U.S. Medical Cold Storage Market Size, Share & Industry Analysis, By Product Type (Ultra-Low Temperature (ULT) Freezers, Low Temperature Freezers, Blood Bank Refrigerators, Low Temperature Refrigerators, and Others), By Storage (Vaccines, Blood Products, Medications & Biologics, Laboratory Specimens, and Others), By Size (Undercounter, Compact, Mid-sized, and Large), By End User (Hospitals, Clinics, Physician Offices, Academic Institutes & Research Laboratories, Pharmacies, Blood Banks, and Others), and Forecast, 2025-2032

KEY MARKET INSIGHTS

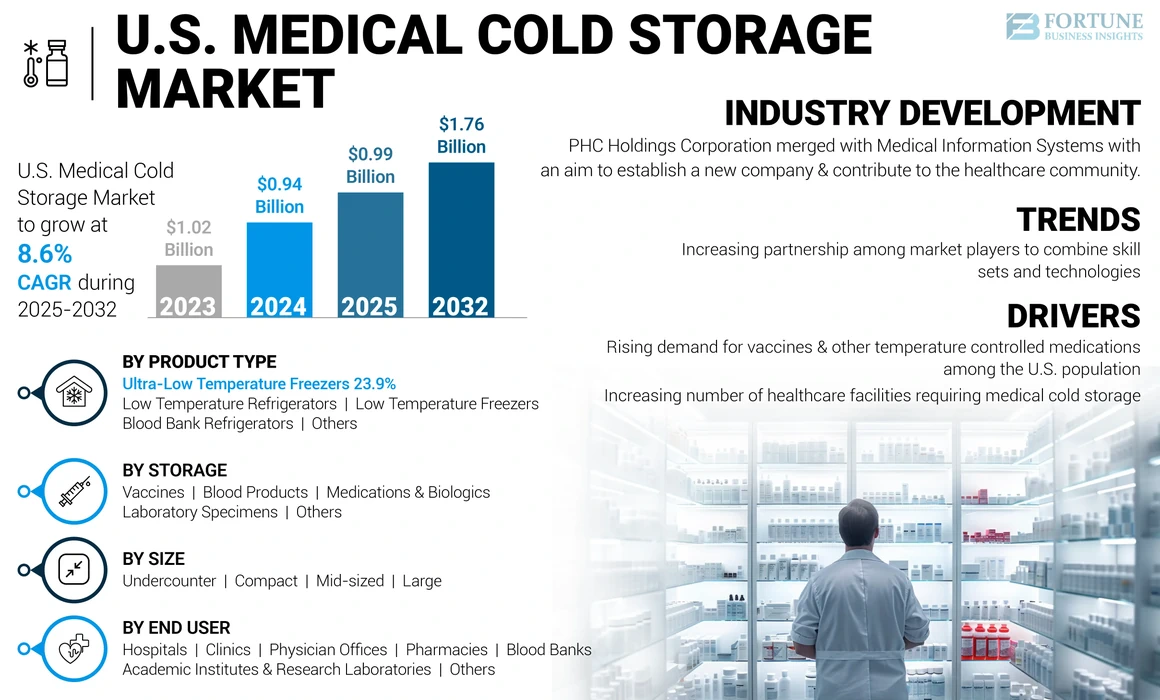

The U.S. medical cold storage market size was valued at USD 0.94 billion in 2024. The market is projected to grow from USD 0.99 billion in 2025 to USD 1.76 billion by 2032, exhibiting a CAGR of 8.6% during the forecast period.

Several pharmaceutical products including vaccines and medications are temperature-sensitive products that require to be stored at a maintained temperature. A slight deviation in the temperature range even for a short period of time can damage these products. Medical cold storage includes refrigerators and freezers that can store these products at the required temperature.

The rising research & development activities for various chronic conditions involving development of mRNA vaccines and other biologics is one of the major contributing factors for the growing demand for medical cold storage products in the U.S.

