U.S. Air Filter Market Size, Share, COVID-19 Impact Analysis, By Type (Cartridge, Dust Collector, HEPA Filter, Bag house Filter, and Others (Mist Filter, etc.)), By End Users (Residential, Commercial, and Industrial), By Industry (Automotive, Chemical, Gas Turbines, Semiconductors, Pharmaceuticals, Healthcare, and Others (Food, etc.), and Forecast, 2025-2032

KEY MARKET INSIGHTS

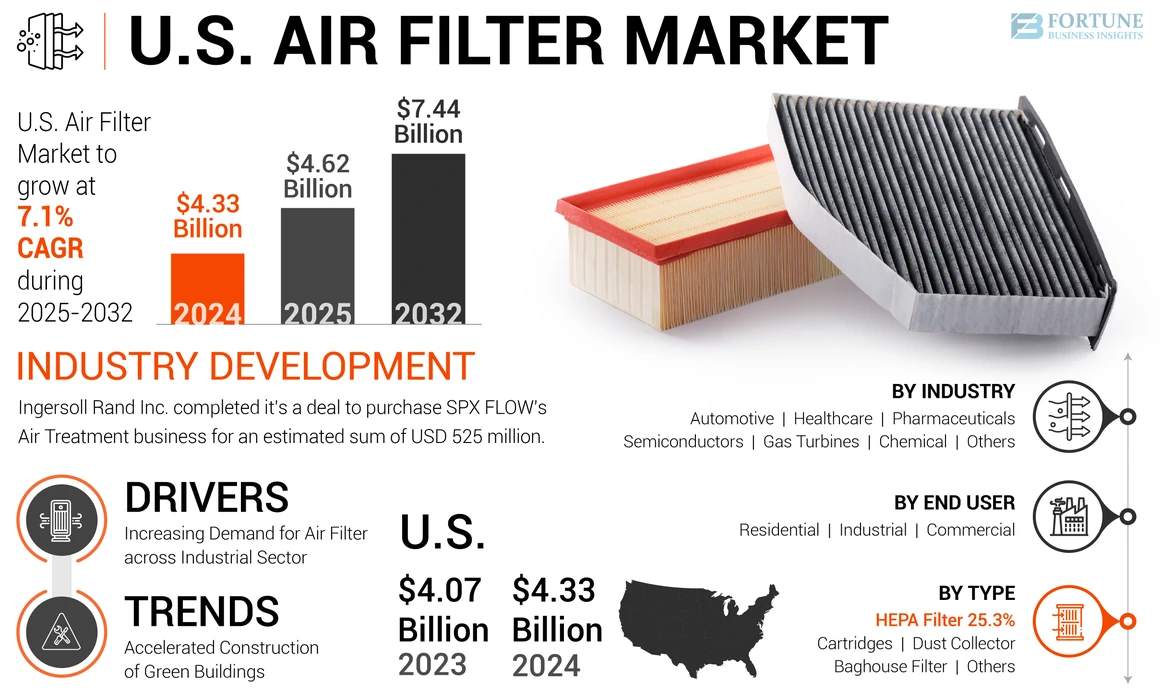

The U.S. air filter market size was valued at USD 4.33 billion in 2024. The market is projected to grow from USD 4.62 billion in 2025 to USD 7.44 billion by 2032, exhibiting a CAGR of 7.1% during the forecast period.

Air Filters are filtrate components used in the vent and duct systems to enhance the operational performance and sustainability of the products. The filter components are available in various filtrate materials such as vinyl polymers, Nano polymers, and other advanced materials offerings across the market for varied operational capabilities. The Filter is used across various industries such as automotive, chemical, gas turbines, semiconductors, pharmaceuticals, and healthcare.

This industry is highly competitive, driven by the technological advancements and integration of advanced product offerings to the filter element, which is expanding the market potential. Also, changing consumer demands supplemented by sustainability standards across the U.S. concerning rising air pollution norms. These drivers and trends across the local market are raising the potential for key players. Subsequently, economic uncertainty, recession short-term impact, and regional geopolitical tension is causing impedance to whey down the earnings. However, increasing awareness of ventilation filter elements and green buildings is expanding the U.S. Air Filter market share for the forecast period.

COVID-19 IMPACT

Economic Uncertainty across Regional Markets Causing Moderate Downfall

Post-COVID-19, leading market players operating across different developing nations and U.S. air filter observed a considerable decline with lower profit margins on the products raising competitiveness bars. Majorly, an abrupt manufacturing closure and decline in production levels hampered the production that plumed the sales of these market players.

