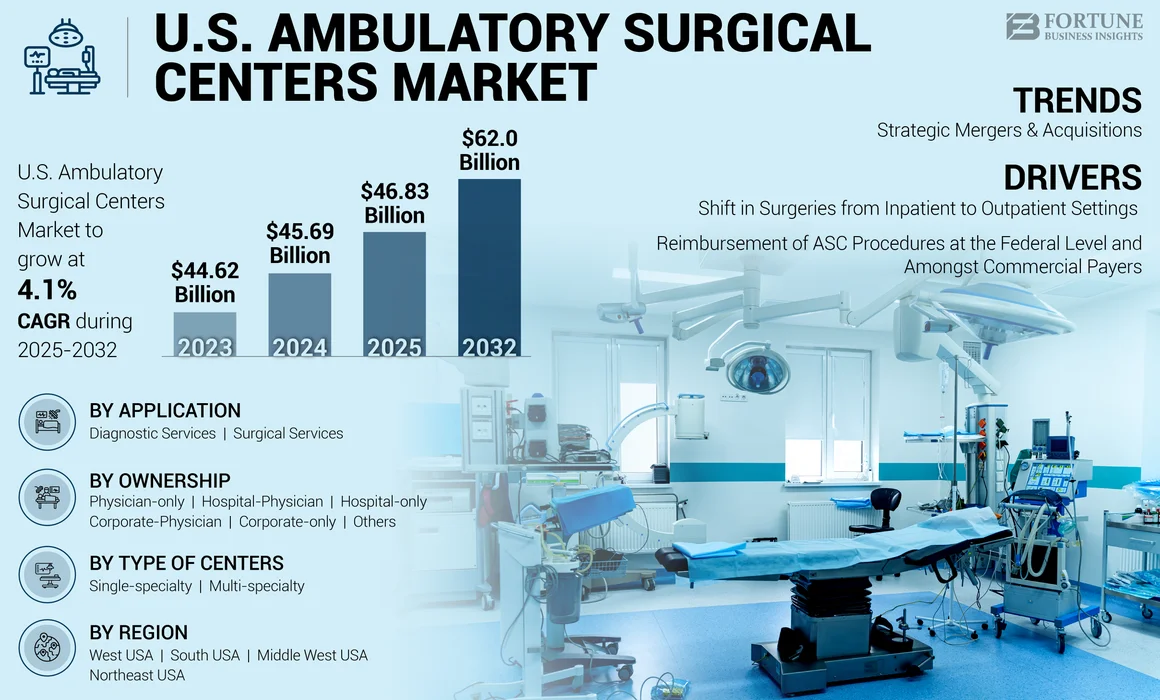

U.S. Ambulatory Surgical Centers Market Size, Share & Industry Analysis, By Type of Centers (Single-specialty and Multi-specialty), By Ownership (Physician-only, Hospital-Physician, Corporate-Physician, Hospital-only, Corporate-only, and Others), By Application (Diagnostic Services and Surgical Services), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The U.S. ambulatory surgical centers market size was valued at USD 45.69 billion in 2024. The market is projected to grow from USD 46.83 billion in 2025 to USD 62.03 billion by 2032, exhibiting a CAGR of 4.1% during the forecast period.

Ambulatory Surgical Centers (ASCs) refer to innovative outpatient healthcare centers offering surgical services, such as preventive and diagnostic services, on the same day. These settings offer a comfortable ambiance and affordable services compared to most hospitals in the U.S. The specialty services offered by these settings include surgeries related to orthopedics, pain management, ophthalmology, gastroenterology, dermatology, and urology.

Market growth is mainly attributed to the increasing need for new solutions and innovation to cut down healthcare costs in the U.S. Moreover, the growing incidence of chronic diseases requiring surgeries is driving the market growth. Furthermore, rising investments, a shift in patients’ admission from hospitals to ASCs, and favorable reimbursement scenarios are propelling market progress. Additionally, the increasing number of these centers over the last decade is expected to drive market growth in the coming years. For instance, according to the data published by the Ambulatory Surgery Center Association (ASCA) in September 2024, there were 6,394 Medicare-certified ASCs in 2024.

Prominent companies in the market include TH Medical, SCA Health (UnitedHealth GROUP), and Surgery Partners. These players have a well-established footprint in the U.S. market and a high focus on strategic growth initiatives such as acquisitions.

MARKET DYNAMICS

Market Drivers

Considerable Shift in Surgeries from Inpatient to Outpatient Settings to Surge Market Growth

In recent years, there has been a gradual shift of surgical procedures from inpatient to outpatient settings and a shift in surgical volume from hospital outpatient departments (HOPD) to ASCs. This high volume of surgeries being performed in ASCs is mainly attributed to the shorter stays, use of innovative & new technologies, cost-effective surgical procedures, and fewer risks of infection.

- For instance, according to the article published by the National Center for Biotechnology Information (NCBI) in March 2023, surgical procedures within the U.S. are increasingly shifting to outpatient or non-hospital locations. They are expected to expand at the rate of 4.05% annually.

- Similarly, according to the data published by the American Academy of Orthopedic Surgeons (AAOS) in March 2024, when analyzing all Current Procedural Terminology (CPT) codes collectively, procedures conducted at ASCs yielded around 35.0% savings in total costs, 41.0% savings on facility fees, 36.0% savings in Medicare payments, and 28.0% savings for patients when compared to hospital outpatient departments (HOPDs).

Additionally, the demand for outpatient care, particularly in cardiac catheterization, spinal, bariatric, and cataract surgeries, along with diagnostic and ultrasound services, has seen substantial growth. This trend is prompting hospitals to expand through the acquisition of outpatient facilities, physician practices, and ASCs. As a result, these factors are anticipated to significantly increase the adoption of ASCs in the U.S., contributing to a robust expansion in market growth.

Positive Reimbursement of ASC Procedures at the Federal Level and Among Commercial Players to Boost Market Growth

The significant availability of reimbursements for ASC procedures is one of the critical drivers for the market’s growth. The introduction of favorable policies for reimbursement is prompting the Centers for Medicare & Medicaid Services (CMS) to increase its list of surgeries that can be conducted in ASCs. Moreover, rising initiatives by commercial payers to encourage physicians to perform various surgical procedures in these settings are expected to drive market growth in the coming years.

Furthermore, CMS constantly focuses on reviewing the complications associated with performing surgeries in these settings, thereby improving the safety of patients undergoing operations in ASCs.

- For instance, in April 2022, Blue Cross and Blue Shield of Texas (BCBSTX) revised its fee schedule to increase reimbursements for approximately 1,500 outpatient surgery services performed at in-network ambulatory surgery centers (ASCs) for commercial members. This adjustment raised provider reimbursements by 15.0% to 50.0% per eligible procedure while offering patients the same quality of care at significantly lower costs compared to hospital settings.

- In June 2021, UnitedHealth Group committed to direct more surgeries toward ASCs by aiming to have more than 55.0% of outpatient surgeries and radiology services delivered at ASCs by 2030. Also, UnitedHealth Group has adopted certain policies that allow reimbursement of certain elective surgical procedures if they are conducted in these settings only.

Such intense focus of players on the safety of surgical procedures in ambulatory settings can attract a large patient pool in the U.S. These factors are expected to propel the U.S. ambulatory surgical centers market growth in the future.

Market Restraints

Complications and Emergencies During Surgical Procedures in ASCs May Impede Market Growth

Although ambulatory surgical centers offer numerous benefits, including improved patient outcomes and cost efficiency, the challenges during surgical procedures in these settings are expected to limit their market growth in the coming years. As the adoption of ASCs has increased in the U.S. in recent years, complications and emergencies associated with certain surgical procedures presented significant barriers. Only a limited range of procedures can be performed in ASCs compared to hospitals due to these safety concerns.

- For instance, data from the ASC Quality Collaboration Quality Report 2024 highlights complication rates in ASCs: unplanned anterior vitrectomy occurred in 0.283% of cataract surgery patients, patient falls were reported at 0.132 per 1,000 admissions, burns at 0.016 per 1,000 admissions, and wrong site or procedure events at 0.019 per 1,000 admissions. Additionally, toxic anterior segment syndrome (TASS) was observed in 0.064 per 1,000 anterior segment surgery patients.

Ambulatory surgical centers also face structural limitations. They lack overnight facilities, requiring patients to transfer to nearby hospitals for post-operative observation if necessary. Furthermore, many ASCs do not have the advanced equipment or specialized staff needed to handle medical emergencies due to high costs and training requirements. In contrast, hospitals are better equipped with advanced technology and highly trained personnel for managing complications.

Patients undergoing procedures at ASCs often need to visit separate facilities for follow-up care, rehabilitation, or treatment of complications. This adds inconvenience and financial burden, potentially reducing patient preference for ASCs. These factors have raised concerns about the safety and feasibility of certain surgeries in ASCs, which may lead to a decline in procedure volumes within these settings.

Market Opportunities

High Adoption of Robotic Technology in ASCs to Offer Lucrative Growth Opportunities

In recent years, the demand for technological advancements in surgical procedures at ambulatory surgical centers (ASCs) has grown significantly in the U.S. Robotic-assisted surgery (RAS) has emerged as a key innovation, offering benefits such as smaller incisions, reduced tissue damage, lower infection risks, and faster recovery times. These advantages make robotic-assisted surgery an attractive option for patients seeking cost-effective care in outpatient settings.

Robotic technologies such as the da Vinci Xi system have enabled procedures such as total knee arthroplasty (TKA), allowing surgeons to achieve precise implant alignment and soft tissue balance while reducing post-operative recovery time.

- For instance, Providence Mission Hospital reported improved patient outcomes and faster recoveries after introducing the da Vinci Xi system in 2021.

- Similarly, in October 2024, Distalmotion SA's Dexter surgical robot received FDA De Novo approval for adult inguinal hernia repair, marking a significant step in expanding robotic surgery access to outpatient settings. Dexter's design aims to overcome cost, space, and workflow barriers, making it ideal for everyday surgeries in ambulatory surgical centers.

Furthermore, the integration of artificial intelligence (AI), machine learning (ML), and digitalization enhances the efficiency and quality of robotic-assisted procedures. As more patients transition from traditional hospital settings to ASCs, the adoption of robotic technologies is expected to drive market growth by meeting the demand for minimally invasive and efficient surgical care in ASCs.

Market Challenges

Shortage of Staff is Leading to Delays in Procedures, Which Causes Challenges in the Market

The expansion of ASCs in the U.S. and the adoption of diverse procedures face several challenges that are expected to hinder market growth over the forecast period. During the COVID-19 pandemic, many ASC staff members left the profession, creating staffing shortages that persist today. Some ASCs struggle to fill vacant positions, especially during off times, which limits their operational capacity.

- For instance, according to an April 2022 report by the American Medical Association (AMA), the U.S. is projected to face a shortage of 37,800 to 124,000 physicians by 2034. ASCs that fail to adopt proactive strategies for physician recruitment and retention may encounter further difficulties in addressing staffing gaps.

Additionally, hospitals often offer higher salaries than ASCs, attracting potential surgeons with more competitive compensation packages. This difference makes it challenging for ASCs to recruit and retain skilled staff. Consequently, insufficient staffing levels can delay surgeries and reduce surgical capacity, directly impacting revenue generation.

- For instance, as of 2025, MedHQ reported that many ASCs, despite having adequate facilities, are unable to schedule a sufficient number of cases due to limited staffing.

These factors collectively pose significant challenges to the growth of ASCs in the U.S., limiting their ability to meet rising demand and sustain operational efficiency.

Regulatory Hurdles May Pose a Significant Challenge for the ASCs

Ambulatory surgery centers (ASCs) face significant regulatory hurdles due to the complex and varied nature of federal and state regulations. These laws, which vary by state, regulate the development and expansion of ASCs. For instance, states such as North Carolina and South Carolina are reforming or repealing CON requirements, while others maintain strict regulations.

Furthermore, the ASCs must comply with federal laws such as the Anti-Kickback Statute (AKS), which prohibits improper referrals and requires transparency in investment interests.

U.S. AMBULATORY SURGICAL CENTERS MARKET TRENDS

Strategic Mergers & Acquisitions to Determine Market Growth Trajectory

One of the most important trends witnessed in this market in the U.S. is that there has been an increased focus on strategic mergers and acquisitions. Companies operating in this market are constantly focusing on several strategies, such as mergers, acquisitions, and business expansions. These strategies are expected to help them increase their revenue, thereby fostering the market growth.

The acquisition of medical practices, including specialties such as ophthalmology, enables companies to integrate these services into their ASCs, enhancing patient care. Smaller organizations can also benefit significantly from being acquired by larger entities. This integration allows them to leverage the resources and networks of managed care organizations (MCOs), facilitating more streamlined and integrated care delivery. As a result, smaller organizations can experience rapid growth and improved operational efficiency through these strategic initiatives.

- For instance, in January 2025, AMSURG expanded its ambulatory surgery center network by acquiring an ownership interest in Texarkana Surgery Center, a facility in northeast Texas offering same-day procedures across multiple specialties.

- In April 2023, UnitedHealth Group's Optum and the parent company of SCA Health acquired physician groups from Kelsey-Seybold, Crystal Run Healthcare, Healthcare Associates of Texas, and Atrius Health. The acquisition focused on expanding services and supporting high-quality care with better experiences for patients and medical service providers.

As an increasing number of companies are engaging in the strategic mergers and acquisitions of ASCs across the U.S., there is expected to be a greater awareness and adoption of the usage of these facilities.

Download Free sample to learn more about this report.

IMPACT of COVID-19

Decline in Surgeries During COVID-19 Pandemic Reduced Market Revenue

The COVID-19 pandemic had a negative influence on the market. Challenges, such as shortage of workforce, procedural prioritization, risk of transmission of COVID-19 virus, and the limited number of surgical procedures in these settings, challenged the market growth during this period. ASCs in the U.S. witnessed a decline in the number of visits, thereby reducing the overall revenue of ambulatory settings. Moreover, operational restrictions, such as mandates to stop or postpone elective surgeries during the COVID-19 pandemic, negatively impacted the market.

- For instance, in April 2020, the Centers for Medicare & Medicaid Services, in collaboration with medical societies and associations, announced recommendations for postponing non-essential surgeries and other procedures with the help of a tiered framework.

Additionally, factors including the rapid spread of the COVID-19 pandemic through public gatherings and conserving vital resources, such as personal protective equipment and mechanical ventilators, postponed elective surgical procedures in these settings in 2020. However, the migration of patients from hospitals to ambulatory surgical centers is expected to be rapid post the COVID-19 outbreak. The resumption of elective procedures also increased the patient volume in 2021 and helped the market recover partially and reach the pre-pandemic level. In the same year, the substantial increase in the revenue of ambulatory settings due to increased patient visits also contributed to the surge in market growth. Furthermore, in 2022, the market fully recovered, falling back to its pre-pandemic level, and is expected to witness significant growth during the forecast period 2025-2032.

SEGMENTATION ANALYSIS

By Type of Centers

Single-specialty Segment to Hold a Dominant Share Due to Growing Cases of Ophthalmic Disorders

Based on the type of centers, the market is segmented into single-specialty and multi-specialty.

The single-specialty segment dominated the U.S. market in 2024 and is anticipated to continue its dominance during the forecast period. The dominance is attributed to the growing incidence of ophthalmic disorders and the strong presence of single-specialty ASCs in the U.S. Moreover, the rise in ophthalmic procedures performed in these settings is also anticipated to boost the segment growth during the forecast period.

