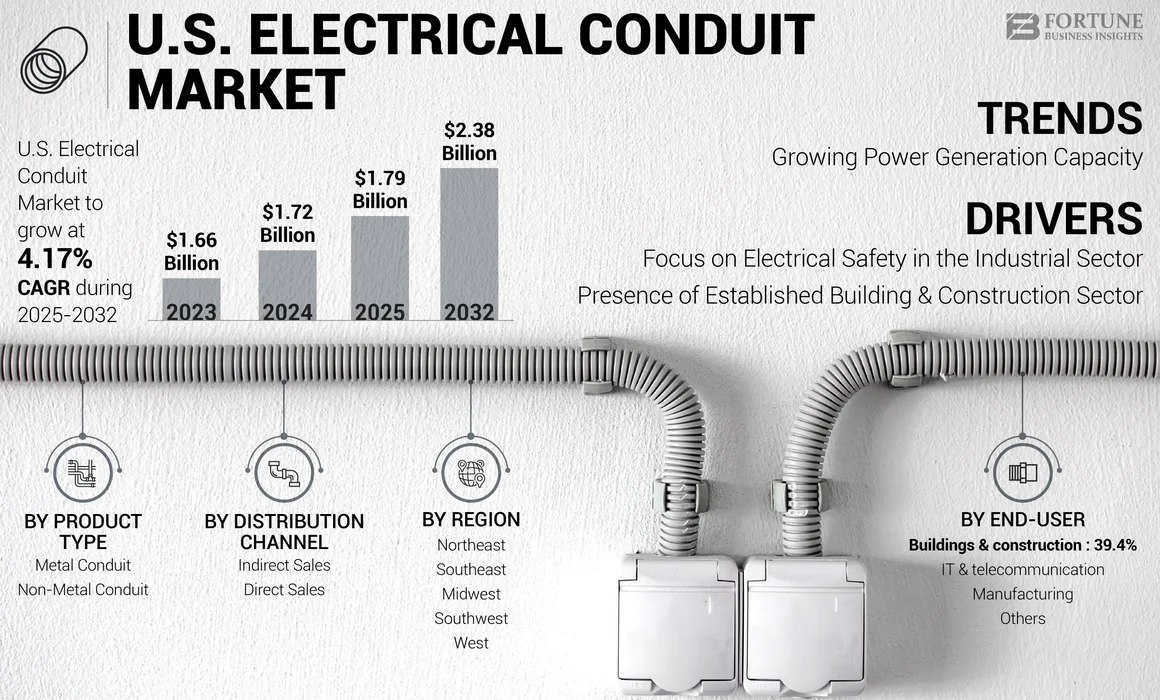

U.S. Electrical Conduit Market Size, Share & Industry Analysis, By Product Type (Metal Conduit and Non-Metal Conduit), By Distribution Channel (Indirect Sales and Direct Sales) By End-user (Buildings & Construction, Manufacturing, IT & Telecommunication, and Others), and By Region (Northeast, Southeast, Midwest, Southwest, and West), Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The U.S. electrical conduit market size was valued at USD 1.72 billion in 2024. The market is projected to be worth USD 1.79 billion in 2025 and reach USD 2.38 billion by 2032, exhibiting a CAGR of 4.17% during the forecast period.

An electrical conduit serves as a protective casing and routing pathway for electrical lines. It is crafted from various materials, such as plastic, metal, fibers, or fired clay, which are chosen based on the usage of that conduit. These are typically installed within the wiring system of a structure. The market categorizes conduits by product type and end-user segments.

Conduit systems vary in material and classification, often detailed by wiring regulations for their usage, form, and installation essentials. These may encompass rigid and flexible conduits serving diverse purposes. The growth of the market is propelled by rising demand across industries, durability factors of conduit systems, and ongoing material advancements.

