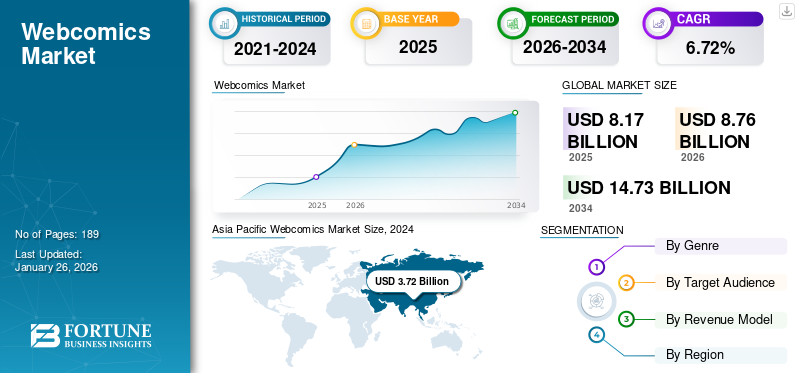

Webcomics Market Size, Share & Industry Analysis, By Genre (Action, Comedy, Sci-Fi, Horror, Romance, and Others), By Target Audience (Kids and Adults), By Revenue Model (Subscription-based and Ad-based), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global webcomics market size was valued at USD 8.17 billion in 2025. The market is projected to be worth USD 8.76 billion in 2026 and reach USD 14.73 billion by 2034, exhibiting a CAGR of 6.72% during the forecast period. Asia Pacific dominated the webcomics market with a market share of 48.69% in 2025.

Webcomics (digital or electronic comic books) are comics created for online publishing on a website or mobile applications. Digital comic books are created using various art software such as Adobe Illustrator.

Global Webcomics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 8.17 billion

- 2026 Market Size: USD 8.76 billion

- 2034 Forecast Market Size: USD 14.73 billion

- CAGR: 6.72% from 2026–2034

Market Share:

- Asia Pacific led the webcomics market with a 48.69% share in 2025, driven by strong demand in Japan, South Korea, and Southeast Asia, fueled by anime and mobile comic platforms.

- By genre, action held the largest share, while romance is growing rapidly among women and teen readers.

- By model, subscription platforms are preferred for access to diverse content.

Key Country Highlights:

- Japan: A global hub for anime-style webcomics; mobile-first content thrives.

- United States: Growth driven by digital access and comic-to-TV adaptations.

- South Korea: Government support and global expansion of Webtoon platforms.

- India: Rising digital comic use, with local stories and Bollywood themes.

- France & Germany: Expanding digital readership and localization.

- United Kingdom: Growth in digital comic access through schools and libraries.

There has been a significant rise in digital comic book platforms worldwide in recent years. The major players are expanding their presence by launching apps for digital comics owing to increasing digitization worldwide. New launches are expected to increase the availability and adoption of electronic comic books among consumers in the coming years. For instance, in February 2022, Byte Dance, an internet technology company, launched its new comic app, Fizzo Toon, in Japan and invested USD 42 million in KidariStudio, a web novel and webtoon creator. The content partnership agreement is poised to strengthen webtoon operations in China, and ByteDance is expected to get the intellectual property of around 1300 webtoons.

In May 2021, Black Sands Entertainment, a publisher and media company, launched the Black Sands Publishing app, a digital comic platform. According to the company, the application offers various digital comic series created by about 16 independent publishers and artists and Black Sands.

In March 2021, Graphics India, an Indian superheroes and comics creator, launched a new subsidiary, TOONSUTRA. The new Webtoon comic platform is free for mobile devices on both Android and iOS devices, exclusively for India. It features genres such as Bollywood, romance, fantasy, mythology, and superheroes.

The sudden outbreak of the COVID-19 pandemic affected the traditional comic book market throughout 2020 and 2021, given the temporary and permanent closure of physical retail outlets.

Despite the impact of the pandemic and supply chain disruptions in the global physical comic book industry, the demand for digital comics increased during the lockdown in 2020 as individuals across countries turned to reading comics online during their extended free time and to reduce boredom through reading. Several players in this market focused on launching digital comics to cater to growing demand owing to the closure of comic book stores in 2020. For instance,

- In June 2020, Bakarmax, an India-based animation and comic studio, announced the launch of Karejwa, its new webcomic, illustrated by Ankit Kapoor and written by Varun Grover.