However, the higher costs associated with the installation and maintenance of these medical refrigerators and freezers and increasing use of the refurbished products are some of the factors anticipated to hamper the market growth.

COVID-19 IMPACT

Supply Chain Disruption During the COVID-19 Pandemic Restrained the Market Growth

The COVID-19 pandemic impacted the U.S. medical cold storage market negatively due to the disruption in supply chains and the gap between the demand and supply of medical cold storage devices, including ultra-low temperature freezers and refrigerators in the market.

The pandemic lockdown and restrictions resulted in supply chain disruption among the manufacturers and led to increased efforts of the manufacturers to cater to the overwhelming demand for these products.

However, in 2021, increased COVID-19 vaccines roll out in the U.S. and increased awareness regarding the ultra-low temperature requirement for COVID-19 vaccines led to an increased demand for cold storages in 2021.

- For instance, as per CDC, Pfizer’s COVID-19 vaccine required ultra-low temperature storage (-60°C to -80°C) before opening and mixing.

According to interviews with key opinion leaders in the market, the demand for ULT freezers in the U.S. increased substantially during the end of 2020 and the financial year 2021. This was due to the increased demand for storage of vaccines.

- For instance, according to BioLife Solutions Inc., the ULT freezer unit production volume increased in 2021 to support the COVID-19 vaccine storage and distribution programs. The company doubled its manufacturing capacity of ULT freezers and shipped around 8,000 freezers in 2021.

The increased research and development activities among pharmaceutical companies, biotechnological companies, and other research universities to develop and introduce novel vaccines and drugs for various chronic conditions is expected to fuel the market growth in the coming years.

U.S. Medical Cold Storage Market Trends

Increasing Partnership among Market Players to Combine Skill Sets and Technologies

The rising demand for novel technology and solutions in devices used for medical cold storage is leading to rising collaborations, and partnerships among the market players. The aim is to expand their product portfolio and combine the technology and skills to develop the latest technologically advanced products in the market.

- For instance, in November 2022, TruMed Systems, a medical inventory management company, partnered with Helmer Scientific Inc. The partnership is aimed to provide a solution for access-controlled cold storage for vaccines and medications requiring refrigeration and freezing.

The adoption of technology that incorporates automation and digitalization is valuable to the pharmaceutical and other healthcare facilities to cater to the rising demand for these products among the healthcare providers and facilities.

The latest technologies, such as real-time temperature monitoring, inventory management, and other features, in the medical refrigerators and freezers are becoming key factors for the merger and collaborations among the manufacturers to develop advanced medical cold storage devices.

Download Free sample to learn more about this report.

U.S. Medical Cold Storage Market Growth Factors

Rising Demand for Vaccines and Other Temperature Controlled Medications among the U.S. Population to Boost the Demand

The rising patient population suffering from various conditions is resulting in the growing demand for vaccines and biologics. Along with this, the increasing research and development activities among the pharmaceutical and biotechnological companies and awareness among the general population are fostering the demand for these vaccines in the country.

- For instance, in August 2022, U.S. FDA issued an emergency use authorization for JYNNEOS vaccine for monkeypox infection for individuals aged 18 years and above. This is expected to increase the vaccine supply and vaccination rate among the population.

Similarly, the recent COVID-19 pandemic increased the focus of the manufacturers and distributors to develop effective vaccines for similar outbreaks and increased the demand for cold storage space and equipment.

Along with this, the rising focus of the key players to develop temperature-controlled drugs and biologics that require cold storage is another major contributing factor that fuels the U.S. medical cold storage market growth.

- According to a 2022 article published by K2 Scientific, in July 2021, there were approximately 180 novel mRNA drug products that entered the FDA approval pipeline.

Thus, the demand for medical cold storage among the healthcare facilities in the country is anticipated to fuel up during the forecast period.

Increasing Number of Healthcare Facilities Requiring Medical Cold Storage in the U.S. to Cater to the Growing Demand

The increasing demand for temperature controlled drugs and vaccines to cater to the rising prevalence of various chronic conditions among the population is leading to rising adoption of medical refrigerators and freezers across various settings.

