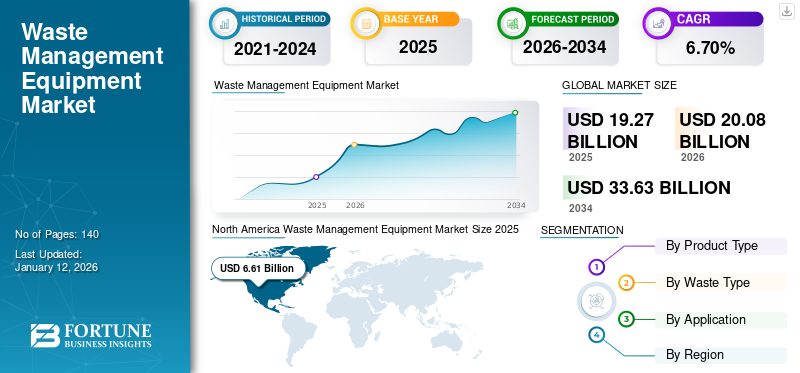

Waste Management Equipment Market Size, Share & Industry Analysis, By Product Type (Waste Disposal Equipment and Waste Recycling & Sorting Equipment), By Waste Type (Hazardous and Non-hazardous), By Application (Industrial Waste, Municipal Waste, and Others), Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global waste management equipment market size was valued at USD 19.27 billion in 2025 and is projected to grow from USD 20.08 billion in 2026 to USD 33.63 billion by 2034, exhibiting a CAGR of 6.70% during the forecast period. North America dominated the waste management equipment market with a market share of 34.30% in 2025.

Waste management equipment is utilized for collecting, transferring, disposing, and handling waste in an effective manner. This type of equipment is used for handling industrial, hazardous waste, and municipal waste. The equipment involves collections of solid, gas, and solid waste. Good management of waste is necessary for individuals and sustainable buildings. This equipment is used for handling the non-hazardous, and hazardous waste. It consists of two types of equipment such as waste disposal equipment and waste recycling & sorting equipment. Waste disposal equipment consists of transportation, loading, and unloading of waste using dumpers, dumpsters, and trucks. Additionally, conveyors, shredders, and screeners are some of the equipment used in waste recycling & sorting equipment.

An increasing urbanization across developing countries as well as developed countries, such as India, China, Brazil, the U.S., and others, has resulted in the huge amount of waste generated globally. This is expected to escalate the demand for equipment used for handling and disposal of waste in an effective manner. Rising awareness among end-users for the collection of waste is one of the important factors driving the growth of the market. For instance, according to the World Health Organization, the percentage of the urban population globally grew by 1.8% from 2019-20. Increasing demand for waste handling and disposal machines, which is required for the collection of waste generated by the industrial sector in the U.S., Germany, and France is projected to fuel the market growth. Food wastage has grown significantly over the last few years. Furthermore, increasing industrialization in developing countries such as India, China, Brazil, and Africa has led to advancements of the oil and gas, medical, chemical, and automobile sectors coupled with the generation of huge amount of construction and demolition waste, which led to pollution harmful for human health.

The COVID-19 pandemic impacted negatively on the global market growth, owing to the decline in waste generation from commercial and industrial sectors and increasing demand from the residential sector. Halted construction-related and manufacturing activities in the first quarter of 2020 impacted the growth of the market. Increasing volume of medical waste, owing to increasing sales of face masks, test kits, and gloves due to increasing prevalence of COVID-19 cases is expected to drive market growth. According to the International Finance Corporation of World Bank, the rise in amount of waste from industrial and medical areas was around 40%.

The increasing generation of municipal waste has increased the financial or physical challenges for municipal or industrial sectors to cover. In 2020, according to AMSA Group based in Milan, Italy, the total waste production was decreased by 27.5%, owing to the implementation of lockdown globally. However, the waste recycling rate increased by 1% from 2019 to 2020. Additionally, municipal waste production globally dropped by 16.65% as compared to 2020. Therefore, it reduced the waste generated from sectors and ultimately declined market sales.

