Virtual Data Room Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Large Enterprises and Small and Medium Enterprises), By Business Function (Mergers and Acquisitions, Initial Public Offerings, Enterprise Activities, and Document Warehousing), By Application (BFSI, Retail and E-commerce, Healthcare and Life Science, IT and Telecom, Government, Construction and Real Estate, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

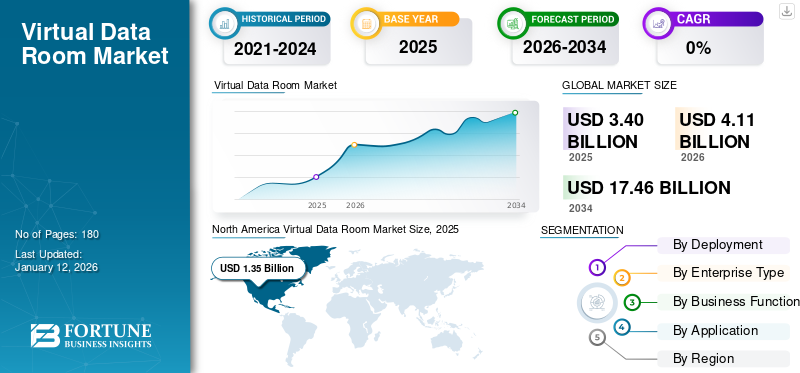

The global virtual data room market size was valued at USD 3.4 billion in 2025. The market is projected to grow from USD 4.11 billion in 2026 to USD 17.46 billion by 2034, exhibiting a CAGR of 19.80% during the forecast period. North America dominated the global market with a share of 39.70% in 2025.

The virtual data room provides secure online platforms for storing, sharing, and managing confidential documents and information. Virtual data rooms are used during mergers and acquisitions, initial public offerings, enterprise activities, and document warehousing, where the secure exchange of sensitive data is essential. Key players in this market offer cloud-based and on-premises solutions tailored to the specific needs of various industries, ensuring data security, compliance with regulations, and efficient collaboration among stakeholders. As businesses increasingly rely on digital transactions and remote collaboration, the demand for virtual data rooms continues to expand to meet the growing demand for secure and efficient data management solutions.

Furthermore, the shift toward remote work and virtual deal making amid the COVID-19 pandemic has accelerated the adoption of VDRs among businesses, particularly in the sectors including BFSI and healthcare, where secure document sharing and due diligence are critical. The pandemic also highlighted the importance of data security and compliance, leading to greater emphasis on VDR solutions with advanced encryption and regulatory compliance features.

IMPACT OF GENERATIVE AI

Introduction of Advanced Algorithms for Enhanced Document Security to Aid Market Growth

Generative AI has emerged as a transformative technology in the virtual data room market, revolutionizing document management and collaboration processes. By leveraging advanced machine learning algorithms, generative AI enables the automatic generation of realistic text, images, and other multimedia content. In the context of VDRs, generative AI facilitates the creation of synthetic documents, metadata tagging, and content summarization, streamlining document indexing and retrieval processes. Moreover, generative AI-powered natural language processing (NLP) models enhance document understanding capabilities, enabling VDRs to extract key insights, identify patterns, and categorize information more accurately. This improves search functionality, due diligence processes, and decision-making capabilities for users within the VDR ecosystem.

Furthermore, generative AI technologies, such as deep learning-based language models, can potentially enhance document security within VDRs. By analyzing document content and user interactions, AI-powered anomaly detection algorithms can identify suspicious activities and flag potential security breaches in real-time. Additionally, generative AI can assist in developing advanced encryption techniques and access control mechanisms to safeguard sensitive information stored within VDRs. As organizations prioritize data privacy and compliance with regulations, integrating generative AI capabilities into VDR platforms offers a proactive approach to mitigate security risks and ensure confidentiality in document-sharing and collaboration environments.

