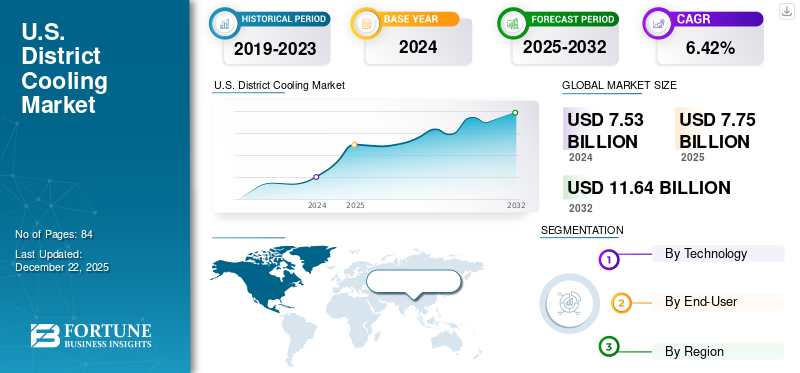

U.S. District Cooling Market Size, Share & Industry Analysis, By Technology (Electric Chillers, Absorption Chillers, and Others), By End-User (Residential, Industrial, and Commercial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The U.S. district cooling market size was valued at USD 7.53 billion in 2024. The market is projected to grow from USD 7.75 billion in 2025 and is expected to reach USD 11.64 billion by 2032, exhibiting a CAGR of 6.42% during the forecast period.

District cooling encompasses a centralized chiller plant to cool water and circulate it to multiple buildings. It is an energy efficient and sustainable way to provide cooling, and is equivalent to district heating due to a similar working principle with district heating.

The market will witness high demand in the coming years due to an inclination toward sustainability and energy efficiency, along with rapid urbanization and infrastructure development plans.

Engie is one of the key players in the market, as it has a significant presence in the district energy sector. It offers effective and sustainable cooling options for urban regions, utilizing centralized facilities to achieve cost effective and lower environmental effects.

MARKET DYNAMICS

MARKET DRIVERS

Inclination toward Sustainability and Energy Efficiency to Drive Growth of the Market

The rising requirement for sustainability and energy efficiency in cities and buildings is increasing demand for cooling systems. District cooling systems provide a more energy-efficient and sustainable solution for cooling buildings than conventional air conditioning systems.

For instance, Centrio Energy operates the largest ice storage and water storage carbon-free district cooling system in the U.S., which provides sustainable district cooling service to 53 million square feet of building space in 115 buildings located in Illinois, U.S. The system facilitates the carbon savings of 35,000 metric tons with 250,000,000 million gallons of water saved per year.

Moreover, with urbanization and the world population growth, there is a demand for infrastructure and buildings designed to be sustainable and energy-efficient. District cooling systems utilize centralized cooling plants to cool numerous buildings, which can result in noteworthy energy savings compared to individual air conditioning units.

Rapid Urbanization and Infrastructure Development to Augment Demand for District Cooling Systems

Urbanization and infrastructure development is one of the major drivers for the district cooling systems market in the U.S. As cities continue to grow and modernize, the demand for efficient, centralized cooling solutions is rising. Urban areas are witnessing an increase in high-density developments such as commercial skyscrapers, residential complexes, data centers, and other commercial facilities, which require reliable and large-scale cooling systems. Moreover, increasing smart city and green infrastructure projects are expected to drive the demand for district cooling plants in the country.

In April 2023, the U.S. Department of Energy announced funding worth USD 13 million to support community geothermal cooling and heating solutions. The project supports rural, urban, suburban, and remote communities across the country. This funding covers a total of 11 selected projects, which include more than 60 partners in the U.S. Such projects are expected to foster the district cooling market growth in the country over the forecast period.

MARKET RESTRAINTS

Increasing Number of Various Alternative Cooling Technologies to Hinder Market Growth

The U.S. district cooling systems market is expected to face significant restraints due to the presence of various alternative technologies for cooling. Many manufacturers and service providers use alternative cooling technologies to provide a long-lasting cooling experience to multistoried buildings. Technologies such as Variable Refrigerant Flow (VRF) are one of the fastest-growing technologies in cooling systems.

These systems circulate the lowest refrigerant required for each zone to fulfill the building load. This also eliminates the energy waste associated with duct loss. The variable refrigerant flow's flexibility and reliability are also major factors in generating market demand. The growing infrastructure construction activities worldwide also boost VRF technologies due to the multiple service providers in the market.

MARKET OPPORTUNITIES

Increasing Focus on Decreasing Greenhouse Gas Emissions and Meeting Climate Change Goals is Expected to Create Market Opportunities

The increasing focus on greenhouse gas emissions and meeting climate change goals will drive the market in the coming years. The International Energy Agency’s District Heating and Cooling, including Combined Heat and Power (DHC TCP), conducts policy analysis, research & development, and international collaboration to enhance the market penetration of district cooling systems with minimal environmental effect.

