Unmanned Helicopter Market Size, Share & Industry Analysis, By Type (Small (Below 10Kg), Medium (10-25Kg), and Heavy (Above 25Kg)), By Application (Military [ISR, Combat, Search & Rescue, Transportation, Naval Support, and Border Support], Government Agency [Planning, Inspection, Surveying, Public Safety, and Search & Rescue], and Industrial [Planning, Inspection, Surveying]), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

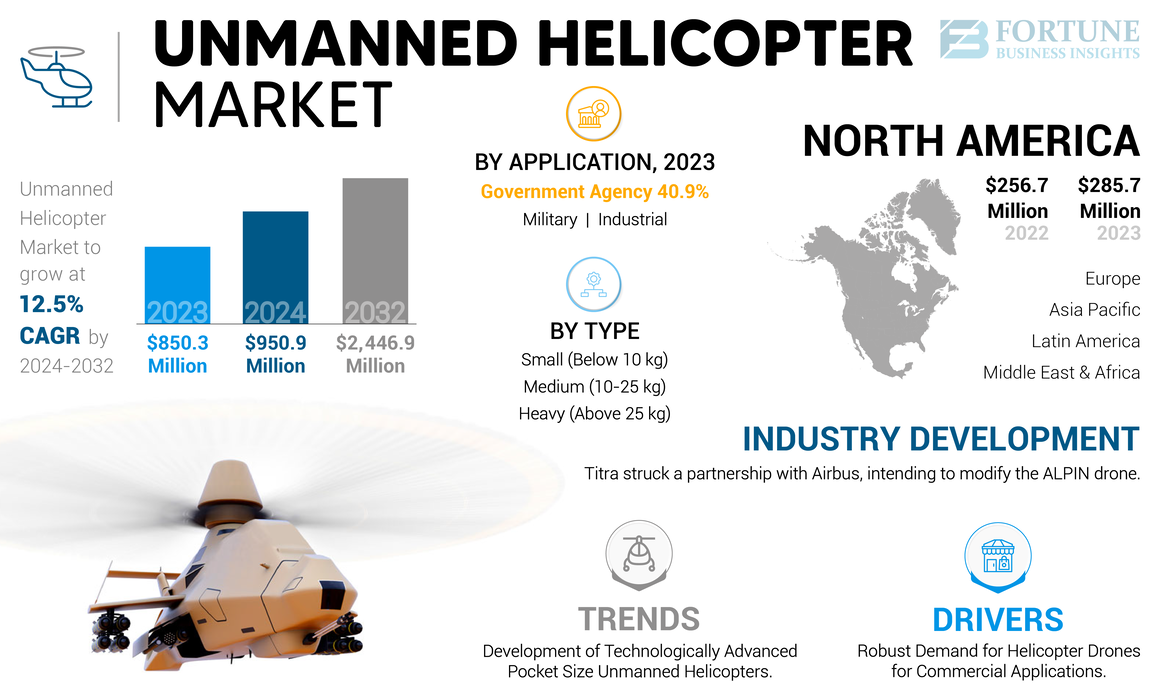

The global unmanned helicopter market size was valued at USD 850.3 million in 2023 and is projected to grow from USD 950.9 million in 2024 to USD 2,446.9 million by 2032, exhibiting a CAGR of 12.5% during the forecast period. North America dominated the unmanned helicopter market with a market share of 33.6% in 2023.

Unmanned helicopters are generally used by military government agencies for surveillance and reconnaissance, maritime missions, inspection, and others. The energy sector is anticipated to develop new opportunities by introducing advanced technology in the unmanned product category. It is expected to support maintenance infrastructure projects across the transportation and warehousing industry. Recently, the U.S. has increased its investment in unmanned helicopter and UAV technology and is anticipated to boost market sales. Various institutes develop the product for specific scientific research applications, including the prototype development of modern technology, environmental monitoring, and educational platform. The rise in demand for the product is due to increased military budgets of developing and developed economies such as the U.S., China, India, and Russia.

Originally developed for military missions, unmanned helicopters are increasingly being utilized for surveillance, reconnaissance, and logistics in defense operations. The rising geopolitical tensions and increased defense spending by various governments are significant factors driving this market. Moreover, continuous innovations in UAV technology, including improvements in satellite communication and payload capabilities, are enhancing the functionality of unmanned helicopters. This includes the ability to operate in harsh weather conditions and provide real-time data to ground control.

