U.S. Vaginal Atrophy Treatment Market Size, Share & Industry Analysis, By Therapy Type (Drug Therapies {Estrogen Based [Imvexxy, Premarin, and Others], Non-Estrogen Based [Intrarosa, Osphena, and Others]}, and Non-Drug Therapies {Light Therapy, Laser, and Others}), By Route of Administration (Oral, Parenteral, and Topical), By Distribution Channel (Hospital Pharmacies, Retail Store & Pharmacies, and Online Channels), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

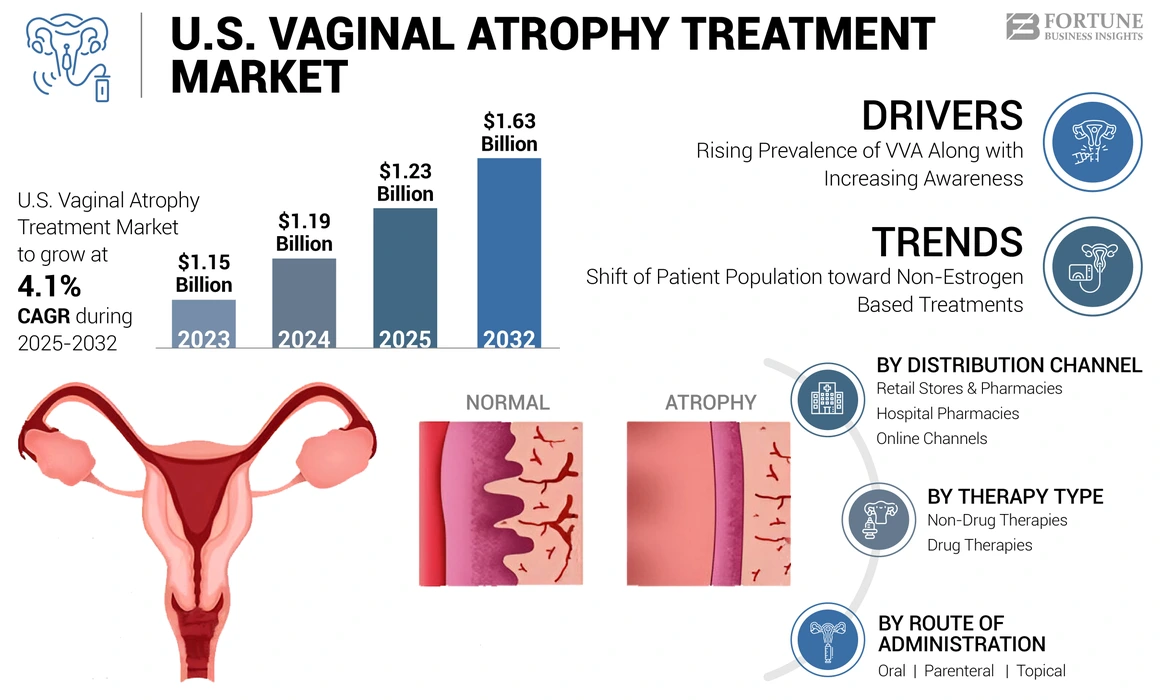

The U.S. vaginal atrophy treatment market size was valued at USD 1.19 billion in 2024. The market is projected to grow from USD 1.23 billion in 2025 to USD 1.63 billion by 2032, exhibiting a CAGR of 4.1% during the forecast period.

Vaginal atrophy, also known as Genitourinary Syndrome of Menopause (GSM), is a condition that causes drying, inflammation, and thinning of the vaginal walls, which occurs due to low estrogen levels in the body. The condition is prevalent among the postmenopausal population, and it affects more than half of the menopausal population.

- According to the data published by the Center for Advanced Gyn & Urogynecology in June 2022, 47% of the patients experience symptoms of Vulvar and Vaginal Atrophy (VVA) when they become menopausal.

In addition, the increasing prevalence and its huge impact on women's health is leading to an increased focus on research and development activities to develop and introduce new treatment options in this field. Several non-hormonal therapies are available without prescriptions, offering sufficient relief for most women with mild symptoms.

Vaginal DHEA (Dehydroepiandrosterone Dehydroepiandrosterone), low-dose vaginal estrogens, ospemifene, and systemic estrogen therapy are some of the effective options for the vaginal atrophy treatment of moderate to severe GSM.