For instance, in November 2024, the Governor of New York announced USD 10 million of funding under the Clean Heat for All: Packaged Terminal Heat Pump program for the adoption of advanced heating and cooling technologies in large buildings across the state. Moreover, this program facilitates innovation, which modernizes the heat and cooling technologies of existing buildings. The government's efforts to foster energy efficiency through improvements in large-scale heating and cooling systems in the state will propel the U.S. district cooling market growth over the forecast period.

MARKET CHALLENGES

Increasing Cost Competition is Expected to Challenge Market Growth

District cooling provides lasting efficiencies and environmental advantages. Still, the upfront investment is a significant challenge when compared to separate cooling systems or more accessible, lower-cost options such as VRF systems or standalone chillers. This sensitivity to price, particularly among smaller property owners or developers with a focus on short-term finances, complicates the justification of the higher initial expenses associated with joining a district cooling system.

Additionally, the lack of widespread understanding of the Total Cost of Ownership (TCO) challenges the expansion of district cooling. In the absence of thorough education and incentive initiatives that emphasize decreased maintenance, enhanced reliability, and prospects for long-term savings, potential customers frequently favor the initial lower cost of competing technologies.

U.S. DISTRICT COOLING MARKET TRENDS

Integration of Renewable Energy and Advanced Technologies is one of the Key Trends

The U.S. district cooling sector is progressively adopting renewable energy integration and cutting-edge technologies to improve sustainability and efficiency. A significant trend is the integration of solar thermal, geothermal, and waste heat recovery systems to lessen dependence on conventional fossil fuels, which is in line with increasing environmental concerns and goals for reducing carbon emissions.

For instance, initiatives such as the Veolia Energy Boston district cooling system employ Combined Heat and Power (CHP) facilities, which improve energy efficiency and can integrate with renewable sources. Additionally, sophisticated technologies such as smart grids, real-time tracking, and AI-driven optimization are being utilized to enhance system efficiency, decrease energy usage, and lower operational expenses.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic challenged the energy and power industry and the district cooling market also faced difficulties due to several factors. The early stage of the pandemic led to the shutdown, which led to challenges in district cooling systems equipment and component availability. Additionally, during the pandemic, the U.S. government announced lockdowns across the country, such as border closures and factory closures, which led to disruptions in U.S. trade. Due to the logistics slowdown, the unavailability of the labor force across the U.S. caused disturbances in import & export activities. Also, production services of the district cooling components were paused, which caused the shutdown of all the related operations.

SEGMENTATION ANALYSIS

By Technology

Electrical chillers dominated the Market Due to Its Power-Saving Features

Based on technology, the market is segmented into electric chillers, absorption chillers, and others. Electrical chillers dominated the U.S. district cooling market share as electrical chillers are mostly used in district cooling. Due to its power-saving features, which help reduce energy consumption in multistoried buildings, it is a preferable chiller throughout the majority of applications.

The demand for absorption chillers within the district cooling market is significant and growing, primarily due to their ability to utilize waste heat, leading to increased energy efficiency and sustainability benefits. In the coming years, the market will increase due to factors such as the development of infrastructure and rising construction activities in developing regions.

By End-User

Commercial Sector Dominates Due To Increased Energy Efficiency Goals and Sustainable Building Solutions

Based on end-user, the market is segmented into residential, commercial, and industrial. The commercial segment dominates the market owing to rapid urbanization, energy efficiency goals, and sustainable building solutions. For instance, in April 2024, the U.S. General Services Administration announced funding of USD 23.8 million to enhance federal facilities. This funding includes infrastructural developments of 13 projects across 10 states through GSA’s Good Neighbor Program to meet High-Performance Green Building (HPGB) and Low-Embodied Carbon (LEC) standards.

Additionally, the industrial end-user of district cooling refers to a manufacturing facility or industrial plant that utilizes a centralized district cooling system to meet its cooling needs instead of operating its chillers. Furthermore, industrial and commercial buildings are increasingly adopting district cooling systems to meet their cooling needs efficiently, sustainably, and cost-efficiently.

To know how our report can help streamline your business, Speak to Analyst

U.S. DISTRICT COOLING MARKET COUNTRY OUTLOOK

The market has been studied geographically across five main regions: Northeast, Midwest, West, South, and Southeast.

Northeast Dominates the U.S. Market Due to Strict State and Local Energy Codes

The Northeast region accounted for the largest U.S. district cooling market share owing to factors such as energy efficiency mandates, urbanization, and climate resilience. The presence of a high population in New York, Boston, and Philadelphia propels the demand for cooling services, particularly in commercial and residential buildings. Moreover, strict state and local energy codes, such as the New York Climate Leadership and Community Protection Act, push demand for sustainable and efficient cooling solutions. Additionally, the Northeast region’s humid weather increases the need for reliable cooling, while extreme weather events highlight the importance of resilient infrastructure.

Furthermore, the southern region accounted for the second largest market share owing to the high temperature in the area. States such as Texas, Georgia, and Arizona are experiencing increasing high temperatures in summer seasons, placing significant restraint on the adoption of traditional HVAC systems and escalating energy consumption. Hence, as the temperature continues to rise, district cooling is expected to be a critical infrastructural requirement for the cities in the Southern region of the country over the forecast period.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Dominate owing to Extensive Service Portfolios and Advanced Technologies

The U.S. district cooling market consists of Veolia, ENGIE, NRG Energy, and Vicinity Energy, which manage well-established district cooling systems in large urban areas. Competition focuses on elements such as pricing, energy efficiency, network capacity, and service reliability. Acquisitions, new projects, and collaborations with local governments and developers propel market growth. Smaller, regional companies also play a role in the landscape, targeting niche markets or localized energy solutions, resulting in a combination of national leaders and specialized providers competing for market share and project victories. Some of the other companies active in the market are Danfoss Group, Trane Technologies Scientific Systems, LLC, Stellar Energy, Alfa Laval, CenTrio Energy, Ebcorpo, Akron Energy Systems, Metro Nashville District Energy System (DES), Xylem, and others.

List of Key District Cooling Companies Profiled

- Ramboll (Denmark)

- Danfoss Group (Denmark)

- Veolia (France)

- Stellar Energy (U.S.)

- Engie (France)

- Alfa Laval (Sweden)

- Trane Technologies (Ireland)

- CenTrio Energy (U.S.)

- Ebcorpo (U.S.)

- Vicinity Energy (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2025: Danfoss Group announced the acquisition of ENFOR’s district energy software to enhance the company’s Leanheat suite of sustainable cooling and heating solutions, which combines data analytics and artificial intelligence for optimization of energy consumption and operational efficiency of district energy and buildings.

- February 2025: Trane announced the expansion of its advanced thermal management system to cater to critical environments. The company has introduced a Trane Coolant Distribution Unit (CDU) with new liquid cooling capabilities to enhance its thermal management system used in data centers.

- December 2024: Engie announced the acquisition of District Heating Eco Energías based in Spain; the company specializes in the development of district heating networks based on biomass and other renewable resources. This acquisition has strengthened Engie’s market position in the district cooling market in Spain.

- April 2022: Veolia announced that it would initiate two new district heating projects for developing local, sustainable, and low-carbon energy sources. In Finland, the company is launching the world's largest biorefinery project producing CO2-neutral bio-methanol from the pulp manufacturing process. Secondly, the Group is partnering with Waga Energy to commission the largest biomethane production unit to recover biogas from a non-hazardous waste landfill in France.

- December 2021: German utility ENGIE partnered with GASAG to deliver a low-carbon smart initiative in the district of Spandau, northwest of Berlin. The two have won a contract to offer ‘The New Gartenfeld’ project to install distributed energy, smart mobility, and digital infrastructure and technologies. District heating plants and heat pumps, renewable energy including solar PV on rooftops, and electric vehicle charging systems are installed to convert a former cable factory site into a sustainable district of the future.

Investment Analysis and Opportunities

The U.S. district cooling market is experiencing growth as demand for energy-efficient cooling solutions rises, influenced by urbanization, climate change, and the growing use of sustainable technologies. Both public and private sectors are driving investments, as developers and utilities aim to lower carbon emissions and enhance energy resilience.

For instance, in April 2024, Vicinity Energy's continuous growth of its district energy systems in urban areas such as Boston and Philadelphia, supported by private equity groups such as Antin Infrastructure Partners, aimed to establish the largest district energy network nationwide featuring combined heat and power, energy storage, and renewable thermal energy. This drive for sustainable infrastructure offers considerable chances for investors aiming to benefit from the rising need for dependable and eco-friendly cooling options.

REPORT COVERAGE

The U.S. district cooling market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.42% from 2025 to 2032 |

|

Unit |

Value (USD Billion) and Volume (Thousand RT) |

|

Segmentation |

By Technology

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market was worth USD 7.21 billion in 2022.

The market is expected to exhibit a CAGR of 3.23% during the forecast period (2023-2030).

By technology, the absorption chillers segment witnessed the largest share in 2022.

Veolia, ENGIE, and Alfa Laval Inc. are the top players in the market.

The U.S. market size is expected to reach USD 11.64 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us