GLOBAL UNMANNED HELICOPTER MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2023 Market Size: USD 850.3 million

- 2024 Market Size: USD 950.9 million

- 2032 Forecast Market Size: USD 2,446.9 million

- CAGR: 12.5% from 2024–2032

Market Share:

- North America dominated the unmanned helicopter market with a 33.6% share in 2023, driven by rising defense modernization efforts, strong UAV investments, and favorable government initiatives in the U.S. and Canada.

- By type, the heavy segment accounted for the largest share due to growing demand for surveillance, cargo transport, and industrial applications.

- By application, the government agency segment led the market, supported by wide adoption in public safety, surveying, and environmental monitoring missions.

Key Country Highlights:

- United States: Increased defense investment and programs like fully autonomous naval teaming are boosting demand for unmanned helicopters. U.S.-based firms such as AeroVironment and FLIR Systems are driving innovation in surveillance and ISR applications.

- China: Rising military budget and emphasis on UAV development for surveillance, logistics, and reconnaissance are contributing to robust market expansion.

- India: Growing defense expenditures and modernization programs are fueling demand for tactical and ISR-capable unmanned helicopters across military branches.

- France: Airbus Helicopters has begun autonomous rotorcraft testing for the French Navy, marking a key step in Europe’s development of advanced unmanned flight systems.

The global COVID-19 pandemic has been unprecedented and staggering, with unmanned helicopters experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. Based on our analysis, the global market exhibited a decline of -11% in 2020 as compared to 2019. The increased adoption of unmanned systems during the COVID-19 pandemic across the globe to support regular medical supply, health care kits, and PPE kits fueled the product demand. The industry witnessed positive development due to autonomous air traveling benefits and contact-free services in several countries. Numerous major companies invest time and money in product development and innovation to gain a competitive advantage in the market. The pandemic accelerated the adoption of unmanned systems for delivering medical supplies and conducting surveillance, further boosting market share. Governments signed contracts for development of unmanned helicopters to aid in public health efforts, which has positively impacted market dynamics.

Unmanned Helicopter Market Trends

Development of Technologically Advanced Pocket Size Unmanned Helicopters to Propel Market Growth

Unmanned Aerial Vehicles (UAVs) have grown into an essential part of military operations. Especially for surveillance, intelligence, and reconnaissance support, on the battlefield, several countries are developing UAVs that provide access to remote locations with real-time information. The FLIR systems developed the PD-100 Black Hornet, the smallest unmanned helicopter, adopting the most advanced technology. PD Black Hornet is developed and constructed of a rugged plastic molded shell with an aerodynamic shape to resist stormy winds. It includes a length of 100 mm and a rotor of 120 mm, along with 160 gm of weight that contains a guard camera.

Black Hornet has flown at a speed of 10 m/s with a maximum of 25 minutes. A steerable electro-optic camera installed on a black hornet provides still video displayed on a hand-held device. The camera additionally shows a zoom option for clear picture quality operating the ground station control. The autopilot system has another feature installed on the board with a two-mode option that is performed manually or programmed for the predefined path using a GPS.

- In August 2023, Teledyne Technologies Incorporated’s Teledyne FLIR Defense announced a contract with Norway-based Kongsberg Defence & Aerospace, valued at approximately USD 31 million. This agreement would supply the Cerberus® XL mobile counter-Unmanned Aerial System (UAS) as part of a comprehensive counter-UAS solution for Ukraine. The contract includes the provision of surveillance platforms, software, spare parts, support, and training.

Download Free sample to learn more about this report.

Unmanned Helicopter Market Growth Factors

Strong Demand for Helicopter Drones for Commercial Applications to Propel Market Growth

Helicopters are well-suited for quasi-static positioning of advanced sensors in 3D space with high precision. Even in windy conditions, these helicopters offer precise flight control and operations in cluttered environments due to their maneuverability and ability to fly at low speed. Helicopter drones are increasingly utilized for tasks such as aerial photography, surveying, and infrastructure inspection. Their ability to hover and maneuver in tight spaces makes them ideal for detailed inspections and monitoring operations.

Innovations in drone technology, including enhanced sensors, AI integration, and improved battery life, are expanding the capabilities of helicopter drones. These advancements enable more efficient data collection and analysis, making them valuable tools for businesses.

In April 2024, RHC (Robinson Helicopter Company) announced its acquisition of Ascent AeroSystems, a Massachusetts-based manufacturer of compact coaxial helicopter drones. Ascent AeroSystems is now a wholly-owned subsidiary of RHC, reinforcing the company's commitment to scaling innovation and supporting diverse missions worldwide. Ascent is recognized for its compact helicopter drones, designed for a variety of industrial, public safety, and defense applications.

RESTRAINING FACTORS

High Cost of Helicopter Drones and Strict Regulations to Hinder Market Growth

Technology firms have brought up multiple possible drawbacks that affect the unmanned helicopter market growth over the forecast period. These drawbacks include lack of transparency in government regulations, privacy, safety, security, and usage restrictions. The research and development of these helicopters are expensive. The standards and guidelines mentioned by the government authorities for UAVs are very strict. For the management, operational capabilities, and delivery functions of an unmanned aerial service firm, these guidelines are to be followed compulsorily. Even for commercial use, strict guidelines are to be implemented by governments such as safety & risk mitigation and unmanned rotorcraft service and flight operations.

Component Failure and Design Constraints to Hamper Growth

Many military applications require higher efficiency, situational awareness abilities, wide frequency, and compatibility to operate under severe conditions. Hence, the complexity of the design must be increased. The unmanned rotorcraft's size and performance are limited by the techniques and fundamental theories. Even though the product can be used in rougher environments, shattering damages can be caused on a battlefield due to any type of equipment failure. However, the restrictions in the design and development of military unmanned rotorcrafts may prevent the market growth.

Unmanned Helicopter Market Segmentation Analysis

By Type Analysis

Heavy Segment Anticipated to Dominate Due to Increased Product Demand for Industrial Applications

Based on type, the market is segmented into small (below 10kg), medium (10-25kg), and heavy (above 25kg).

The heavy segment is estimated to hold the largest share due to the high demand for military and commercial applications. The growth can be attributed to an increase in the demand for emergency cases, cargo transport, border security, and surveillance applications. The industrial unmanned helicopter has wide applications due to its long battery life and high altitude benefits. These factors are projected to fuel market growth over the coming years.

The small and medium segments are expected to grow at a healthy CAGR over the projected period. This is owed to a rise in the demand for small and medium sized unmanned aerial vehicles for numerous applications across the globe.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Government Agency Has Higher Number of Applications Due to Product’s User for Monitoring and Survey

Based on application, the market is classified into military, government agency, and industrial.

The government agency segment is further classified into planning, inspection, surveying, public safety, and search & rescue. The government agency segment is expected to dominate the market. Government agencies are increasingly utilizing unmanned helicopters for a variety of purposes, including conducting surveys, monitoring forests, tracking wildlife, and supporting other applications. This growing adoption is expected to significantly drive the expansion of this segment.

The military segment is further segmented into ISR, combat, search & rescue, transportation, naval support, and border patrol. The rise in government spending to purchase UAVs, tactical and analytical systems to secure border security and surveillance in various countries is the key factor propelling segment growth.

The industrial segment is further segregated into planning, inspection, and surveying. The industrial application segment is expected to exhibit the fastest growth rate due to a rise in the demand for aerial imaging, aerial photography, and inspection applications.

REGIONAL INSIGHTS

By region, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Unmanned Helicopter Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to dominate the unmanned helicopter market. The region’s market size stood at USD 285.7 million in 2023. The advent of technology has led to a rise in the modernization of defense structures in the aviation sector. The region’s dominance can be attributed to the increasing presence of key players in the market such as VELOS ROTORS LLC. and AeroVironment Inc. The U.S. Navy and Marine Corps launched a naval fully autonomous teaming ability during an exercise in California and increased the demand for unmanned helicopter service and UAV technology. The industry is well-scoped due to this and the presence of favorable government regulations and essential infrastructure in the U.S. and Canada.

Asia Pacific is anticipated to witness remarkable growth during the forecast period. The market growth is attributed to the growing technology in the defense industry in Asia Pacific, increasing number of operations, rising demand for stations, and soaring demand for search and rescue operations and border patrolling.

