U.S. Hotel Toiletries Market Size, Share & COVID-19 Impact Analysis, By Type (Single-use Toiletries [Liquid Hand Soap, Shampoo, Conditioner, Body Wash, and Others]) and Dispensers [Liquid Hand Soap, Shampoo, Conditioner, and Body Wash]), By Application (Ordinary Hotels and Luxury Hotels), and Region Forecast, 2025-2032

KEY MARKET INSIGHTS

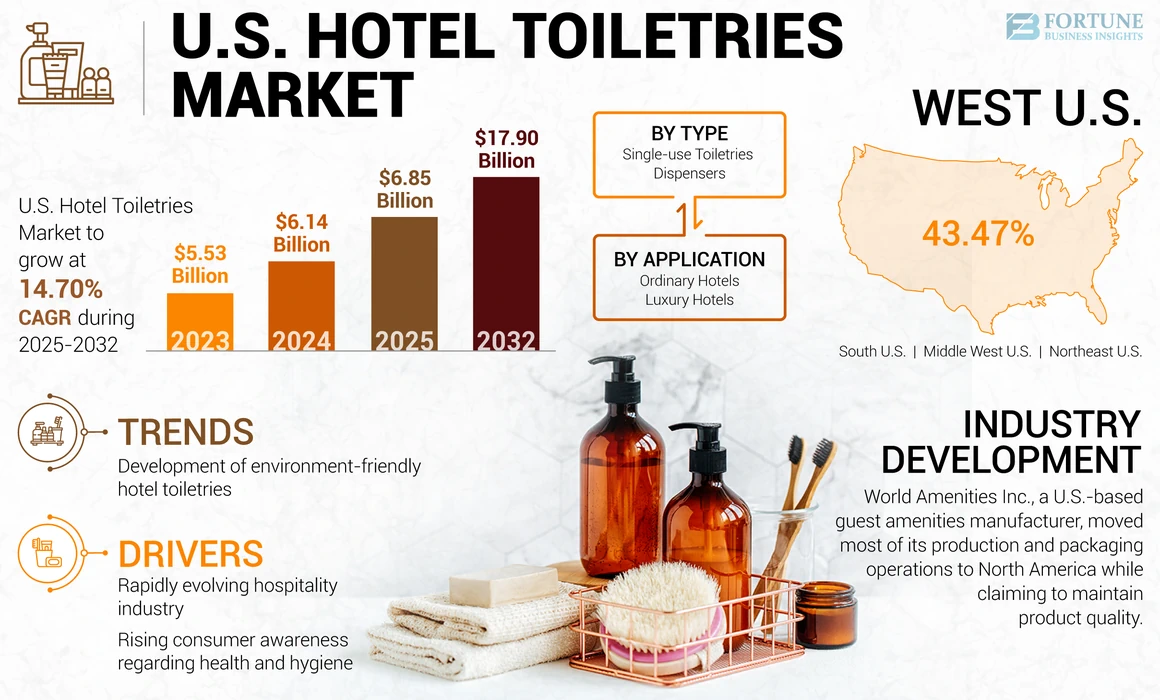

The U.S. hotel toiletries market size was valued at USD 6.14 billion in 2024. The market is projected to grow from USD 6.85 billion in 2025 to USD 17.90 billion by 2032, exhibiting a CAGR of 14.70% during the forecast period.

Hotel toiletry refers to a collection of hygiene & beauty products such as body washes, toothpaste, shampoos, conditioners, body lotions, shower gels, and bath & body oils. The selection of bathroom amenities is considered an integral part of hotel management as it can significantly influence the hotel guest experience.

Branded hotels or luxury hotel chains typically supply bathroom amenities with their hotel logo. In this respect and from a hospitality standpoint, bathroom amenities are key in enhancing hotel companies’ brand image/reputation. At a macro level, the increasing need for business travel and work-related training will facilitate the U.S. market growth throughout the forecast timeframe.

COVID-19 IMPACT

Market Growth Impeded Due to Temporary and Permanent Shutting Down of Hotels amid COVID-19 Pandemic

The COVID-19 pandemic created economic and public health crises in the U.S. throughout 2020. The hospitality industry is one of the hardest hit sectors due to the unprecedented pandemic. While most of the hotels in the U.S. experienced booking cancellations due to lockdowns and other COVID-19 restrictions in 2020, some were permanently shut down. For instance, the Luxe Rodeo Drive hotel in Beverly Hills, California, shut down in September 2020 due to the pandemic's adverse financial effects.

Further, the low occupancy rate and closure of hotels in the country declined the demand for bathroom amenities in 2020. However, the demand is expected to rebound and match pre-pandemic levels over the forecast timeframe, backed by the resumption of international travel activities.

LATEST TRENDS

Download Free sample to learn more about this report.