Additionally, the high supply-demand gap, low manufacturing levels, and high raw material price curtailing reduction across the equipment market have compelled manufacturers to raise investments for new product development, causing additional backlogs and restricting the introduction of new products. Thus, the COVID-19 pandemic has shown how pivotal decisions are moving the market trajectory through new operational and marketing strategies.

U.S. Air Filter Market Trends

Download Free sample to learn more about this report.

Accelerated Construction of Green Buildings is Laying the Foundation for Future Market Growth

The emerging trend towards the construction of green buildings is empowering this market. This is owing to the rising awareness of occupants for health, stringent government norms regarding indoor air quality (IAQ), rising hazardous emissions, etc.

Furthermore, the growing demand for automation and sustainability standards across buildings, heating, and ventilation systems bolsters the demand for more automated and sustainable air filter products. Thus, automated procedures play an important role in laying the foundation of sustainability trends and green buildings, raising the bar for competitiveness.

- For instance, In Dec 2021, Freudenberg, a global air filtration product manufacturer, released RPS Products soon after the acquisition of U.S. Protect Plus Air Holding Inc. that helps in maintaining indoor air quality.

U.S. Air Filter Market Growth Factors

Increasing Demand for Air Filter across Industrial Sector to Bolster the Market

The demand for air filters across the industrial sector is growing exponentially. It is because extensive capabilities offered by the products, such as capturing dust particles as low as pm 2.5, thereby minimizing the risks of molecular and microbiological contamination. Additionally, air quality monitoring in high-yield semiconductor manufacturing facilities is highly important than ever. Dirty Particulate and corrosive gaseous pollutants have become a serious problem in these facilities. Air filter, however, prevents the entry of this contaminant in high-yield facilities with industry-leading outdoor ventilation system and adjacent air filtration systems growing U.S. air filter market growth during the forecast period.

- In September 2021, Mann Hummel, an air filter manufacturer, launched a combi Filter containing activated carbon to reduce harmful gas and odors in vehicles.

RESTRAINING FACTORS

High Initial Investment and Frequent Maintenance are Probable Restraints to the Market

Air filters are necessary for ventilation and air ducting across the automotive and heating ventilation and air conditioning (HVAC) industry, which has raised the potential income during the pandemic. However, high replacement costs and material choking of high particulate filtrate require frequent replacement, consequently lowering the demand and curtailing restraint.

Additionally, lower filtration and ventilation rates result in increased humidity levels, thus, adversely affecting the health condition of working as well as living occupants.

Moreover, the improperly installed location minimizes the fresh outdoor air intake and blockage of airflow, resulting in the contaminated intake air. This results in lowered filtration rate across the overall living surroundings. Also, the need for more awareness about filtrate standards and the unavailability of qualified technicians for air Filters over the past few years is shrinking the market size for the forecast period.

U.S. Air Filter Market Segmentation Analysis

By Type Analysis

HEPA Filter Experiencing Significant Rise Owing to Various Applications

By type, the market is divided into cartridge, dust collectors, HEPA filter, bag house filter, and others (mist filter).

Across the type segment, Highly Efficiency Particulate Air Filter (HEPA) is forecasted to grow extensively with increased demand for improved ventilated systems with improved air quality and standards. In the U.S., air filter standards have been revised with MERV 16-rated standards that ensure the very fine particulate filter of pm2.5 and pm10 acquire a major market share in the forecast period.

Cartridges and dust collectors are estimated to grow progressively with growing automotive and industrial emissions demand. Also, these filters offer extensive filtration and help to reduce emission cut down by 60%.

Moreover, bag house filter and other filter (mist filter) to have moderate growth with specialty use and specific requirement to help acquire sustainable growth in the market.

By End User Analysis

Residential Segment to Hold Highest CAGR Owing to Rising Air Filter Replacement Activities

By end-user analysis market is classified into residential, commercial, and industrial.

U.S. infrastructure development has brought an impeccable pace to construction activities in U.S. Furthermore, the rising use of room air conditioners, air purification systems, and demand for air purifiers across the residential segment. Additionally, strict HEPA filter standards are the growth driver bolstering the demand for air filters across the residential segment.

