Wound Closure Market Size, Share & Industry Analysis, By Product Type (Sutures [Absorbable and Non-absorbable], Hemostatic Agents [Active Hemostats, Passive Hemostats, Combination Hemostats, and Others], Staplers [Powered and Manual], and Others), By Application (Orthopedics, Gynecology and Obstetrics, General Surgery, Ophthalmology, Cardiology, and Others), By End-User (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

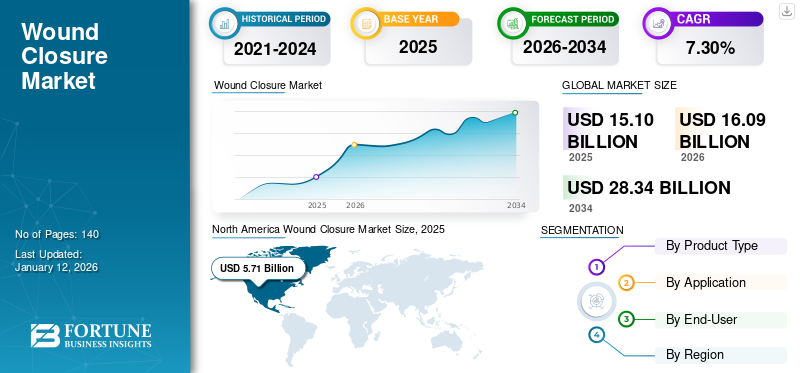

The global wound closure market size was valued at USD 15.10 billion in 2025. The market is projected to grow from USD 16.09 billion in 2026 to USD 28.34 billion by 2034, exhibiting a CAGR of 7.30% during the forecast period. North America dominated the wound closure market with a market share of 37.80% in 2025.

Wound closure is one of the essential parts of emergency medicine, which refers to the techniques used to close a wound, including sutures, staplers, hemostats, and others. It is the final step of surgical intervention among patients. The rising number of surgical procedures for cardiovascular, gynecological, and orthopedic conditions drives the demand for wound closure products.

- As per the data provided by the Journal of Orthopedic Case Reports in July 2024, the total number of joint replacements increased from 16,308 in 2020 to 17,440 in 2021 in India.

The market consists of key players, such as Johnson & Johnson Services, Inc., Baxter, Medtronic, B. Braun SE, and Pfizer, Inc. These companies are increasingly implementing growth strategies such as new product launches, acquisitions, and expanding geographical reach to consolidate their presence in the global and regional markets.

MARKET DYNAMICS

Market Drivers

Growing Prevalence of Chronic Conditions to Support Market Growth

The growing prevalence of chronic diseases, such as cardiovascular disorders, orthopedic disorders, among others, is resulting in a rising number of patient admissions in healthcare settings. The increasing number of patient hospitalizations further increases the number of surgical procedures. This increases the demand for advanced wound closure products to treat chronic diseases, and is subsequently driving the wound closure market growth.

- As per data provided by Statistics Portugal in February 2025, around 42.3% of people aged 16 and above had a chronic disease or long-standing health problem in 2024 in Portugal.

- As per data provided by Arthritis Australia in October 2024, around 4.1 million Australians will suffer from arthritis by the end of 2025. This number is expected to increase to 5.4 million by the end of 2040.

Similarly, the increasing aging population is posing a major concern as these people are highly prone to chronic conditions. The surging age-associated chronic conditions further augment the number of surgical procedures globally.

- For instance, as per data provided by the World Health Organization (WHO) in October 2024, the population aged 60 years and over will increase from 1.00 billion in 2020 to 1.40 billion in 2030. Further, by the end of 2050, the population of people aged 60 years and older at the global level will reach 2.1 billion.

Furthermore, there is a rise in the number of accidents and trauma cases, resulting in severe and chronic wounds, which may require immediate medical intervention among these patients. The growing rate of traumatic injuries is also likely to result in the rising number of surgical procedures among these patients, which is further anticipated to boost market growth during the forecast period.

