U.S. Biofertilizers Market Size, Share & COVID-19 Impact Analysis, By Type (Nitrogen Fixing, Phosphate Solubilizers, Others), By Microorganism (Rhizobium, Azotobacter, Azospirillum, Pseudomonas, Bacillus, VAM, Others), By Application (Seed Treatment, Soil Treatment, Others), By Crop Type (Cereals, Pulses & Oilseeds, Fruits & Vegetables, Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

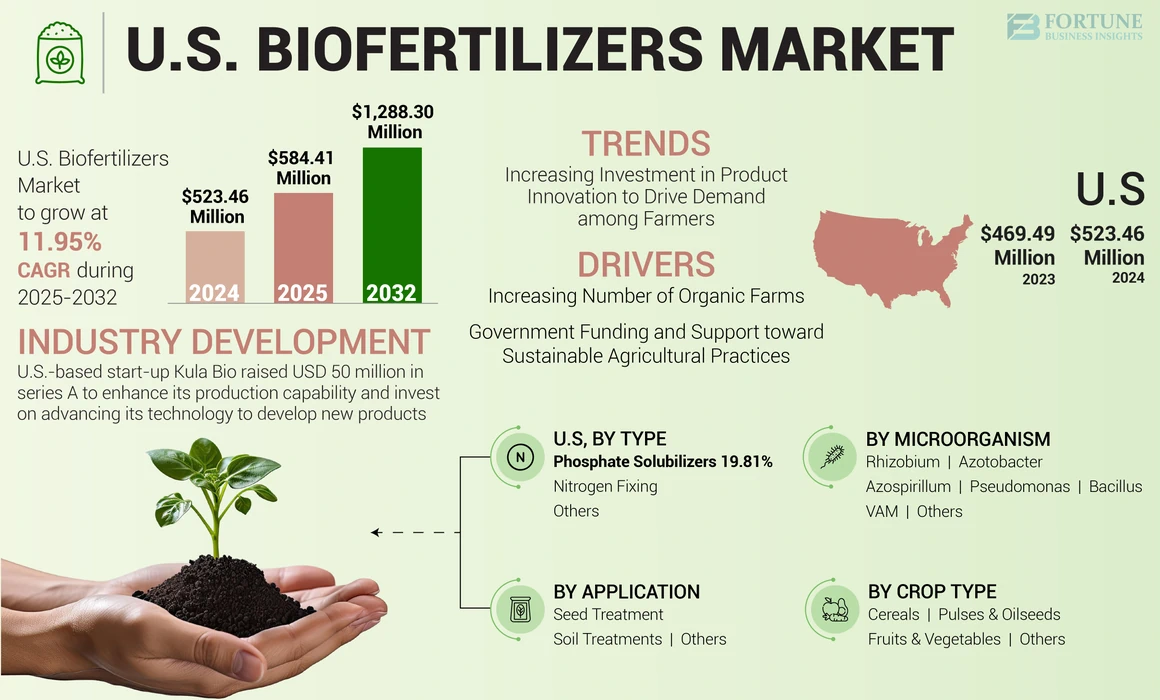

The U.S. biofertilizers market size was USD 523.46 million in 2024. The market is projected to grow from USD 584.41 million in 2025 to USD 1,288.30 million by 2032, exhibiting a CAGR of 11.95% during the 2025-2032 period.

Biofertilizers refer to agricultural fertilizers containing microorganisms that help improve soil fertility and ensure plant growth. The U.S. is one of the largest consumers of the product and farmers rely heavily on using sustainable agricultural inputs to improve their crop yield. Products such as rhizobium biofertilizers are significantly popular in the country.

COVID-19 IMPACT

Logistics Disruption Significantly Hampered the Overall Market Growth

The market size suffered slightly during the COVID-19 pandemic. The pandemic impacted the global and the U.S. agri-inputs supply chain, causing a slowdown in the bio-fertilizer market growth. The farmers in the U.S. also suffered as there was a significant gap between the demand and supply of such products in the market. Some of the manufacturers increased the price of their products, causing further distress to the dwindling profit margin of farmers. Despite agricultural activities remaining operational during the pandemic, lockdown and transport disruptions hampered the manufacturer's ability to source the raw materials required for manufacturing and transporting the final goods to the farmers. Hence, farmers shifted from shop-based products to products such as manure, which are readily available in various farms.

U.S. Biofertilizers Market LATEST TRENDS

Download Free sample to learn more about this report.

Increasing Investment in Product Innovation to Drive Demand among Farmers

Start-ups are investing significantly in developing innovative agricultural solutions for the growing U.S. market. Companies such as Kula Bio are developing proprietary technology that increases the microorganisms' shelf life and efficacy. Some companies, such as Earnest Earth, are developing bacterial strains which can tolerate changing environmental conditions. Furthermore, some companies are adopting advanced technology, such as machine learning to formulate new products. The combination of innovation with technology is expected to enable manufacturers to increase their product effectiveness in the upcoming years.

