U.S. Diagnostic Imaging Services Market Size, Share & Industry Analysis, By Procedure (CT, MRI, X-Ray, Ultrasound, and Others), By Application (Cardiology, Neurology, Oncology, Orthopedics, Gynecology, and Others), By Payor (Public Health Insurance and Private Health Insurance/Out of Pocket), and By Setting (Hospital In-patient, Hospital Outpatient (HOPD), Freestanding Imaging Centers, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

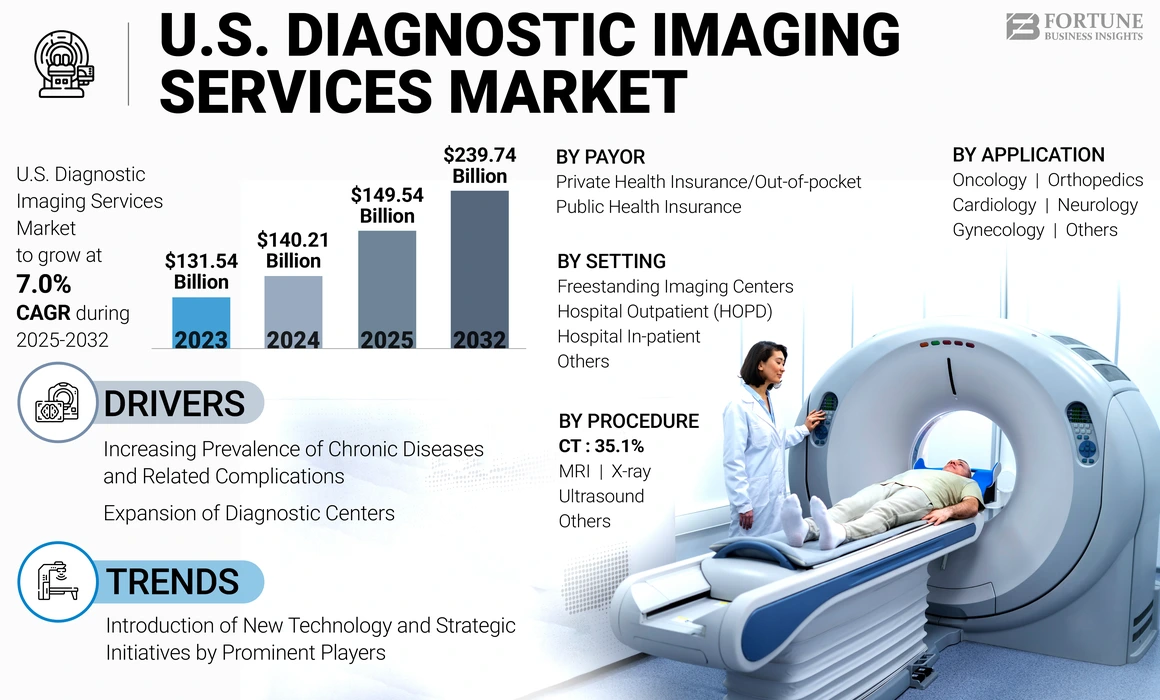

The U.S. diagnostic imaging services market size was valued at USD 140.21 billion in 2024. The market is projected to grow from USD 149.54 billion in 2025 to USD 239.74 billion by 2032, exhibiting a CAGR of 7.0% during the forecast period.

Medical imaging is a crucial diagnostic procedure that provides vital data with high efficiency and safety. Imaging services include different imaging modalities such as MRI, nuclear medicines scans, ultrasound, x-ray, and CT scans, which are non-invasive techniques to diagnose various diseases. Growing technological advancements in MRI modality and the widening application of MRI in the medical field are the key drivers augmenting market growth. In addition, the expansion of insurance coverage for diagnostic imaging, along with the introduction of new services by major industry players, are expected to further drive the growth of the diagnostic imaging services throughout the forecast period.

Major players in the market include RadNet Inc., Akumin Inc., and Rayus Radiology, which have a strong foothold in the U.S. market. These companies are highly focused on strategic growth initiatives such as acquisitions and new service launches to boost their market position.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Chronic Diseases and Related Complications to Drive Market Growth

In recent years, the prevalence of chronic diseases in the U.S. has risen sharply, impacting a growing portion of the population. This trend is anticipated to significantly boost the demand for diagnostic imaging services, which are essential for detecting cancers and other abnormalities. Additionally, the growing aging population is more susceptible to such chronic diseases, and is expected to further increase the need for diagnostic imaging in the U.S.

