

The global twin turboprop leasing market size was valued at USD 5.61 billion in 2023. The market is projected to grow from USD 5.93 billion in 2024 to USD 10.73 billion by 2032, exhibiting a CAGR of 7.7% during the forecast period. Asia Pacific dominated the twin turboprop leasing market with a market share of 37.79% in 2023.

Twin turboprop leasing refers to the rental of aircraft with two turboprop engines, often used for a variety of aviation applications, including regional transportation, cargo services, and medical evacuations and special missions. The growing need for regional connectivity is a key factor as airlines seek to operate unconventional routes and connect smaller cities. This demand is driven by government programs aimed at improving air travel infrastructure and promoting economic development in remote areas. In addition, advances in turboprop technology have increased the fuel efficiency and reliability of aircraft, which is attractive to operators focused on reducing operating costs. Furthermore, the emphasis on stability and low emissions is pushing airlines to consider turboprop aircraft as an environmentally friendly alternative to regional aircraft.

Additionally, leasing twin turboprop aircraft has many advantages, including affordability and ease of operation. It allows operators to expand their fleet without the large investment required for direct purchase, allowing them to adapt to market needs quickly. The market is also witnessing trends, including increasing interest in leasing aircraft and expanding leasing services to meet the diverse needs of customers. As the aviation industry continues to grow, the twin turboprop leasing market is expected to play a major role in meeting the growing demand for regional air travel solutions.

The twin turboprop leasing market was severely affected by the COVID-19 pandemic, marked by various challenges and changes in demand. The pandemic caused a significant drop in air travel, leading to a decrease in the need for twin turboprop aircraft. Airlines and charter operators encountered financial challenges, resulting in the need to cancel and postpone lease agreements.

Global Twin Turboprop Leasing Market Overview

Market Size:

- 2023 Value: USD 5.61 billion

- 2024 Value: USD 5.93 billion

- 2032 Forecast Value: USD 10.73 billion

- CAGR of 7.7% from 2024–2032

Market Share:

- Asia Pacific led the twin turboprop leasing market with a 37.79% share in 2023, driven by strong regional connectivity demand, rising infrastructure investments, and increasing air travel in emerging economies.

- By aircraft type, the light twin turboprop segment is expected to hold a 55% share in 2025.

Key Country Highlights:

- The twin turboprop leasing market in Japan is expected to reach USD 517.6 million by 2025.

- China is projected to witness a strong CAGR of 9.2% during the forecast period, while Europe is anticipated to grow at a CAGR of 7.9%.

- By lease type, the dry lease segment is projected to generate USD 3,357.9 million in revenue by 2025.

Twin Turboprop Leasing Market Trends

Fleet Modernization with Advanced Twin Turboprop Aircraft is a Prominent Trend

Aircraft renewal with advanced twin-turboprop aircraft is a popular trend in the global market due to the desire of airlines and operators to replace older aircraft with advanced models. This innovation is important as operators seek to increase efficiency, reduce fuel consumption, and comply with evolving regulatory standards for emissions and noise.

Recent advances in twin turboprop technology have made these aircraft more suitable for operators. New twin turboprops are equipped with improved avionics systems, improved engine performance, and more passenger comfort features. For example, aircraft, such as the ATR 72 and the Bombardier Dash 8 Q400 have received upgrades in their systems, such as advanced flight control systems, noise reduction designs, and better engines.

The demand for new twin-turboprop aircraft is based on market dynamics. As the airline industry recovers from the effects of the COVID-19 pandemic, airlines are seeking to expand their fleets while reducing operating costs. The current economic environment has given rise to interest in turboprop aircraft as short-haul carriers. This trend reflects a strong market for new twin-turboprop aircraft leasing as operators seek to meet their fleet renewal needs without the capital costs associated with aircraft purchases. In June 2024, the Indian Air Force (IAF) marked a milestone in its new aircraft drive with the arrival of its third Airbus C295 aircraft. The purchase is a result of a unique 'Make in India' partnership between Airbus Defense and Space and Tata Advanced Systems Limited (TASL). This partnership will not only ensure the delivery of these critical aircraft but will also boost domestic production and increase India's confidence in the defense sector.

Download Free sample to learn more about this report.

Twin Turboprop Leasing Market Growth Factors

Surge in Demand for Regional Connectivity to Catalyze Market Growth

Growing need for regional connectivity is a major driver boosting the demand for twin turboprop leasing. As airlines and operators seek to expand their networks, they are increasingly focusing on serving smaller airports and less accessible destinations. Twin turboprop aircraft are ideal for these routes due to their ability to operate from short runways and ability to make short flights. This trend is also supported by government programs in many countries that aim to increase access to air travel, especially in remote areas. For example, programs, such as India's UDAN, aim to improve regional air connectivity and increase demand for turboprop aircraft that can do well in these ways.

