Window Film Market Size, Share & Industry Analysis, By Type (Sun Control Film, Decorative Film, Safety & Security Film, Privacy Film, and Others), By Application (Automotive, Building & Construction, Marine, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

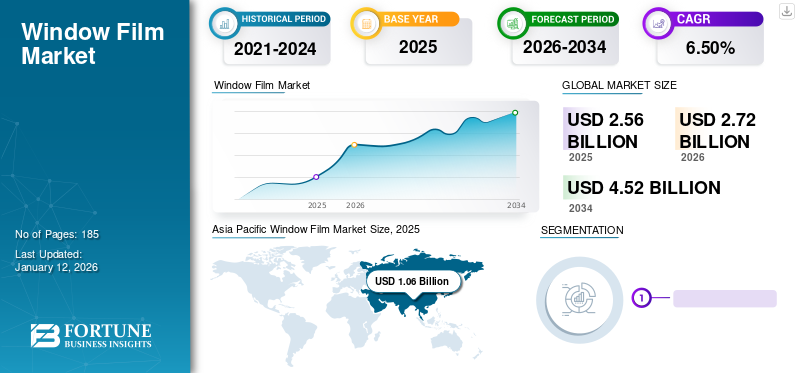

The global window film market size was valued at USD 2.56 billion in 2025 and is projected to grow from USD 2.72 billion in 2026 to USD 4.52 billion by 2034, exhibiting a CAGR of 6.50% during the forecast period. Asia Pacific dominated the window film market with a market share of 42% in 2025. Moreover, the window film market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.04 billion by 2032.

Window films are thin, strong sheets of polymer material laminates that are processed in several ways to enhance the general look, aesthetic appeal, or performance of the window when applied. Window films are widely used in building and construction and automotive industries for preventing harmful solar radiation and enhancing aesthetic appeal. Advancements in technology have been game-changers for manufacturers in the window film industry. The introduction of innovative films with improved color and shades to match the aesthetic requirements of the customers will expedite the industry's growth. Leading companies are strategically acquiring small-scale players to expand their product portfolio & global distribution network. For instance, in September 2021, Eastman Chemical Company announced plans to acquire Matrix Films LLC. With this acquisition, Eastman is looking to expand its consumer base & expertise in North America, the Middle East & European market for window & paint protection films.

The automotive & construction industry faced many challenges during the COVID-19 pandemic. The deteriorated demand for cars during the lockdown lowered the adoption of films in the automotive industry. Moreover, the production units were negatively impacted owing to a lack of manpower and interruption in the overall supply chain. However, with the implementation of resilient business continuity plans and significant control of the spread of the pandemic, the market recovered slowly with the recovery of the automotive & construction industry.

GLOBAL WINDOW FILM MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 2.56 billion

- 2026 Market Size: USD 2.72 billion

- 2034 Forecast Market Size: USD 4.52 billion

- CAGR: 6.50% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2025 with a 42% share, growing from USD 1.06 billion in 2025 to USD 1.14 billion in 2026.

- By type, sun control film led the market due to its ability to reduce solar heat gain and energy use.

- By application, building & construction is projected to exhibit the fastest CAGR, driven by rising demand for energy-efficient and UV-protective films.

- The marine segment is expected to hold a 7.3% market share in 2024.

Key Country Highlights:

- China & India: Rapid construction activities and infrastructure growth are boosting demand for window films.

- United States: Market projected to reach USD 1.04 billion by 2032 due to strong automotive aftermarket and retrofitting in construction.

- Germany: Adoption of automotive films and energy regulations support steady market expansion.

- Brazil: Key automotive production hub; new energy efficiency codes to boost construction film demand.

- Middle East & Africa: Growth led by increasing automotive film adoption and expanding construction sector.

Window Film Market Trends

Use of Protective Films in the Automotive Industry is a Key Trend in the Market

Window films for automotive applications have become one of the top aftermarket products in the industry. According to the Auto Care Association, there have been more than 500,000 independent U.S.-based manufacturers, part stores, repair shops, and distributors. The demand for automotive protective films is rising due to the increase in the number of accidents, as direct sunlight can damage passengers’ skin, and high temperatures can lead to system failure. Moreover, films solve numerous problems of drivers, which include bright sunlight, shining windows, and heat that fades or cracks the interior. Asia Pacific witnessed a window film market growth from 1.06 billion in 2025 to USD 1.14 billion in 2026.

Download Free sample to learn more about this report.

