U.S. Hot-dip Galvanized Steel Market Size, Share & Industry Analysis, By Type (Sheet and Strip, Structure, Pipe and Tube, Wire and Hardware, and Others), By Application (Construction, Automotive, Home Appliance, General Industrial, and Others), and Country Level Forecast, 2024-2029

KEY MARKET INSIGHTS

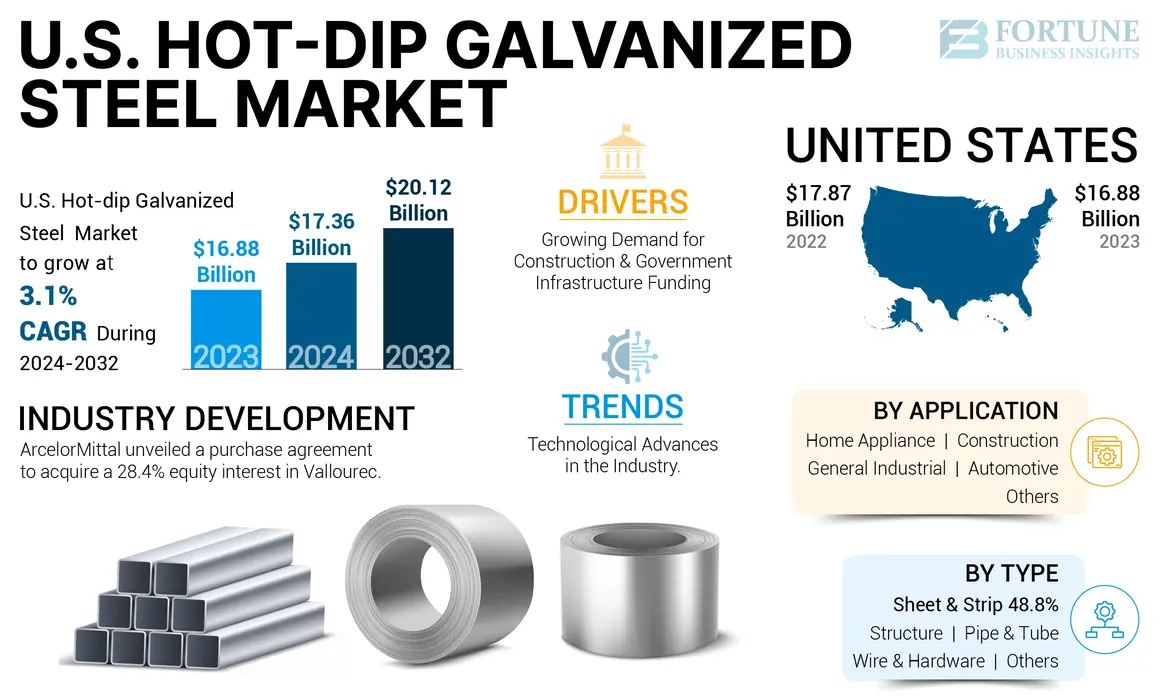

The U.S. hot-dip galvanized steel market size was valued at USD 16.88 billion in 2023. The market is projected to grow from USD 17.36 billion in 2024 to USD 20.12 billion by 2029 at a CAGR of 3.1% during the forecast period.

Hot-dip galvanized steel is a corrosion resistant material created by dipping steel into molten zinc. The process (bath of molten zinc) creates a metallurgical bond between the zinc coating and the steel substrate, providing long-lasting protection against rust and corrosion. The steel is thoroughly cleaned and pre-treated before dipping, ensuring the zinc layer adheres properly. Hot-dip galvanizing provides a uniform coating thickness, extending service life and reducing maintenance costs. Due to its durability and resistance to rust, the product is widely used in industries such as construction, automotive, appliances, general industry, and more.

The rising demand for electrical appliances and equipment has boosted market growth, as hot-dip galvanized steel is used in producing electrical enclosures, conduits, and cable trays. The increasing adoption of sustainable and eco-friendly construction practices is expected to further increase demand for the product in the coming years.

The COVID-19 pandemic crisis significantly influenced the steel industry, impacting every stage of the supply chain, from the creation of raw materials to the delivery of the final products. The crisis led to a decrease in steel demand because both industrial manufacturing and construction projects were put on hold because of lockdowns and additional restrictive measures. Nonetheless, as the global economy started recovering from the pandemic, the steel industry rebounded.

U.S. Hot-dip Galvanized Steel Market Trends

Technological Advances In the Industry Help to Boost Market Growth

Recent advances in coating technology have improved the effectiveness and appeal of hot-dip galvanized steel. Innovations focus on improving durability and aesthetics to meet the changing needs of variety of industries. A key advancement involves the development of alloy elements and coating compositions. By adding elements such as aluminum, zinc, magnesium, or rare earth metals, manufacturers can customize coatings to provide excellent corrosion protection, even in harsh environments such as marine or industrial environments. These alloys can form a denser, tighter protective layer, thereby extending the service life of hot-dip galvanized steel products.