Furthermore, the growing adoption of technologies such as laser technology (Fractional CO2 laser and MonaLisa Touch) and light technology has created immense competition among companies to introduce new products in the vaginal atrophy treatment market. Several companies are investing in R&D activities to conduct clinical trials and to include medical devices such as vaginal dilators and lasers in their existing portfolio. However, these technologies are often used off-label to restore vaginal health and improve the overall quality of life for affected individuals. By diversifying their product offerings, companies cater to the needs and preferences of women seeking relief from the symptoms of this condition.

- For instance, in September 2023, Daré Bioscience, Inc., a company offering solutions in women's health innovation, exhibited the results of its Phase 1/2 clinical study of DARE-VVA1, an investigational formulation of tamoxifen, a drug used for intravaginal administration to treat VVA in women without using hormones.

The COVID-19 pandemic negatively affected the market’s growth owing to supply chain disruptions, delays in treatment, and a shortage of drug availability. Healthcare facilities experienced disruption in services, including routine gynecological visits and elective procedures. This led to delays in the diagnosis and vaginal atrophy treatment among patients, thus impacting the demand for treatment options and impacting the market negatively.

U.S. Vaginal Atrophy Treatment Market Trends

Preferential Shift of Patient Population toward Non-Estrogen Based Treatments

Growing concerns regarding the side effects of estrogen-based therapies are driving the preferential shift toward non-estrogen-based treatments for VVA. For several women, non-hormonal options such as over-the-counter moisturizers and lubricants are effective in relieving symptoms or are used in combination with pharmaceutical preparations. In addition, non-estrogen-based treatments for hot flashes are considered to be a more effective treatment option for several people.

- In May 2023, the FDA approved a new drug, fezolinetant, which can be used for the treatment of hot flashes and night sweats. The therapy is effective for women who don’t want to take hormone replacement therapy or who have been treated for hormone-sensitive cancers.

Furthermore, the availability of effective non-estrogen-based treatments has expanded in recent years, providing patients with a broad range of options to manage this condition.

In April 2022, the Ohio State University published an article stating the potential benefits of using non-hormonal moisturizers for vaginal dryness or discomfort during intercourse. These products are easily available at drug stores and online retailers.

Download Free sample to learn more about this report.

U.S. Vaginal Atrophy Treatment Market Growth Factors

Rising Prevalence of VVA Along with Increasing Awareness to Fuel the Treatment Demand

The rising prevalence of VVA due to increasing life expectancy coupled with the growing number of women entering into menopause every year is driving the demand for innovative treatment options.

- According to the data published by the National Institutes of Health (NIH) in May 2022, approximately 1.0 million women experience menopause every year in the U.S. Menopause affects usually between the ages of 45 and 55.

Thus, increasing the prevalence of VVA will increase awareness among women through several social and educational campaigns and awareness programs, which will further subside social stigma among women as more people will talk about the related symptoms. These factors will further fuel the demand for proper vaginal atrophy treatment options.

To cater to the rising demand, market players are constantly working toward bringing innovative vaginal atrophy treatment options by conducting clinical trials and expanding their existing product portfolios to launch new drugs and medical devices for vaginal atrophy treatment. Thus, the aforementioned factors contribute to the U.S. vaginal atrophy treatment market growth.

- For instance, in September 2023, Daré Bioscience, Inc., a company offering solutions in women's health innovation, exhibited the results of its Phase 1/2 clinical study of DARE-VVA1, an investigational formulation of tamoxifen, a drug used for intravaginal administration to treat vulvovaginal atrophy in women without using hormones.

RESTRAINING FACTORS

Potential Side Effects Associated with Treatment Drugs May Hinder Growth of the Market

The symptoms of vaginal atrophy are progressive and persistent unless they are treated at an early stage. Several treatment options are available to treat symptoms of VVA, including hormonal therapy and non-hormonal therapy. Estrogen-based and hormonal drugs have played an important role in improving the symptoms. However, various side effects associated with the use of hormonal drugs, such as increased risk of cardiovascular events, breast cancer, thrombosis, and endometrial hyperplasia, may restrict its adoption.