- In June 2020, DC Entertainment, a U.S.-based entertainment company, collaborated with HBO Max, a Warner Bros subsidiary, to launch a new original digital comic book series, To the Max, with three new superheroes.

Webcomics Market Trends

Increasing Adaptation of Digital Comic Books into Movies, Series, and Games to Drive Product Demand

The rising adaptation of comics into popular television series, movie franchises, and video games into comics has emerged as a key trend within the global digital comic industry. The popularity of movies and games introduces new audiences to digital comic books, contributing significantly to the growth of the global webcomics market. Moreover, several players focus on partnerships with animation studios to boost product demand. The partnerships allow companies to integrate their famous characters and create new exciting plots, increasing fan curiosity and positively influencing the global webcomics market trends. For instance,

- In March 2023, Webtoon, a digital comic platform, partnered with Line Studio, a game developer, to launch a new mobile game, True Beauty, based on the digital comic True Beauty.

- In August 2022, Dark Horse Media, a U.S.-based comic book publisher, extended its partnership with Netflix, a U.S.-based media company. The company will continue to provide a first look at its IP for both films and series to Netflix. The company has launched multiple projects with Netflix. The popularity of comics is growing immensely due to the adaptation of dark horse comics in Netflix series and movies.

- In August 2022, IDW Media Holdings, a U.S.-based media company, partnered with Anima, an animation studio in Latin America, to develop and produce an adult animated television series based on IDW Publishing's brutal nature comic books.

Download Free sample to learn more about this report.

Webcomics Market Growth Factors

Increasing Popularity of Non-fungible Tokens Comics to Favor Market Expansion

Non-Fungible Tokens comics allow fans, creators, and readers to engage creatively, boosting the demand for electronic comic books. The increasing availability of digital NFT comics has the same collectable value as physical editions, increasing demand from comic collectors and boosting market growth. Several prominent players focus on launching new NFT comics to boost their product sales. For instance,

- In October 2022, DC Entertainment, a U.S.-based entertainment company, launched a new collection of NFT digital comics, DC Collectible Comics (DC3). The new collection is available in two categories: Legacy (collection of classic comics) and Modern (collection of latest releases). The DC3 certificate is assigned to five rarity levels: uncommon, common, epic, legendary, and rare.

- In May 2022, Marvel, in partnership with VeVe, a digital collectibles app, launched a digital NFT limited edition comic, Amazing Spider-Man, with 30,000 comics. The comics are distributed among different rarity levels, such as secret-rare, uncommon, rare, ultra-rare, and common.

Rising Government Support to Fuel Market Growth

Digital comic books are becoming popular for children to educate and communicate with fun. Governments worldwide are also promoting comic books as a great and fun way of learning among children. The increasing government initiatives and institutions' increasing need for more digital content to engage students are boosting the product demand among parents and children. For instance,

- In January 2024, the South Korean government announced plans to open a webtoon-dedicated school by 2027. The government also announced its ambition to help the South Korean webtoon market grow by USD 1 billion by 2027.

- In March 2022, OverDrive Education, a digital distributor of eBooks and audiobooks, announced its new offering of digital comics to schools via its Sora student reading app. Schools can purchase cost-effective, age-appropriate bundles of around 1,500 digital comic books from popular publishers such as Marvel, Dark Horse, and Image Comics. According to the company, the app is available in more than 53,000 schools worldwide.

- In March 2021, the Union Education Minister of India launched around 100 comic books aligned with NCERT textbooks across grades 3 to 12. The comics are accessible online on the DIKSHA app or web portal.

RESTRAINING FACTORS

Increasing Availability of Substitute Products May Impede Market Growth

The increasing availability of substitutes such as digital non-fiction and digital fiction books limits market growth. Audiobooks have become more prevalent in recent years, and the lockdown in 2020 has only increased the demand for audiobooks. The ease of accessibility for disabled and non-English speaking consumer groups is increasing the demand for audiobooks. Unlike fiction and non-fiction, comics are not available in audio format, hampering the global webcomics market share. With increasing preference and popularity for audiobooks, audiobook platforms are introducing new formats and expanding their libraries. For instance,

- In September 2022, Spotify, an audio streaming company, launched its new audiobook business with a library of 3, 00,000 titles to purchase and listen to the U.S. consumers.

- In November 2022, Spotify, an audio streaming company, announced the expansion of 3, 00,000 audiobooks available in the U.K., Ireland, Australia, and New Zealand for listening and purchase.