Furthermore, as regional airlines aim to capitalize on this demand, twin turboprop leasing is a very attractive option. This allows operators to expand their fleet without the high costs associated with purchasing new aircraft. This flexibility is important in a market where demand varies and makes leasing an attractive solution for airlines seeking to optimize their operations and respond quickly to changing market conditions.

Technological Advancements in Aircraft Designs and Efficiency to Drive the Twin Turboprop Leasing Market Growth

Modern turboprop aircraft are equipped with advanced avionics systems, improved engine performance, and more passenger amenities. These improvements not only reduce operational costs, such as fuel consumption and maintenance but also provide a better flight experience for passengers. For example, new models, such as the ATR 72 and the Bombardier Dash 8 Q400, have major upgrades that increase performance and reliability.

Focusing on fuel efficiency is important in today's aviation landscape, where rising fuel prices and environmental concerns are forcing operators to seek more sustainable solutions. Twin turboprops are known for their lower operating costs compared to regional jets, making them an attractive option for airlines seeking to maintain productivity while meeting environmental standards. As manufacturers continue to innovate and develop better turboprop models and operators upgrade their fleets, the leasing market will benefit.

RESTRAINING FACTORS

Rising Fuel Prices and Increasing Operational Costs Place a Restraint on the Market

As operating expenses rise, airlines and operators may be more cautious in expanding their fleets or entering into leasing agreements. Additionally, the financial uncertainty stemming from global economic conditions can lead to reduced demand for air travel, which in turn affects the market growth. Operators may prioritize cost-cutting measures, including delaying fleet modernization or opting for smaller, more economical aircraft, thereby affecting the overall twin turboprop leasing demand.

In addition, economic uncertainty can exacerbate these challenges. During times of economic recession or uncertainty, airlines and operators can implement cost-saving measures, including postponing fleet expansion or renovation projects. This cautious approach will reduce demand for twin turboprop aircraft leases as operators seek to reduce financial liabilities in a volatile market.

Twin Turboprop Leasing Market Segmentation Analysis

By Twin Turboprop Analysis

Light Twin Turboprop Lead Due to Growing Demand from Regional Airlines, Charter Operators, and Private Aviation

Based on twin turboprop, the market is segmented into light twin turboprop, small twin turboprop, medium twin turboprop, and heavy twin turboprop.

By twin turboprop type, the light segment is expected to hold a 55% share in 2025. The segment held the largest market share in 2023 and is experiencing significant growth, driven by catering to the needs of regional airlines, charter operators, and private aviation. Moreover, light twin turboprops, such as the Beechcraft Baron and Piper Aerostar, offer lower fuel consumption compared to larger jets, making them an attractive option for operators seeking to optimize their expenses.

The small twin turboprop segment is estimated to grow significantly during the forecast period. The increasing emphasis on regional connectivity, driven by government initiatives and infrastructure development, is propelling the demand for small twin turboprops.

To know how our report can help streamline your business, Speak to Analyst

By Light Twin Turboprop Analysis

Cessna 208 Caravan Holds Leading Position Owing to its Versatility and Proven Reliability

The market is divided by light twin turboprop into Air Tractor AT0402B, Air Tractor AT0502B, Daher-Socata TBM 900, Cessna 208 Caravan, and others.

The Cessna 208 Caravan accounted for the largest market share and is estimated to be the fastest-growing segment during 2024-2032. Increasing demand for reliable utility aircraft in humanitarian aid, air cargo, and tourism drives segment growth. Moreover, advancements in technology, such as the introduction of the Grand Caravan EX with improved performance and efficiency, enhance its appeal.

The Air Tractor AT0502B segment observes significant growth. The H125/AS350 is known as an agricultural aircraft; the AT-502B is designed for the aerial application of fertilizers and pesticides, which is increasingly vital in modern farming practices. The growing demand for food production, coupled with the need for efficient crop management, drives the need for such specialized aircraft.

By Small Twin Turboprop Analysis

Beechcraft King Air 360’s High Preference is Led by Growing Executive and Business Transport

The market is classified by small twin turboprop into Pilatus PC-6 Porter, Beechcraft King Air C90GTx, Beechcraft King Air 360, and others.

The Beechcraft King Air 360 segment holds the highest market share due to several compelling factors. As a premium twin turboprop, the King Air 360 is favored for executive transport, medical evacuation, and cargo operations. Its advanced avionics, spacious cabin, and impressive range makes it a preferred choice for operators seeking a high-performance aircraft.

The Beechcraft King Air C90GTx segment is anticipated to display significant market share and growth during the forecast period. The aircraft’s ability to operate from shorter runways and its cost-effective performance make it an attractive option for regional air travel.

