U.S. Parental Control Software Market Size, Share & Industry Analysis, By Operating System (Windows, Android, iOS & OS X, and Cross-Platform & Others), By Deployment (On-premise and Cloud), By Application (Residential and Educational Institutes), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

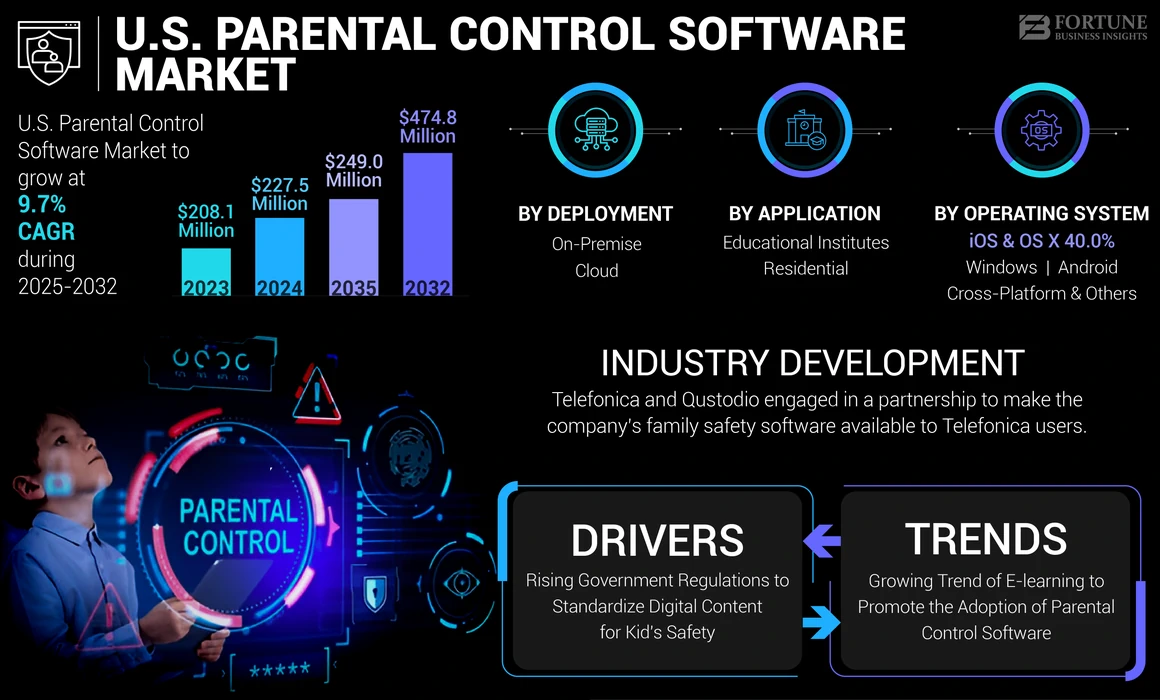

The U.S. parental control software market size was valued at USD 227.5 million in 2024. The market is projected to grow from USD 249.0 million in 2025 to USD 474.8 million by 2032, exhibiting a CAGR of 9.7% during the forecast period.

Parental control software is a tool that enables parents to monitor their kid's online activity, record and limit their screen time, block and filter websites and content, and view their browsing history and communications. Most schools and other educational institutions have included computers, tablets, and laptops in their curriculum. Also, exposure to online social media platforms has raised parents' concerns for kids' safety and mental health. This has urged the need to install parental control tools in their devices to prevent students from getting exposed to restricted sites.

The U.S. market is set to grow as the demand for parental control software installation is rising due to increase in screen time, personal device ownership, social media use, online gaming, and, most importantly, harmful content watched by kids in the U.S. This, in turn, has encouraged governments to standardize digital content for kid's safety. Owing to these factors, the market is expected to showcase a healthy rise in recent years.

COVID-19 IMPACT

Parental Control Software Market Showcased a Significant Rise Owing to Rising Growth of Internet Services

The pandemic crisis prompted the shutting of schools and other educational institutions, leading children all over the U.S. to stay home until further notice. Remote learning surged the use of media devices among kids, further leading to increased screen time for teens and tweens across the country. Also, tweens and teens relied on smartphones and other digital tools to remain in touch with their friends, as face-to-face interactions were restricted due to the coronavirus pandemic. Further, online gaming, interactive media platforms, and internet use have also become significant aspects of the lives of children across the country. With the screen time increase among the kids, parents were concerned about the type of content their children consumed. The software providers are in a fortunate position to offer solutions that work across all home networks and all varieties of devices. According to research published by Kaspersky Lab, 84% of parents worldwide were concerned about their children's online well-being, and 64% of parents believe that their children spend excessive time online. Thus, parental control technology will be at the forefront to protect children from irrelevant online content in the coming years.