Industry Value to Surge Driven by the Development of Environment-friendly Hotel Toiletries

Industry participants focus on developing environment-friendly bathroom amenities such as toothbrushes, refillable dispenser bottles, recyclable plastic bottles, and shower caps. At a macro level, the increasing number of eco-conscious consumers, who prefer sustainably produced and packaged bathroom amenities in guest rooms, is encouraging product innovation across hotel chains, particularly in the luxury hotels category.

Recently, numerous branded hotels have introduced sustainable products to enhance the guest experience. In this respect, hotel chains have been focusing on reducing plastic waste in hotel rooms by employing environment-friendly packaging materials. For instance, in April 2022, World Amenities, a U.S.-based guest amenities manufacturer, introduced the new Nectar Collection, Spa Rituals Collection, MAGNETIX Dispensing Systems, and Premium Disposable Spa Slippers for hotels. Each product line features shampoos, conditioners, body washes, and body lotions packaged using 100% recyclable bottles. These products are made by using EcoPure biodegradable technology. The increasing popularity of plant-based, cruelty-free, and herbal products, especially among millennials, will encourage global brands (bathroom amenity manufacturers) to develop environment-friendly products in the foreseeable future, positively influencing the market growth.

DRIVING FACTORS

Rapidly Evolving Hospitality Industry to Favor Market Expansion

The increasing number of hotels in the U.S. significantly contributes to market expansion. In recent years, several hotels have been constructed across the U.S., particularly in states such as California and New York. For instance, approximately 12,027 new hotel rooms opened across California in 2021, according to the California Hotel Development Survey 2021. The U.S. hotel toiletries market share is estimated to increase steadily in the coming years, backed by the rapidly evolving hospitality sector.

Rising Consumer Awareness Regarding Health & Hygiene to Fuel Product Demand

Rising awareness about health and hygiene fuels market growth. With the increasing health risks, changing lifestyles, and growing awareness regarding the need for personal care, individuals across the U.S. are becoming increasingly hygiene conscious, thereby triggering the product demand. Given the rising consumer awareness regarding health & hygiene, hotels in the U.S. focus on providing a wide variety of toiletries to promote hygiene. Furthermore, the COVID-19 pandemic has made individuals more conscious about personal hygiene as hotel guests expect high-quality hotel toiletries in bathrooms. These factors are accelerating the product adoption process across the country.

RESTRAINING FACTORS

Large Quantities of Plastic Waste Created by Hotel Toiletries to Impede Market Growth

Bathroom amenities generate large quantities of plastic waste, hampering product demand. Shampoos, conditioners, liquid soaps, and other hotel toiletries packaged in plastic bottles can become waste after use. These tiny bottles end up in landfills and can harm the environment. The increasing number of eco-conscious consumers in the U.S. and globally will hamper product demand in the forthcoming years.

In this regard, the U.S. government has imposed various laws to reduce the amount of plastic waste from hotels. For instance, in February 2022, the Hawaii legislature announced its plan to ban small toiletries across hotels in Hawaii to tackle the growing concerns regarding plastic waste in the state.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Single-use Toiletries Recorded Surging Demand Owing to Portability, Convenient Storage, and Low Cost

Based on type, the market is segmented into single-use toiletries and dispensers.

The single-use toiletries segment is divided into liquid hand soap, shampoo, conditioner, body wash, and others. On the other hand, the dispensers segment is categorized into liquid hand soap, shampoo, conditioner, and body wash.

'Single-use toiletries' is the most popular product category across the U.S. hotels. Factors such as portability and convenient storage fuel the demand for single-use toiletries. Liquid hand soaps in dispensers and single-use toiletries are widely utilized across the hospitality industry. These are used in luxury hotels, restaurants, and lodgings, owing to their benefits, such as more hygiene and protection from different forms of contamination.

Many hotels across the U.S. employ single-use toiletries as they are less expensive than dispensers. However, these products create a large amount of plastic waste and pollute the environment. This factor will significantly hamper the demand for single-use toiletries in the U.S. in the coming years. However, various U.S. states are taking initiatives to restrict single-use toiletries in hotels to protect the environment.

By Application Analysis

Increasing Number of Budget-conscious Travelers to Trigger Product Adoption in the Ordinary Hotels Category

Based on application, the market is segmented into ordinary hotels and luxury hotels.

The ordinary hotels segment emerged as the largest in 2022. Ordinary hotels provide basic services to their customers (without luxury features) at an economical price. These hotels are an ideal option for budget-conscious travelers. Leading hotel companies, such as ModernHaus SoHo and Crosby Street Hotel, focus on expansion strategies to stay competitive within the ordinary hotels segment.

The luxury hotels segment is expected to witness significant growth over the forecast period, backed by the rising number of affluent travelers to the U.S. and an increasing need for luxury hotels to enhance their customer experience.

REGIONAL INSIGHTS

Region-wise, the market is studied across West U.S., South U.S., Middle West U.S., and Northeast U.S.

West U.S. was valued at USD 2.67 billion and emerged as the largest market in 2024. Growth in the hospitality and tourism sector, specifically across U.S. states such as Idaho, Montana, Utah, California, Washington, and Hawaii, contributes to the growth of the West U.S. market. Hotels in the region focus on enhancing their customer services and geographical presence to stay competitive. Furthermore, the increasing instances of new hotel openings will fuel the hotel toiletries demand in the near term. For example, in April 2022, the Madrona, a new hotel with 24 rooms, a restaurant, and a lounge space, was opened in Healdsburg, California.

In recent years, various U.S. states have restricted single-use toiletries in hotels to reduce plastic waste generated in the country. For instance, in May 2021, New York passed a law banning single-use plastic toiletries in hotels. As per the law, hotels in New York must ban plastic toiletries by 2024 and switch to refillable dispensers and eco-friendly containers for body and hair products.

To know how our report can help streamline your business, Speak to Analyst

South U.S., Middle West U.S., and Northeast U.S. are other significant contributors to the U.S. market. While rising government investment in tourism favors market growth in the South U.S., key toiletry manufacturers in the Middle West U.S. are developing new products such as body wash and moisturizers for hotels which will surge the hotel toiletries demand in the region. The increasing number of travelers and growing consumer awareness regarding the importance of eco-friendly products in U.S. states, including New York, Vermont, Massachusetts, and Rhode Island will boost the product demand in Northeast U.S. over the forecast period.

KEY INDUSTRY PLAYERS

New Product Launches to Facilitate Brands Achieve Sustainable Competitive Advantages

The market is characterized by intense competition, with international and domestic players sharing the market space. Numerous industry participants have been developing a wide range of innovative products such as pure essential oils, liquid soaps, natural fragrances, shower gel, extra-mild soaps, and hotel shaving kits to stay competitive. The employment of herbal/vegan/natural raw materials to manufacture bathroom amenities is emerging as a key industry trend.

For instance, in Nov 2022, Ritz Carlton, a U.S.-based hotel chain, announced Diptyque, a French luxury perfume business, as its bath amenity partner. Diptyque will provide luxurious bath products to the Ritz- Carlton hotels and resorts worldwide. In December 2022, Ritz Carlton launched an exclusive gift set to celebrate its partnership with Diptyque.

LIST OF KEY COMPANIES PROFILED:

- Essential Amenities (U.S.)

- Transmacro Amenities (U.S.)

- World Amenities (U.S.)

- Accent Amenities, Inc. (U.S.)

- Hancey Cosmetics (China)

- Kimirica Hunter International (India)

- Yangzhou Jiahua Guest & Daily Supply Co., Ltd. (China)

- HD Fragrances (France)

- StyleVision Hotel Supplies GmbH (Germany)

- Hara Naturals (India)

KEY INDUSTRY DEVELOPMENTS:

- August 2022: Waldorf Astoria Hotels, a U.S. hotel chain, partnered with Aesop, an Australian luxury brand. The hotel chain will offer full-size in-room sustainable hotel toiletries featuring 97% recycled plastic through this partnership.

- April 2021: World Amenities Inc., a U.S.-based guest amenities manufacturer, moved most of its production and packaging operations to North America while claiming to maintain product quality.

- April 2021: The Grand Resort, an Ohio-based destination resort, announced that it elaborated its hotel amenities to provide better services to its guests. In this respect, the hotel offers a roman bath, cigar lounge, spa treatment facilities, and a golf course.

- February 2021: Molton Brown, a U.K.-based luxury fragrance & toiletry manufacturer, introduced the “New Signature Dispenser” at Old Edwards Inn & Spa, a resort in North Carolina. According to the resort/company, installing one dispenser can prevent approximately 137 kgs of plastic waste in landfills and replace 18,250 bottles annually.

REPORT COVERAGE

The report analyzes the market in-depth and highlights crucial aspects such as prominent companies, product types, and applications. Besides this, it provides insights into U.S. hotel toiletries market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.70% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market size was USD 6.14 billion in 2024 and is anticipated to reach USD 17.90 billion by 2032.

In 2024, the market value stood at USD 6.14 billion.

Ascending at a CAGR of 14.70%, the market will exhibit steady growth over the forecast period (2025-2032).

By type, the single-use toiletries segment is expected to dominate the market throughout the forecast period (2025-2032).

An increasing number of hotels across the U.S. is accelerating market growth.

World Amenities, Transmacro Amenities, and Essential Amenities are the leading market participants.

West U.S. dominated the market in 2024.

Rising consumer awareness regarding health and hygiene will accelerate product adoption in the near term.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us