By Medium Twin Turboprop Analysis

S2R0T34 to Dominate Market Share Owing to its Reliability in Crop Dusting

The market is categorized by medium twin turboprop into S2R0T34, Air Tractor AT-802, Dornier 228, and others.

The S2R0T34 segment is anticipated to hold the largest market share and register the highest CAGR during the forecast period. As the agricultural sector increasingly adopts advanced techniques for pest control and fertilization, the demand for efficient and reliable aircraft, such as the S2R0T34, is on the rise.

The Dornier 228 segment is anticipated to display significant growth over the forecast period due to its versatility and capability to operate in challenging environments. With applications ranging from passenger transport to cargo and surveillance, the Dornier 228 is well-suited for various missions, particularly in remote and underserved regions.

By Heavy Twin Turboprop Analysis

ATR 72 Twin Turboprop’s Market Leadership is Fueled by its Affordability in Short-Haul Routes

Based on heavy twin turboprop, the market is categorized into De Havilland Canada DHC-6 Twin Otter, ATR 72, Bombardier Dash 8 Q400, Antonov An-24/An-26, and others.

The ATR 72 segment held the highest market shares in 2023 and is estimated to depict the fastest-growth over the analysis period. The segment’s growth is driven by its efficiency and capacity for regional air travel. With a seating capacity of up to 74 passengers, the ATR 72 is favored by airlines looking to serve short-haul routes economically.

The Bombardier Dash 8 Q400 segment is anticipated to have significant growth during the forecast period. The growing emphasis on regional connectivity and the need for efficient air travel solutions are driving demand for the Dash 8 Q400. Leasing allows airlines to access this high-capacity aircraft without the financial commitment of purchasing, enabling them to respond to fluctuating market demands effectively.

By Lease Type Analysis

Dry Lease Type is More Favored Owing to Greater Control Over Operational Costs

Based on lease type, the market is categorized into dry lease and wet lease.

The dry lease segment is projected to generate USD 3,357.9 million in revenue by 2025. The segment held the highest market shares in 2023 and is anticipated to be the fastest growing during the forecast period. By leasing the aircraft without a crew, airlines can manage their staffing and operational expenses according to their specific needs. This flexibility is particularly beneficial for regional airlines and charter operators that may experience fluctuations in demand.

The wet lease segment is projected to have a significant market share during the study period. For operators who may not have the resources or expertise to manage their flight crews, wet leasing offers a comprehensive solution. The lessor takes on the operational responsibilities, allowing the airline to focus on other aspects of its business, such as marketing and customer service.

By Application Analysis

Regional Passenger Transport is in Primary Focus as it Connects Smaller Cities and Underserved Regions

Based on application, the market is categorized into regional passenger transport, aerial survey and mapping, emergency medical services, cargo, training, and others.

The regional passenger transport segment is anticipated to have the largest market share during the forecast period. The growth in the segment is due to the growing emphasis on improving regional connectivity to facilitate economic development and support local communities.

The others segment is anticipated to have the highest growth rate during the forecast period. The segment includes agriculture, mapping and other applications. The ability of twin-turboprop aircraft to perform diverse tasks, combined with ease of operation and cost-effectiveness, positions them as a key player in the growing aviation landscape.

REGIONAL INSIGHTS

The regional market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific Twin Turboprop Leasing Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates and is the fastest-growing region in the global market. The regional market was valued at USD 2.12 billion in 2023. Asia Pacific is experiencing rapid growth, driven by increasing regional connectivity and a burgeoning middle class seeking air travel options. Governments in India and Indonesia are investing in infrastructure and promoting regional air services, which create opportunities for twin turboprop operators. The demand for aircraft that can operate in diverse environments, including smaller airports with limited infrastructure, making twin turboprops an attractive option.

- The market in Japan is expected to reach USD 517.6 million by 2025.

- China is projected to witness a strong CAGR of 9.2% during the forecast period.

North America held a significant twin turboprop leasing market share in 2023. The market is dominated by established manufacturers, such as Beechcraft, which has a large market share with its King Air range. Demand for twin-turboprop aircraft in the region is driven by the need for efficient regional air travel, especially in less accessible areas and shorter routes. Operators are increasingly choosing leasing options to expand their fleet without the high costs associated with new aircraft deliveries.

The twin turboprop leasing market in Europe held the second-largest share in 2023. In Europe, the market is influenced by environmental regulations and attention to sustainability. Operators are increasingly turning to more efficient aircraft to meet emission standards and reduce operating costs. The presence of well-known manufacturers, such as ATR and Bombardier, provides operators with many new turboprop options. Europe is anticipated to grow at a CAGR of 7.9% during the forecast period.