Furthermore, increased blood donation drives in the country especially post COVID-19 pandemic is another major reason contributing to the growth of the blood banks in the country.

- According to a 2022 article published by Oxford University Press, the number of donor specimens in the U.S. increased to 131,913 in November 2020 from 115,312 in July 2020.

Similarly, the increased demand for COVID-19 vaccines among the patient population augmented a higher storage space and infrastructure for these vaccines.

- According to a 2022 report published by Pharmaceutical Care Management Association (PCMA), the number of independent pharmacies increased by around 13% in the U.S. from 2011 to 2021.

Therefore, the growing demand for healthcare products and services among the population in the country and rising number of healthcare facilities are expected to drive the demand for cold storage in the country during the forecast period.

RESTRAINING FACTORS

High Costs Associated with the Products and Initial Investment to Hamper the Market Growth

The rising technological advancements in medical refrigerators and freezers owing to the increased focus of the market players is leading to increased demand for these products among healthcare facilities. However, the high cost associated with the installation and maintenance of these products is an important factor expected to hinder the market growth.

- The average cost of an ULT freezer can range between USD 12,000 to USD 40,000 depending on various parameters such as size, capacity, among others.

- Also, the average cost to run an upright, mechanical ULT freezer can vary from USD 70 to USD 1,000 per year, and regular maintenance and additional cost of Heating, Ventilation, and Air-Conditioning (HVAC) systems can drive the cost up even further and become a constraint for laboratories and research facilities.

The high consumption of electricity of these equipment, especially ultra-low temperature (ULT) freezers is another major concern of the healthcare settings regarding the utilization of these products in the facilities.

- For instance, according to the U.S. Department of Energy, a conventional ULT freezer can use approximately 20 kWh of energy per day, which is equivalent to the energy use of the average U.S. household.

Therefore, the high cost of the initial setup of medical refrigerators and freezers along with limited medical grade refrigerators adoption as compared to the commercial grade refrigerators is a major factor anticipated to restrain the market growth during the forecast period.

U.S. Medical Cold Storage Market Segmentation Analysis

By Product Type Analysis

Ultra-Low Temperature Freezers to Dominate Due to Increasing R&D Activities among Healthcare Facilities

On the basis of product type, the market is segmented into Ultra-Low Temperature (ULT) freezers, low temperature freezers, blood bank refrigerators, low temperature refrigerators, and others.

The ULT freezers dominated the U.S. medical cold storage market share in 2022. The dominant share was due to the increased demand for ULT freezers, especially during the COVID-19 pandemic, to store and distribute the COVID-19 vaccines in the country.

Along with this, the rising focus of the market players to develop and introduce products with new technology is expected to fuel segmental growth during the forecast period.

- For instance, in March 2022, B Medical Systems received the WHO Performance, Quality, and Safety (PQS) qualification for its U201 ULT freezer, which makes it the first ULT freezer to receive the certification.

Low temperature freezers segment is expected to grow at a considerable growth rate during the forecast period owing to increasing research and development activities in the research universities, and other healthcare facilities requiring the samples and specimens stored at a low and required temperature.

Blood bank refrigerators segment is expected to grow at the highest CAGR during the forecast period owing to increasing number of blood donations in the country.

- For instance, according to a 2022 article published by Oxford University Press, the number of donor specimens in the U.S. increased to 131,913 in November 2020 from 115,312 in July 2020.

The increased use of drugs and medications stored at a lower temperature (2-8°C) is an important factor contributing to the growth of the low-temperature refrigerators in the market during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Storage Analysis

Vaccines Segment Dominated the Market Due to Increased Vaccination Rates among the Population

On the basis of storage, the market is segmented into vaccines, blood products, medications & biologics, laboratory specimens, and others.

Vaccines segment dominated the U.S. market share in 2024. The dominance of the segment is attributed to the increased COVID-19 vaccination rates among the population in the country. Along with this, the increasing number of approvals and introduction of several vaccines for various conditions including COVID-19 is another major factor contributing to the growth of the segment.

- For instance, in July 2022, Pfizer Inc., and BioNTech SE received the U.S. FDA approval for their COVID-19 vaccine, COMIRNATY.

The blood products segment is anticipated to grow at a considerable CAGR during the forecast period. The increasing number of blood donations in the country, especially post COVID-19 pandemic, is one of the major reasons for the growth of the segment.

- According to the Association for the Advancement of Blood & Biotherapies (AABB), the number of whole blood units collected for allogeneic, non-directed donations during 2021 increased by 0.7% to 9.84 million units. At the same time, the number of apheresis RBC units collected increased by 7.3% to 1.93 million units compared to 2019.

The medications & biologics segment is expected to grow at the highest CAGR during the forecast period. The considerable growth of the segment is due to various factors, including increasing consumption of drugs and biologics for various chronic conditions, and growing R&D activities among the key manufacturers to develop and introduce novel therapies for various disorders, among others. These are some of the factors expected to increase the adoption of medical refrigerators and freezers in the market.

Similarly, the laboratory specimens segment is expected to grow during the forecast period owing to increasing clinical activities and testing that includes tons of specimens in research laboratories, academic institutes, hospitals, and other healthcare facilities.

By Size Analysis

Large Segment Dominated the Market Owing to Increasing Amount of Specimens Among the Healthcare Facilities

On the basis of size, the market is segmented into undercounter, compact, mid-sized, and large.

Large segment dominated the market in 2024 due to increasing amount of samples and specimens in hospitals, blood banks, and other healthcare facilities.

The rising focus of the major players to introduce medical refrigerators, freezers of large volume capacity is another prominent factor contributing to the growth of the segment.

- For instance, in February 2023, PHC Holdings Corporation launched PHCbi series brand VIP ECO SMART ULT freezer in North America of large sized volume i.e. 528 L and 729 L.

Mid-sized segment is expected to grow during the forecast period in the market owing to high utilization of prescription drugs that is leading in growing number of pharmacies, which is subsequently increasing the adoption of mid-sized refrigerators and freezers in the country.

Similarly, compact and undercounter segments are expected to grow at a considerable CAGR during the forecast period owing to the advantages of the small size which is more useful in space constraint infrastructure including small-sized research laboratories, and other facilities.

By End User Analysis

Hospitals Segment Dominated the Market Owing to Increased Patient Visits and Procedures and Utilization of Various Products

On the basis of end user, the market is segmented into hospitals, clinics, physician offices, academic institutes & research laboratories, pharmacies, blood banks, and others.

Hospitals segment is expected to grow at the highest CAGR during the forecast period in the market as the number of procedures leading to rising utilization of medications, biologics, blood products, and other products in the setting.

- For instance, according to a 2022 report published by the Government of Minnesota, the total net spending on medicines increased by USD 82.00 billion from 2016 to 2021, owing to the introduction of novel therapies and increased utilization among the patient population.

Academic institutes & research laboratories segment is expected to grow at a considerable CAGR during the forecast period. The increasing research and development activities in these institutes and laboratories for various chronic conditions is one of the prominent factors augmenting the growth of the segment in the market.

- According to a February 2023 article published by the British Medical Journal (BMJ), it was reported that about USD 29.2 billion is invested to purchase vaccines, USD 2.2 billion to support clinical trials, and USD 108.0 million in manufacturing plus basic and translational science.

Blood banks segment is expected to grow at a normal rate during the forecast period. The growing number of blood donors in the country is expected to drive the adoption of medical refrigerators and freezers among these facilities.

Physician offices and clinics segments are expected to grow during the forecast period owing to rising number of these facilities in the country and increasing patient visits to these facilities.

- For instance, according to a 2022 survey conducted by Medical Group Management Association (MGMA), around 55% of the physician office practices reported an increase in the patient visit volumes in 2022 as compared to 2021.

The pharmacies segment is projected to grow at a normal growth rate during the forecast period. The growth of the segment is due to increasing demand for these refrigerators and freezers among the pharmacies due to stringent focus on temperature control for medications and biologics.

The increasing demand is further resulting in the rising focus of key players to introduce advanced refrigerators and freezers for pharmacies, thus supporting the growth of the market.

- For instance, Walgreens developed a hub and spoke storage model to receive vaccine shipments and purchased 300 portable ULT25NEU freezers and 105 undercounter SU105UE freezers from Stirling Ultracold.

KEY INDUSTRY PLAYERS

Dexcom, Inc. Dominated the CGM System Market Owing to New Product Approvals & Launches

This market is fragmented with several players operating in the market with various types of medical refrigerators and freezer.

Thermo Fisher Scientific Inc., Haier Biomedical, and PHC Holdings Corporation are some of the major players operating in the market. The rising efforts of these players to develop and introduce novel products with technological advancements is one of the major reasons contributing to the growing share of these players.

- For instance, in April 2022, Thermo Fisher Scientific Inc. launched a new Ultra-Low Temperature Chest Freezer to green portfolio with an aim to offer eco-friendly, compliant, and secure cold storage globally.

Similarly, BioLife Solutions Inc., Helmer Scientific Inc., the Liebherr Group, Accucold, among others are some of the few other players with growing market share in the U.S. market owing to the rising focus of these players to expand their product portfolio. The increasing number of mergers and acquisitions by these players is another major factor favoring the growth of these players in the market.

- For instance, in May 2021, BioLife Solutions Inc. acquired Stirling with an aim to increase their production for ultra-low temperature freezers.

List of Top U.S. Medical Cold Storage Companies:

- Thermo Fisher Scientific Inc. (U.S.)

- Haier Biomedical (China)

- PHC Holdings Corporation (Japan)

- Helmer Scientific Inc. (U.S.)

- BioLife Solutions Inc. (U.S.)

- Accucold (U.S.)

- FOLLET PRODUCTS, LLC. (U.S.)

- Eppendorf SE (Germany)

- VESTFROST SOLUTIONS (Denmark)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 - PHC Holdings Corporation merged with Medical Information Systems with an aim to establish a new company and contribute to the healthcare community.

- November 2022 - Helmer Scientific Inc. and TruMed Systems collaborated for inventory management and controlled access solutions with Helmer cold storage units.

- May 2022 – Thermo Fisher Scientific Inc. partnered with LabShares to provide instruments, lab equipment, and consumables with an aim to help start-up life sciences companies accelerate their drug discovery efforts.

- March 2022 - Cardinal Health expanded its medical distribution footprint in Ohio with an aim to improve safety, service, and quality and to deliver better operational efficiency.

- February 2021 - FOLLETT PRODUCTS, LLC. collaborated with PHC Corporation of North America (PHCNA) with an aim to supply ULT freezers.

REPORT COVERAGE

The report provides a detailed market analysis. It focuses on key aspects, such as market overview, market segmentation and analysis, types of product type, storage, size, and end user, competitive landscape of the key players, and the comparative analysis of the average prices of products. Besides this, it offers insights into market dynamics, market trends, and highlights key industry developments. The report further includes a COVID-19 impact analysis on the market.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.6% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Storage

|

|

|

By Size

|

|

|

By End User

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 0.94 billion in 2024 and is projected to reach USD 1.76 billion by 2032.

The market is expected to exhibit steady growth at a CAGR of 8.6% during the forecast period (2025-2032).

By product type, ultra-low temperature (ULT) freezers segment is the leading segment.

The increasing demand for vaccines and temperature-controlled medication, growing number of healthcare facilities, and increasing research and development activities among various healthcare facilities are some of the key factors driving the market.

Thermo Fisher Scientific Inc., PHC Holdings Corporation, Haier Biomedical, and BioLife Solutions Inc. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us