Urology Devices Market Size, Share & Industry Analysis, By Product Type (Endoscopes {Cystoscopes, Ureteroscopes, and Others}, Laser & Lithotripsy Devices, Dialysis Devices, Other Devices, and Accessories), By Application (Urolithiasis, Urethral Malignancies, Bladder Disorders, Kidney Diseases, and Others), By End-user (Hospitals & Ambulatory Surgical Centers, Dialysis Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

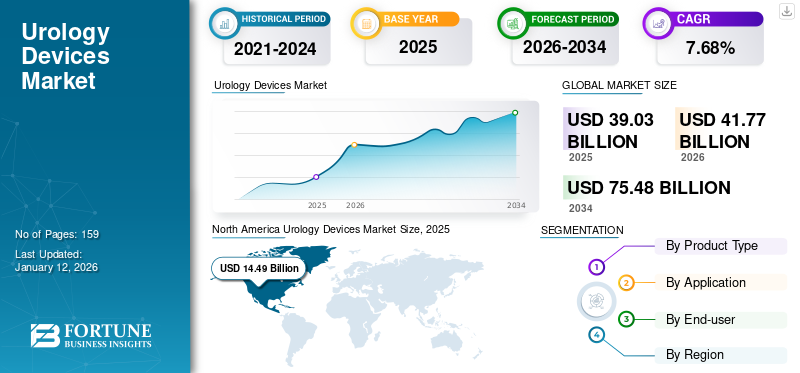

The global urology devices market size was USD 39.03 billion in 2025. The market is projected to grow from USD 41.77 billion in 2026 to USD 75.48 billion by 2034, exhibiting a CAGR of 7.68% during the forecast period. North america dominated the urology devices market with a market share of 37.11% in 2025.

The urology devices help in the diagnosis and treatment of various urological disorders such as urolithiasis, urethral malignancies, bladder disorders, and kidney diseases. It includes various consumables such as catheters, dilators, and sheaths. These devices consist of urodynamic systems, urology robotic systems, laser & lithotripsy devices, cystoscopes, and ureteroscopes, which are used to diagnose bladder and urethra-related disorders.

The growth is attributed to the increasing prevalence of kidney stones, bladder cancer, prostate cancer, and chronic kidney diseases. Moreover, technological advancements in urology products are expected to propel the demand for these devices to treat these diseases. Furthermore, the growing demand for single-use cystoscopes and the rising number of acquisitions and mergers by the market players are anticipated to boost the global urology devices market growth during the forecast period.

- For instance, in July 2023, Teleflex Incorporated announced the acquisition of Palette Life Sciences, Inc., a medical device manufacturer, to boost its urological devices portfolio. Such instances are projected to drive the growth of the market over the forecast period.

The emergence of COVID-19 pandemic has declined the demand for urology devices due to lower patient volumes and delays in elective surgeries. The reallocation of healthcare resources for COVID-19 treatment, the declining number of patient visits to hospitals & specialty clinics, the disruptions in supply chains, and other major parameters impacted the sales of cystoscopes, laser & lithotripsy, and urology accessories across the globe. However, in 2021, elective surgeries were resumed as the regulations imposed by the governments across various countries were relaxed. Furthermore, in 2022 and 2023, the market witnessed significant growth due to increased product launches and technological advancements.

Urology Device Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 39.03 billion

- 2026 Market Size: USD 41.77 billion

- 2034 Forecast Market Size: USD 75.48 billion

- CAGR: 7.68% from 2026 to 2034

Market Share:

- North America dominated the urology devices market with a 37.11% share in 2025. This leadership is driven by the high prevalence of kidney diseases, increased patient visits for diagnosis and treatment, strong presence of key players, and rapid adoption of advanced technologies like single-use cystoscopes.

- By product type, accessories held the largest market share in 2024, owing to increased adoption of catheters, dilators, and other consumables in clinical settings worldwide, facilitating ease of treatment and diagnosis.

Key Country Highlights:

- Japan: Growth driven by rising demand for advanced urological devices and a growing elderly population prone to urological disorders. Adoption of robotic-assisted surgeries also supports market expansion.

- United States: The U.S. leads due to strong healthcare infrastructure, ongoing product launches (e.g., Boston Scientific’s single-use cystoscopes), government approvals, and increasing prevalence of urological diseases. The FDA’s clearance of robotic surgery platforms and single-use devices also fuels growth.

- China: Market expansion is supported by improving healthcare infrastructure, rising awareness about urological conditions, and significant investments in medical device manufacturing and distribution. Recent acquisitions by companies aiming to strengthen presence in China accelerate growth.

- Europe: Growth is supported by stringent regulatory approvals (CE marking), increasing prevalence of bladder and kidney disorders, and innovations like high-definition single-use cystoscopes. Growing geriatric population and government initiatives promoting minimally invasive surgeries further contribute.

Urology Devices Market Trends

Growing Adoption of Single-use Cystoscopes to Boost Market Growth

The various benefits of single-use flexible cystoscopes include reduced infection transmission and consistent quality with no need for reprocessing or repairs. Additionally, the surge in awareness regarding the benefits of single-use cystoscopes stimulates several manufacturers to increase their development and clinical research to introduce disposable cystoscopes in the market.

- In January 2024, Boston Scientific announced the launch of VeraVue Single-Use Flexible Cystoscope. This cytoscope is utilized to aid healthcare professionals to diagnose and treat indications related to the urinary tract. Furthermore, it also provides an imaging of the lining of the bladder and urethra while allowing for the performance of several diagnostic procedures through these visual demonstrations.

Moreover, several other market players have received clearance from the government authorities to sell single-use cystoscopes in the market. Furthermore, single-use cystoscopes save a significant amount of time compared to other reusable counterparts and provide equivalent satisfaction.

- For instance, as per the data published by Ambu USA in February 2024, a research study was conducted to evaluate time tracking for single-use cystoscopes in comparison with reusable cystoscopes. The study result indicated that the time taken by single-use cystoscopes and reusable cystoscopes is 10 minutes and 18 minutes, starting from preparation for the procedure to disposal.

Thus, the increasing focus on developing and introducing single-use cystoscopes is expected to increase the demand for urology devices during the forecast period.

Download Free sample to learn more about this report.

Urology Devices Market Growth Factors

Increasing Incidence of Kidney Disorders to Propel Market Progress

The rising incidence of kidney disorders such as chronic kidney diseases and kidney failure are the major factors for the increased adoption of dialysis devices globally. For instance, according to the annual report-2021 of Fresenius Medical Care, the estimated number of chronic kidney failures will be more than 6.0 million by 2030.

Moreover, a large patient pool for dialysis treatment increased dialysis product usage, such as dialysate and hemodialysis machines. Leading companies are introducing urology devices, thereby spurring global urology devices market growth.

- For instance, in April 2023, Medtronic and DaVita, Inc. launched Mozarc Medical Holding LLC, an independent company focused on kidney health and patient-centered technology solutions to improve patient experience and increase access to care worldwide.

Such new launches, coupled with the growing prevalence of kidney disorders, and are expected to increase the patient population seeking dialysis treatment, thereby propelling the market growth.

Rising Research & Development Activities for the Introduction of Technologically Advanced Products to Boost the Market

The increasing prevalence of various disorders related to urology, such as urethral malignancies, end-stage renal diseases, chronic kidney diseases, and urolithiasis has encouraged healthcare professionals and producers to increase the R&D for the introduction of technologically advanced urology devices.

- For instance, in February 2023, Ethicon, Inc. announced the first robotic-assisted removal of kidney stones using the Monarch platform. This approach helps to reduce the chances of retreatment after kidney stone removal and decreases complications and risk rates. Such technological advancements are projected to boost market growth during the forecast period.

Apart from the healthcare providers, many manufacturers and nephrologists have also introduced new and advanced devices to treat various kidney-related disorders. The advancements in the products, which offer an immediate promise of better visualization and durability, are expected to increase the adoption of urology devices globally.

RESTRAINING FACTORS

Adverse Effects Associated with Cystoscopes to Hamper the Market Growth

Several complications associated with cystoscopes, such as infections, bleeding, urinary incontinence, and bladder perforation, have reduced the adoption of these devices in the market.

- For instance, as per the data published by the Mayo Foundation for Medical Education and Research in December 2022, there are several complications associated with cystoscopy, such as high fever, pain or bleeding during urination.

- Similarly, according to the study published by Springer Nature Limited in 2020, the prevalence of urinary tract infection (UTI) associated with office cystoscopy was 10–20%. Such side effects associated with cystoscopes are expected to limit their adoption to a certain extent.

Several governments and authorities are raising awareness among urology health care facilities related to the side effects associated with the use of these devices.

- For instance, in April 2022, the U.S. FDA announced the investigation of numerous medical device reporting (MDRs) that described patient infections and other possible contamination effects associated with reprocessing of urological endoscopes.

Furthermore, the high cost of urology devices is hampering market growth. Reusable equipment costs are largely incurred with the up-front purchase of capital goods, while disposable equipment requires regular restocking, which could be costlier in the long term.

Thus, the high cost of urology devices and the risks of infections associated with urology devices are expected to act as a barrier to the market's growth.

Urology Devices Market Segmentation Analysis

By Product Type Analysis

Accessories to Hold a Highest Share due to its Growing Adoption in Clinics

Based on the product type, the market is segmented into endoscopes, laser & lithotripsy devices, dialysis devices, other devices, and accessories.

The endoscopes segment is projected to expand at a substantial growth rate during the forecast period. The large share of the segment is attributed to the increasing prevalence of urolithiasis coupled with the high demand for disposable cystoscopes, especially in developed countries. Disposable cytoscopes help to optimize the schedule and the flow of information by eliminating the time required for reprocessing, repair, and maintenance and may help to reduce the waiting time for patients due to a lack of available reusable options. Moreover, cystoscopes are provided in sterilized packaging for each patient, eliminating the potential risk of infection resulting from cross-contamination of reusable scopes.

The accessories segment held the largest market with a share of 58.53% in 2026 and is expected to expand at a substantial CAGR during the forecast period, 2026-2034. The segmental growth is due to various market players' increasing launch of urological accessories.

- In January 2022, Otsuka Pharmaceutical Factory, Inc. launched Actreen, an intermittent urological catheter. The product is a single-use catheter consisting of a catheter (tube) and connector that can be used during self-catheterization in people having difficulty urinating.

Furthermore, increased patient visits to urology clinics coupled with the increasing adoption of catheters and dilators in the urology clinics for treatment are expected to contribute to the segmental growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Kidney Diseases Held the Highest Share Due to the Rising Prevalence of Chronic Kidney Diseases

Based on the application, the market is segmented into urolithiasis, urethral malignancies, bladder disorders, kidney diseases, and others

In 2026, the kidney diseases segment held the largest market with a share of 43.20% in 2026 and is expected to expand at a substantial CAGR during the forecast period, 2026-2034. The segment growth is attributed to the increasing prevalence of end-stage kidney disease and the growing demand for dialysis and minimally invasive surgeries worldwide.

The bladder disorder segment is expected to expand at a significant CAGR during the forecast period, 2025-2032. The segmental growth is due to the increasing geriatric population, who are more prone to bladder infections, urinary tract infections, and diabetes, causing bladder control problems. Moreover, the rising need to diagnose urological diseases in hospital & ambulatory settings is expected to increase the segmental growth during the forecast period.

- For instance, according to statistics provided by the American Cancer Society, Inc., in January 2023, 82,290 new cases of bladder cancer were estimated by the end of 2023 in the U.S.

- Also, according to an article published by WebMD LLC in February 2021, bladder cancer is diagnosed in approximately 275,000 people each year across the world.

Such instances are projected to increase patient visits to urology clinics, thereby driving market demand.

By End-user Analysis

Hospitals & Ambulatory Surgical Centers to Account for Highest Share Due to High Adoption of Cystoscopes for Diagnosis

Based on the end-user, the urology devices industry is segmented into hospitals & ambulatory surgical centers, dialysis centers, and others.

In 2026, the hospitals & ambulatory surgical centers segment held the largest market with a share of 51.98% in 2026 and is expected to expand at a substantial CAGR over the projected period. The segmental growth is attributed to increasing hospital patient visits with urology-related disorders. Moreover, the growing adoption of urology endoscopes such as cystoscopes and ureteroscopes for continuous treatment and diagnosis of urolithiasis in hospitals is predicted to boost segment growth over the forecast period.

The dialysis centers segment is expected to expand at a significant CAGR during the forecast period, 2025-2032. The segmental growth is due to increasing footfalls of patients suffering from kidney failure disorders in dialysis centers. Moreover, the rising awareness related to dialysis and the growing focus of market players to target dialysis centers drive segmental growth.

- For instance, in April 2022, NephroPlus announced the opening of two new dialysis centers, one each in Urgench and Bogot, Uzbekistan. However, the company planned to open the fourth center in Tashkent soon.

REGIONAL INSIGHTS

North America Urology Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the urology devices market share with a revenue of USD 14.49 billion in 2025 and is expected to continue its dominance during the forecast timeframe. The increasing number of patients suffering from kidney diseases, the surge in patient-visits for treatment and diagnosis, and the strong presence of key market players in the region are anticipated to drive the market. Moreover, the rapid adoption of single-use cystoscopes and the surge in the launch of technologically advanced devices by market players are expected to drive market growth in the region. The U.S. market is projected to reach USD 14.4 billion by 2026.

- In May 2022, Johnson & Johnson’s MedTech company Ethicon announced that its Monarch robotic surgery platform received FDA 510(k) clearance. This platform enabled urologists to reach and visualize areas of the kidney with precision and control.

- In July 2020, Olympus Corporation launched the Soltive SuperPulsed Laser System in the U.S. as an option for urologists to use for stone lithotripsy and soft tissue applications.

Europe held the second-highest market share in 2024 and is anticipated to expand at a substantial CAGR during the forecast period. The growth is attributed to a large patient pool suffering from bladder disorders, urolithiasis, and other urology disorders. Moreover, the growing number of approvals of urology devices by the C.E. European commission is anticipated to increase the adoption of urological devices in Europe. The UK market is projected to reach USD 1.87 billion by 2026, while the Germany market is projected to reach USD 2.74 billion by 2026.

- In October 2023, Ambu A/S announced the European regulatory clearance (CE mark) of its new HD cystoscope, the Ambu aScope 5 Cysto HD, in combination with the full-HD endoscopy system, the Ambu aView 2 Advance. This product offers urologists a single-use cystoscope with advanced imaging due to its high-resolution camera chip and the full-HD endoscopy system.

The market across the Asia Pacific is expected to expand at the highest CAGR during the forecast period. The highest CAGR of the region is attributed to the increasing focus on the improvement of healthcare infrastructure, growing awareness regarding the diagnosis of urology disorders, and rising product launches by companies across Japan, China, and India. The Japan market is projected to reach USD 2.14 billion by 2026, the China market is projected to reach USD 3.2 billion by 2026, and the India market is projected to reach USD 1.81 billion by 2026.

The rest of the world is expected to expand at a comparatively lower CAGR during the forecast period. The growth is attributed to the increasing healthcare expenditures, especially in Middle East Africa, growing incidence of chronic kidney disorders, and increased patient visits to urology clinics in these regions.

Key Industry Players

Market Players with Diversified Product Portfolio to Hold Key Market Share

Fresenius Medical Care AG & Co., Coloplast A/S, Boston Scientific Corporation, B.D., and NIPRO are the prominent players in the market and accounted for a significant market share in 2024.