Webcomics Market Segmentation Analysis

By Genre Analysis

Action Segment Dominates Due to Increasing Popularity and Demand for Superheroes Webcomics

The Action segment will account for 34.47% market share in 2026. Based on genre, the market is segmented into action, comedy, sci-fi, horror, romance, and others. The action segment held a major market share in 2024 owing to the significant demand for superhero digital comic books across countries. Several prominent players focus on launching new action electronic comic books. For instance, in April 2022, Valiant Entertainment partnered with Blackstone Publishing to debut a new line of adult novels featuring beloved Valiant characters. The new line includes iconic heroes and villain characters from the valiant universe, such as Livewire, Eternal Warrior, and Shadowman.

The romance segment is expected to witness significant growth during the forecast period due to the increasing popularity of romantic graphic novels among women and teenagers. The increasing popularity of romantic digital comic books with plots of marriage, divorce, lust, jealousy, teen break up and betrayal, and, of course, teen heartbreak coupled with the emerging trend of LGBTQ romance stories are driving the segment growth. Recent years have witnessed industry stakeholders launch new comics to cater to the increasing demand for romance webcomics. For instance, in January 2023, Webtoon, a South Korea-based comics platform, announced the expansion of its intellectual property comics collection with the adaptation of various web novels, including Chasing Red and Float.

To know how our report can help streamline your business, Speak to Analyst

By Target Audience Analysis

Adults Segment Leads Due to Wide Availability of Digital Comic Books for Adults

The global market is segmented into adults and kids by target audience. The adult The adults segment will account for 73.63% market share in 2026, due to the wide availability of adult digital comic books, revisiting their long-lasting imagination and easing stress. The adults have hobbies of collecting comics owing to independence and the ability to buy expensive and specialized comic books. The collectors buy new and rare comics and preserve them to resell to gain monetary profits.

The kids segment is also expected to grow significantly during the forecast period owing to the need for improving reading skills and entertainment purposes and the growing popularity of cartoons. Furthermore, children are shifting to digital comic books due to the prevalence of digital devices and the internet. Numerous players in the market are focusing on expanding into the kids segment owing to increasing demand for kids’ electronic comic books. For instance,

- In February 2023, Marvel Entertainment, in collaboration with StoryToys, a subsidiary of Team17 Group plc, announced the launch of the new Marvel HQ app, designed for families and kids. The new app is designed for kids aged 4 to 7, containing fun and age-appropriate games, videos, and electronic comic books across the Marvel Universe.

- In August 2022, Mad Cave Studios, a Miami-based graphic novel publisher, acquired Papercutz, a kid’s graphic novel publisher. The acquisition includes famed licensed properties such as The Smurfs, Casagrandes, Geronimo Stilton, and Loud House.

By Revenue Model Analysis

Subscription-based Segment Fosters Growth Due to its Increasing Consumer Preference Owing to a Wide Range of Comics

By revenue model, the market is divided into subscription-based and ad-based. The subscription-based segment is expected to account for 65.41% of the market in 2026. In this model, consumers pay a monthly subscription fee and get access to all the comics during that period. The accessibility to a wide range of electronic comic books, monthly payments, and convenience drive the demand for a subscription-based model. Industry participants are focusing on expanding their portfolio across subscription models. For instance, in July 2023, Manta, a South Korean subscription-based digital comics platform, announced the launch of 10 new exclusive comic series. Furthermore, the ad-based segment is expected to grow steadily during the forecast period.

REGIONAL INSIGHTS

The global market is analyzed across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Webcomics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the market with a valuation of USD 4 billion in 2025 and USD 4.3 billion in 2026. The presence of many comic book publishers, the rising population, and increasing internet penetration are key factors driving regional growth. The flourishing growth of the anime industry in Japan among international and domestic consumers has further boosted regional growth. Major industry participants are focusing on partnerships to expand their reach and diversify their portfolios. For instance, in June 2022, Rakuten Group, Inc., a Japan-based technology conglomerate, partnered with Toon Cracker Co., Ltd., a Japan-based online comics publisher, to produce original vertically scrolling full-color digital comics for the smartphone business. The Japan market is projected to reach USD 3.59 billion by 2026, the China market is projected to reach USD 0.18 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

North America’s market size and growth are driven by the presence of prominent players such as Marvel & DC Entertainment, increasing usage of smart devices, notably mobile phones, and an increase in disposable income. At a macro level, the increasing social media usage across countries encourages industry participants to target individuals through advertisements and marketing efforts. Several key players are focusing on expansions owing to the increasing demand for electronic comic books across domestic markets. For instance, in May 2020, Kakao Entertainment, a Korea-based leading provider of mobile content platforms, announced the merger of Tapas Media and Radish Media, its North American subsidiaries, creating a digital publishing platform with over 100,000 creators and 100,000 stories. According to the company, the merger will expand Kakao Entertainment's global IP value chain in North America.