- According to an article published by the National Center for Biotechnology Information, in 2023, estradiol alone increases the risk of breast cancer by 10%.

- Similarly, Pfizer Inc. has commercialized its product Estring (estradiol vaginal system), stating several warnings. According to the data published by Pfizer, estrogen-alone therapy increases the chances of endometrial cancer, cardiovascular disease, dementia, and others.

Thus, these factors are shifting the preference toward alternative treatment options such as non-hormonal-based therapies and other complementary therapies. Furthermore, according to the data published by the National Center for Biotechnology Information (NCBI) in 2020, women are more likely to prefer non-hormonal methods such as the use of vaginal softeners, vaginal, gels, and lubricants, which can improve vaginal atrophy symptoms with reduced side effects. Thus, the availability of alternative vaginal atrophy treatment options may restrict the adoption of drug-based therapies.

U.S. Vaginal Atrophy Treatment Market Segmentation Analysis

By Therapy Type Analysis

Increasing Number of Drug Approvals and Launches Led to the Dominance of the Drug Therapies Segment

Based on therapy type, the market is segmented into drug therapies and non-drug therapies.

The drug therapies are further segmented into estrogen-based and non-estrogen-based. Further, the estrogen-based segment is segmented into imvexxy, premarin, and others, and the non-estrogen-based segment is sub-divided into intrarosa, osphena, and others. Similarly, non-drug therapies are further segmented into light therapy, laser therapy, and others.

The drug therapies segment dominated the U.S. vaginal atrophy treatment market share in 2024 owing to the increasing number of drug approvals and launches by market players such as Pfizer Inc., AbbVie Inc., Novo Nordisk Inc., and others. Moreover, the increasing investments in R&D by major players to develop new innovative drug therapies is also one of the factors contributing to the market growth.

- In December 2023, Daré Bioscience, Inc. received U.S. FDA authorization for its Investigational New Drug (IND) application for DARE-VVA1, an intravaginal proprietary formulation for tamoxifen, a non-hormonal treatment option to treat moderate to severe dyspareunia.

The non-drug therapies segment is projected to witness significant growth during the forecast period owing to an increasing preference shift toward minimally invasive procedures and potential authorizations and approvals of advanced technologies such as laser and light for vaginal atrophy treatment in the country. Laser therapy assists healthcare providers in offering personalized treatment options to patients on the basis of individual preference. In addition, over-the-counter products, such as lubricants and moisturizers, are easily accessible to patients in pharmacies and online retailers, which makes it easy for patients to purchase them without a prescription. Thus, the easy availability of products such as vaginal gel and creams will boost their adoption, further contributing to segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Route of Administration Analysis

Adoption of Several Products in the Topical Segment has led to its Dominance

Based on the route of administration, the market is segmented into oral, parenteral, and topical.

The topical segment dominated the market due to the presence of a wide range of products. Moreover, its ease of application and customizable dosing options are some of the benefits that are contributing to its increasing adoption. In addition, topical delivery is widely adopted by patients as it is a non-invasive method and is easy to use.

- In July 2019, an article published in the American Society of Clinical Oncology stated that laser therapy used with topical estrogen showed significant improvement in treating vaginal dryness and dyspareunia.

The parenteral segment is the second dominant segment as the parenteral route of administration is performed using injections, penetrating directly into the skin membrane. It is a preferred route of drug administration in emergencies as it has better bioavailability compared to other drug administration routes, and it can deliver a precise dose of drugs.

The oral segment is projected to witness lucrative growth during the forecast period. Ospemifene is the only FDA-approved non-hormonal oral drug used for the treatment of VVA symptoms. Several research studies have been published that Ospemifene has reduced risks of cardiovascular events and cancers, among others, with fewer side effects than hormonal drugs. Thus, these factors will increase the preference for oral drugs among women, further driving its demand in the coming years.

By Distribution Channel Analysis

Easy Accessibility and Availability of Several Drugs in Retail Stores & Pharmacies Led to its Dominance

The market is segmented into retail stores & pharmacies, hospital pharmacies, and online channels based on distribution channel.

The retail stores & pharmacies segment dominated the market. The wide availability of products coupled with easy access for individuals makes it convenient for women to purchase them over the counter. These products can be bought without having a prescription. The products are present in several forms, including lubricants, moisturizers, and others, which allows the customer to choose products according to their preferences and needs.

