U.S. Fire Sprinklers Market Size, Share & Industry Analysis, By Product (Wet Pipe Fire Sprinkler, Dry Pipe Fire Sprinkler, Pre-action Sprinkler System, and Deluge Sprinkler System), By End-User (Residential, Commercial, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

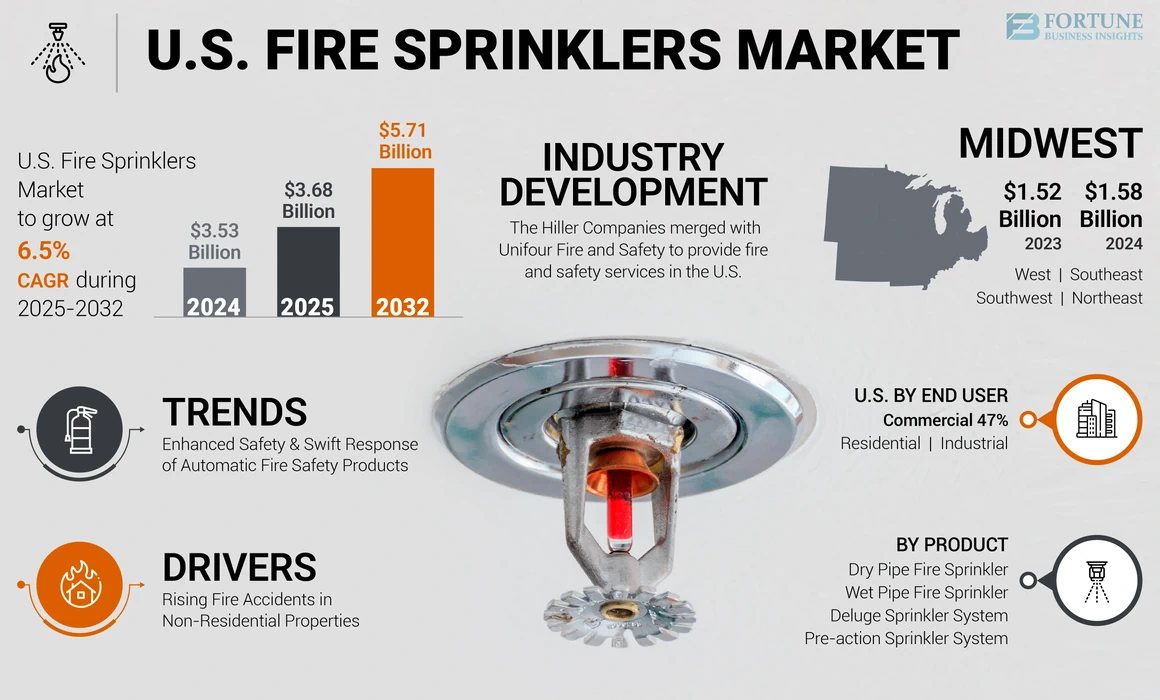

The U.S. fire sprinklers market size was valued at USD 3.53 billion in 2024. The market is projected to grow from USD 3.68 billion in 2025 to USD 5.71 billion by 2032, exhibiting a CAGR of 6.5% during the forecast period.

Fire sprinklers are fire protection devices designed for fire suppression by releasing water or other extinguishing agents when a predetermined temperature is reached. The fire sprinkler is used across diverse sectors including residential commercial and industrial facilities and has been included in the research scope. Fire sprinkler systems such as wet pipe, dry pipe, pre-action, and deluge systems are found in residential, commercial, and industrial properties owing to their benefits such as simple design, high reliability, easy installation, and relatively low cost of maintenance.

Non-residential structures, such as educational institutions and healthcare facilities, attracted huge monthly investment by the end of 2023, closely followed by the residential construction sector. Increasing investment across diverse sectors is subjected to infuse capital in the installation of fire protection systems and boost market growth. For instance, private construction and real estate attracted heavy investment in the residential sector of about USD 896.8 billion in November 2023. Several key players in the market are focused on providing a wide range of services including designing, engineering, fabrication, installation, testing, and inspection of fire sprinkler systems. This approach gives a one-stop solution for end-users across the U.S. to address their fire protection needs.

During the COVID-19 pandemic, temporary shutdowns and lockdowns of manufacturing facilities have relatively impacted the market demand across sectors including automotive, and aerospace. Many manufacturing facilities had to close temporarily to adhere to government regulations and safeguard the health of their workforce. As a result, the market witnessed a decline in demand, impacting manufacturers and suppliers in the industry. However, retrofitting activities showed considerable growth during the pandemic and post-pandemic period, as a result of regulatory policies and mandates.