Market Restraints

High Costs of Advanced Wound Closing Devices Could Limit Their Adoption

The continuous technological advancements and associated R&D expenses of wound closure devices significantly drive their costs. This increasing pricing further limits their adoption rate, especially in emerging countries such as China, Poland, and Brazil. The high cost of these products is leading to their inaccessibility among the broader patient population.

- For instance, according to Medical ecart, manual surgical stapler costs range from USD 2,000 to USD 4,000. Similarly, the cost of powered staplers ranges from USD 4,000 to USD 8,000.

- Similarly, a study published by Springer Nature in December 2023 reported that the average cost per patient in the powered stapler group was between USD 6,720 - 6,760 in the study in Spain.

In addition, the lack of proper, adequate reimbursement policies for surgical procedures for chronic conditions such as cardiovascular disorders, gynecological disorders, and others among the majority of the emerging countries makes it difficult for the population to undergo treatment due to financial burden. Patients in low and middle-income countries (LMICs), including Southeast Asian countries and African countries, among others, find it challenging to afford these surgical procedures.

Thus, the inadequate reimbursement and high cost of wound closing devices may limit the adoption of these products and hamper the market growth.

Market Opportunities

Rising Focus on Regulatory Guidelines for Wound Closure Products Creates New Growth Opportunities

Regulatory bodies, including the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA), require extensive testing and documentation to ensure the safety and efficacy of medical devices, including sutures and staplers.

Furthermore, due to the limited number of approved products, such as sutures, hemostats, and staplers for wound closure, the market players are initiating clinical studies to develop innovative products for surgical procedures.

- For instance, in February 2024, Johnson & Johnson Services, Inc., announced the publication of two studies in the Journal of Arthroplasty on the best practice approaches to wound closure and dressing management in total knee arthroplasty (TKA) and total hip arthroplasty (THA).

Furthermore, market players are emphasizing receiving regulatory approvals to launch novel skin closure devices in the global market.

- For example, in November 2023, Johnson & Johnson Services, Inc., received the CE mark approval for ETHIZIA, an adjunctive hemostat solution clinically proven to achieve sustained hemostasis in difficult-to-control bleeding scenarios involving internal organs.

These regulatory approvals and increasing demand for advanced wound closing technologies, particularly in treating chronic conditions such as short bowel syndrome, chronic pulmonary diseases, and hernias, among others, create a new opportunity for market growth.

Market Challenges

Increasing Number of Product Recalls is a Major Market Challenge

The increasing number of recalls for wound closure products is a significant market challenge, affecting manufacturers' credibility, patients' safety, and market growth.

Product recalls commonly occur due to contamination, damaged products, labelling errors, and quality control issues, which compromise clinical outcomes and patient trust. The factors mentioned above affect the market growth.

- For instance, in April 2024, the Sultanate of Oman Ministry of Health Drug Safety Center, Muscat, announced a recall of the non-biodegradable surgical stapler, Tri-Staple M 2.0 black reinforced intelligent reload, manufactured by Covidien LLC. The reason for the product recall was the damaged cartridge, which had the potential to cause severe complications during the surgery.

- In May 2022, Covidien LLC initiated the voluntary Class II device recall for the EEA Autosuture Circular Stapler with DST Series Technology. Due to the hampered product quality, the manufacturer recalled the lot.

Therefore, increasing product recalls in wound closing devices creates a significant operational and reputational challenge, raising concerns about product reliability and safety among healthcare providers and limiting market growth.

Wound Closure Market Trends

Preferential Shift from Traditional to Advanced Wound Closure Solutions is a Key Market Trend

There is an increasing preferential shift toward modern techniques due to several shortcomings associated with traditional techniques, such as inefficient wound closure and a higher risk of post-operative infections. Due to these complications, the surgeons are adopting modern solutions that offer improved precision and better patient outcomes. In addition, there is a growing demand for bioresorbable sutures, antibacterial adhesives, and hydrocolloid-based wound sealants that promote quicker healing and reduce the risk of infection.