The Middle East & Africa will witness significant growth during the forecast period. The market share in the Middle East & Africa is characterized by a growing demand for regional air travel, driven by economic development and increased tourism. Countries in the region are investing in their aviation infrastructure, creating opportunities for twin turboprop operators. Leasing is becoming a preferred option for airlines seeking to expand their fleets without the financial burden of purchasing new aircraft.

Latin America is anticipated to show moderate growth during the forecast period. The growth in the region is driven by the need for efficient air transportation in a region characterized by vast distances and diverse geography. Operators are increasingly turning to twin turboprops to connect remote communities and provide essential services. The leasing market is supported by a mix of local and international airlines that recognize the operational advantages of turboprop aircraft, such as lower operating costs and the ability to access smaller airfields.

KEY INDUSTRY PLAYERS

Key Industry Players are Concentrating on Development of New Aircraft Models and the Expansion of Leasing Services

The twin turboprop leasing industry is highly fragmented, with several players involved in the development of shelters. Many major stakeholders are focusing on fleet modernization by acquiring more advanced twin turboprop aircraft. Modern turboprops offer improved performance, efficiency, and passenger comfort features, making them attractive options for airlines seeking to upgrade their fleets. Top twin turboprop leasing companies, such as ATR and Bombardier are introducing new models with enhanced capabilities to meet this demand in general aviation as well as military.

List of Top Twin Turboprop Leasing Companies:

- Textron Aviation Inc. (U.S.)

- ATR (France)

- Piaggio Aerospace (Italy)

- Viking Air (Canada)

- Air Tractor, Inc. (U.S)

- Bombardier (Canada)

- Aviation PLC (Singapore)

- Nordic Aviation Capital (Ireland)

- Falko Regional Aircraft (U.K)

- AerCap Holdings N.V. (Ireland)

KEY INDUSTRY DEVELOPMENTS:

- August 2024 – Nordic Aviation Capital (NAC) announced the successful completion of a lease agreement for three ATR 72-600 aircraft with Fiji Airways. This flight is from the order book of NAC and ATR.

- July 2024 – Air Tahiti signed a new purchase agreement with the French-Italian turboprop manufacturer for four ATR 72-600 aircraft. The delivery of two turboprops planned between 2025 and 2028 will support the company's increased airspeed and increased power.

- July 2024 – Croatia Airlines planned to select a potential supplier for the turboprop aircraft by the end of next year and expects the aircraft to enter service for the Croatian airline in 2026.

- July 2024 – De Havilland Aircraft of Canada Limited, known as De Havilland Canada, and Servicio Aéreo a Territorios Nacionales S. A. SATENA signed a solid agreement to acquire eight DHC-6 Twin Otter aircraft in order to expand its fleet and facilitate the implementation of strategic growth initiatives in Colombia. Acquiring the DHC-6 Twin Otter aircraft will ensure critical air connectivity in Colombia, facilitating access to isolated communities across the nation.

- March 2024 – The Royal Canadian Air Force (RCAF) leased two twin-turbo engines from commercial airline Air Tindi based in the Northern Territories. The company planned to operate the aircraft from Canadian Forces Base Trenton in southern Ontario under a contract known as a Multi-Engine Flight Agreement (MEUF).

REPORT COVERAGE

The global twin turboprop leasing market research report provides a detailed analysis of the market insights. It focuses on key aspects such as leading companies, different aircraft types, materials used, and applications. Besides this, the report offers insights into the market trends, short-term and long-term contract analysis, and supply chain trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several aspects that have contributed to the growth of the developed market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

属性 |

詳細 |

|

研究期間 |

2019-2032 |

|

基地年 |

2023 |

|

推定年 |

2024 |

|

予測期間 |

2024-2032 |

|

歴史的期間 |

2019-2022 |

|

成長率 |

2024-2032から7.7%のCAGR |

|

ユニット |

価値(10億米ドル) |

|

セグメンテーション |

双子のターボプロップによって

|

|

軽いツインターボプロップによって

|

|

|

小さな双子のターボプロップによって

|

|

|

ミディアムツインターボプロップによる

|

|

|

双子のターボプロップによって

|

|

|

リースタイプによる

|

|

|

アプリケーションによって

|

|

|

地域別

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 5.61 billion in 2023 and is projected to reach USD 10.73 billion by 2032.

Registering a CAGR of 7.7%, the market will exhibit steady growth during the forecast period (2024-2032).

The light twin turboprop segment is expected to lead this market during the forecast period.

Textron Aviation Inc. (U.S.), ATR (France), Piaggio Aerospace (Italy), Viking Air (Canada), Air Tractor, Inc. (U.S), and Bombardier (Canada) are few top twin turboprop leasing companies in the global market.

Asia Pacific dominated the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us