The large market share of these companies is attributed to factors such as a strong presence in North America and Europe and a diversified product portfolio of dialysis equipment and accessories. Moreover, the growing focus on developing advanced products to treat urology-related disorders is expected to strengthen their market share during the forecast period.

- In March 2021, Boston Scientific Corporation entered into a definitive agreement with an affiliate of Baring Private Equity Asia (BPEA) to acquire Lumenis LTD’s global surgical business. The business includes urology and otolaryngology products, such as premier laser systems, fibers, and accessories used for urology.

A few more companies operating in the market include Labories, Intuitive Surgical, Inc., Nikkiso Co Ltd, Ambu A/S, Stryker, KARL STORZ SE & Co. K.G., B.D., and Ethicon Endo-Surgery, Inc. These companies are focusing on various strategies, such as partnerships, new product launches, collaborations, and research and development activities, in order to strengthen their market shares.

List of Top Urology Devices Companies

- Boston Scientific Corporation (U.S.)

- Coloplast A/S (Denmark)

- Ethicon, Inc. (Johnson & Johnson Services, Inc.) (U.S.)

- Ambu A/S (Denmark)

- KARL STORZ SE & Co. KG (Germany)

- Olympus Corporation (Japan)

- Richard Wolf GmbH (Germany)

- Siemens Healthcare GmbH (Germany)

- Stryker (U.S.)

- Cook Medical (U.S.)

- Dornier Medtech (Germany)

- Rocamed (Monaco)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 - Boston Scientific Corporation entered into a definitive agreement to acquire Axonics, Inc. This acquisition would expand the urology portfolio of Boston Scientific Corporation with differentiated technologies to treat urinary and bowel dysfunction.

- September 2023 - Cook Medical’s Motion Hybrid Wire Guide is commercially available in Canada. This wire guide is an excellent choice for clinicians in urological specialties given that it functions as both an access wire guide and a safety wire guide in one.

- December 2022 - Precision Optics Corporation, Inc. a manufacturer of advanced optical instruments for the medical and defense industry announced new product development order for single use urology program with an aim to expand its focus on the medical device market.

- September 2022 - Advanced MedTech Holdings announced the acquisition of a majority interest in WIKKON. This acquisition expands Advanced MedTech’s urological market access in China via a comprehensive nationwide sales & service network and an established local R&D, manufacturing, and supply chain ecosystem.

- September 2022 - Advanced MedTech Solutions Pvt. acquired Shenzhen Huikang Medical Apparatus Co., Ltd., a Chinese market leader in urology with an aim to strengthen its market position in China.

- June 2022 - Austrak Pvt. Ltd., a Hyderabad-based pharma company launched its new super speciality division in nephrology and urology with an aim to supply products and services to prevent, diagnose and treat disease.

- February 2022 - KARL STORZ SE & Co. K.G. received approval from the U.S. FDA for its Blue Light system to be used with Photocure ASA's Cysview product in Blue Light Cystoscopy procedures for the detection of non-muscle-invasive bladder cancer (NMIBC).

- September 2020 - Ambu A/S received a contract with UroGPO, the largest purchasing organization for urology practice clinics in the U.S., for Ambu's aScope 4 Cysto and aView 2 Advance H.D. Monitor.

REPORT COVERAGE

The market research report provides a detailed competitive landscape. It focuses on key aspects such as new product launches in the market. Additionally, it includes the prevalence of urinary disorders and key industry developments such as mergers, partnerships, & acquisitions. Moreover, it covers regional analysis of different segments, and company profiles of key players operating in the market. The report encompasses qualitative and quantitative insights that contribute to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.68% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 41.77 billion in 2026 to USD 75.48 billion by 2034

The market is expected to exhibit a CAGR of 7.68% during the forecast period (2026-2034).

The accessories segment is set to lead the market by product type.

The rising prevalence of urolithiasis, increasing burden of chronic kidney diseases, surging demand for single-use cystoscopes, and the growing acquisitions and mergers by major players are driving the market growth.

Fresenius Medical Care AG & Co., Coloplast A/S, Boston Scientific Corporation, B.D., and NIPRO are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us