Window Film Market Growth Factors

Growing Demand for Energy-Efficient Buildings to Drive Market Growth

The rising importance of energy consumption is a vital factor that is expected to drive market growth during the forecast period. The demand for energy-efficient buildings is increasing owing to the limited resource availability and extensive environmental effects, including climatic changes and global warming. Buildings consume a significant amount of energy that adds extra CO2 to the atmosphere. A study conducted by the University of West London in the U.K. has revealed that buildings emitting CO2 emissions account for at least 43% of the total emissions, and of which window facade systems account for 60% of the building energy losses. Further, the study suggests that the usage of solar control films decreases cooling energy consumption by 35% annually and a 2% increase in the cost of annual heating energy. Moreover, window films are also called E-films as they save energy.

Additionally, the increasing demand for films in the building & construction industry is also expected to drive market growth. An increase in window tinting activities, coupled with stringent government regulations for green & energy-efficient buildings, is expected to drive the market.

Growing Demand from the Automotive Industry to Fuel Market Growth

The automotive industry’s growing demand for window films is propelling market growth due to several factors. Firstly, window films enhance vehicle aesthetics and provide privacy, appealing to the consumer seeking customization and comfort. Additionally, they offer UV protection, reducing interior fading and heat buildup, thus improving the driving experience and prolonging vehicle lifespan.

Moreover, increasing awareness about the health risks associated with prolonged sun exposure while driving a vehicle boosts product adoption for their sun-blocking properties. Furthermore, advancements in technology have led to the development of high-performance films with features, such as infrared rejection and glare reduction, further driving demand. As regulations on vehicle tinting become more standardized and stringent, the market for automotive films continues to expand to meet both consumer preferences and legal requirements.

RESTRAINING FACTORS

Recurrent Change in Regulations to Confine Market Growth

The industry has been constantly in changing phases due to the adoption of new technologies. Different countries and states have various rules and policies. Hence, this exerts massive pressure on the manufacturers as they have to alter the manufacturing process in order to meet varying requirements. For instance, in 2017, New York implemented a new law testing the vehicle’s window tint during its annual inspection. If the car registers tints more than 70%, the vehicle will fail the inspection and will be penalized. Moreover, in emerging countries, such as India, vehicle laws are also getting stricter. According to the Motor Vehicles Act, the front and rear windshield should be over 70% VLT (Visual Light Transmission), which means no more than 20% tinting is permissible as per laws. This confines the market growth with strict and varying norms.

Window Film Market Segmentation Analysis

By Type

Sun Control Film Segment Dominates owing to its Higher Adoption to Reduce Sun Light

The market is segmented by type into sun control film, decorative film, safety and security film, privacy film, and others.

Sun control film segment held the largest window film market share 51.47% in 2025. Sun control films reduce heat transfer from outside, provide comfort, and save energy, along with protecting homes and offices. Sun control offers a solution to problems such as glare, fading, and the amount spent on the air conditioner. It protects and extends the life of furnishing and also protects the human skin from harmful UV rays of the sun. Usually, it cuts down 78% of the heat coming from the sun through windows and hence controls the number of units consumed by air conditioners. Conversely, it also prevents heat loss by reflecting 35% hof eat in the room.

Decorative films are the most commonly used films to enhance the look of windows. They are usually used in interiors, such as partitions, balconies, doors, glasses, and windows. Decorative films give windows a beautiful look by reducing visibility through the glass. They are durable and removable, which makes changing design convenient.

By Application

To know how our report can help streamline your business, Speak to Analyst

Building & Construction Segment to Exhibit the Fastest CAGR Due to Increasing Consumer Preference for Films

Based on application, the market is segmented into automotive, building & construction, marine, and others. The building & construction segment is further bifurcated into residential and commercial.

The building & construction segment is expected to grow at the fastest CAGR during the forecast period. In the building & construction application, the films are used for commercial and residential spaces. In most commercial and residential spaces, decorative, solar, security, and specialty films are preferred. The demand for window films from building & construction applications is increasing owing to their properties, such as protection against UV rays, anti-glare, durability, lightweight, and energy conservation.

- The marine segment is expected to hold a 7.3% share in 2024.

Films also have prominent applications in the automotive sector contributing 55.51% globally in 2026. The increase in concern for safety, privacy, and security drives the market for automotive films. Furthermore, the rise in demand for electric vehicles and the emerging government regulations in major countries such as the U.S. and Germany will aid market growth in the automotive industry.