U.S. Biofertilizers Market Growth FACTORS

Increasing Number of Organic Farms to Augment the Growth of the U.S. Biofertilizers Market

Many conventional farms in states such as California, Vermont, New York, and Maine are transitioning toward organic farming. As per data provided by the U.S. Department of Agriculture (USDA), there are 17,445 certified organic farms in the U.S. In organic cultivation practices, biofertilizer is one of the major agricultural inputs used to improve productivity. Rhizobium, azotobacter, and other nitrogen based products are widely used for cultivating organic fruits and vegetables. The growth in organic farming is expected to boost the demand of biologicals in the country.

Government Funding and Support toward Sustainable Agricultural Practices to Promote Biofertilizers Industry Growth

As per data provided by the World Bank, the price of fertilizers increased by 30% in 2022 owing to the COVID-19 impact and the Russia Ukraine war. Such a hike in agriculture input cost significantly strained the operation of U.S. farmers growing corn and wheat specifically. Hence, to support the farmers in combating the hike in the price of fertilizer cost, the U.S. Department of Agriculture (USDA) announced its support for developing innovative and sustainable fertilizer by providing a grant of USD 250 million. Such programs help the producers to innovate and develop new products for the growing market in the U.S.

Moreover, to reduce the reliance on synthetic fertilizers, programs such as carbon credits are introduced to nudge the chemical fertilizer manufacturing companies toward manufacturing environmentally sustainable products. Farmers are also able to derive significant monetary profit from such programs. For instance, U.S.-based company Indigo Ag helps farmers to generate income through carbon credit markets.

RESTRAINING FACTORS

Varying Effectiveness of Bacterial Strains under Different Climatic Conditions to Impede Market Growth

The effectiveness of these products varies significantly based on the soil and climatic conditions. Its efficacy decreases with an increase in temperature and changes in the pH levels of soil. Additionally, in extreme climatic conditions, a suitable carrier material is unavailable for bacterial strains growth, impacting their efficacy. As the climatic conditions are worsening in the U.S., there is an urgent need to address the bacteria efficacy and improve product quality. Such instances can hamper the U.S. biofertilizers market growth.

U.S. Biofertilizers Market SEGMENTATION Analysis

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Nitrogen Fixing Biofertilizers to Lead Owing to the Increased Demand for Agricultural Crops

Nitrogen-fixing products account for the highest share of biofertilizers in the U.S. market. The U.S. is one of the major global producers of corn, wheat, and soybeans, and the farmers invest significantly in products which help improve the yield of these crops. The use of nitrogen-fixing products helps in nitrogen fixation, iron sequestration, allowing plants to use such molecules for growth and development. With an increase in crop production, the demand for such products is expected to increase significantly.

As per a research published by the U.S. Department of Agriculture (USDA), limited presence of phosphorous in the soil can cause low yield and poor growth. Using phosphate solubilizing bacteria (PSB) helps improve the crops' phosphorous intake. Soybean, one of the major crops grown in the U.S., requires phosphorous for its growth which can help improve crop yield.

By Microorganism Analysis

Rhizobium Holds Maximum Share Due to Increasing Demand for Nitrogen Fixing Biofertilizers

Rhizobia is one of the major microorganisms that can easily form a symbiotic relationship with plants, convert atmospheric nitrogen to ammonia, improve soil fertility, and rehabilitate arid lands. Legumes such as peas, chickpeas, and soybeans are able to benefit from such association and attain significant growth.

Azotobacter species is one of the major microorganisms found suitable for improving plant nitrogen nutrition and can be used for large-scale production of such products. It helps synthesize plant growth hormones and stimulate other rhizosphere microorganisms that promote plant growth and protect host plants. Using such azotobacter containing fertilizer also helps reduce reliance on urea and other chemical nitrogen-containing fertilizers. Other microorganism species such as Azospirillium, Pseudomonas, Bacillus and VAM are also used for manufacturing such fertilizers.

By Application Analysis

Seed Treatment to Dominate Due to Higher Bioavailability Compared to Other Applications

Seed treatment is the most widely adopted process among the different modes of application used for applying biofertilizers. Rhizobium and azotobacter can be easily applied on seeds effectively and economically and can be used on field crops, pulses, cereals grains, and other crops to enhance plant emergence and growth, improve nutrition intake, and crop and plant immunity.

Another way through which these products are applied to the crops is through soil treatment. Applying them to soil helps keep the soil together and consolidate the soil structure. This helps to reduce soil erosion, enable nutrient recycling and improve crop yield.

