U.S. Drinkware Market Size, Share & COVID-19 Impact Analysis, By Material (Glass [Stemware, Barware, and Others] and Plastic [Stemware, Barware, and Others]), By Application (Household, Bars & Restaurants, and Others), By Distribution Channel [Business-to-Business and Business-to-Consumer {Supermarket/Hypermarkets, Specialty Stores, Online/E-Commerce, and Others}], and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

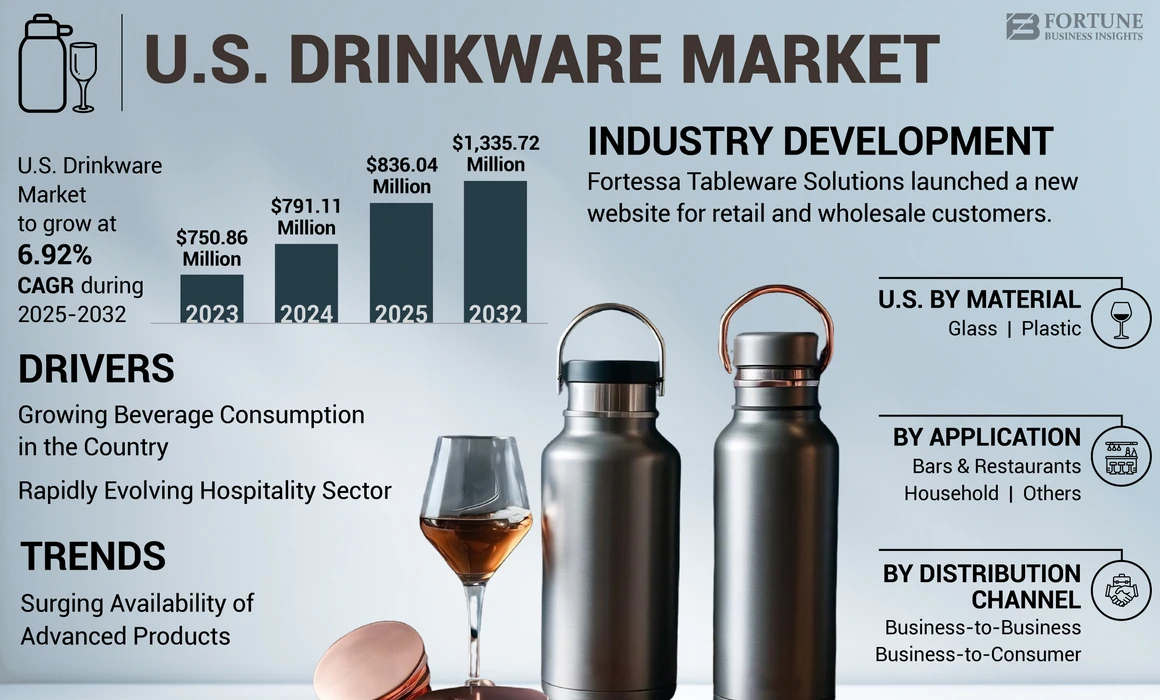

The U.S. drinkware market size was valued at USD 791.11 million in 2024. The market is projected to grow from USD 836.04 million in 2025 to USD 1,335.72 million by 2032, exhibiting a CAGR of 6.92% during the forecast period (2025-2032).

Drinkware products are glasses or cups used to drink any beverage. These products are made from stainless steel, plastic, or glass and are popular for their appearance and elegance, notably in bars and restaurants. The increasing demand for specialized glassware used in bars, pubs and restaurants favors market expansion.

Rising investments in the hospitality industry and increased consumer spending in bars, restaurants, and hotels increase the global market share. Moreover, the increasing consumer spending on dining out and entertainment triggers the product demand, thus amplifying the market share. Moreover, the rising trend of craft cocktails and mixology culture positively propels the product demand across bars and restaurants, increasing the U.S. drinkware market share. Given that the U.S. is a prominent domestic market for drinkware, the evolution of the U.S. market increases the global market growth.