Europe is poised to showcase substantial growth over 2024 to 2032 and will capture a considerable unmanned helicopter market share. The region’s anticipated growth can be credited to the increased availability of innovative technology-based and leasing facilities. The regional market is growing due to rising investments by key players in developing and adopting innovative Artificial Intelligence (AI) technologies that would improve unmanned flight launch and landing service operations. Airbus Helicopters conducted the first round of autonomous take-off and landing tests using a modified rotorcraft as part of its unmanned air system development for the French Navy.

Latin America and the Middle East & Africa are expected to experience significant growth in the unmanned helicopter market. Factors contributing to this expansion include increased defense budgets, advancements in technology, a strong emphasis on public safety, and a rising demand for survey, observation, and data collection activities across industrial and defense sectors. The arrival of modern facilities and investing strategies in defense have increased in the UAE and other Middle East countries. Furthermore, improving the region's financial condition is benefitting economic growth, which is expected to support the market growth throughout the forecast period.

KEY INDUSTRY PLAYERS

Northrop Grumman, AeroVironment Inc., and FLIR System to Lead Market with Strong Product Portfolio

The market is fragmented due to the presence of several companies having a strong product portfolio and their priority on improving the expansive distribution network of primary developed and emerging countries. Currently, Northrop Grumman, AeroVironment Inc., and FLIR Systems are leading the market, accounting for a dominant share in 2023. However, there is a lack of strong entry barriers, thereby leading to an increasing number of domestic players entering the market.

Other key players, such as UMS Skeldar, Schie Corporation, LAFLAMME AERO INC., STEADICOPTER, and Quantum, have entered the market with developed and modern unmanned rotorcraft products. The introduction of a creative small unmanned aerial system for military application and massive investment in the expansion of modern technologies for ISR missions are some of the major strategies adopted by market players.

LIST OF TOP UNMANNED HELICOPTER COMPANIES:

- VELOS ROTORS LLC (U.S.)

- LAFLAMME AERO INC. (Canada)

- STEADICOPTER (Israel)

- CybAero AB (Sweden)

- Alpha Unmanned Systems (Spain)

- Schiebel Corporation (Austria)

- HELIPSE (France)

- Aeroscout GmbH (Switzerland)

- HighEye (Netherlands)

- Anduril Industries (U.S.)

- Aeryon/FLIR (U.S.)

- Quantum Systems (Germany)

- Northrop Grumman Corporation (U.S.)

- UMS Skeldar (Switzerland)

- Lockheed Martin Corporation (U.S.)

- Saab Group (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Biggen Technologies (BGT), specialized in drones, unmanned helicopters, and automation, made a demonstration of their array of unmanned helicopters, comprising electric transmission, engine-powered, and multi-payload models, depicting their innovative designs and cutting-edge technology.

- May 2024: Turkish drone-maker Titra entered a collaboration with Airbus. The move intends to modify the ALPIN drone to enable its operation from naval platforms and enable autonomous take-off and landing.

- January 2024: Airbus Helicopters and Aerovel signed an agreement regarding the takeover of Aerovel and Flexrotor, its Unmanned Aerial System (UAS), as part of a strategy to consolidate its tactical unmanned solutions portfolio. Flexrotor is a small tactical UAS designed for ISTAR (intelligence, surveillance, target acquisition and reconnaissance) missions over land and at sea.

- January 2024: The UAE Ministry of Defence awarded EDGE a contract to supply 200 HT-100 and HT-750 unmanned helicopters to improve its VTOL capabilities. The HT-750 is a larger model capable of transporting heavy payloads.

- January 2024: Turkey’s ASELSAN completed the handover of the first ASELFLIR-400 Electro-Optical Reconnaissance, Targeting, and Surveillance System for use on homegrown T-129 ATAK attack helicopters and other Turkish platforms. The system has been designed to serve as the primary sensory apparatus for both land and air platforms. This contributes to the country's strategic goal of minimal dependence on foreign technologies in the electro-optics industry.

REPORT COVERAGE

The research report provides a detailed market analysis. It focuses on key aspects such as leading companies, types, and applications of the product. Besides this, the report offers insights into the market trends and highlights key industrial development and defense applications. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the developed market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 12.5% over 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 850.3 million in 2023 and is projected to reach USD 2,446.9 million by 2032.

Registering a CAGR of 12.5%, the market will exhibit steady growth during the forecast period.

The heavy (above 25kg) segment is the leading segment and is expected to dominate this market during the forecast period.

Northrop Grumman Corporation is the leading player in the global market.

North America dominated the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us