On the other hand, advances in surface treatment technology and treatment processes also help to extend the life and durability of coatings. Treatments such as chemical passivation or chromate conversion coatings enhance adhesion and provide additional corrosion resistance.

Download Free sample to learn more about this report.

U.S. Hot-dip Galvanized Steel Market Growth Factors

Growing Demand for Construction and Government Infrastructure Funding to Drive Market Growth

With the growth of the construction industry, the demand for hot-dip galvanized steel has also increased, as it is widely used in the construction of buildings, bridges, and other infrastructure projects. The galvanizing process involves coating the steel with a layer of zinc, enhancing its strength, longevity, and resistance to rust and corrosion. This makes it a cost-effective and reliable material for construction projects, especially in areas with high levels of moisture and humidity.

The 117th U.S. Congress passed several bills, including the CHIPS Act, the Bipartisan Infrastructure Act, and the Inflation Reduction Act, which collectively allocate more than USD 1.2 trillion in infrastructure investment between 2021 and 2030. The funding aims to modernize the nation's aging infrastructure and complete the repair of many major projects.

Hot-dip galvanized steel is often used in building structures, such as beams, columns, and trusses. Its high strength and corrosion resistance make the building structure more stable and durable, which can effectively extend the service life of the building. In addition, hot-dip galvanized steel pipes offer good welding properties, facilitating processing and installation for construction workers. In infrastructure projects such as pipelines, the anti-corrosion properties of hot-dip galvanized steel ensures the long-term stable operation of pipelines. Therefore, the increase in construction and infrastructure projects in the country will drive the U.S. hot-dip galvanized steel market growth during the forecast period.

RESTRAINING FACTORS

Strict Environmental Regulations is Expected to Restrain the Market Growth

The market is heavily dependent on zinc, a key raw material in the galvanizing process. However, the extraction, processing, and handling of zinc can have adverse effects on the environment, particularly in terms of emissions and waste disposal. Stringent regulations aimed at reducing pollution and promoting sustainable development often require companies to invest in costly measures to mitigate their environmental conditions. For hot-dip galvanized steel mills, this may involve implementing advanced pollution control technologies, such as scrubbers or filtration systems, to reduce emissions of hazardous substances such as particulate matter and volatile organic compounds. This places significant cost pressure on the product steel industry.

In addition, strict regulations regarding wastewater management and hazardous waste disposal can add complexity and increase the expense of the production process. Compliance with these regulations increases operating costs and requires significant administrative work and ongoing monitoring.

As a result, companies operating in the market may face challenges in maintaining profitability and competitiveness while meeting stringent environmental standards. Thus, strict environmental regulations are not conducive to the growth of the hot-dip galvanized steel market.

U.S. Hot-dip Galvanized Steel Market Segmentation Analysis

By Type Analysis

Sheet and Strip Segment Accounts for Key Share Due to Its Exceptional Mechanical Properties.

Based on type, the U.S. market is segmented into sheet and strip, structure, pipe and tube, wire and hardware, and others.

The sheet and strip segment is identified as the dominant type of hot-dip galvanized steel in the U.S. market. The segment is poised to remain a primary choice among end-users mainly due to its exceptional mechanical properties. HDG sheets and strips are primarily used in the construction and automotive industries for various purposes, including framing and support systems in construction. The product is mainly used due to their strength and resistance to environmental elements. In automotive, they are used to manufacture seat frames and structural components for automotive seating systems due to their strength and formability.

Apart from sheet and strip, the product is utilized in pipe & tube and wire & hardware. According to the American Galvanizers Association, hot-dip galvanizing offers over 70 years of maintenance-free corrosion protection in highly corrosive environments. Hence, it provides higher corrosion resistance than conventional steel. Owing to its exceptional resistivity it is mainly used in such environments where there is a need for highly corrosive materials. This makes it ideal for industries with high corrosion demands such as chemical, petrochemical, and energy sectors.

The structure segment is another important product type utilized in platforms and structures for machinery, staircases, and handrails. It is also used in conveyor systems and is prevalent in coal-fired power stations. As a result, the demand for this type of structure is anticipated to grow moderately during the forecast period.

The unique properties and growing demand from various end-use industries are likely to propel growth in these types of HDG steel products, generating collective market opportunities during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Construction Segment to Owing to its Vast Adoption in Building Frames and Bridges

Based on application, the market is segmented into construction, automotive, home appliance, general industrial, and others.