Waste Management Equipment Market Trends

Rising Awareness Regarding Recycling Among End-users to Boost Market Growth

Increasing environmental effects are making consumers more inclined toward recycling activities. Rising awareness about the importance of reducing industrial waste is one of the important trends in the global market. Additionally, in December 2022, according to the United Nations Environment Program, annually, around 11 billion tons of waste was generated across the globe, and decomposing the organic proportion of municipal solid waste contributed to around 5% of global carbon emission. Around 20% of the total global waste is recycled each year and developed countries offer waste recycling services for poorer nations.

The rate of recycling waste fell across nations in North America, Europe, and Asia Pacific, owing to the COVID-19 pandemic. According to the National Academy of Science (NAS), the COVID-19 pandemic generated around 8 million tons of plastic waste across the globe and generated over 25,000 tons of waste from the ocean. Such factors are enhancing the demand for such equipment to handle and collect waste in an effective manner.

Download Free sample to learn more about this report.

Waste Management Equipment Market Growth Factors

Increasing Municipal Waste and Rising Demand for Disposal Methods to Drive the Market Growth

Increasing the waste generation from the municipal and industrial sectors is a major problem around the globe in developing as well as developed countries. Additionally, an increasingly urban population coupled with an increasingly huge amount of waste generated needs efficient and appropriate waste management equipment. This is expected to surge the demand for more compactors, dumpsters, and recycling machines. According to the World Bank Group (WBG), in 2021, around 1.3 billion tons of waste generated globally is expected to rise by 2.2 billion tons of waste by 2025, which increases the demand for effective compactors and dumpsters.

According to the Global Waste Index 2022, South Korea ranked first, which generated around 400 kg of waste generated, out of which 60.8% of the waste is recycled and dumped into incineration and landfill sectors, which boosts the demand for waste recycling and waste disposal equipment. In addition, there is an increasing number of industries around the globe along with increasing technological advancements in recycling facilities. For instance, in India, approximately around 60% of the waste was processed in 2020 as compared to 28.6% in the financial year 2018. Therefore, increasing municipal waste creates the demand for such equipment.

RESTRAINING FACTORS

Lack of Awareness About Waste Management in Developing Countries to Restrain Market Growth

Solid waste management is a multifaceted problem comprising institutional and environmental aspects. Open burning and open dumping are the most implemented forms of waste treatment in developing countries and low income countries such as China, India, and others. Rising concerns of health risks due to growing electronic waste hamper the market growth during the forecast period. Unmanageable or uncontrollable disposal waste management equipment could generate pollutant emissions from the environment, which is harmful for end-users.

Furthermore, there has been a rise in the count of landfills and incineration centers across developing countries coupled with dumping of waste in open spaces. For instance, around 80% of the solid waste in South African countries are dumped in open streets, rivers, and spaces, which is estimated to contribute 29% of the global carbon emission by 2022, and is projected to grow by 64% by 2030. Further, fluctuation in raw material prices is restraining the growth of the market. Therefore, lack of awareness about waste management practices in developing countries is expected to restrain the market growth.

Waste Management Equipment Market Segmentation Analysis

By Application Analysis

Industrial Waste to Gain Traction Owing to Increasing Number of Industries

By application, the market is fragmented into municipal waste, industrial waste, and others.

The industrial waste segment dominates the market and is expected to exhibit a significant CAGR of 4.8% during the forecast period. This is due to the increasing waste generation from the construction, oil & gas waste, and manufacturing sectors. For instance, according to the United Nations Environmental Protection Agency (EPA), in 2021, the U.S. generated around 600 million tons of construction waste. Therefore, an increasing demand for waste equipment for loading and unloading of waste is expected to drive the market growth.

The municipal waste segment is expected to register moderate growth. This is due to rising public awareness regarding sustainable waste management techniques, which creates the demand for more waste equipment for handling and disposing of waste generated from municipal sectors.

The others segment consists of agricultural waste and is set to depict decent growth due to rising environmental concerns and increasing pollution, which is a major factor driving market growth. In March 2022, “Agnes Garbage Management” initiative taken up by IIT Kanpur led to the invention of a new composting machine that converts collected waste into manure (fertilizer) in just 10 days. Such a new product development in the market is expected to propel market growth.