The online channel segment captured the second position in the market owing to the availability of a wide range of products and better product pricing. Customers have the flexibility to compare different products and make informed decisions regarding which treatments are best suited for them.

Hospital pharmacies are projected to witness comparatively slower growth during the forecast period as women are more likely to purchase products directly from online or retail stores when they have initial symptoms of menopause, such as vaginal dryness or pain during intercourse.

List of Key Companies in U.S. Vaginal Atrophy Treatment Market

Substantial and Diversified Product Portfolio to Help Companies Maintain Market Dominance

In terms of competitive landscape, U.S. vaginal atrophy treatment is a consolidated market with few dominating players offering a wide range of drug and non-drug therapies. Some of the companies offering drug therapies include Pfizer Inc., TherapeuticsMD, Inc., Novo Nordisk A/S, and AbbVie Inc., among others.

Pfizer Inc. dominated the market due to higher adoption and sales of the drug Premarin in the U.S. market.

- In 2023, the Premarin family generated a revenue of USD 361.0 million in the U.S. Premarin is mainly used in hormone replacement therapy for menopausal symptoms treatment.

Non-drug therapies are witnessing significant momentum owing to continuous technological advancements and an increasing preferential shift toward minimally invasive procedures. Some of the key companies offering non-drug therapies include Joylux, Inc. and BioFilm IP LLC. The companies offer laser and light technologies as an alternative treatment option for vaginal atrophy. These are often used off-label, and they are widely adopted in the U.S. Companies are constantly working towards receiving FDA authorization in the country. Therefore, the anticipated approval of these technologies will contribute to its market share.

- In January 2023, Joylux, Inc. partnered with Canyon Ranch, a company operating in integrative wellness guidance to offer women’s health solutions. The partnership aims to market Joylux, Inc. wellness device (red light technology), which will improve vaginal health.

LIST OF KEY COMPANIES PROFILED:

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- TherapeuticsMD, Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- R.B. Health (U.S.) LLC. (U.S.)

- Millicent Pharma Ltd. (Ireland)

- Duchesnay USA (U.S.)

- ASCEND Therapeutics U.S., LLC. (U.S.)

- Joylux, Inc. (U.S.)

- BioFilm IP LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: LifeMD partnered with women’s health-focused specialty pharmaceutical company ASCEND Therapeutics to improve EstroGel access, a hormone therapy for postmenopausal women.

- June 2023: Pfizer Inc. relaunched its DUAVEE (conjugated estrogens/bazedoxifene), an estrogen-based menopause hormone therapy, in the U.S. market with enhanced packaging. DUAVEE has shown promising results in reducing moderate to severe hot flashes due to menopause.

- January 2023: TherapeuticsMD, Inc. announced the completion of its previously announced transaction with Mayne Pharma Group Limited, which granted Mayne Pharma an exclusive license to commercialize TXMD’s products, including Imvexxy, in the U.S.

- December 2022: TherapeuticsMD, Inc., signed a definitive agreement to license its products with Mayne Pharma Group Limited. In this agreement, TherapeuticsMD, Inc., has agreed to allow Mayne Pharma to commercialize the products in the U.S.

- August 2022: TherapeuticsMD, Inc., raised a USD 15.0 million investment from Rubric Capital Management L.P. This funding enabled the company to meet the significant demand for its portfolio of women’s health and wellness products in the U.S.

REPORT COVERAGE

An Infographic Representation of U.S. Vaginal Atrophy Treatment Market

To get information on various segments, share your queries with us

The U.S. vaginal atrophy treatment market research report provides a detailed analysis. It focuses on key aspects, such as market size and forecast, pipeline analysis, new product launches (major players), and prevalence data. Besides, the report offers insights into the latest market trends, market statistics, and key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.1% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Therapy Type

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 1.19 billion in 2024.

The vaginal atrophy treatment market in the U.S. will exhibit a steady CAGR of 4.1% during the forecast period.

The drug therapies segment is the leading segment in the market.

The key growth drivers of the market include the increasing prevalence of vaginal atrophy and innovations and advancements in treatment options.

Pfizer, Inc. and AbbVie are the leading players in the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic