Water Purifier Market Size, Share & Industry Analysis, By Product Type (Point-of-use Filters {Under the Counter Filters, Counter Top Filters, Pitcher Filters, Faucet-mounted Filters, and Others} and Point-of-entry Filters), By Category (RO Filters, UV Filters, Gravity Filters, and Others), By Application (Residential and Light Commercial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

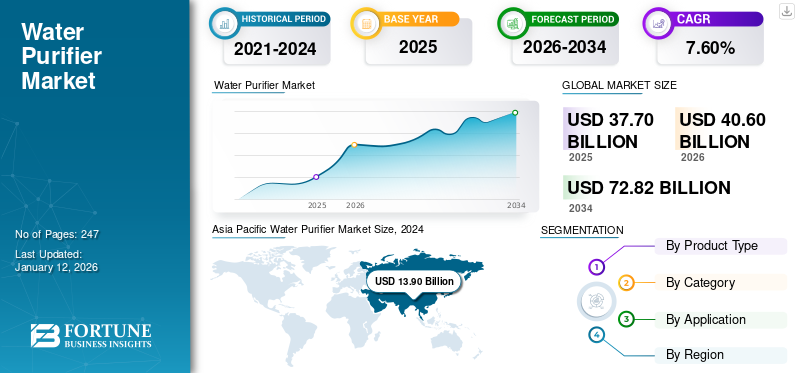

The global water purifier market size was valued at USD 37.7 billion in 2025. The market is projected to grow from USD 40.6 billion in 2026 to USD 72.82 billion by 2034, exhibiting a CAGR of 7.60% during the forecast period. Asia Pacific dominated the water purifier market with a market share of 40% in 2025. Moreover, the water purifier market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 10.63 billion by 2032, driven by the increasing awareness concerning pollution and water-borne diseases.

Water purifiers remove contaminants & sediments from water, kill, or remove biological contaminants, such as microorganisms, including bacteria & viruses, and remove minerals and make water better in taste & smell. They also make the water healthier for drinking and other activities, such as cooking, bathing, and washing. There are mainly two types of water purifiers: point-of-entry or whole-house filter systems and point-of-use systems. The purifiers installed at the point of water entry into buildings are called point-of-entry systems. Those purifiers installed at the endpoint where water is used for consumption are known as point-of-use systems. Installing both point-of-entry and point-of-use filter systems results in complete water purification, from water softening to removing pathogens. The water purification system removes contaminants in the raw water with the help of different technologies, including reverse osmosis, ultra-violet, and gravity-based purification processes.

Disruptions in supply chains during the COVID-19 pandemic significantly affected the market growth. Production slowed down during the initial days of the pandemic. However, with gradual control over the spread of the virus after mid-2020 and the deployment of recovery plans by manufacturers and governments, the market started recovering.

Increasing consumer awareness about the benefits of purified water, coupled with rising consumer expenditure, will drive the market growth across the globe. Major players in the market are focusing on the expansion of their geographical footprint in different regions across the globe and expansion of their product lines. For instance, in 2021, A.O. Smith, a prominent player in the market, launched a new under-the-counter water treatment unit with UV plus silver-activated post-carbon technology in the Indian market.

Global Water Purifier Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 37.7 billion

- 2026 Market Size: USD 40.6 billion

- 2034 Forecast Market Size: USD 72.82billion

- CAGR: 7.60% from 2026–2034

Market Share:

- Asia Pacific dominated the water purifier market with a 40% share in 2025, driven by improving standards of living, rising disposable income, and growing consumer awareness of water safety across China, India, and Southeast Asia.

- By category, RO filters are expected to retain the largest market share in 2025, supported by their high efficiency in removing 99% of contaminants and their rising use in treating hard water.

Key Country Highlights:

- United States: The market is projected to reach USD 10.63 billion by 2032, driven by increasing awareness concerning pollution and water-borne diseases, and strong penetration of water treatment systems.

- China: Demand is driven by rapid industrialization, rising population pressure on potable water, and lack of access to safe tap water, which is boosting household adoption of water purification systems.

- Germany: Market growth is supported by the demand for purified water in food and beverage production, especially alcoholic drinks, and efforts to counteract industrial water pollution.

- Brazil: Market expansion is driven by government initiatives to reduce single-use plastics and rising concern over water contamination due to the mining industry.

- Saudi Arabia: With no freshwater sources and reliance on desalination, the region sees strong demand for advanced water purification systems, supported by high disposable incomes and consumer readiness to invest in health-enhancing technologies.

Water Purifier Market Trends

Technological Innovations for Developing Smart Water Purification Systems is Key Market Trend

Although there are many water filtration technologies available in the market, P-o-U treatment systems are still considered mature and fundamental technologies that aim to remove waterborne contaminants at considerably cheaper costs. Few of the other established technologies used are flocculation & coagulation, filtration, and disinfection. Flocculation & coagulation are typically used for the removal of turbidity in the water, eliminating the ancillary structure for the growth of microorganisms. On the other hand, disinfection and filtration deactivate, destroy, and remove microorganisms from the system to make the water safe for consumption and domestic usage.