- For instance, according to the data published by the National Foundation for Cancer Research (NFCR), the American Cancer Society’s Cancer Facts & Figures 2024 projects that 25,400 malignant tumors of the brain and spinal cord will be diagnosed in the U.S. in 2024. Furthermore, it states that an estimated 90,000 brain tumors are diagnosed in the U.S. annually, and approximately 28.0% are considered to be malignant.

Moreover, cardiovascular disease is one of the most life-threatening health conditions in the U.S. Individuals with diabetes face a significantly higher risk of developing heart-related complications. For instance, according to the data published by GE Healthcare in March 2023, more than 20.0 million U.S. patients experiences chest pain annually due to cardiovascular abnormalities, a factor expected to drive the demand for Cardiac CT imaging.

Imaging methods such as X-rays, MRI, and ultrasound play a crucial role in diagnosing, staging, and tracking the progression of various chronic conditions, particularly those affecting abdominal and other soft tissues. As a result, the rising number of individuals with these conditions, the demand for the product is expected to grow, contributing to market expansion.

Expansion of Diagnostic Centers to Augment Market Growth

Over the past few years, an increased demand for imaging services in diagnostic centers has increased compared to hospitals, driven by factors such as affordability and accessibility. Diagnostic centers typically offer lower cost imaging procedures than hospitals, where prices can range from a few hundred to several thousand dollars. This cost difference is attributed to the higher utilization rates of imaging equipment in diagnostic centers, which allows the fixed costs of purchase, maintenance, and operation to be distributed across a larger patient base.

Moreover, key market players are expanding their presence by opening new diagnostic centers to enhance patient accessibility. For instance,

- In March 2023, LucidHealth, Inc. launched its 14th outpatient imaging center in Fort Myers, Florida, offering advanced services like 3D mammography and breast biopsies.

- In April 2022, RAYUS Radiology and Froedtert & The Medical College of Wisconsin opened a new imaging center in West Bend.

Such a scenario is expected to fuel the growth of diagnostic imaging services in the U.S. as patients increasingly seek cost-effective and convenient options for medical imaging.

Market Restraints

Shortage of Skilled Workforce to Restrict Market Growth

One of the major factors limiting market growth in the U.S. is the shortage of a skilled workforce, which may pose challenges to fulfill the demand for rising imaging procedures to a certain extent, thereby declining or delaying the procedures.

- For instance, in December 2022, the Mammography International Consortium of AI (MICA) released data published from the Association of American Medical Colleges (AAMC), indicating a shortfall of nearly 42,000 radiologists and other clinical specialists in the U.S. by 2033.

Although medical schools have increased their enrollments in the past few years, low acceptance rates continue to limit the availability of radiologists in the country to fulfill the rising demand. Additionally, a significant portion of the current radiology workforce is nearing retirement, further exacerbating the shortage.

- For instance, as per the data published by Medicus Healthcare Solutions, LLC. in January 2025, among the total active radiologists in the U.S., there were 56.4% of radiologists aged more than 55, while the number of radiology trainees increased by just 2.5%.

Thus, the shortage of skilled workforce remains one of the biggest restraints on the growth of the diagnostic imaging procedures in the U.S. Furthermore, concerns regarding the potential side effects of medical imaging procedures are also expected to restrain market growth.

Market Opportunities

Use of Artificial Intelligence (AI) in Medical Imaging to Fuel Market Growth

Artificial intelligence (AI) is revolutionizing medical imaging by enhancing accuracy, efficiency, and diagnostic capabilities. AI algorithms can quickly analyze vast amounts of imaging data, identifying patterns and abnormalities that human observers may miss. This technology is particularly valuable for early detection and characterization of diseases, including cardiovascular conditions, cancers, and neurological disorders.

AI tools can automate tasks such as aortic valve analysis, carina angle measurement, and pulmonary artery diameter evaluation. They also excel in detecting fractures, musculoskeletal injuries, and high-risk conditions such as pneumothorax, reducing false-negative rates and improving patient outcomes. Additionally, AI-powered systems can identify and label structures such as organs and tumors, streamlining workflows for healthcare professionals while enabling precise treatment planning.