- For instance, in October 2024, the University of Florida Health (UFH) mentioned that over half of all U.S. individuals have cataracts, and around 4.0 billion cataract surgeries are performed in the U.S. annually.

The multi-specialty segment is projected to record a substantial CAGR during the forecast period. The segment growth can be attributed to the increasing focus of prominent players on launching multi-specialty ASCs to address the U.S.

To know how our report can help streamline your business, Speak to Analyst

By Ownership

Physician-only Segment Leads the Market Owing to Increasing Sole Ownership of ASCs

Based on ownership, the market is segmented into physician-only, hospital-physician, corporate-physician, hospital-only, corporate-only, and others.

The physician-only segment accounted for the largest U.S. ambulatory surgical centers market share in 2024. Physicians are finding ASC ownership more appealing due to the higher profit margins it offers compared to traditional hospital settings. This setup also gives them greater control over their practice, allowing them to oversee things such as surgery schedules and staff management. As a result, more physicians are expected to opt for sole ownership of ASCs in the U.S., which may spur the segment growth.

- For instance, according to the BH Sales Group's Quarter 2 report released in August 2024, 68.0% of ambulatory surgery centers (ASCs) in the U.S. were directly owned by physicians.

The hospital-physician segment held a substantial share of the market. Hospitals are increasingly partnering with physicians in joint ventures to capitalize on their expertise and patient networks. This collaboration not only enhances operational efficiency but also improves patient care by incorporating physician insights into ASC management. Additionally, ASCs operate at lower costs than traditional hospitals, making them an attractive option for both hospitals and physicians. These factors are expected to drive growth in this segment during the forecast period.

The corporate-physician segment held a moderate market share in 2024. The segment’s growth is expected to be driven by corporate entities taking partial ownership roles in ASCs owing to the increasing demand for outpatient surgical procedures in the U.S.

The hospital-only segment accounted for a considerable market share in 2024 due to the increasing focus of hospital networks on the expansion of their ASCs through various initiatives, such as new facility launches to provide outpatient services to the majority of the U.S. population.

The corporate-only segment is anticipated to increase significantly during the forecast period of 2025-2032. The segment’s high growth rate is attributed to the increasing focus of management companies on forming a common joint venture with ASCs. This ownership model is expected to gain popularity in the coming years as partnerships between corporate firms and ASCs are emerging.

The others segment is anticipated to witness stagnant growth during the forecast period due to increasing demand for outpatient procedures coupled with the high prevalence of chronic conditions among the population.

By Application

Surgical Services Segment to Continue its Dominance Due to Increasing Number of Surgical Procedures

Based on application, the market is segmented into surgical services and diagnostic services.

The surgical services segment dominated the market in 2024 and is expected to register the highest CAGR during the forecast timeframe. This segment's large share and high growth rate are attributed to the increasing number of surgical procedures in ambulatory settings due to the lower costs of ASCs compared to hospital settings. These procedures majorly include surgeries related to pain management, gastroenterology, ophthalmology, and orthopedics.

- For instance, according to the data published by the National Center for Biotechnology Information (NCBI) in March 2023, it was anticipated that the number of outpatient procedures would reach 144.0 billion in 2023.

The diagnostic services segment is estimated to record a moderate CAGR during the forecast period. The segment's growth is expected to be driven by rising cases of conditions such as colorectal cancer. ASCs offer diagnostic services such as colonoscopies and screenings, which are expected to boost growth in this area further.

U.S. AMBULATORY SURGICAL CENTERS MARKET COUNTRY OUTLOOK

Based on geography, the market has been studied across the West USA, South USA, Middle West USA, and Northeast USA.

South USA

In 2024, the South USA held the highest share of the market. The market’s growth in this region is attributed to the strong presence of market players providing ambulatory services, a large patient pool requiring various surgical procedures, and an increasing number of ambulatory surgical centers in Alabama, Texas, and North Carolina.

- For instance, according to recently published data by the Centers for Medicare & Medicaid Services (CMS), in September 2024, the number of ambulatory surgical centers in Texas reached 488, witnessing significant growth compared to the past few years.