Commercial air Filters are growing progressively owing to expanding air purifier market size and commercial space construction, withstanding substantial growth in the market. Also, air filter application across the industrial filter is estimated to grow moderately with particular filtration methods and a higher cost of installation.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Gas Turbine Filtration to Exhibit Major Growth Due To Extensive Maintenance and Strict Norms

By industry, the analysis market is divided into automotive, chemical, gas turbines, semiconductors, pharmaceuticals, healthcare, and others (food, etc.).

U.S industrial strict emission norms and concerns for healthy air to breathe have pushed the standards for industrial emissions at a high bar, minimizing particulates emission to lower rates. Thus, gas turbine emissions and pharmaceutical industry filters are estimated to grow heavily across the industry segment.

Additionally, the growing use of washable air filters across the automotive sector and particulate filters application in clean rooms, clinical labs, and chemical effluent filtration products is attributed to expanding the application across chemical, healthcare, semiconductors, and others (food processing) industries.

COUNTRY INSIGHTS

The U.S. market size is forecasted to grow progressively with a growing CAGR. The growth of the U.S. market is attributed to the growing use of optimized and advanced air filters across the residential and commercial sectors. These filters need frequent replacement and maintenance. However, growing investment in the filtrate element research to develop more hygienic and washable air filters to expand the market share for the forecast period.

KEY INDUSTRY PLAYERS

Expansion Strategies and New Product Introduction to Strengthen Their Market Positions

Manufacturers are focusing on developing new market strategies, such as collaboration and acquisitions with other small players, to attain a considerable position in comprehensive strength. Furthermore, players operating in the market are offering innovative product offerings that are capable of providing a power-packed performance that is helping to achieve maximum efficiency that can cut cost up to 30%. Key players consistently developing new products that last longer and are easily reusable, and minimizing the landfills is projected to strengthen key players’ position across the market.

- For instance, In the financial year 2024, Freudenberg has made an investment of USD 615.72 million that has helped to achieve a sales revenue hike of 32% from new product offerings.

LIST OF TOP U.S. AIR FILTER COMPANIES:

- 3M Company (U.S.)

- Donaldson Company, Inc. (U.S.)

- MANN + HUMMEL (Germany)

- Coway Co.,Ltd. (South Korea)

- Freudenberg Filtration Technologies SE & Co. KG (Germany)

- K&N Engineering, Inc. (U.S.)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- PARKER-HANNIFIN CORP (U.S.)

- Cummins Inc. (U.S.)

- Camfil (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- December 2024 – Camfil Inc., a major air filter producer and Distributor company, introduced its V-Bed energy efficient Air Filter Durafil ES3. This innovative product aims to diminishing energy consumption and lowering lifetime maintenance expenses for residential purposes.

- October 2024 – Ingersoll Rand Inc., a global producer of essential flow generation and industrial filtration solutions, had recently completed its a deal to purchase SPX FLOW's Air Treatment business for an estimated sum of USD 525 million.

- September 2024 – AAF International acquired Natioxnal Air Filter Service of New Jersey, an air filtration management company. The acquisition aims at delivering more value to customers by expanding the filtration portfolio.

- July 2024 – Camfil opened a new manufacturing facility in Arkansas, US to expand its filtration operations in the state. The new facility includes air filter elements production plant, weld workshop, warehouse, fabrication, dust lab and others.

- June 2021 - Daikin Industries Limited, an air ventilation giant, announced a partnership with American Air Filter (AAF) to expand its distribution network across North America.

REPORT COVERAGE

The research report provides a deep dive analysis of the types, end users, and industries. It provides information about leading companies and their business overview, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, current market trends, and sustainability trends and highlights key drivers and restraints. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.1% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type, End User, and Industry |

|

By Type |

|

|

By End User |

|

|

By Industry |

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 4.33 billion in 2024.

In 2032, the market is expected to be valued at USD 7.44 billion.

The U.S. market is estimated to have a noteworthy CAGR of 7.1%.

Within the type segment, HEPA Filters are expected to be the leading segment in the market during the forecast period.

Increasing Demand for Air Filter across industrial sector to bolster the market.

3M Company, Donaldson Company, Inc., MANN + HUMMEL, Coway Co.,Ltd., Freudenberg Filtration Technologies SE & Co. KG, K&N Engineering, Inc., DAIKIN INDUSTRIES, Ltd., PARKER-HANNIFIN CORP, Cummins Inc., and Camfil

High initial investment and frequent maintenance are probable restraints to the market

Residential segment to hold highest CAGR owing to rising air filter replacement activities.

Accelerated construction of green buildings is laying the foundation for future market growth

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us