The U.S. market is projected to reach USD 1.93 billion by 2026.

Europe market is expected to grow significantly during the forecast period owing to increasing disposable income, a surge in digital publishing, and the wide availability of electronic comic books in regional languages. Various players focus on expanding in this region owing to increasing demand for more quality digital content. The UK market is projected to reach USD 0.09878 billion by 2026, while the Germany market is projected to reach USD 0.21137 billion by 2026. For instance,

- In March 2022, WEBTOON, a digital comic platform, announced the establishment of a new European corporation, expanding its regional presence. The new WEBTOON European Corporation will be based in France. According to the company, it plans to add around 100 new series in German and 200 new series in French.

- In April 2021, StreetLib, an E-book publishing platform, partnered with Izneo, a European digital comic book platform, to distribute digital comics and manga in Italy.

Key Industry Players

Key Players Focus on Product Launches and Partnerships to Stay Competitive

Key industry participants adopt various competitive strategies, such as launching new products and partnerships, in the intensely competitive landscape. For instance, in February 2023, Archie Comics, a comic book publisher, announced a collaboration with WEBTOON, a digital comic platform, to bring webcomics Archie Comics: Big Ethel Energy return with new episodes exclusively on WEBTOON.

List of Top Webcomics Companies:

- Marvel Entertainment, LLC (U.S.)

- Dark Horse Media, LLC (U.S.)

- Image Comics (U.S.)

- DC Entertainment (U.S.)

- IDW Media Holdings, Inc. (U.S.)

- Lion Forge(U.S.)

- Shueisha (Japan)

- Shogakukan ( Japan)

- Kadokawa Future Publishing (Japan)

- Lezhin Entertainment (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Rakuten Group, Inc., a Japan-based technology conglomerate, launched its new digital comic book distribution service, R-Toon.

- July 2022: Image Comics, a U.S.-based comic publisher, announced the launch of a new fantasy-adventure comic, Kaya, by Wes Craig.

- May 2022: DC Entertainment, a U.S.-based entertainment company, announced the launch of a new slate of digital comics, Red Hood: Outlaws and Zatanna & the Reaper, through Webtoon, a digital comic platform.

- May 2022: DC Entertainment, a U.S.-based entertainment company, launched a new comic, Vixen: NYC, in partnership with Webtoon, a digital comic platform.

- March 2022: Warner Bros., a film and entertainment studio, partnered with Cartamundi Group to create the world's first-ever hybrid collection of six million DC Comics-inspired trading cards packaged with redeemable Non-Fungible Tokens (NFTs). The cards featured 155 different superheroes and NFTs minted on the Ethereum sidechain Immutable X. According to the company, the launch highlights the company's efforts in bringing a new hybrid of physical and digital fan engagement and introducing its comics to new audiences.

- September 2021: Marvel Entertainment, LLC, a U.S.-based comic book publisher, focused on going digital and started with Marvel Universe Unlimited. The user can access over 30,000 digital comics with new exclusive stories, additional discounts on merchandise, and access to Marvel events.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, material analysis, categorization, leading applications of the product, and key distribution channels. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.72% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Genre

|

|

By Target Audience

|

|

|

By Revenue Model

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 8.17 billion in 2026.

The market is expected to record a CAGR of 6.72% over the forecast period of 2026-2034.

Based on genre, the action segment accounted for a major market share in 2024 due to the rising consumer preference for superhero comics.

The increasing popularity of non-fungible token comics is expected to drive market growth.

Some of the top players in the market are Marvel Entertainment, LLC (U.S.), Dark Horse Media, LLC (U.S.), Image Comics (U.S.), DC Entertainment (U.S.), and IDW Media Holdings, Inc. (U.S.).

The Asia Pacific market for webcomics dominated in terms of product sales in 2025.

The increasing availability of substitute products is expected to restrain webcomics deployment globally throughout the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us