In oncology, AI aids in detecting cancer spread and supports personalized treatment strategies. For instance, AI-based image segmentation allows clinicians to target specific areas for surgical or pharmacological interventions. In radiology, AI enhances the detection of subtle anomalies in CT scans, MRIs, and X-rays, offering consistent accuracy even under high workloads. Recognizing these advantages, market players are increasingly adopting AI to enhance the efficiency of their diagnostic imaging services. This growing reliance on AI is anticipated to boost market expansion in the coming years. For instance,

- In November 2023, RadNet Inc. launched DeepHealth, an AI-powered health informatics portfolio, to enhance radiology's efficiency and role in healthcare.

- In November 2023, Radiology Partners launched its RPX AI orchestration platform on Amazon Web Services (AWS) to simplify the deployment of AI medical imaging tools for hospitals.

Market Challenges

Decreasing Reimbursement for Imaging Procedures to Challenge Industry Development

Currently, declining reimbursement rates for diagnostic imaging procedures, coupled with rising equipment prices, have placed additional financial strain on small and medium-sized healthcare providers. These facilities often depend on third-party payers for reimbursements, making them particularly vulnerable to ongoing cuts in reimbursement rates. In addition, the high costs associated with acquiring, maintaining, and operating advanced imaging technologies pose significant challenges for many healthcare facilities. This financial burden limits their ability to invest in these systems and thereby reduces patient access to diagnostic imaging in the U.S.

- For instance, a study published by the NCBI in September 2024 revealed that Medicare reimbursements for advanced imaging modalities, particularly common spinal imaging procedures, experienced significant reductions between 2005 and 2020.

Such financial strains are expected to pose a major challenge to U.S. diagnostic imaging services market growth in the coming years.

U.S. DIAGNOSTIC IMAGING SERVICES MARKET TRENDS

Introduction of New Technology and Strategic Initiatives by Prominent Players to Spur Market Growth

In recent years, the medical imaging industry has undergone rapid transformation, driven by technological advancements in diagnostic imaging, innovative business models, and strategic collaborations. These developments are enhancing diagnostic and therapeutic capabilities while improving patient care.

Recent innovations include the adoption of cryogen-free MRI systems, the Internet of Things (IoT), and Artificial Intelligence (AI), which are reshaping the sector. AI, in particular, is revolutionizing imaging by increasing diagnostic accuracy, streamlining workflows, and enabling personalized care. Digital imaging technologies now offer superior image quality, faster acquisition times, and simplified storage compared to traditional methods, further boosting their adoption. Additionally, the introduction of hybrid MRI equipment, high-field MRI, and superconducting magnets has significantly enhanced the diagnostic capabilities of service providers globally.

Moreover, key players in the market are continuously introducing advanced solutions and forming strategic partnerships to improve the landscape of diagnostic imaging across the U.S.

- For instance, in November 2024, Akumin Inc. launched Akumin Axis at RSNA 2024. This platform is designed to optimize patient access in radiology by providing single or multi-modality imaging solutions for hospitals and physician groups.

- In February 2024, MedQuest Associates collaborated with GE HealthCare on a three-year initiative to deliver digital tools and advanced medical device technologies for outpatient imaging centers.

These innovations and partnerships are driving the growth of diagnostic imaging services in the U.S., meeting the rising demand for early disease detection and improved patient outcomes.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a negative impact on the market in 2020, primarily due to the hospitals and imaging centers limited the number of procedures conducted. For instance, the total number of CT scan procedures conducted in the U.S. decreased from 92 billion in 2019 to 73 billion in 2020, with an annual decline of 21.0%. Moreover, major players in the market, such as RadNet, Inc., observed an annual decline of 12.9% in the number of procedures conducted across all imaging modalities in 2020.

Furthermore, the average cost of these procedures increased during the COVID-19 outbreak. For instance, the cost of CT scans increased from USD 231.0 in 2019 to USD 312.0 in 2020. However, this decline had a short-term negative impact on the market, with minimum or no long-term effects on the fundamental drivers of diagnostic imaging demand. These factors led to a decline in the number of diagnostic imaging procedures conducted in the U.S., negatively affecting industry growth in 2020. The market began to recover in 2021 and 2022 and is set to exhibit steady growth in the forecast period from 2025-2032.

SEGMENTATION ANALYSIS

By Procedure

CT Segment Dominated the Market due to Rise in Number of CT Scan Procedures

Based on procedure, the market can be divided into CT, MRI, X-ray, ultrasound, and others. The CT segment held the largest share in 2024. The growing burden of chronic diseases, including heart disease and cancer, is leading to a higher demand for CT scans as a diagnostic tool. The increasing number of CT scans performed across the U.S., is expected to contribute to the segment's expansion. Moreover, the demand for CT scanners increased post-pandemic, as chest CT scan played a major role in diagnosing COVID-19 infections.

- For instance, according to the article published by the National Center for Biotechnology Information (NCBI) in May 2024, the American Cancer Society projected that 2.0 million new cancer cases would be diagnosed in the U.S., driving the demand for CT exams.

- As per the data published by the OECD, in 2021, the U.S. conducted approximately 84.5 million CT scan procedures, a 15.8% increase from the previous year.

The X-ray segment held a moderate share in 2024 due to product launches and technological advancements. Moreover, the growth of the segment can be attributed to the high incidence of fractures due to road accidents and sports injuries, driving the use of X-ray for fracture detection.

The MRI segment held a considerable share in 2024 due to the increasing number of MRI procedures in the U.S. for detecting abnormalities and early diagnosis of diseases such as neurological disorders and tumors.

The ultrasound segment held a stagnant market share in 2024 supported by its widespread availability of ultrasound units in the U.S. for various applications, such as viewing the fetus during pregnancy and detecting urinary tract infections.

The others segment held the second-largest share in 2024 due to the rise in the number of fluoroscopy, PET/CT, SPECT, and nuclear medicine procedures across the U.S.

To know how our report can help streamline your business, Speak to Analyst

By Application

Rising Prevalence of Neurological Disorder Led the Dominance of Neurology Segment

Based on application, the market is segmented into cardiology, neurology, oncology, orthopedics, gynecology, and others. The neurology segment dominated the U.S. market in 2024, driven by the rising prevalence of neurological disorder cases and strokes. Advanced imaging services could aid physicians in confirming and diagnosing neurological disorders, contributing to the segment’s growth.

- For instance, as per the Parkinson's Foundation’s statistics of 2025, around 1.0 million people in the U.S. have Parkinson's disease, with this number is expected to increase to 1.2 million by 2030.

The oncology segment held the second-largest market share in 2024 and is expected to grow at a moderate CAGR during the forecast period due to the strong prevalence of cancer in the U.S.

The cardiology segment is anticipated to grow at the fastest CAGR during the study period owing to the increasing number of cardiovascular cases in the U.S. For instance, according to the data published by the Centers for Disease Control and Prevention (CDC) in July 2024, Heart Valve Disease (VHD) affects more than 5.0 million people in the U.S. each year.

The orthopedics segment held a considerable market share in 2024 owing to an increasing number of X-rays for diagnosing bone defects and injuries due to rising trauma and road accidents across the country.

The gynecology and others segments are expected to grow at a steady rate during the forecast period. The rising cases of urinary tract infections, abdominal abnormalities, and other conditions are some of the factors driving the demand for ultrasound procedures in the country.

By Payor

Private Health Insurance/Out-Of-Pocket Segment Dominated Due to Growing Working Population

Based on payor, the market is segmented into public health insurance and private health insurance/out-of-pocket. The private health insurance/out-of-pocket segment dominated the U.S. market in 2024. The growth of the segment is attributed to the rise of the working demographic opting for private insurance coverage. For instance, according to the data published by the U.S. States Census Bureau in September 2024, 65.4% of people in the U.S. had private health insurance in 2023.

The public health insurance segment is expected to increase at a substantial growth rate during the forecast period, fueled by the increasing coverage of government-sponsored insurance programs. For instance, according to data published by the U.S. Census Bureau in September 2024, 36.3% of people in the U.S. were covered under public health insurance in 2023.

By Setting

Hospitals In-Patient Segment Dominated Owing to the Increasing Patient Preference for Hospitals

Based on setting, the market for diagnostic imaging services is segmented into hospital in-patient, Hospital Outpatient (HOPD), freestanding imaging centers, and others.

The hospital in-patient segment dominated the market in 2024, driven by the increasing patient preference for hospitals, which offer the convenience of diagnosis and treatment under one roof.

The Hospital Outpatient (HOPD) segment is anticipated to expand at the highest CAGR in the coming years, driven by the increasing patient preference for outpatient centers for imaging procedures, primarily due to their cost-effectiveness and convenience.