The U.S. electrical conduit market will witness high demand in the coming years due to the growth of the IT and telecommunication industries. Atkore International is one of the major players in the market. It has released Environmental Product Declarations (EPDs) for its Galvanized Steel, Stainless Steel, and PVC Conduit & Fittings product lines. An independent third party has verified these EPDs and provided a product's life cycle assessment, including measurements of its environmental impact, such as greenhouse gas emissions, energy use, water consumption, waste generation, and other relevant factors.

MARKET DYNAMICS

MARKET DRIVERS

Increased Focus on Electrical Safety in the Industrial Sector is Driving Market Growth

In the U.S., consumers are aware of electrical safety in both industrial and commercial settings. This majorly contributes to the U.S. electrical conduit market growth. In the U.S., the Occupational Safety and Health Administration (OSHA) sets rules and standards for workplace safety in the wire & cable manufacturing sector. These rules cover electrical safety, machine safety, and chemical exposure, driving the demand for cable/wire protection products, such as electrical conduits. Despite consumer awareness and safety standards, the U.S. witnesses hazards related to electrical. For instance, according to OSHA, electrocution was responsible for around 8% of construction worker deaths in 2021.

Presence of Established Building & Construction Sector is Driving Market Growth

Considerable businesses are operating in the building and construction sector in the U.S. This is driving the demand for electric conduits across the country. For instance, the U.S. Department of Housing and Urban Development and the U.S. Census Bureau cordially announced that privately-owned housing completions in November were at a seasonally adjusted yearly rate of 1,601,000, which is above the November 2023 rate of 1,466,000. This presence of established businesses in the construction sector is driving the demand for electrical conduits.

MARKET RESTRAINTS

Fluctuations in Raw Materials Prices and Supply in the U.S. Restrains Market Growth

The prices of the important materials used in the construction of electrical conduits, such as PVC, HDPE, aluminum, and stainless steel highly vary. These differences are affected by global economic conditions, including energy and oil prices, which affect production and transportation costs. An unexpected increase in these prices will increase production costs for manufacturers, forcing them to raise prices or reduce profit margins, which can inhibit U.S. electrical conduit market growth.

MARKET OPPORTUNITIES

Rising Demand For Data Centers To Create Opportunities For The Market

According to the International Energy Agency, a considerable demand for data network services is projected to grow, driven by data-demanding activities, such as cloud gaming, video streaming, and others. Additionally, this demand is expected to grow due to technologies such as blockchain and machine learning. For instance, Bitcoin – one of the best examples of proof-of-work blockchain and the most esteemed cryptocurrency by market capitalization consumed an estimated ~110 TWh in 2022, 20 times more than in 2016. Such data-intensive services surged the demand for data centers. The increasing data center infrastructure is subsequently growing the adoption of cable protection solutions such as electrical conduits, thus offering new opportunities for market growth.

MARKET CHALLENGES

Availability of Alternatives to Hamper Market Growth

The availability of substitutes in the market is creating challenges for market growth. Some of the alternatives in the market are ducts, cable trays, and others. Cable tray offers advantages, such as easy installations and lower prices compared to electrical conduits. In addition, it offers easier access to regular modifications or maintenance. Furthermore, more individual gears/parts are needed in a conduit system than in a cable tray system. This factor increases the man-hours required to transport the components needed for the conduit system up to the installation level.

Download Free sample to learn more about this report.

ELECTRICAL CONDUIT MARKET TRENDS

Growing Power Generation Capacity is Increasing the Demand for Electrical Conduits

Energy generation significantly drives the demand for electrical conduits, with electricity produced through three major energy groups: fossil fuels (coal, petroleum, and natural gas), renewable energy, and nuclear energy. Various sources, such as solar energy, geothermal energy, biomass, and nuclear energy, power the generation process through steam turbines. Despite differing methods, the electrical components required for transmitting electricity remain the same.

Additionally, the U.S. employs diverse energy sources and technologies for electricity generation, with certain sources being more prominent. According to the U.S. Energy Information Administration, which provides data on electricity generation from utility-scale and small-scale systems, in 2022, utility-scale electricity generation in the U.S. totaled approximately 4.24 trillion kilowatt-hours (kWh). Additionally, small-scale solar photovoltaic systems contributed an estimated 0.06 trillion kWh of electricity.