West USA

West USA accounted for a substantial share of the market in 2024. The growth of this region is attributed to the rising focus of key players on launching new centers and entering into strategic agreements to expand access to high-quality ASC services in states such as California, Illinois, Ohio, and Indiana.

Middle West USA and Northeast USA

Middle West USA and Northeast USA are expected to grow at the second-highest and moderate CAGR, respectively, during the forecast period. The rising number of procedures in orthopedics & gastroenterology, rising players’ initiatives, and the strong presence of ASCs are expected to boost market growth during the forecast timeframe.

COMPETITIVE LANDSCAPE

Key Industry Players

TH Medical Held Key Market Share in 2024 Due to Vast ASC Chains

The market is highly fragmented due to the presence of many companies offering ambulatory surgical services in the U.S. However, several key players, such as TH Medical, Surgery Partners, and SCA Health (UnitedHealth GROUP), held a substantial share of the market in 2024.

TH Medical dominated the market in 2024. Its dominance is due to the large number of ambulatory surgical centers owned, operated, and added by the company. For instance, in 2024, TH Medical added 11 new ambulatory surgery centers, including a new partnership with the Florida Orthopedic Institute.

Other companies, such as HCA Management Services, L.P., Physicians Endoscopy, LLC, SurgCenter, and Medical Facilities Corporation, held substantial market shares due to their strong presence in the U.S. and the number of ASCs owned by them. Furthermore, strategic initiatives, such as mergers and acquisitions, are expected to increase their market shares in the coming years.

LIST OF KEY U.S. AMBULATORY SURGICAL CENTER COMPANIES PROFILED

- AMSURG (U.S.)

- TH Medical (U.S.)

- Surgery Partners (U.S.)

- SurgCenter (U.S.)

- SCA Health (UnitedHealth GROUP) (U.S.)

- HCA Management Services, L.P (U.S.)

- Physicians Endoscopy, LLC (U.S.)

- Constitution Surgery Alliance (U.S.)

- Medical Facilities Corporation (U.S.)

- American Vision Partners (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Constitution Surgery Alliance announced that four of its partnered ambulatory surgery centers (ASCs) have been named to the Leapfrog Group's "Top Ambulatory Surgery Center" list for 2024.

- June 2024: AMSURG’s 57 surgery centers were recognized by the U.S. News & World Report as among the best in the nation for 2024, based on factors such as patient outcomes and avoidance of complications. This strengthened the company’s market position.

- April 2024: TH Medical announced its plans to increase investments in specialty care to grow its ambulatory surgical center footprint in the market.

- February 2024: Surgery Partners and Parkview Health announced a statewide partnership for ambulatory surgical care growth across Indiana, which strengthened its market position in the U.S.

- September 2023: SurgCenter developed an ambulatory surgery center, Interventional & surgical suites of Wilkes-Barre in Wilkes-Barre. The facility is dedicated to vascular surgery.

- February 2023: TH Medical’s subsidiary United Surgical Partners International (USPI) signed a new development agreement with Providence to increase access to ambulatory surgical services across many communities in the Western U.S.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, type of centers, ownerships, and applications. Besides this, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report includes the number of ASCs in key states, an overview of top surgical procedures in ambulatory settings, a comparative analysis of the average price and cost of elective procedures in ASCs & HOPDs, and an analysis of the COVID-19 impact on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.1% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type of Centers

|

|

By Ownership

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market value stood at USD 45.69 billion in 2024 and is projected to reach USD 62.03 billion by 2032.

The market is expected to exhibit a steady CAGR of 4.1% during the forecast period of 2025-2032.

By type of centers, the single-specialty segment led the market in 2024.

Considerable shifts in surgeries from inpatient to outpatient settings and positive reimbursement of ASC procedures at the federal level and among commercial players are the key factors driving market growth.

TH Medical, SCA Health (UnitedHealth GROUP), and Surgery Partners are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us