Virtual Data Room Market Trends

Increasing Demand for Enhanced Security Features and Compliance Capabilities to Surge Market Growth

VDR providers are prioritizing the development and implementation of advanced security measures to safeguard sensitive information stored and shared within their platforms. This trend encompasses adopting multi-layered encryption techniques, robust access controls, and secure authentication mechanisms to protect data integrity and confidentiality. For instance, VDRs are leveraging end-to-end encryption protocols, such as AES-256, to encrypt data both in transit and at rest, ensuring that only authorized users can access sensitive documents. Additionally, features including watermarking, dynamic document watermarking, and digital rights management (DRM) are being implemented to track document usage and prevent unauthorized distribution or replication.

Furthermore, VDRs are enhancing their compliance capabilities to meet industry-specific regulations, such as GDPR, HIPAA, and SOC 2. This trend involves integrating compliance auditing tools, activity logging functionalities, and automated reporting mechanisms to facilitate regulatory compliance assessments and audits. For instance, virtual data room platforms incorporate audit trail functionalities to record and track user activities within the system, providing a comprehensive overview of document access, modifications, and downloads for compliance purposes. Moreover, role-based access control (RBAC) and granular permission settings enable VDR administrators to define and enforce access policies based on user roles and responsibilities, ensuring adherence to regulatory requirements and industry standards. Thus, the growing need for advanced compliance and security capabilities is fueling the virtual data room market growth.

Download Free sample to learn more about this report.

Virtual Data Room Market Growth Factors

Increasing Frequency and Complexity of Mergers and Acquisitions (M&A) Activities among Businesses Globally to Fuel Market Growth

As companies pursue strategic growth initiatives and seek opportunities for expansion, the demand for secure and efficient platforms for due diligence, document sharing, and collaboration intensifies. Various factors, including globalization, industry consolidation, and the emergence of disruptive technologies, fuel market growth. For instance, in the technology sector, the proliferation of startups and the rapid pace of innovation often lead to acquisitions by larger corporations seeking to acquire new capabilities or enter new markets. Similarly, in industries such as finance and healthcare, regulatory changes and market dynamics drive M&A activities, necessitating the use of VDRs to facilitate confidential transactions and ensure compliance with regulatory requirements.

As a result, virtual data room providers are experiencing heightened demand for their services, driving innovation in user experience, security, and compliance capabilities to meet the evolving needs of businesses engaged in M&A transactions. Therefore, the increasing prevalence of M&A activities serves as a significant driver propelling the virtual data room market share across various industries.

RESTRAINING FACTORS

Growing Privacy and Security Concerns to Impede Market Growth

Despite advancements in encryption technologies and access control mechanisms, organizations remain wary of potential vulnerabilities and risks associated with storing and sharing sensitive information in cloud-based environments. High-profile data breaches and regulatory penalties have heightened awareness of the importance of data protection and compliance, leading businesses to approach VDR adoption with caution. Additionally, the complexity of regulatory landscapes, such as GDPR, HIPAA, and SOC 2, imposes stringent requirements on VDR providers to ensure data security and regulatory compliance, increasing the burden of compliance management for organizations. As a result, some businesses may hesitate to fully embrace VDR solutions, particularly in highly regulated industries where data privacy and compliance are paramount concerns.

Virtual Data Room Market Segmentation Analysis

By Deployment Analysis

Surge in Demand for Cost-effective Solutions to Fuel the Cloud Segment Growth

As per the study, the deployment is bifurcated into cloud and on-premise.

The cloud segment holds the maximum share of 69.91% in 2026, and CAGR due to its scalability, accessibility, and cost-effectiveness. Cloud-based solutions offer flexible storage options, enabling businesses to scale their data room capacity as needed seamlessly. Additionally, accessing data rooms from any location with an internet connection enhances collaboration and efficiency, driving their widespread adoption. Furthermore, the pay-as-you-go pricing model of cloud-based VDRs reduces upfront infrastructure costs and allows organizations to manage expenses more effectively, contributing to their sustained growth.

The on-premise segment holds comparatively less share than cloud-based solutions due to their inherent limitations in scalability, accessibility, and cost-effectiveness. On-premise solutions require significant upfront investment in hardware infrastructure and maintenance, making them less flexible and more resource-intensive to manage.

By Enterprise Type Analysis

Need for Managing Complex Transactions in Large Enterprises to Surge Large Enterprises Segment Growth

According to research, the enterprise type is divided into large enterprises and small and medium enterprises.

The large enterprises segment dominates the market with a share of 62.51% in 2026, due to their extensive data management needs, higher budgets for technology investments, and greater emphasis on security and compliance. Large enterprises often engage in complex transactions, such as mergers and acquisitions, where VDRs are essential for securely sharing sensitive information.

SMEs are expected to grow at the highest CAGR owing to the growing need to streamline business processes, facilitate remote work, and enhance collaboration with partners and clients. Additionally, as SMEs grow and expand their operations, they require scalable and cost-effective solutions to manage their data securely, driving a higher adoption of virtual data rooms compared to large enterprises.

By Business Function Analysis

Rising Need for Confidential Data Exchange among Businesses to Drive Segment Growth

As per research, the business functions studied are mergers and acquisitions, initial public offerings, enterprise activities, and document warehousing.

Mergers and acquisitions, the initial public offerings segment holds the maximum share of 50.72% in 2026, as parties involved in M&A transactions or IPOs need VDRs to facilitate the exchange of confidential information, enabling seamless collaboration while ensuring data security and compliance with regulatory requirements. The high stakes and large volumes of documents involved in M&A and IPO transactions make VDRs indispensable tools for streamlining due diligence, negotiations, and regulatory filings, driving significant adoption and market share in these segments.

The enterprise activities segment is projected to grow at the highest CAGR owing to the utilization of VDRs for activities such as internal document sharing, contract management, financial audits, and legal proceedings, driving sustained demand for VDR solutions. Additionally, as businesses transition toward digital transformation and remote work, the need for secure and efficient data storage and sharing solutions further propels the growth of VDR adoption among enterprises, contributing to the highest CAGR in this market segment.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Necessity for Protecting Sensitive Data in the BFSI Industry to Surge Segment Growth

As per research, the applications studied are BFSI, retail and E-commerce, healthcare and life science, IT and telecom, government, construction and real estate, and others.

The BFSI segment holds the highest share of 24.56% in 2026, due to its frequent involvement in complex and confidential transactions, such as mergers and acquisitions, initial public offerings, and fundraising activities. VDRs offer a secure platform for storing and sharing sensitive financial documents, regulatory filings, and due diligence reports, enabling financial institutions to streamline transaction processes while ensuring compliance with strict regulatory requirements. Additionally, the BFSI sector prioritizes data security and confidentiality, making VDRs indispensable for facilitating secure communication and collaboration among stakeholders involved in critical financial transactions.

The healthcare segment is expected to grow with the highest CAGR in the market due to the increasing digitization of patient records, medical imaging files, and research data, coupled with stringent regulatory requirements, such as HIPAA and GDPR. VDRs offer secure platforms for storing, accessing, and sharing sensitive healthcare information, facilitating collaboration among healthcare providers, pharmaceutical companies, research organizations, and regulatory authorities. Additionally, adopting telemedicine, remote patient monitoring, and precision medicine technologies further drives the demand for VDRs to securely manage and exchange electronic health records (EHRs), clinical trial data, and genomic data, contributing to the sector's rapid growth.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Virtual Data Room Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.35 billion in 2025 and USD 1.62 billion in 2026, due to several factors, including the region's robust technological infrastructure, high adoption rates of cloud-based solutions, and major VDR providers headquartered in the area. Additionally, the region is home to a large number of enterprises engaged in mergers and acquisitions, financial transactions, and legal proceedings, driving the demand for VDRs. For instance, prominent VDR providers, such as Intralinks Holdings, Inc. and Datasite, are headquartered in the region and cater to a diverse clientele across industries, contributing to the region's dominance in the VDR market. The U.S. market is projected to reach USD 1.07 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is projected to exhibit the highest CAGR in the market due to the region's rapid digital transformation, increasing adoption of cloud technologies, and growing demand for secure document management solutions. As businesses in the region embrace globalization and engage in cross-border transactions, the need for VDRs to facilitate secure data sharing and collaboration becomes paramount. For instance, emerging economies, such as China and India, are witnessing a surge in M&A activities, driving the demand for VDRs to support due diligence processes and ensure regulatory compliance, contributing to the region's high growth rate in the VDR market. The Japan market is projected to reach USD 0.20 billion by 2026, the China market is projected to reach USD 0.24 billion by 2026, and the India market is projected to reach USD 0.18 billion by 2026.

Europe holds a significant market share owing to the region's stringent data privacy regulations, such as GDPR, driving the demand for secure data management solutions. The UK market is projected to reach USD 0.16 billion by 2026, while the German market is projected to reach USD 0.19 billion by 2026. Additionally, Europe's diverse and mature industries, including finance, healthcare, and legal services, rely on VDRs for confidential transactions and compliance purposes. For instance, European financial institutions use VDRs for mergers and acquisitions. Additionally, healthcare organizations leverage VDRs for clinical trials and regulatory submissions, contributing to Europe's substantial presence in the VDR market.

South America and the Middle East & Africa hold less share and an average CAGR in the market due to emerging digital transformation initiatives, increasing awareness of data security concerns, and the gradual adoption of cloud technologies. While these regions may lag in VDR adoption compared to more mature markets, factors such as regulatory changes, globalization of business operations, and the rising need for secure document management solutions drive incremental growth. For instance, the demand for VDRs to ensure compliance and secure data sharing rises steadily as regional enterprises engage in cross-border transactions and face regulatory pressures, contributing to the region's growth.

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Key players operating in the virtual data rooms actively create advanced solutions to cater to customer demands. They also focus on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations proactively pursue collaboration, acquisitions, and partnerships to bolster their product offerings.

List of Top Virtual Data Room Companies

- Intralinks, Inc. (U.S.)

- Drooms (Germany)

- Datasite (U.S.)

- SmartRoom (U.S.)

- Ansarada Pty Ltd. (Australia)

- Vault Rooms (U.S.)

- ShareVault (U.S.)

- iDeals (U.K.)

- Caplinked (U.S.)

- EthosData (U.K.)

KEY INDUSTRY DEVELOPMENTS

- September 2023: Intralinks, Inc. released DealVault, an updated cloud-based archive storage solution that enables customers to securely access and share deal archives, eliminating the need for physical USB drives. Additionally, customers can quickly unarchive deals to expedite the start of their next deal.

- August 2023: Datasite, a leading provider of SaaS-based technology for M&A professionals globally, completed the acquisition of MergerLinks, a financial data platform based in London. MergerLinks was utilized by finance professionals to access deal information, promote their credentials, and engage with investors, companies, and advisors in capital transactions.

- March 2023: Drooms, Europe's premier virtual data room solution for real estate assets, launched "LIFECYCLE," offering three versions, including a free-to-use option. This basic version enables real estate and M&A transaction participants to securely store, organize, and access asset documentation in one platform, streamlining processes and empowering asset managers to focus on value-raising tasks with ease.

- March 2023: Intralinks, Inc. launched new features in VDRPro, including updates to the UX appearance of filter tabs for consistency across the product. Additionally, drop-down button lists have been restyled and rearranged for easier access to reports and functions. Notably, the Dashboard and All Questions tab are now always visible, with the closed questions filter displaying a counter. Exchange managers have the option to blur documents when users move off-screen, enhancing security by preventing screenshots of sensitive information.

- March 2023: Datasite launched Datasite Cloud, a comprehensive platform designed to streamline the entire dealmaking process. This initiative reflects Datasite's commitment to empowering the dealmaking community by offering a suite of applications in one centralized platform, covering pipeline management, asset marketing, due diligence, and post-merger integration.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading business functions of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Business Function

By Application

By Region

|

Frequently Asked Questions

The market for virtual data rooms is projected to reach USD 17.46 billion by 2034.

In 2025, the market was valued at USD 3.4 billion.

The market is projected to grow at a CAGR of 19.80% during the forecast period.

The BFSI industry is expected to lead the market.

Increasing frequency and complexity of mergers and acquisitions (M&A) activities among businesses globally to fuel market growth.

Intralinks, Inc., Drooms, and Datasite are the top players in the market.

North America is expected to hold the highest market share.

By business function, the enterprise activities segment is expected to grow with a remarkable CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us