Download Free sample to learn more about this report.

The final energy consumption in this table excludes the electrical system energy losses. It differs from the total consumption by end-use sector, in which the electrical system energy losses are allocated proportionally to the amount of electricity sold to end customers in each end-use sector.

IMPACT OF COVID-19

The COVID-19 pandemic posed substantial business risks for key players in the commercial and residential sectors. Closure of spaces, reduced demand, and supply chain disruptions impacted the product/service delivery, hindering manufacturers' commitments to customers. This instability, compounded by travel restrictions, affected manufacturers' ability to secure contracts and meet deadlines, causing a decline in sales. Despite varying impacts based on geography and networks, both small and large players implemented different measures to mitigate the pandemic's effects on their operations.

SEGMENTATION ANALYSIS

By Product Type

Growing Number of Energy Projects in Solar and Wind Sector to Propel the Metal Conduit Segment Growth

By product type, the market is segmented into metal and non-metal conduit.

The metal conduit segment dominated the market in 2024. The increase in new energy projects, especially in the solar and wind sectors, contributes to the demand for metal pipes due to their ability to support complex wiring requirements. Consumers highly prefer steel conduits to metal conduits. The fire-resistant properties of steel conduits make them ideal in applications where fire safety is important. This makes it suitable for construction projects that are required meet safety regulations. The ongoing expansion of infrastructure projects, particularly in urban areas, is fueling demand for reliable electrical installations. Steel conduits are favored for their strength and longevity, making them suitable for various construction applications.

The non-metal conduit segment is the fastest-growing segment in the market. Non-metallic pipes, made from materials such as PVC, HDPE, and fiberglass are highly resistant to corrosion and chemicals, making them suitable for different instances of environmental damage where metal pipes are susceptible to harm.

By Distribution Channel

Higher Level of Trust From Electricians and Contractors on Indirect Sales, Contributes Toward the Segmental Growth

Based on the distribution channel, the market is segmented into indirect sales and direct sales.

Indirect sales is the dominating segment in the market. Electricians and contractors often consider indirect sales distributors while buying electrical conduits due to high trust, consistent supply, and credit terms. In addition to this, these distributors maintain significant inventory in multiple locations, making it easier for contractors to purchase products quickly.

Moreover, the direct sale of electrical conduit systems, typically involving the selling of conduit materials (like PVC, metal, or flexible tubing) and related fittings directly to customers, often bypassing traditional electrical distributors. Hence, expansion of large scale organizations with direct sales soltions operating in the market is expected to drive growth in coming years.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Growing Adoption of Products in the Buildings and Constructions Sector Due to Higher Protection Capability Leads to the Segment Growth

In terms of end-user, the market is segmented into buildings & construction, manufacturing, IT and telecommunication, and others.

The buildings & construction sector dominates the market due to widespread adoption of products, providing essential protection for homes, buildings, and commercial spaces. They protect, route, and organize electrical wiring when utilized in building and construction.

Moreover, manufacturing segment is expected to emerge as second largest end-user segment. The manufacturing sector is a significant consumer of electrical conduits, with increasing demand for efficient and secure electrical systems in new and existing plants. Hence, rise in manufacturing activities in the country is expected to fuel demand for electric conduit in the country over forecast period.

U.S. ELECTRIC CONDUIT MARKET REGIONAL OUTLOOK

In terms of region, the market is segmented into Northeast, Southeast, Midwest, Southwest, and West. The Northeast market is set for robust growth as it aligns with broader trends in infrastructure development, regulatory compliance, and technological advancements. The Midwest is noticing significant investment in infrastructure, especially commercial and residential construction, increasing the demand for reliable electrical systems.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players are Developing Enhnaced Featured Conduits to Strengthen Their Positions

In terms of the competitive landscape, the market shows significant focus among participants on developing conduits with enhanced operational characteristics to strengthen their position in the industry. Atkore and Legrand are expected to have a significant U.S. electrical conduit market share as they have been active in the industry for a long time, and the operational potential of the portfolio has been improved. In addition, the Atkore company operates in hundreds of cogeneration plants globally, offering the advantages of flexibility, diversity, and others.