COVID-19 IMPACT

Closure of Bars and Restaurants during the Pandemic Impacted Market Growth

The COVID-19 pandemic created unprecedented challenges and disruptions for various industries in 2020, including the drinkware market in the U.S. Government-imposed lockdowns and restrictions led to the closure of bars, restaurants, and hospitality establishments in 2020. This factor significantly reduced the demand for barware and stemware products as these establishments scaled down or ceased their operations. For instance, according to the National Restaurant Association, the restaurant and food service industry's food and beverage sales in the U.S. decreased from USD 864.3 billion in 2019 to USD 659.0 billion in 2020.

The shift from offline to online sales was significant in 2020 due to the closure of physical retail stores during the lockdown. The multichannel approach became a significant trend, resulting in positive growth for manufacturers as several companies and retailers quickly adapted to online sales by improving their e-commerce capabilities and digital presence.

U.S. Drinkware Market Trends

Increasing Availability of Innovative Products to Propel Product Demand

Creative and visually appealing designs in glassware, including cups and glasses, are gaining popularity in the U.S., making them functional and fashionable. Moreover, the trend of tailored stemware for wine varietals enhancing the wine-tasting experience has had a positive impact on the market. Besides, several prominent players have launched innovative products to diversify their portfolios and boost sales.

For instance, in February 2023, Dragon Glassware, a California-based glassware company, launched the new astronaut glasses. According to the company, the product features a double-walled design of an astronaut inside the glass with an iridescent NASA symbol and Artemis badge.

Download Free sample to learn more about this report.

U.S. Drinkware Market Growth Factors

Increasing Consumption of Beverages in the U.S. to Favor Market Growth

The rapidly growing consumption of beer and wine during meetings and social gatherings in the U.S. boosts market growth. According to the Brewers Association, a U.S.-based trade association, the total number of breweries in the U.S. increased from 9,092 in 2020 to 9,709 in 2022. The increasing number of breweries nationwide increases the demand for beer glassware across the U.S. states.

The increasing alcohol consumption in the U.S. increases the demand for glassware across the country. The growing wine and wellness trend, owing to the convergence of health-conscious lifestyles and health benefits of wine consumption, also significantly contributes to the demand for wine across the country, propelling the U.S. drinkware market growth.

Rapidly Evolving Hospitality Industry to Propel Market Growth

The hospitality industry in the U.S. has witnessed significant growth backed by the rapidly evolving tourism sector. In this respect, the U.S. tourism industry will contribute significantly to the number of commercial establishments countrywide throughout the forecast timeframe, fueling the product demand. Moreover, hospitality establishments constantly strive to positively enhance customer experience, accelerating the adoption of innovative, stylish, and functional products. At a macro level, the rising demand for customized barware glasses used in bars and restaurants positively influences market trends.

RESTRAINING FACTORS

High Production Costs and Counterfeiting Products Limit Market Growth

Fluctuations in raw material prices, such as plastic resins and sand, impact the cost of manufacturing. The price fluctuations negatively affect product pricing and profitability, reducing the product demand from price-sensitive consumers. Moreover, the production process for glassware involves energy-intensive steps, including glass melting and shaping, contributing to high manufacturing costs. These higher costs can influence pricing strategies and limit the market's attractiveness to price-sensitive consumers.

Furthermore, the rising availability of counterfeit products at lower prices presents significant challenges for manufacturers. Counterfeit products often do not adhere to the same quality standards as genuine products, which can restrict the product demand in the U.S.

U.S. Drinkware Market Segmentation Analysis

By Material Analysis

Significant Demand for Glass Products to Fuel Glass Product Sales

Based on material, the market analysis includes glass and plastic categories.

The glass segment holds a major market share as the material is reusable and lasts for a longer time than plastic. Creative and visually appealing designs in glasses are gaining popularity in the U.S., making them functional and fashionable for use at restaurants, bars, and households.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Demand for Drinkware at Restaurants and Bars to Boost Product Demand

Based on application, the market is segmented into households, bars & restaurants, and others.

The bars & restaurant segment dominates the U.S. market given the rising number of bars and pubs countrywide. The increasing opening of new bars and restaurants across the U.S. boosts drinkware demand. Glassware is an essential part of restaurants and bars to serve drinks quickly and efficiently, making the drink look appealing and adding to the aesthetic appeal. The increasing consumer purchasing power and standard of living fuels the demand for drinkware across restaurants and bars in the U.S.