Increasing fire accidents across non-residential and residential properties are further demanding the installation of fire sprinklers in developing and new buildings across the U.S. region. According to the National Fire Incident Reporting System (NFIRS), more than 50% of the states in the U.S. have reported more than 500,000 fire incidents in the year 2023. Due to the increasing adoption of building automation and the demand for comprehensive safety solutions, the market for automatic fire sprinkler systems is projected to experience growth.

U.S. Fire Sprinklers Market Trends

Enhanced Safety and Swift Response of Automatic Fire Safety Products to Boost Market Development

Automatic sprinklers are effective and highly reliable for designing fire protection systems in diverse industrial, residential, and commercial buildings. These fire sprinkler systems are highly efficient in ceasing the spread of fire in spaces owing to reduced dependency on human factors and ensuring an immediate response in emergency conditions. Automated systems offer several benefits such as an immediate alert to the local fire department, activating sprinkler systems within the first few minutes of a fire break out, and reducing humanitarian and financial loss for buildings. According to the National Fire Protection Association in October 2021, the civilian fire death rate per fire was 89% lower in the case of Automatic Extinguishing Systems (AES) compared to non-automatic extinguishing systems. Such fire sprinklers along with fire suppression also aid in detecting and sending alarms to the corresponding operator which further benefits the early prevention of fire accidents.

Download Free sample to learn more about this report.

U.S. Fire Sprinklers Market Growth Factors

Rising Fire Accidents in Non-Residential Properties to Propel Product Demand

Fire incidents have witnessed a rise in fire mishaps especially at commercial and industrial facilities. Paper, plastics, and recycling facilities have observed prominent growth in fire accidents due to lithium-ion batteries, accelerants, chemicals, and flares. The country has reported increased electronic waste and recycling facility fires, driven by increased demand for electronic products and increased affordability. Over the past few years, a total of 20% increase has been found in fires resulting in a 70% increase in deaths across the U.S., according to the U.S. Department of Homeland Security. In 2023, over 22.3 million fire incidents were reported by 19,460 fire departments owing to several reasons. Fire sprinklers with their immediate response system, significantly reduce the chances of deadly heat flames and toxic smoke. Furthermore, fire safety regulations and standards by international and domestic associations are further directing the demand for sprinkler systems from fire safety. Overall rise in fire incidents at non-residential and related facilities in recycling properties is generating huge market demand for fire sprinkler.

RESTRAINING FACTORS

Extreme Weather Conditions to Limit Market Growth

Regions with extreme cold temperatures pose a high risk of water freezing in the pipes causing system failures and keeping sprinklers ineffective when they are needed. Conversely, in locations with high temperatures and drought, there might be limitations on water usage affecting the fire sprinkler systems to function properly and impede the U.S. fire sprinklers market growth. Additionally, this would further increase operational costs for the system making it even costlier. Extreme weather events such as hurricanes, typhoons, or heavy storms can lead to flooding, potentially damaging or submerging sprinkler systems, rendering them inoperable. However, manufacturers are developing innovative solutions to reduce these challenges for operators.

U.S. Fire Sprinklers Market Segmentation Analysis

By Product Analysis

Wet Pipe Fire Sprinkler System to Capture Largest Market Revenue Share Due to High Reliability and Cost-Effective Benefits

Based on product, the market is categorized into wet pipe fire sprinkler, dry pipe fire sprinkler, pre-action sprinkler system, and deluge sprinkler system.

Wet pipe fire sprinkler is poised to dominate the market with the highest market revenue share and highest growth rate during the forecast period. The segment’s growth is fueled by cost efficiency, high reliability, faster response, easy installation, maintenance needs, and their wide range of applications across sectors.

Dry pipe fire sprinkler is anticipated to hold the second largest market share as these systems are primarily used for specific applications such as unheated warehouses, attic spaces, and cold storage spaces. The dry pipe sprinkler system provides protection from fire incidents at locations with extremely cold temperatures.

Pre-action and deluge sprinkler systems are estimated to showcase steady growth during the forecast period and are mainly used to protect commercial properties such as museums and libraries.

By End-User Analysis

Commercial Segment to Hold the Largest Market Share owing to Supportive Regulatory Policies

Based on end-user, the market is classified into residential, commercial, and industrial.