However, through R&D, various new technologies are being developed and employed by the manufacturers. Companies, such as Pentair, Brita, and A.O. Smith Corporation are particularly focused on developing new technologies and bringing innovation in P-o-U systems. Over the past few years, P-o-U water treatment systems have undergone remarkable technological improvements. One such emerging and promising technology gaining impetus is capacitive deionization. It is being used as an alternative to conventional membrane separation technologies for the removal of ionic as well as polarizable species from water. This technology has lower operational costs, greater energy efficiency, and considerably lower water rejection.

Download Free sample to learn more about this report.

Water Purifier Market Growth Factors

Increasing Awareness Regarding Pollution & Water-borne Diseases to Fuel Demand for Water Purifiers Globally

With the increasing population, the burden on the available water resources has increased. Water-distributing organizations are working under pressure to ensure the supply of clean, safe water to the citizens. However, the growth in population has also increased the stress on manufacturing industries, which may lead to severe water pollution. Growing urbanization and industrialization have taken a heavy toll on the available water sources owing to the addition of toxic minerals and chemicals. There have been growing instances of outbreaks of water-borne diseases, such as diarrhoea, cholera, typhoid, and campylobacterosis, especially in developing and poor economies in Asia, Latin America, and Africa. In fact, the WHO estimates that around 1.5 million civilian deaths are caused by water-borne diseases every year. Therefore, both the governments and NGOs have expanded their focus on building an infrastructure for the provision of safe water to the public.

The companies operating in the market have also launched advertising campaigns, which showcase the harmful effects of consuming contaminated water and the benefits of water purification. With the high and easy availability of such information, consumers are becoming more aware of these life-threatening diseases and the harmful effects of drinking contaminated water. This is pushing them to install water purification systems inside their homes and workplaces, thus driving the water purifier market growth.

RESTRAINING FACTORS

High Maintenance Cost of Filters to be a Key Challenge for Market Growth

From the point of view of consumers, to keep the quality of the water intact, the filters used in water purification systems need to be replaced from time to time. The replacement criteria for these filters is dependent on the product type and technology used. The key filters and components commonly used in these systems are reverse osmosis membranes and ultraviolet lights. These components are fairly expensive, which can make the consumers reluctant to purchase them. Generally, point-of-use filters need to be replaced between six to twelve months. On the other hand, commercial filters need to be replaced continuously after every production run. Point-of-entry filtration products need servicing between 2-3 years. Therefore, such frequent changes of filters can deter consumers from purchasing P-o-U water treatment systems, thus becoming a key challenge for the growth of the market.

Water Purifier Market Segmentation Analysis

By Product Type Analysis

Point-of-use filters Segment Remained Largest Product Type in 2023 owing to its Use in Lighter Applications

Based on product type, the global market is segmented into point-of-use filters and point-of-entry filters.

The point-of-use filters segment is further divided into countertop filters, under the counter filters, pitcher filters, faucet-mounted filters, and others. Among the two major segments, the point-of-use filters segment held the largest share of 70.52% of the market in 2026. Point-of-use filters are compressed systems and requires less space. The lower volume capacity of these filters makes them suitable for lighter applications. Among point-of-use water filters, countertop filters are major contributors to the revenue of the segment.

The point-of-entry filter segment accounted for a considerable market share in 2023. These water filtration systems are installed at the mainline where water enters the house and are ideal for domestic purposes. Point-of-entry filters are also called as whole-house filters. The water purified through the point-of-entry filters is distributed to the kitchen, washing machine, bathroom, refrigerator, toilet, and other household applications. Point-of-entry filters have higher water treatment capacity and are costlier than point-of-use filters.

By Category Analysis

RO Filters Segment Accounted for the Majority of Market Share Due to Their Relatively Higher Efficiency

Based on category, the market is segmented into RO filters, UV filters, gravity filters, and others.

The RO filters segment held the largest revenue share of 42.86% of the market in 2026. RO water filters remove 99% of the contaminants and are specially used to produce bottled quality water. These filters are witnessing high demand to treat hard water owing to their excellent barrier against harmful minerals. Sometimes, RO filters restrict essential minerals, such as iron, calcium, and magnesium, which can alter the taste of the water.

The gravity filters segment accounted for a significant share of the market. These filters purify water with the help of gravity and do not require electricity.

U.V. filters are witnessing steady demand due to the advantages of simple mechanisms, no use of chemicals, and cost-effectiveness.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Residential Segment to be leading due to Rising Need for Water Purification from Residential Buildings

On the basis of application, the market is segmented into residential and light commercial.

The residential segment accounted for the largest water purifier market with a share of 53.97% in 2026 and is anticipated to retain its position during the forecast period. Water is extensively consumed in residential buildings than the commercial ones. The usage of water for cooking, bathing, washing, and other purposes is anticipated to further rise with increasing residential population, further augmenting the segment’s growth.

The use of water purifiers for light commercial purposes is also anticipated to rise significantly in the future owing to reduction in the use of plastic bottles, along with continuous supply of cost-effective, drinkable, and better tasting water.