- In 2022, Atkore Corporation announced the acquisition of two privately held Oregon-based companies, namely Cascade Poly Pipe and Conduit ("Cascade") and Northwest Polymers. Cascade is a specialist manufacturer of straight fence HDPE pipes made from recycled materials, mainly serving telecommunications, utility, and datacom. Northwest Polymers is a major recycler of PVC, HDPE, and other plastics and a strategic supplier to Cascade and other local manufacturers.

LIST OF KEY U.S. ELECTRIC CONDUIT COMPANIES PROFILED

- Atkore International Group Inc. (U.S.)

- ABB (Switzerland)

- Wheatland Tube (U.S.)

- Legrand (France)

- Southwire Company (U.S.)

- CANTEX Inc (U.S.)

- Champion Fiberglass Inc (U.S.)

- Western Tube (U.S.)

- Electri-Flex Company (U.S.)

- WL Plastic (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2023 – ABB, a global technology leader, opened a new facility in Coleshill, England, to meet the growing demand for cable markets, including heavy vehicles, rail and infrastructure, commercial construction, marine and data centers. The building is equipped with a new vacuum stainless steel that increases the production capacity by 35% to meet the increasing demand for flexible cable protection solutions and special piping systems.

- October 2022: Eaton Corporation announced its contract with the General Services Administration (GSA) to expand EV supply equipment (EVSE) and services to accelerate low-carbon federal infrastructure projects.

- August 2022: PFLITSCH and ABB announced alliance to enhance cable protection safety and reliability. PFLITSCH selected ABB to design a combined product of cable assemblies, cable glands, accessories & specialized protection systems that integrate into high and low-voltage wiring and meet customers' needs across various applications.

- April 2022: IPEX Inc. announced the acquisition of Harrington Corporation. The acquisition enables IPEX Inc. to expand its presence and get an exciting opportunity in the U.S.

- September 2021 – ABB Installation products made innovations in conduit and cable support to the global rail transportation industry. The modular PMA TRUST support system from ABB Installation Products accommodates multiple pipes and cables of various sizes for easy installation and routing in rotating shafts, offering a modular design for the transportation market looking for safety, efficiency, and performance.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The U.S. electrical conduit market is projected to witness significant growth, driven by infrastructure development, renewable energy expansion, and increasing EV adoption, presenting investment opportunities in this sector.

In August 2022, Grey Rock Investment Partners, through its affiliated investment companies, agreed to make a controlling investment in Conduit Power, LLC, and finance the growth of the company through capital expenditure. At USD 100 million, Conduit plans to use the capital investment to further its strategy of providing full-service solutions to help commercial and industrial customers achieve their cost-reduction goals while reducing the cost of electricity supply and improving the time and reliability of electricity supplied. Conduit has developed an energy pipeline for utility projects in the southern U.S. with a primary focus on energy companies in Texas.

REPORT COVERAGE

The report provides a comprehensive analysis of the U.S. electrical conduit market, focusing on key aspects such as leading companies, product types, cables, wire systems, and wire industries. It offers insights into market trends, key industry developments, and factors contributing to recent market growth. Additionally, the report covers technological advancements, reimbursement scenarios for energy generation from various sources (including renewables), government initiatives for high efficiency, and the impact of COVID-19 on the market. Moreover, it highlights industry dynamics, encompassing mergers, partnerships, acquisitions, and construction industry reimbursements.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2024 |

|

Growth Rate |

CAGR of 4.17% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Distribution Channel

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 1.72 billion in 2024.

The market is expected to exhibit a CAGR of 4.17% during the forecast period.

The metal conduit segment dominated the market in 2024.

Atkore International Group Inc. and ABB are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us