Commercial segment is likely to hold the largest market revenue share among other end-users. As a result of rising investment in non-residential infrastructure development, the commercial segment is estimated to experience the highest growth rate during the forecast period. The commercial end-user segment accounted for almost half of the total U.S. fire sprinklers market share in 2023 owing to rising fire cases in non-residential properties. Rising construction spending across the states, supportive government policies, increasing awareness about safety and protection solutions, and rising fire accidents across commercial properties in the region are a few of the prominent factors impacting the market’s growth. For instance, USFA estimated that 116,500 fire accidents were reported in the year 2021 showing a double-digit increase of about 12.7% in the number of non-residential building fires resulting in robust demand for fire sprinkler across the region. Automatic extinguishing systems predominantly find application in healthcare properties followed by educational institutes owing to the high risk of fire accidents, as per the National Fire Protection Association in 2019.

Furthermore, the adoption of regulatory policies and retrofitting activities for older buildings are also expected to generate demand for fire sprinkler across the region. Government regulations and the adoption of new rules across the U.S. are all benefitting the market growth of fire sprinkler in commercial properties. For instance, The Public Housing Fire Safety Act in 2023 proposed the establishment of a yearly USD 25 million competitive grant program, offering financial assistance to public housing authorities looking to retrofit older high-rise and commercial buildings with sprinkler systems, thereby working toward preventing future tragedies.

The industrial segment carries an increased risk of property loss due to fire accidents and held a considerable market share in 2023. Although a large number of residential structures are hit by fires every year, fire sprinkler penetration remains low across the states, presenting strong opportunities for the fire sprinkler systems.

To know how our report can help streamline your business, Speak to Analyst

COUNTRY INSIGHTS

Based on region, the market is divided into West, Midwest, Southeast, Southwest, and Northeast.

Midwest is poised to hold the largest share and experience a strong growth rate in the U.S. fire sprinklers market during the forecast period. Midwest states such as Illinois, and Ohio reported more than 1 million fire cases individually resulting in strong demand for fire sprinkler across the Midwest region. The region accounted for a significant fire sprinklers market share in 2023, owing to rising awareness about fire safety solutions and supporting government regulations. The demand for fire sprinkler across the region is estimated to experience the highest growth. Adoption of new regulations for older buildings, high-rise offices, and manufacturing facilities are all subjected to boost the market demand for fire suppression systems across the U.S.

Increased awareness about fire safety, aggressive legislation to meet fire codes, rising investment in infrastructure development, and incentives for fire protection systems by the local or state authorities to further generate market demand for fire sprinkler systems. The rising adoption of automation systems across the country is projected to boost the demand for automatic sprinkler systems with advanced technologies such as remote monitoring solutions. Several U.S. cities have mandated the installation of sprinkler systems in older buildings owing to the rising risk of fire accidents. For instance, according to IFC Code M102.1 automatic sprinkler systems are installed in accordance with Section 903.3.1.1. shall be provided across existing high-rise buildings except airport traffic control towers and open parking structures.

Southeast reported the highest number of fire accidents including forest fires, residential, vehicle, and non-residential fires, followed by the Midwest and West region. According to the NFIRS 2023, Southeast reported 31.5% of the total fire incidents, boosting the demand for highly efficient fire protection and safety solutions including fire sprinkler. California reported the largest number of fire incidents, bringing strong market opportunities for the increasing sales of fire sprinkler and installation of fire sprinkler safety solutions.

Following the Southeast U.S., and Northeast region is likely to witness an uptick in sales of fire sprinkler systems due to rising awareness about fire safety solutions at residential buildings and the benefits of fire sprinkler systems such as minimized risk of property damage and controlled fire outbreaks. Supportive policies, subsidies for end users, and government regulations are all boosting the demand for fire sprinklers, impacting the market growth during the forecast period.

West U.S. region accounts for more than one-fourth of the total reported fire accidents according to the NFIRS. Regulatory policies and standards for high-rise buildings have boosted the demand for sprinklers across the region. The installation of a fire sprinkler system is mandated by NFPA in newly constructed and existing buildings undergoing renovations with building sizes exceeding 5,000 sq. ft. Fire sprinkler offers crucial safety solutions for workforce and equipment in retail spaces, warehouses, and other buildings. Cities and states are developing building codes with updated standards and regulations for buildings. For instance, The International Residential Sprinkler (IRC) mandate has been universally adopted in California, as well as the District of Columbia, with several other states and local jurisdictions contemplating its inclusion in code updates.

Regulatory adoptions, supportive fire protection policies, and rising adoption of automation across sectors are all subject to generate strong market demand for fire sprinkler across the Southeast region. Several manufacturing companies and service providers are expanding their portfolios across the geography via expansion strategies such as mergers, acquisitions, and partnerships. For instance, Pye-Barker Fire & Safety announced the acquisition of Koetter Fire Protection in order to expand its service offerings across diverse U.S. locations and gained seven locations of Koetter Fire Protection throughout Texas.