LATEST TRENDS

Download Free sample to learn more about this report.

Growing Trend of E-learning to Promote the Adoption of Parental Control Software

Enhancements in smartphones, educational content, and updated internet services fuel the adoption of e-learning practices. According to the Organization for Economic Co-operation and Development (OECD), 95% of students from Norway, the U.S., Switzerland, and Austria have access to computers and strong internet connections for educational and learning purposes.

Furthermore, the pandemic has forced schools, colleges, and universities to operate remotely, resulting in increased online learning use and kids directly accessing the internet without supervision. With colleges and universities conducting lectures and classes online, students have started spending more time on the internet and mobile phones. As per the e-learning expert, almost 73% of U.S. children are taking online classes post-pandemic. This has significantly forced parents to spend on parental control solutions.

With the rapid and extensive adoption of online learning, parents are inclined toward technology to help their children better understand smartphone use and interactive content. Consequently, the adoption of the software is expected to rise steadily in the near future across the U.S.

DRIVING FACTORS

Rising Government Regulations to Standardize Digital Content for Kid's Safety to Boost Market Growth

Online content offers a variety of educational, social, and entertainment benefits to kids and teens. However, a considerable amount of harmful content also exists across the content available on the web. This content can negatively impact a kid's behavior. Therefore, parents are adopting parental control tools to monitor their child's online activity and prevent them from watching illegal content. Governments are focusing on ensuring child safety regulations for digital media applications worldwide. Similarly, the U.S. government provides parents with a safe and free internet experience by issuing various laws and regulations. For instance,

- The Children's Online Privacy Protection Act (COPPA) focuses on offering verified content by the providers or operators on the website for children under 13 years of age.

- The Children's Internet Protection Act (CIPA) addresses the concerns of harmful and obscene content access over the internet by children. Under the CIPA, schools, and libraries need to earn an E-rate program certificate to gain a discount for internet access. For the certification, schools need to monitor minors' online activities and educate children regarding appropriate online behavior.

Such laws and regulations and parental guidance are expected to augment the U.S. parental control software market growth.

RESTRAINING FACTORS

High Initial Cost, Privacy Concerns, and Hampered Parent-child Relationship Could Impact Product Adoption

Despite rapid adoption over the past several years, the demand for parental control apps among U.S. parents could be affected by several factors. These include:

Disturbing Parents-Children Relationships: The parental control software monitors and restricts the person's online activity. Excessive monitoring and curtailing a child's online activity can disturb parents-children relationship.

High Expenses Associated with Parental Control Software: Parental control tools typically offer advanced features and functionalities. Companies are constantly improving the tools by integrating them with advanced technologies. These advanced parental control solutions result in high cost of the software. For certain parents, the initial price of the software can be too high. Thus, the high cost of the tool might impede market growth.

Data Privacy Concern Related to Integration of Parental Control Solution: The software can be prone to cyber-attacks and is subjected to data breaches. The software can contain personal and valuable data and can harm other electronic devices in its vicinity. These issues related to the software can curb market growth.

SEGMENTATION

By Operating System Analysis

To know how our report can help streamline your business, Speak to Analyst

iOS compatible Software to Dominate Owing to Maximum Number of iOS Users across the Country

The iOS & OS X segment generates maximum smartphone adoption revenue. The demand for iOS-compatible software is expected to increase in the coming years, owing to the maximum number of iOS users across the country.

According to a study by Blue Matrix in 2022, the number of kids using iPhones in the U.S. is around 80%, and it is expected to grow in the upcoming years. The major players based in the country constantly engage in relevant mergers and acquisitions. This helps companies to expand their customer base (iOS users across the country).

Windows segment is expected to gain a significant share as U.S. schools select affordable Windows devices for kids’ learning. Similarly, advancements in Android phones and their reasonable prices are gaining traction among U.S. children.

By Deployment Analysis

Cloud-based Parental Control Solutions to Gain Traction Due to its Effective Functionality

The cloud segment is gaining a competitive edge over on-premises software. Cloud-based tools are hosted remotely on the vendor's server and highly stable with less downtime. Furthermore, these tools are available monthly, quarterly or annually, along with automatic updates and support services. Also, the cloud-based parental control software is easy to install, flexible, and provides strong data protection.

The on-premise segment is expected to showcase low demand during the forecast period.