By Distribution Channel Analysis

Rising Sales of Glassware through Supermarkets/Hypermarkets to Propel Market Growth

Based on distribution channel, the market report is segmented into supermarkets/hypermarkets, specialty stores, online/e-commerce, and others.

The supermarket/hypermarket segment dominates the market. The growing consumer footfall in supermarkets and hypermarkets due to lower prices, promotions, and discounts accelerates product sales through retail formats.

The COVID-19 lockdown increased consumer preference for online shopping due to the temporary closure of retail stores. This trend is expected to continue in the coming years as numerous companies emphasize offering products through e-commerce websites and online stores to increase product availability at key locations, accelerate product sales, and generate revenue streams.

List of Key Companies in U.S. Drinkware Market

Key Players Focus on Expanding Product Portfolio and Investments in Sustainable Products to Increase Market Share

Key players such as Libbey Inc., Fortessa Tableware Solutions Inc., Juliska, and others focus on strengthening their product portfolio to meet the consumer demand for drinkware. Furthermore, the growing trend of experiential dining and unique beverage offerings propel the demand for glassware across the country. For instance, in March 2023, Messhall Kitchen, a Los Angeles-based restaurant, introduced a new Film Favorites menu, including ten film-themed cocktails.

Major players in the North America drinkware market invest in mergers and acquisitions to acquire higher market share. The increasing demand for eco-friendly and sustainable products among environmentally conscious individuals boosts the demand for sustainable glassware. Several players launched natural and eco-friendly products to cater to the increasing demand for sustainable products. For instance, in June 2021, Novolex, a South Carolina-based packaging solutions company, launched a new production line at its manufacturing facility in Chattanooga, Tennessee.

LIST OF KEY COMPANIES PROFILED:

- Libbey Inc. (U.S.)

- Arc Group (U.S.)

- RIEDEL (Tiroler Glashutte GmbH) (Austria)

- Fortessa Tableware Solutions Inc. (U.S.)

- Stoelzle Glass Group (Austria)

- Lancaster Commercial Products LLC (U.S.)

- Juliska (U.S.)

- Mosser Glass (U.S.)

- Tossware (U.S.)

- Vivocci (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2022: Fortessa Tableware Solutions, a U.S.-based manufacturer, announced a merger with Zwiesel Glas, a German-based company. The partnership would strengthen both companies' businesses in the U.S. market.

- April 2022: Fortessa Tableware Solutions, a U.S.-based tableware manufacturer, announced the launch of a new website for wholesale and retail customers. The new site has a user-friendly layout, improved browser experience, and faster user checkout options.

- April 2022: Simple Modern, a U.S.-based glass manufacturer, announced the expansion of its manufacturing facility in Oklahoma City. In this regard, the company leased a 175,000-square-foot manufacturing facility and has invested approximately USD 5 million.

- February 2022: Lenox, a U.S.-based tableware and glassware company, collaborated with sommelier Victoria James to launch an exclusive stemware collection for wine drinkers. The glasses were developed for specific climatic regions that produce wine.

- April 2021: Dragon Glassware, a U.S.-based glassware manufacturer, launched a luxury cannabis decanter set. The glass is shaped similar to the Cannabis indica leaf sold exclusively on the company’s website.

REPORT COVERAGE

The market research report provides a detailed market analysis and focuses on crucial aspects, such as key companies, materials, and application areas. Besides this, the market report offers insights into the industry trends and highlights key industry developments. In addition to the aforementioned factors, the report outlines several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.92% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Material

|

|

By Application

|

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights states that the U.S. market size was valued at USD 791.11 million in 2024 and is projected to reach USD 1,335.72 million by 2032.

The U.S. market is forecasted to record a CAGR of 6.92% from 2025 to 2032.

By material, the glass segment leads and holds a major market share.

The increasing consumption of alcoholic beverages in hotels restaurants is a key factor favoring market growth.

Libbey Inc., Arc Group, Fortessa Tablewear Solutions LLC, Bormioli Rocco, Stoelzle Glass Group, and others are the major players in the U.S. market.

The increasing number of innovative products are expected to propel the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us