To know how our report can help streamline your business, Speak to Analyst

By Product Type Analysis

Waste Recycling & Sorting Equipment to Grow at Highest CAGR Due to Increasing Amount of Waste Generated

Based on product type, the market is fragmented into waste recycling & sorting equipment and waste disposal equipment. The waste disposal equipment segment is sub-segmented into trucks, compactors, dumpsters, and others (drum crushers). In addition, the waste recycling & sorting equipment segment is categorized into screeners, conveyors, and others (grinders).

The waste recycling & sorting equipment segment is projected to dominate the waste management equipment market with a 57.47% share in 2026, owing to increasing awareness of the benefits associated with waste management systems among end-users. Additionally, growing concerns about reducing the greenhouse effect with strict government regulations across the globe contributed positively to the market growth.

The waste disposal equipment segment is growing at a decent rate due to rising urbanization across developing as well as developed countries such as India, China, the U.S., and others, which created a huge amount of waste. Maintaining proper waste management requires more waste equipment to handle waste effectively and efficiently. Such factors drive the waste management equipment market growth.

By Waste Type Analysis

Hazardous Segment to Dominate the Market Owing to Stringent Government Regulations

The market is segmented into non-hazardous and hazardous.

The hazardous waste segment represented a market size of USD 62.50 billion in 2026 due to the huge amount of waste generated from medical sectors and chemical sectors such as medical kits, COVID-19 vaccine kits, and face masks, which are very harmful and release emission from waste. Thus, strict regulations imposed by several governments to implement safe waste management practices are expected to fuel the market growth.

The non-hazardous segment is growing with a significant CAGR of 4.9% during the forecast period due to increasing awareness of waste management systems to recycle and reduce non-hazardous waste. Non-hazardous waste consists of municipal solid waste, batteries, agricultural waste, and scrap tires.

REGIONAL INSIGHTS

The report covers an in-depth analysis of five main regions, Asia Pacific, Europe, North America, South America, and the Middle East and Africa.

North America Waste Management Equipment Market Size 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for USD 6.61 billion in 2025 owing to the presence of several key players in the region along with good product offerings. Additionally, huge amount of waste generated in the U.S., Canada, and Mexico creates the demand for waste equipment to manage waste properly. For instance, in 2022, the U.S. population generated 268 million tons of waste. Thus, on an average, around 4.5 pounds of waste are generated by individuals in the U.S. These factors fuel the demand for waste equipment to manage, handle, and dispose waste in an effective way.

U.S. to Witness Fastest Growth Owing to Huge Amount of Waste Generated

Key players, such as Dover Corporation, Oshkosh Corporation, and Caterpillar Inc, among others, are having strong presence in the U.S. Additionally, in the North America region, the U.S. generates huge amount of construction waste, municipal solid waste, and industrial waste. For instance, the U.S. produces 1,700 pounds of foods, plastic, or hazardous waste per person. Additionally, the waste recycling rate of Canada province grew by 76% in 2021, as compared to 71% in 2019. These factors are expected to boost the demand for these systems, driving the market growth.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is estimated to grow at the highest CAGR of 5.4% during the forecast period. The regional market value stood at USD 3.03 billion in 2024 due to a surge in the amount of waste generated from countries such as Japan, India, and China. For instance, India generates around 60 million tons of waste annually. This waste can be transferred to landfills without any waste treatment. This fuels the product demand, driving the market growth. Similarly, Japan has focused on bringing automation to the commercial and industrial sectors to manage waste production. Thus, waste management equipment helps improve operational efficiency, reduce labor costs, and enhance safety by limiting human contact with hazardous waste. The Japan market reaching USD 1.50 billion by 2026, the China market reaching USD 4.84 billion by 2026, and the India market reaching USD 4.55 billion by 2026.

Europe

The Europe market is expected to grow at a moderate rate due to strict government regulations and this region has a wide installation of recycling and composting centers, which creates the demand for compactors, dumpsters, and others. For instance, according to the European Union, in 2020, approximately 4.8 tons of waste was generated in Europe out of which 31.3% of waste land was filled and processed in the same year. The UK market reaching USD 1.63 billion by 2026 and the Germany market reaching USD 3.64 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa regions are expected to record decent growth due to huge amount of waste generated and increasing environmental concerns toward waste recycling services, which boost the market growth. Additionally, Saudi Arabia, Qatar, Kuwait, and the UAE are some of the high amount of waste generating countries, which increases the penetration of waste management equipment and fuels the growth of the market.