Key Industry Players

End-to-End service Provision and Acquisitions are Strategized to Widen Key Players Market Presence across the U.S.

Several established key players in the market are striving to expand their market presence and provide end-to-end services such as inspection and design of fire safety solutions for fire sprinklers, alarms, extinguishers, and pumps. Market participants are introducing integrated fire safety solutions with added features such as remote and real-time monitoring solutions to reduce the risk of fire accidents.

Johnson Control introduced fire safety monitoring solutions that offer faster preventative solution for fire accidents

- For instance, Johnson Controls in 2020, launched a smart fire sprinkler monitoring solution for end users which would alert building managers and aid in fire accidents prevention.

APi Corporation, Johnson Control, Siemens AG, and Pye-Barker Fire & Safety, LLC, are a few of the top players in the market focusing on expansion through mergers and acquisition strategies and are also striving to widen their portfolios for a varied range of applications. More than 50% of the expansion strategy was executed by Pye-Barker followed by Hiller Companies in the U.S.

LIST OF TOP U.S. FIRE SPRINKLERS COMPANIES:

- American Fire Systems Inc (U.S.)

- APi Group Corporation (U.S.)

- Century Fire Sprinklers Incorporated (U.S.)

- Confires Fire Protection LLC (U.S.)

- Desmi A/S (Denmark)

- DIBOCO FIRE SPRINKLERS, INC. (U.S.)

- Fireline Corporation (U.S.)

- Hiller Companies (U.S.)

- Janus Fire Systems (U.S.)

- Johnson Controls (Ireland)

- Minimax Viking Group (Germany)

- Pye-Barker (United Fire Protection) (U.S.)

- Reliable Automatic Sprinkler Co., Inc. (U.S.)

- Rollins Fire Sprinklers, Inc. (U.S.)

- Senju Sprinkler (U.S.)

- Siemens (Germany)

- SIRON Fire Protection (Netherlands)

- State Systems (U.S.)

- Victaulic Company (U.S.)

- Wayman Fire Protection (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: Pye Barker acquired Vanguard Fire & Security Systems to expand its product and service offerings such as fire sprinkler, fire alarm, and security and CCTV Systems.

- April 2023: The Hiller Companies merged with Unifour Fire and Safety, headquartered in North Carolina to provide fire and safety services in the U.S. The company provides design and installation services for fire sprinklers, fire extinguishers, fire alarms, and pumps to diverse sectors including commercial properties, educational facilities, and residential buildings.

- March 2023: Senju Sprinkler, a fire suppression manufacturer of Japanese origin, introduced a novel 5.6K Factor Flush-Type Pendent Sprinkler tailored for commercial use. The company recently introduced the NF-QR 5.6K model holds FM Approval, emphasizing quick response. With its compact and flush mount design, this sprinkler is designed for diverse commercial applications, including hotels, offices, and high-rise buildings.

- December 2022: Viking Corporation announced price variations for pipes and fittings from January 2022 owing to variations in raw material pricing, which would generate an impact on the complete line of fire sprinklers, valve systems, and related devices.

- May 2022: Protegis Fire & Safety was acquired by Summit Fire & Security, a subsidiary of SFP Holdings, Inc. Protegis specializes in the inspection, installation, service, and repair of fire alarms, security systems, fire pumps, fire sprinkler systems, extinguishers, and fire suppression systems.

- March 2022: APi Group announced the acquisition of Chubb Fire and Security Business from Carrier Global Corporation for a valuation of USD 3.1 billion. Chubb Fire and Security Business offers fire extinguishers, water mist fire suppression, and water sprinkler systems that will further widen the fire suppression products and service offerings to a wide range of customers for APi Group.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2022 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019 – 2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025 – 2032 |

|

Historical Period |

2019 – 2023 |

|

Growth Rate |

CAGR of 6.5% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By End-User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market stood at USD 3.53 billion in 2024.

Fortune Business Insights says that the market will reach USD 5.71 billion by 2032.

Growing at a CAGR of 6.5%, the market will exhibit strong growth during the forecast period.

Increasing non-residential fire accidents is a key factor driving market growth.

The top companies in the market are APi Corporation, Johnson Corporation, Siemens AG, Pye-Barker Fire & Safety, LLC.

Midwest is poised to hold the largest market share followed by Southeast.

Wet pipe fire sprinkler is projected to hold the largest market share.

Commercial segment is expected to capture the largest share.

The enhanced safety and swift response of automatic fire safety products are the key latest trends in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us