The freestanding imaging centers segment is expected to grow at a substantial CAGR during the forecast period. The popularity of freestanding imaging centers in the U.S. is on the rise due to their cost-effectiveness, specialized expertise, shorter wait times, and cutting-edge technology. These advantages are expected to drive growth in this segment during the coming year. Moreover, the increasing number of freestanding imaging centers across the country is enhancing accessibility to diagnostic imaging services.

- For instance, in August 2024, Prisma Health announced the launch of its new retail imaging centers in Greenville and West Columbia to offer imaging services such as MRI, CT, and X-ray services at lower costs with more flexible scheduling options.

The others segment held a stagnant market share in 2024, with growth primarily driven by the rising number of ASCs conducting diagnostic imaging procedures in the country.

COMPETITIVE LANDSCAPE

Key Market Players

Key Players Focus on Innovations to Enhance Patient Access in Radiology

RadNet, Inc., Akumin, Inc., and Rayus Radiology held the major U.S. diagnostic imaging services market share in 2024. RadNet, Inc. dominates the market due to its large number of outpatient diagnostic centers operated by the company in the U.S. and the diverse services portfolio of its imaging services. The company operates around 398 diagnostic imaging centers across the U.S. and annually conducts imaging procedures for around 10.0 million outpatients. Moreover, a recent acquisition of DeepHealth, Inc. helped RadNet to expand its presence in the U.S. Akumin, Inc holds a major market share, ranking just behind RadNet, Inc. The company’s strong focus on innovation and launching new platforms to enhance patient access in diagnostic and interventional radiology has contributed to its growth. Akumin provides hospitals and physician groups with a single modality or a multi-modality imaging solution, positioning it as a key player in the market.

The market includes more companies such as SimonMed, LucidHealth, Inc., US Radiology Specialists, and Radiology Partners, which hold significant market share due to their varied diagnostic imaging service offerings.

LIST OF KEY U.S. DIAGNOSTIC IMAGING SERVICES COMPANIES PROFILED

- RadNet, Inc. (U.S.)

- Akumin, Inc. (U.S.)

- Rayus Radiology (U.S.)

- MedQuest Associates (U.S.)

- LucidHealth, Inc. (U.S.)

- US Radiology Specialists (U.S.)

- Radiology Partners (U.S.)

- Envision Radiology (U.S.)

- Capitol Imaging Services (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025 – Novant Health in partnership with MedQuest Associates acquired over 15 medical imaging locations in the Charlotte region from OrthoCarolina.

- January 2025 – Capitol Imaging Services announced the acquisition of DRH & Associates, Inc., operating as Houston MRI & Diagnostic Imaging ("Houston MRI"), to strengthen its radiology imaging footprint in Texas.

- December 2024 – Siemens Healthineers and DeepHealth, a subsidiary of RadNet Inc., announced a strategic collaboration to enhance ultrasound workflows using AI-powered SmartTechnology.

- December 2024 – DeepHealth, a subsidiary of RadNet Inc., unveiled advanced AI-powered informatics and SmartTechnology solutions at RSNA 2024. These cloud-native innovations, built on the DeepHealth OS platform, aim to enhance imaging-based diagnostics.

- December 2024 – Radiology Partners and RADPAIR formed a strategic partnership to develop AI-driven reporting tools that enhance accuracy and improve radiologist workflow.

- February 2024 – MedQuest Associates and GE HealthCare announced a collaboration to provide digital tools and medical device technology for outpatient imaging centers.

REPORT COVERAGE

The report provides a detailed analysis of the diagnostic imaging services market. It focuses on key aspects such as prominent players, procedures, payor, setting, and application. Besides this, it offers insights into the market trends, number of procedures, and number of outpatient imaging centers and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.0% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Procedure

|

|

By Application

|

|

|

By Payor

|

|

|

By Setting

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 140.21 billion in 2024 and is projected to reach USD 239.74 billion by 2032.

The market is expected to exhibit a CAGR of 7.0% during the forecast period (2025-2032).

By procedure, the CT segment dominated the market.

By setting, the hospital in-patient segment dominated the market.

The increasing prevalence of chronic diseases, strong demand for imaging procedures, continuous technological developments and product enhancements, and increasing geriatric population are the key factors driving the market growth.

RadNet, Inc., Akumin, Inc., Rayus Radiology, and SimonMed are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us