Furthermore, the surge in residential and non-residential construction activities boosts the usage of waste management equipment in construction industries. This factor drives the growth of the market during the forecast period.

KEY INDUSTRY PLAYERS

Prominent Players Emphasize on Strategies to Improve the Overall Market Presence

Key players adopted major developmental strategies such as product launches, acquisitions, and business expansion to improve the product portfolio of waste management equipment and to improve the supply chains across diversified geographies. The development of these products is anticipated to attract a wide customer base over the forecast period. Expanding the portfolio of small emerging players in the sector to grow their presence and offerings among consumers are helping to acquire larger consumer responses and consistent market share during the forecast period. Following are the key developments adopted by major players in the global market.

- October 2022: Alta Equipment Group Inc acquired Ecoverse Industries LTD that deals in environmental balers, shredders, and window turner. The main aim of this acquisition is to improve the product portfolio of the waste management equipment and also get into the new business. The equipment was used for applications such as handling municipal solid waste, wood waste, tires, and food waste.

LIST OF TOP WASTE MANAGEMENT EQUIPMENT COMPANIES:

- Dover Corporation (U.S.)

- Morita Holdings Corporation (Japan)

- Wastequip LLC (U.S.)

- Oshkosh Corporation (U.S.)

- Sierra International Machinery LLC (U.S.)

- JCB (U.K.)

- Kirchoff Group (Germany)

- Waste Connections (U.S.)

- EnerpatGroup UK Ltd (U.K.)

- Caterpillar Inc (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Ingram Equipment Company (IEC) formed a partnership with Air Burners, a air curtain burner systems provider to deliver advanced and efficient waste management solutions to the customers present across the globe.

- May 2021: Wastequip LLC acquired Wastebuilt Environmental Solutions LLC based in the U.S. The company deals in manufacturing and trading of refuse, fleet parts, and related equipment. The acquisition was done for improving the supply chain network of waste management services and equipment of the Wastequip LLC.

- November 2022: Averda International Limited signed a partnership agreement with King Abdullah University of Science and Technology (KAUST) for bringing sustainable waste management services to the universities across Saudi Arabia. The partnership was done for 10 years and aimed to achieve zero waste to landfill centers.

- June 2022: Sierra International Machinery LLC based in California, U.S. opened a new manufacturing facility at Jesup, Georgia, U.S. The new manufacturing facility is 24,000 square feet. The business expansion was done for improving the production capacity of waste management equipment and increasing demand for Sierra’s products.

- August 2022: Brightmark signed a partnership with Jamar Health Products based in the U.S. that deals in medical waste recycling services. The partnership was aimed at improving the waste management services of the company.

- November 2021: Waste Management Inc invested around USD 200 million for improving the recycling infrastructure of the company. The investment also resulted in capturing more recyclable materials, which require more waste management equipment.

REPORT COVERAGE

The market research report covers a detailed depth analysis of the product type, waste type, and application. It provides information about leading players in the global market and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Waste Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 19.27 billion in 2025.

According to insights, the market is expected to be valued at USD 33.63 billion by 2034.

The global market is estimated to exhibit a remarkable CAGR of 6.70% during the forecast period.

Asia Pacific is expected to grow at the highest CAGR of 5.4% during the forecast period. The regional market size stood at USD 3.03 billion in 2024.

Within the application segment, industrial waste is expected to be the leading segment in the market during the forecast period.

Increasing urban population and growing concern regarding industrial waste recycling are driving the market growth.

Caterpillar Inc, Dover Corporation, Morita Holdings Corporation, Wastequip LLC, Oshkosh Corporation, and JCB are some of the top companies operating in the market.

The waste recycling & sorting equipment segment is expected to drive the market.

Major players constituted approximately 30%-35% of the market, which is majorly owed to their presence in multiple regions and diverse product portfolios.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us