By Crop Type Analysis

Cereals Account for Highest Market Share Owing to High Production

Among crop type, the cereals segment accounts for the highest share owing to the country's high production of corn and oats. According to data provided by the National Agricultural Statistics Service and the U.S. Department of Agriculture (USDA), the U.S. produced 13.9 billion bushels of corn and 4.38 billion bushels of soybean in 2022. Such increase in production, export, and consumption is expected to propel farmers to adopt biofertilizers to improve the yield.

The U.S. is also a major producer of oilseeds in the world and produces crops such as soybeans, cottonseed, and sunflower. Thus, the manufacturers have the opportunity to develop products that can improve the overall market share.

KEY INDUSTRY PLAYERS

Key Players are Focusing on Research and Development to Develop New Products

Several major players and startups are competing against each other to expand their market presence in the country. Some of the major players are Lallemand Inc., Novozymes A/S, Kiwa Bio-Tech Products Group Corporation, and others. The U.S. market is the largest shareholder in the North America biofertilizers market and thus the increasing demand for sustainable agricultural solutions has created opportunities for the market players to focus on research and developing new products and launch innovative and crop-specific solutions for farmers. Some of the market players are also entering into strategic partnerships with related players to expand their production capabilities and improve their go-to-market strategy. . They are also providing free sample of biofertilizers to the farmers so that they can determine the efficacy of the products on the crops

List of Top U.S. Biofertilizers Companies:

- Lallemand Inc. (Canada)

- Kiwa Bio-Tech Products Group Corporation (U.S.)

- BioWorks, Inc.(U.S.)

- Novozymes A/S (Denmark)

- Rizobacter S.A. (Argentina)

- SYMBORG CORPORATE, SL. (Spain)

- Suståne Natural Fertilizer, Inc. (U.S.)

- The Espoma Company (U.S.)

- AgroLiquid (U.S.)

- Chr. Hansen Holding A/S (Denmark)

KEY INDUSTRY DEVELOPMENTS:

- January 2022: U.S.-based start-up Kula Bio raised USD 50 million in series A to enhance its production capability and invest on advancing its technology to develop new products.

- May 2022: U.S.-based bio fertilizer company Anuvia Plant Nutrients announced its plans to invest USD 65.5 million in expanding its presence and production capacity in the U.S. market. Such expansion can help the company serve the U.S. farmer needs effectively.

- July 2022: U.S.-based biofertilizer company Performance Nutrition introduced new biofertilizers containing Bacillus, Trichoderma plus the Saccharomyces for agricultural, turf, and ornamental markets and plans to increase its production capacity in Plant City, Florida, and market its products in the North American region.

- September 2021: Novozymes launched new biologicals solution such as BioniQ and Optimize FXC especially for the North American farmers to improve the overall product yield and soil fertility. Such new product launch can help the company expand its presence in the expanding U.S. market.

- August 2022: Pivot Bio, a U.S.-based company, launched PROVEN 40 On-Seed (OS) and RETURN On-Seed for corn, sorghum, and spring wheat that delivers nitrogen-producing microbes on the seed and integrate nitrogen during the planting season.

REPORT COVERAGE:

Request for Customization to gain extensive market insights.

The report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market size and growth rate for all possible segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in the U.S., and key industry trends.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 11.95% from 2025 to 2032 |

|

Segmentation |

By Type

|

|

By Microorganism

|

|

|

By Application

|

|

|

By Crop Type

|

Frequently Asked Questions

According to Fortune Business Insights, the U.S. biofertilizers market was valued at USD 523.46 million in 2024 and is projected to grow from USD 584.41 million in 2025 to USD 1,288.30 million by 2032.

The market is projected to grow at a CAGR of 11.95% during the forecast period (2025-2032).

Biofertilizers are agricultural fertilizers containing beneficial microorganisms that enhance soil fertility and promote plant growth. They improve nutrient availability, reduce chemical fertilizer dependency, and support sustainable farming practices.

Market growth is driven by increasing organic farming, rising government support and funding for sustainable agricultural practices, innovations in product development, and growing farmer awareness about the benefits of biofertilizers.

Nitrogen-fixing biofertilizers such as rhizobium dominate the market due to their effectiveness in improving yields of major crops like corn, wheat, and soybeans. Phosphate solubilizers also hold significant importance.

The efficacy of biofertilizers varies under different soil and climatic conditions, with reduced effectiveness in extreme temperatures or altered soil pH. This variability can hamper widespread adoption and product performance.

Seed treatment is the most common application method due to its cost-effectiveness and high bioavailability. Soil treatment is also widely used to improve soil structure, reduce erosion, and enhance nutrient recycling.

Major companies include Lallemand Inc., Kiwa Bio-Tech Products Group Corporation, BioWorks, Inc., and Novozymes A/S. These companies focus on research, innovation, and strategic partnerships to develop crop-specific and sustainable biofertilizer solutions.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us