REGIONAL WINDOW FILM MARKET ANALYSIS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Window Film Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 1.06 billion in 2025 and USD 1.14 billion in 2026. owing to the rising demand from the building and construction industry. The rise in building activities, such as hospitals, schools, banks, and colleges, is leading to market growth. China and India have been witnessing rapid improvement in terms of infrastructural developments, supported by the current government. Hence, Asia Pacific is expected to witness the highest growth in the market. In Asia Pacific, the marine segment is estimated to hold a 7.1% market share in 2024. The China market is projected to reach USD 0.63 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is expected to hold a significant share of 29% in 2026. The demand for sun control film is highest in this region to reduce the penetration of sunlight in vehicles. The U.S. is the leading consumer due to its well-established construction market and high presence of manufacturers. Also, window retrofitting activities in the U.S. are expected to drive 0.72% in 2026.

Europe

Europe is projected to witness significant growth 0.7% in 2026. The increasing demand for automotive films, glass façades, and curtain walls is expected to drive the market.

Latin America and Middle East & Africa

Brazil is expected to dominate the market in Latin America as the most prominent automotive manufacturers, such as Fiat Chrysler Automobiles NV, General Motors Co., and Ford Motor Co., are present in this region. Furthermore, the new energy-efficient code for commercial and public service buildings for energy conservation by the Brazilian government is expected to boost the window film market growth.

The Middle East & Africa would showcase inclining growth size 0.06 billion in 2026, due to the high production and consumption in the automotive industry in this region.

List of Key Companies in the Window Film Market

Key Market Players to Strengthen Position by Offering Innovative Film Solutions

The major solar control & other film producers are located in North America and Asia Pacific, leading to a fragmented market. The producers located in North America and Europe are aiming to increase their presence in various countries in the Asia Pacific to strengthen their position in the market and drive business growth of their respective organizations. Over the years, leading companies such as 3M, Eastman, Toray, and others have considerably invested in the Asia Pacific region in terms of research centers, new product launches, manufacturing units, sales offices, and other valuable resources. Established players in the market are also looking for opportunities to expand their business in the Middle East & Africa region.

LIST OF KEY COMPANIES PROFILED:

- 3M Company (U.S.)

- Eastman Chemical Company (U.S.)

- American Standard Window Film (U.S.)

- Madico Inc. (U.S.)

- Hanita Coatings (Israel)

- SAINT-GOBAIN (France)

- Toray Plastics (America) Inc. (U.S.)

- Armolan Window Film (U.S.)

- Reflectiv (France)

- Solar Screen International SA (Luxembourg)

KEY INDUSTRY DEVELOPMENTS:

- April 2022: Avery Dennison launched an all-new Dusted Crystal decorative architectural window film. The film has a unique, first-to-market wet-apply quick-release adhesive that allows it to be adjusted during installation and readily removed after drying, leaving almost little trace on the glass. This launch will help the company to serve its products in schools, corporate meeting spaces, hospitality reception areas, medical offices, and glass partition applications.

- January 2021 - American Window Film collaborated with 3M Authorized Film dealers to install 3M safety and security films on glass doors and windows of school districts. The company is aiming to secure the most precious resource of the nation with the help of 3M security films.

- August 2020 - Madico Inc., one of the world's largest manufacturers of groundbreaking window film, coating, metalizing, and laminate quick fixes, confirmed a company restructuring to increase product innovation in the film and specialty solutions divisions.

REPORT COVERAGE

The market research report provides qualitative and quantitative insights into the market and a detailed analysis of the market size & growth rate for all possible segments that exist in the market. The global market is segmented by type, application, and geography. Also, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the regional market's growth over recent years.

The report also elaborates on the market dynamics and competitive landscape. Various key insights presented in the report include price trend analysis, recent industry developments in this market, the regulatory scenario in crucial countries, macro and microeconomic factors, SWOT analysis, supply chain analysis, key industry trends, competitive landscape, and company profiles.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.50% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Thousand Square Meter) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 2.56 billion in 2025 and is projected to reach USD 4.52 billion by 2034.

The market will be growing at a CAGR of 6.50% in the forecast period.

By type, the sun control films segment is expected to lead the market during the forecast period.

Increasing demand from residential and commercial applications is driving market growth.

Asia Pacific dominated the window film market with a market share of 42% in 2025.

3M, Eastman Chemical Company, Toray, Madico Inc., and Solar Gard Performance Plastics are a few of the key players operating in the market

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us