The construction segment is likely to dominate the U.S. hot-dip galvanized steel market share during the forecast period. In construction, it is utilized in many applications, such as in building frames and bridges, where it is used in the forms of beams, columns, and trusses. The galvanized coating protects the steel from corrosion, extending its lifespan even in harsh environments, making it an ideal material for construction applications.

The automotive segment is the second largest application segment in the U.S. hot-dip galvanized steel market. It is used in a plethora of applications, including manufacturing of outer body panels such as doors, hoods, and trunk lids. Furthermore, the galvanized coating protects these panels from corrosion caused by road salts, moisture, and environmental exposure.

General industrial applications include manufacturing enclosures, cabinets, and housings for industrial equipment and machinery. These enclosures protect sensitive components from moisture, chemicals, and mechanical damage. It is also used in conveyor systems for material handling in industries such as manufacturing, mining, and logistics, ensuring durability and reliability under heavy loads. This segment accounted for over 11% of the total sales revenue in 2023.

KEY INDUSTRY PLAYERS

Key Market Players Account for Major Market Share Owing to Their Big Clientele

The manufacturing sector in the U.S. is relatively consolidated, with fewer major players dominating the market and accounting for a significant market share. These companies have established production facilities, well-developed distribution networks, and strong brand recognition. They cater to a wide range of applications and customers, including government agencies, infrastructure projects, and construction companies. Along with large players, there is a relevant presence of regional and small-scale players in the U.S. market. These players often cater to specific regional markets and niche product segments. Despite the fact that they have a relatively small market share, these companies offer unique products with localized expertise.

List of Top U.S. Hot-dip Galvanized Steel Companies:

- ArcelorMittal S.A. (Luxembourg)

- United States Steel Corporation (U.S.)

- Steel Dynamics, Inc. (U.S.)

- NLMK Group (Russia)

- JFE Steel Corporation (Japan)

- Cleveland-Cliffs Inc. (U.S.)

- Southland Industrial Coatings (U.S.)

- Nucor Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: ArcelorMittal launched a new content series, “The Steel Works”. The series explores the latest challenges and trends in the steel industry, which will be helpful for ArcelorMittal’s future growth. The Steel Works series will feature insight and analysis on steel’s role in climate transition, research & development activities, and more. Such initiatives would help the company make valuable future decisions.

- March 2024: ArcelorMittal announced a purchase agreement to acquire a 28.4% equity interest in Vallourec. The acquisition would help ArcelorMittal to make more share in the tubular business. Such a market development strategy enhances the company's presence in the Brazilian and U.S. regions.

- March 2023: United States Steel Corporation (U.S. Steel) announced a definitive agreement for Nippon Steel Corporation (NSC) to acquire U. S. Steel in an all-cash transaction valued at USD 55.00 per share. The transaction value is approximately USD 14.9 billion, which includes the company's equity value and debt. As per the strategic approach by the Board of Directors of both NSC and U. S. Steel., this transaction would create significant value for the shareholders of both companies. The deal was the best strategic alliance between America and Japan against China, which would create stability in the supply chain for both companies and markets.

- December 2022: California Steel Industries, Inc. (CSI) a partner company of Nucor has announced to build a continuous galvanizing line at Fontana, California. The new galvanizing line is expected to serve construction end markets in the western United States and is projected to have an annual capacity of 400,000 tons. With this new expansion, CSI will have a total hot dip galvanizing capacity of 1.2 million tons per year.

- January 2022: Steel Dynamics, Inc. completed the acquisition of a minority equity interest in New Process Steel, L.P. The acquired company is a metal solutions and distribution supply-chain management company and it has a strong customer relationship and a strong reputation for high-quality standards. The acquisition would help the company to increase its market share in the steel market.

REPORT COVERAGE

The report is focused on the key insights of the U.S. market forecasts. Quantitative data include the market size in value (USD Billion) and volume (Kiloton) across profiled segments. Also, the report consists of revenue, market share, and growth rates of all segments across the country. Qualitative data covers the detailed analysis of key market driving factors, restraining factors, market opportunities, key market trends, and revenue shares. Competitive landscape chapter covers the detailed profiling of leading players, contributing to the U.S. market growth.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2029 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2029 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 3.1% from 2024 to 2029 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 16.88 billion in 2023 and is projected to reach USD 20.12 billion by 2029.

Growing at a CAGR of 3.1%, the market will exhibit significant growth during the forecast period.

The sheet and strip segment is the leading type in the market.

Growing construction industry is a key factor driving market growth.

Key players operating in the market are ArcelorMittal S.A., United States Steel Corporation, Steel Dynamics, Inc., NLMK Group, JFE Steel Corporation, Cleveland-Cliffs Inc., Southland Industrial Coatings, Nucor Corporation among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us