REGIONAL INSIGHTS

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Water Purifier Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held the largest share of the global market in 2024. The improving standard of living, along with the rising spending capacity of the population in the region, has resulted in an increased demand for materials and products which offer a simple and healthy lifestyle. One such product family that has gained major traction in the region is that of water purifiers. Many governments in the region have failed to provide pure water for the daily chores of the residents. Hence, consumers have made it a point to include water purification systems in their homes. The increasing population in Asia Pacific has put a strain on the available water resources, such as potable water and boosted the demand for water purifiers in the region. The Japan market is valued at USD 1.58 billion by 2026, the China market is valued at USD 7.82 billion by 2026, and the India market is valued at USD 1.31 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is expected to be a steadily growing market during the forecast period. The regional market’s growth is mainly attributed to the high penetration of water treatment systems among North American consumers. People in the region are significantly aware of the benefits of safe & pure drinking water and thus, have installed water purifiers to ensure the same for their family members. Moreover, the presence of large-scale commercial manufacturers and their well-established distribution networks will fuel the growth of the water purifier market in the region. The U.S. market is valued at USD 7.59 billion by 2026.

Europe

The market in Europe is growing on account of the presence of the lucrative draft alcoholic beverage manufacturing industry. The consumption of alcoholic drinks, such as wine and beer is rising in European nations and has been the key reason behind the demand for these products to purify the water required in the production of these beverages. Also, increasing pollution due to the high concentration of manufacturing industries will boost the demand for RO-based water purifiers to remove toxins and pollutants dissolved in the water. The UK market is valued at USD 2.78 billion by 2026, while the Germany market is valued at USD 3.47 billion by 2026.

Latin America

Two factors are largely driving the market in Latin America. First, the initiative by governments to reduce the usage of single-use plastics has affected the sales of packaged drinking water, and second, the presence of a large mining industry has resulted in the pollution of water in many countries. These two factors have been the key drivers that have shaped the growth of the market in the past.

Middle East

The Middle East is largely dependent on water purification technologies, such as desalination for drinking water as it has no access to freshwater sources. Scanty rainfall and the absence of rivers in the region are the reasons behind this situation. Also, people in these countries have higher spending capacity, which has resulted in them spending considerable amounts of money on water purification products, such as water filters.

List of Key Companies in Water Purifier Market

Key Players to Use Organic and Inorganic Growth Strategies to Maintain Their Market Position

Key players in the market have invested a considerable amount of resources in the research and development of several water purification products and manufacturing technologies. A diversified product portfolio, supported by superior operational efficiency and novel technologies, are the key strategies used by the market leaders for their growth. Companies, such as Pentair PLC, A.O. Smith Co., and Brita have strong and well-established supply chains. New product developments and acquisition of small-scale manufacturers or suppliers are important strategies adopted by leading players to increase their regional presence and stay ahead of the growing competition.

LIST OF KEY COMPANIES PROFILED:

- A. O. Smith Corporation (U.S.)

- Brita LP (U.S.)

- Pentair PLC (U.S.)

- Culligan International Company (U.S.)

- Unilever PLC (U.K.)

- Panasonic Corporation (Japan)

- LG Electronics (South Korea)

- Helen of Troy Limited (U.S.)

- Best Water Technology Group (Austria)

- Kent RO Systems Ltd. (India)

- iSpring Water Systems LLC (U.S.)

- The 3M Company (U.S.)

- Honeywell International Inc. (Switzerland)

- General Electric Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 - Culligan International merged with Waterlogic Group Holding to create ‘Culligan’, a leader in clean and sustainable drinking water solutions.

- August 2022: LG Electronics launched its latest water purifier system, the PuriCare Self-Service Tankless Water Purifier, in the Malaysian market. The newly launched system comes with user-replaceable filters.

- July 2022 - Pentair PLC announced the acquisition of Manitowoc Ice from Welbilt, Inc. The newly acquired company will help Pentair PLC strengthen its commercial water solutions business.

- July 2022 - Brita GmbH selected sustainable Styrenics solutions - Terluran ECO, Styrolution PS ECO, and NAS ECO materials for its water filter jugs portfolio. The move is expected to enable the company to reduce its carbon footprint significantly.

- June 2022- A.O. Smith Corporation announced that it had acquired Florida-based water treatment firm, Atlantic Filter. The move is anticipated to enable the company to expand its presence in Florida and beyond.

REPORT COVERAGE

The water purifier market report provides a detailed analysis of the water purification industry and focuses on key aspects, such as leading companies, product types, categories, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years. The competitive landscape section covers the detailed profiling of leading key players operating in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Category

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global size was valued at USD 37.7 billion in 2025 and is projected to reach USD 72.82 billion by 2034.

Recording a CAGR of 7.60%, the market will exhibit significant growth during the forecast period.

The point-of-use filter segment was the leading segment in this market in 2025.

Multiple benefits associated with using water purification systems is the key factor driving the market.

Asia Pacific held the highest market share in 2025.

Key players operating in the market are A. O. Smith Corporation, Brita LP, Pentair PLC, Culligan International Company, Panasonic Corporation, Helen of Troy Limited, General Electric Company, and Eureka Forbes Ltd. among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us