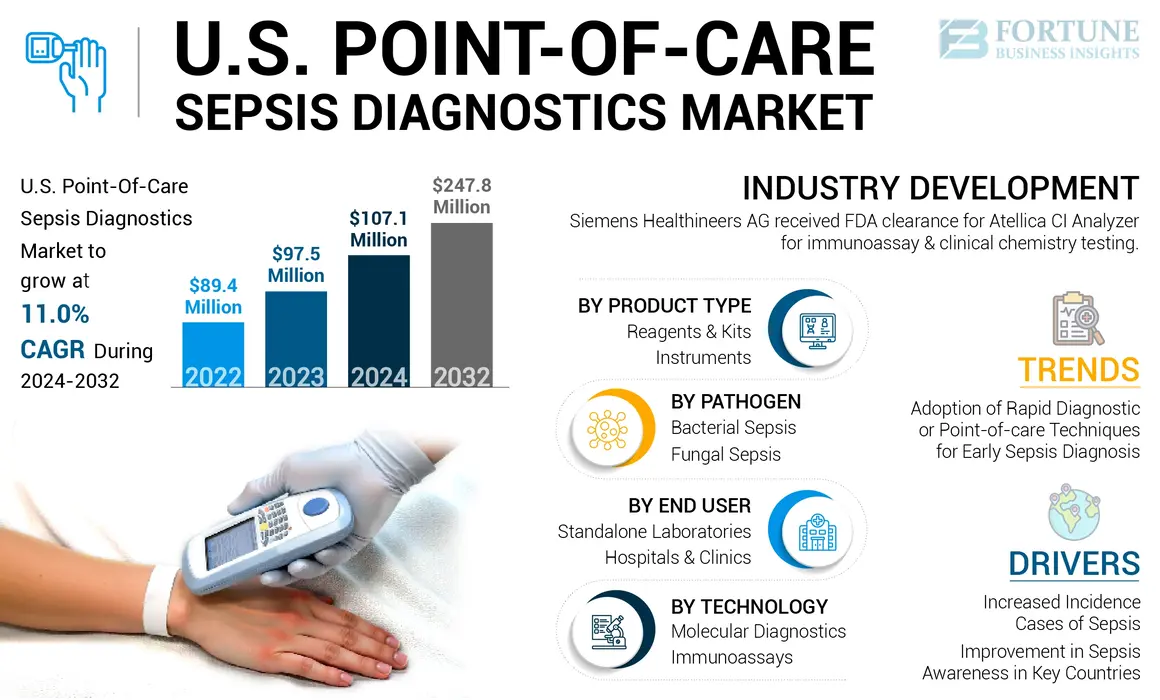

U.S. Point-of-Care Sepsis Diagnostics Market Size, Share & Industry Analysis, By Product Type (Instruments and Reagents & Kits), By Technology (Molecular Diagnostics and Immunoassays), By Pathogen (Bacterial Sepsis and Fungal Sepsis), By End User (Hospitals & Clinics and Standalone Laboratories), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

The U.S. point-of-care sepsis diagnostics market size was USD 97.5 million in 2023. The market is expected to grow from USD 107.1 million in 2024 to USD 247.8 million by 2032, exhibiting a CAGR of 11.0% during the forecast period.

Sepsis occurs when the human body reacts excessively to an infection, which leads to tissue or organ damage. This condition affects millions of people worldwide each year. The sepsis incidence in hospitalized patients has been increasing drastically across the U.S.

- For instance, according to Centers for Disease Control and Prevention (CDC) data published in August 2022, around 1 in 3 people who die in a hospital had sepsis during their hospitalization.

Point-of-care tools for sepsis improve diagnostic speed and accuracy, which leads to prompt administration of appropriate therapeutics, thereby reducing healthcare costs and improving patient outcomes. Furthermore, the increasing prevalence of chronic diseases leads to higher sepsis cases, while rising healthcare expenditure is propelling the adoption of point-of-care sepsis devices. Therefore, the increasing demand for advanced care and research initiatives is boosting the market growth. Moreover, key companies are actively looking to advance care solutions, allowing researchers to focus more on enhancing the design landscape. In addition, the increasing initiatives by key players to launch advanced diagnostic tools in the market are further boosting market growth.

The U.S. market was positively impacted during the COVID-19 pandemic. The sudden rise in sepsis incidence amongst COVID-19 patients resulted in a positive impact on the market. For instance, according to an article published by Wolters Kluwer N.V. in 2021, a study reviewed 113 patients who had died from COVID-19, all of them had sepsis. However, only 41.0% of these patients developed septic shock. The primary cause of death in this group was acute respiratory distress syndrome (ARDS). The study concluded that severe acute respiratory syndrome coronavirus infections could cause pulmonary and systemic inflammation, which leads to multi-organ dysfunction in patients. Moreover, the COVID-19 pandemic positively impacted the sales of these products in the U.S. The number of patient visits and company revenue returned to its pre-pandemic growth levels in 2021, with normalization occurring completely in 2022 and 2023. It is expected to attain robust growth during 2024-2032.

U.S. Point-of-Care Sepsis Diagnostics Market Trends

Increased Adoption of Rapid Diagnostic or Point-of-care Techniques for Early Sepsis Diagnosis

In recent years, one of the significant U.S. point-of-care sepsis diagnostics market trends is increasing adoption of rapid diagnostics and point-of-care for sepsis diagnostic procedures. These rapid diagnostic techniques have improved sepsis diagnostics' speed leading to creation of automated diagnostic, standardization, and efficacy. Companies are getting engaged in launching advanced product offerings due to the growing adoption of point-of-care solutions in the market.

- For instance, in August 2023, PixCell Medical received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for direct capillary sampling with the HemoScreen 5-part differential CBC analyzer. This advancements simplifies blood sampling and minimizes the pre-analytical process, while rapidly detecting sepsis-related disease markers with in a complete blood (CBC) panel. Such advancement in technologies is expected to propel the growth of the market in the future.

Such rising regulatory approvals and the launching of new products for rapid diagnostic or point-of-care techniques across the U.S. are expected to significantly contribute to the market’s growth during the forecast period.

Download Free sample to learn more about this report.

U.S. Point-of-Care Sepsis Diagnostics Market Growth Factors

Increased Incidence/Cases of Sepsis to Surge Market Growth

The primary factor driving the expansion of the U.S. point-of-care sepsis diagnostics market is the rising occurrence of sepsis. This increase in both the number and frequency of sepsis cases often has led to a significant need for sepsis diagnostic tests in the U.S. Additionally, the quicker and more precise diagnoses offered by point-of-care sepsis devices are anticipated to drive market growth.

- For instance, according to an article published by the Centers for Disease Control and Prevention (CDC) in 2024, every year, at least 1.7 million adults develop sepsis annually in the U.S.

This upsurge in sepsis cases has led to a strong demand for point-of-care sepsis diagnostics. Patients who are hospitalized or recently discharged are generally more prone to infections, leading to sepsis. This substantial rise in sepsis prevalence has led to increased demand for sepsis diagnostic procedures. Additionally, rising concern about early diagnosis, coupled with favorable reimbursement policies, is contributing to the U.S. point-of-care sepsis diagnostics market growth during the forecast period.

Improvement in Sepsis Awareness in Key Countries to Contribute to Market Growth

Many governments and organizations, both public and private, are striving to spread knowledge about sepsis among the population. These initiatives usually include screening for sepsis, teaching about sepsis, evaluating how well the sepsis care bundle is being used, enhancing patient results by using cutting-edge diagnostics such as point-of-care sepsis tools, and establishing guidelines for treatment.

Additionally, collaborations between various government and non-government bodies have increased, with the intent to provide information and training to healthcare providers regarding sepsis. Therefore, an increase in various government organizations' and foundations' initiatives for awareness and support is anticipated to augment the overall growth in the point-of-care sepsis diagnostics market.

- For instance, increased attention by the government led agencies such as the Centers for Disease Control and Prevention (CDC), which launched the ‘Hospital Sepsis Program Core Elements’ initiative to raise awareness regarding this critical disease. Initiatives by organizations such as the Sepsis Alliance has also contributed to the heightened awareness.

RESTRAINING FACTORS

High Costs of Diagnostic Devices to Hinder Market Growth

In recent years, the demand for point-of-care sepsis diagnostics has increased, although the market has faced challenges due to the high cost of diagnostic devices. The condition of sepsis is not easily diagnosed, as currently no single test for diagnosing sepsis, and medical personnel employ a combination of tests and immediate and alarming clinical signs. The burden and costs associated with sepsis will restrain the growth of the point-of-care sepsis diagnostics market in key countries during the forecast period.

- According to the Healthcare Financial Management Association data published in July 2020, every year in the U.S., sepsis accounts for 270,000 deaths and costs nearly USD 27.00 billion. It is one of the most significant cost drivers for U.S. hospitals. Sepsis-related hospital admissions involve variable costs, including accommodation charges, diagnostics, therapeutics, and mechanical ventilation. Among these, therapeutics represents one of the most significant variable cost drivers in sepsis management.

Therefore, the high costs associated with sepsis are expected to hamper U.S. market growth in the forecasting years.

U.S. Point-of-Care Sepsis Diagnostics Market Segmentation Analysis

By Product Type Analysis

Reagents & Kits Segment Led due to Increasing Sepsis Prevalence

Based on product type, the market is divided into instruments and reagents & kits.

The reagents & kits segment dominated the U.S. market by product type. The high share of the segment are due to the increasing volume of sepsis cases and early diagnosis awareness among the U.S. population. Moreover, reagents & consumables are utilized in large quantities across various technologies, further contributing to the growth of the segment.

The instrument segment held a sustainable portion of the market. The substantial share of the segment is augmented by increasing technological advancements in sepsis diagnostics and improvement in healthcare infrastructure. Moreover, rising strategic initiatives and product launches by key market players to expand its diagnostics portfolio have accelerated the segment's growth.

- For instance, in November 2023, Inflammatix, Inc. secured the U.S. Food and Drug Administration breakthrough device designation. Stanford University spinout Inflammatix aims to launch within a year its blood test for 30-minute assessment of infection type and severity in hospital emergency departments..

By Technology Analysis

Rising Launches of Immunoassay-based Sepsis Diagnostic Products Led to Immunoassays Segment Growth

Based on technology, the market for point-of-care sepsis diagnostics is bifurcated into molecular diagnostics and immunoassays.

The immunoassays segment held the dominant market share in 2023, driven by rising research and development initiatives aimed at advancing immunoassay technologies. Moreover, strategic partnerships by key players in order to launch advanced immunoassay products are propelling the market growth during the study period.

- For instance, in April 2021, Luminex Corporation (DiaSorin S.p.A.) and Lumos Diagnostics partnered to launch LIAISON IQ, an immunoassay point-of-care (POC) platform that delivers cost-effective POC solutions in under 15 minutes. Such positive initiatives are propelling segmental growth.

Furthermore, the molecular diagnostics segment holds a considerable share of the market and is expected to grow during the forecast period. The growth of the segment is due to the fact that molecular diagnostics are more sensitive, specific, and less time-consuming. A number of manufacturers are also developing point-of-care molecular solutions for a wide variety of bacterial and viral pathogens. The unmet medical need for a rapid tool to diagnose these bloodstream infections is particularly apparent in the emergency rooms. Such opportunities are further expected to support the growth of the segment during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Pathogen Analysis

Increased Bacterial Sepsis Cases and Significant Launches Led the Bacterial Sepsis Segment Dominance

In terms of the pathogen, the market is divided into bacterial sepsis and fungal sepsis.

The bacterial sepsis segment held the highest portion of the U.S. point-of-care sepsis diagnostics market share in 2023. The dominant share of the segment is augmented by the growing occurrence of bacterial sepsis, alongside increasing number of initiatives by key players for advanced product launches for the detection of bacteria causing sepsis.

For instance, in September 2020, T2 Biosystems, Inc. received the Centers for Medicare & Medicaid Services (CMS) approval and continued the New Technology Add-On Payment (NTAP) for the T2Bacteria Panel for Fiscal Year 2021. Such strong factors contribute to the segment’s growth.

Furthermore, the fungal sepsis segment holds a substantial market share and is expected to grow during the forecast period. The higher susceptibility of people with impaired immune systems to developing sepsis from fungal infections, than people with normal immune systems, is contributing to segmental growth.

By End User Analysis

Hospitals & Clinics Segment Led due to Strong Preference for Sepsis Care

Based on end user, the U.S. market for point-of-care sepsis diagnostics is segmented into hospitals & clinics and standalone laboratories.

The hospitals & clinics segment held a dominant share of the U.S. market share in 2023. The growth of the segment is due to the strong number of sepsis cases occurring in hospitalized patients. Additionally, the facilities provided by the government for better hospital stays, skilled healthcare professionals and efficient treatments leading to improved patient outcomes and boosted hospital admission count are propelling the development of the segment in the market.

- According to an article published by Regents of the University of Minnesota in 2020, sepsis is a prominent cause of death in hospitals, with an estimated mortality of 26.7% in hospital patients and 42.6% in intensive care unit (ICU) patients treated. The rising mortality rate in hospitals due to sepsis contributes to the segment’s growth.

The standalone laboratories segment held a significant U.S. point-of-care sepsis diagnostics market share. Strategic initiatives by key players in order to enhance diagnostic services are anticipated to contribute to the expansion of the standalone laboratories segment.

KEY INDUSTRY PLAYERS

Presence of Potential Sepsis Diagnostic Products by Key Market Players to Expand their Market Position

In terms of competition, the market demonstrates a semi-consolidated structure. Thermo Fisher Scientific Inc. held a significant position in the U.S. market in 2023 due to its established brand presence and potential product portfolio in the market. Moreover, the strategic activities of key players propel the market expansion.

- For instance, in October 2018, Thermo Fisher Scientific Inc. announced the sixth licensing agreement for its B·R·A·H·M·S PCT (procalcitonin) biomarker that provides information on the presence and severity of bacterial infections.

Abbott, Radiometer Medical ApS (Danaher Corporation), bioMérieux, Inc., and T2 Biosystems, Inc. are also some of the other prominent players in terms of market share in the U.S. market. Specific strategic initiatives, a wide range of product offerings, and launches are anticipated to boost their presence in the U.S. market during the forecast period.

LIST OF TOP U.S. POINT-OF-CARE SEPSIS DIAGNOSTICS COMPANIES:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Radiometer Medical ApS (Danaher) (U.S.)

- bioMérieux, Inc. (France)

- DiaSorin S.p.A. (Italy)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthineers AG (Germany)

- T2 Biosystems, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Deepull debuts its point of care diagnostic UIICORE diagnostics system for detection of sepsis. UIICORE system uses polymerase chain reaction (PCR) to extract microbial DNA from the human blood sample.

- July 2024: Siemens Healthineers demonstrated advancements in laboratory testing with human-centered engineering and automation at the Association for Diagnostics & Laboratory Medicine (ADLM) 2024 Clinical Lab Expo.

- July 2023: Siemens Healthineers AG received FDA clearance for Atellica CI Analyzer, which is designed for immunoassay and clinical chemistry testing. The analyzer is now available in many of the world’s major markets.

- April 2022: Boditech Med Inc. signed a memorandum with Novo Integrated Sciences, Inc. to establish a marketing and distribution partnership. This collaboration aimed to launch and deploy Boditech Med’s in-vitro diagnostic solutions and technology in North America.

- May 2021: Danaher collaborated with Sepsis Alliance to support the Sepsis Alliance Clinical Community. The agreement was supported to include support for educational programs, including the Sepsis Alliance Summit and Sepsis Alliance Institute Continuum of Care webinars.

REPORT COVERAGE

The U.S. point-of-care sepsis diagnostics market report focuses on an industry overview and market dynamics, such as the drivers, restraints, opportunities, and trends. Besides this, the market research report provides information related to sepsis prevalence, regulatory scenarios, and technological advancements in the market. Furthermore, the U.S. market analysis also focuses on key industry developments and new product launches in the market. In addition, the impact of COVID-19, as well as a detailed company profile and the industry overview during the pandemic, are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 11.0% from 2024-2032 |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Pathogen

|

|

|

By End User

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 97.5 million in 2023 and is projected to reach USD 247.8 million by 2032.

The market is expected to exhibit a CAGR of 11.0% during the forecast period.

The immunoassays segment led the market in 2023.

The contributing factors, such as the increasing prevalence of sepsis and a rise in awareness, are the key factors driving market growth.

Advancements in point-of-care sepsis diagnostics technologies are the key trend in the market.

Thermo Fisher Scientific Inc. and Abbott are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us