By Application Analysis

Increased Screen Time of Kids At Home to Increase Demand for Residential Parental Control Applications

Parents are more concerned regarding their kid's increasing screen time, as the content on the internet kids consume might be harmful. The demand for the software for residential applications is growing and accelerated. Similarly, the increasing social media platforms, access to video on demand on a smart TV, and the trend of remote or distance learning are expected to fuel the demand for residential parental control software.

Conversely, educational institutes are expected to showcase drastic deployments of such software during the forecast period. The U.S. schools have adopted device-based learning for kids and teens, which has fueled the need for a secure educational online environment for children.

COUNTRY INSIGHTS

The U.S. parental control software market is growing at an accelerated pace owing to the increasing inclination of kids toward media usage. The pandemic crisis prompted remote learning, inviting children to choose media to spend time with friends and pursue hobbies and interests. Several kids pursued their gaming interests and surged the adoption of video games and other online gaming activities.

To get more information on the regional analysis of this market, Download Free sample

Additionally, parents were more concerned about the type of content consumed by their kids. According to Statista, the frequency of physical violence appearing in YouTube videos watched by kids in the U.S. as of April 2020 accounted for 16%. However, this frequency was present in a mild form or limited amount; 14% of physical violence was present persistently or significantly. This increased parents' concerns, further augmenting the adoption of the software across the country. Additionally, increasing mergers and acquisitions, government regulations, and service providers are expected to drive the development of the market growth in the coming years.

KEY INDUSTRY PLAYERS

U.S. Parental Control Software Providers are Focusing on Maintaining the Parent-Child Relationship to Gain Maximum Traction

The U.S. software providers have constantly been acquiring and merging with relevant parental control companies to extend their geographic presence. Along with the unique features of individual tools, companies are focusing more on maintaining the parent-child relationship by letting them have a healthy conversation. Along with this, the key players are constantly upgrading their software according to the changing environments. The new updates enable kids to become financially independent. For instance,

- June 2021: Verizon introduced a complete money app dedicated to the family and a prepaid debit card for children aged 8 to 17. This application intends to help kids become financially responsible and allow their parents to monitor their activities.

List of Key Companies Profiled:

- Gen Digital Inc. (NortonLifeLock Inc.) (U.S. & Czech Republic)

- Alphabet Inc. (Google LLC) (U.S.)

- Microsoft Corporation (U.S.)

- McAfee, LLC (U.S.)

- AT&T Inc. (U.S.)

- Smith Micro Software, Inc. (U.S.)

- SafeDNS, Inc. (U.S.)

- Mobicip.LLC (U.S.)

- Qustodio (Spain)

- Bark (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2022: SafeDNS, Inc. announced the addition of a new feature, Child Sexual Abuse, as the company's strategy to fight against sexual content on the internet.

- July 2022: Bark Technologies launched its first smartphone, combining the company's content filtering, monitoring, and location software with additional features in a simple, complete unit.

- April 2022: Bark Technologies expanded its international presence by launching its parental control app in Australia.

- March 2022: Smith Micro Software stated that a Tier 1 wireless carrier in the U.S. had introduced an upgraded version of its family-safety software. The new application is now driven by Smith Micro's SafePath 7 platform. With this, the company aims to expand its reach and offer enhanced digital family safety and location services.

- February 2022: Bouygues Telecom partnered with Qustodio intending to provide French families with advanced solutions. These solutions will help secure their children's digital well-being and online safety.

REPORT COVERAGE

The research report analyses the key aspects that promote children's media usage, provides a competitive dashboard and detailed analysis of key market players, direct and indirect impacting economic factors that revolve around the media usage of the U.S. children, tools/service types, comparative analysis of parental tools, and leading applications of the product. Besides, the report offers insights into the market trends and future implications, highlighting the major industry developments. The study reflects several factors that indicate the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2024 |

|

Growth Rate |

CAGR of 9.7% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Operating System

|

|

By Deployment

|

|

|

By Application

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 227.5 million in 2024.

The market is likely to grow at a CAGR of 9.7% over the forecast period (2025-2032).

The iOS & OS X segment is expected to lead the market due to the large number of iOS users in the U.S.

The market is projected to reach USD 474.8 million by 2032.

The rising government regulations to standardize digital content for kids safety and the risks associated with excessive use of social media and internet connections have prompted parents to opt for parental control solutions, further driving the market growth.

Some of the top players in the market are Bark, Qustodio, and Gen Digital Inc.

Issues related to childrens privacy, high initial cost of the software, and data privacy concerns are curbing the development of the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us