In response to this, market players are actively involved in R&D activities to develop and launch staplers, hemostats, and other products in the global market.

- For example, in May 2024, Johnson & Johnson Services, Inc., launched the ECHELON LINEAR Cutter in the U.S. market. This device features 3D-Stapling and gripping surface technology (GST) to enable greater staple line security, reduce surgical risks, and improve patient outcomes. Adopting such advanced products contributes to more reliable and efficient wound closure practices globally.

Furthermore, the penetration rate for modern sutures, hemostats, staplers, and others is higher among patients in developed countries such as the U.S., the U.K., Germany, Japan, and others. The ongoing clinical trials for modern staplers, hemostats, sutures, and other products among major players are further promoting the adoption of these products in the market.

The benefits mentioned above associated with advanced products have caused the shift from traditional techniques to modern techniques.

Shifting Preference toward Minimally Invasive Surgeries is One of the Major Trends

The increasing shift toward minimally invasive surgeries (MIS) is emerging as a significant trend in the wound closure market. This trend is driven by a rise in demand for faster recovery and reduced post-operative complications. The minimally invasive procedures involve smaller incisions, which cause less trauma to surrounding tissues compared to traditional open surgeries. As a result, there is a growing demand for advanced wound closing solutions that support rapid wound healing, reduce scarring, and minimize the risk of infections.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Sutures Segment Dominated Market with Escalating Number of Surgical Procedures

Based on product type, the market is segmented into sutures, hemostatic agents, staplers, and others. The sutures segment is divided into absorbable and non-absorbable. The hemostatic agents segment is further categorized into active hemostats, passive hemostats, combination hemostats, and others. Moreover, the staplers segment is divided into powered and manual.

The sutures segment held a dominant share of the global market with a share of 39.45% in 2026 and is anticipated to grow at the highest CAGR during the forecast period. The rising number of surgical procedures globally has been fueling the demand for surgical sutures, driving segmental growth. Furthermore, the rising number of technological advancements in surgical sutures contributes to the growing adoption of these products in the market.

- For instance, in June 2023, researchers from Sivas Cumhuriyet University in Turkey discovered that these coated suture surfaces significantly improved fibroblast attachment, migration, and proliferation while stimulating angiogenic growth factors to accelerate wound healing.

The hemostatic agents segment held the second-largest wound closure market share in 2024 and is expected to grow at the second-highest CAGR from 2025 to 2032. The increasing market players' focus on new product launches is one of the major factors driving the segment's growth.

- For instance, in April 2025, Baxter launched HEMOPATCH, the next-generation sealing hemostat, at a symposium in Austria.

On the other hand, the staplers segment held the third-largest share of the market in 2024 and is anticipated to grow moderately during the forecast period. Increasing advancements in the field of surgery and rising initiatives by key players to launch advanced stapling suture devices are enhancing the segmental growth.

- For instance, in June 2025, Johnson & Johnson Services, Inc., announced the launch of the ETHICON 4000 Stapler in the U.S. market. This advanced surgical stapler delivers an exceptional staple line integrity to minimize risk factors for surgical leaks and bleeding complications across specialties.

To know how our report can help streamline your business, Speak to Analyst

By Application

Growing Demand for Wound Closure Products for Surgeries Led to Dominance of General Surgery Segment

Based on application, the market is divided into orthopedics, gynecology and obstetrics, general surgery, ophthalmology, cardiology, and others.

The general surgery segment dominated the market with a share of 22.62% in 2026 and is projected to grow at the second-largest CAGR throughout the forecast period. The segment growth is attributed to the growing demand for wound closure products for surgeries such as cholecystectomy, appendectomy, and herniorrhaphy.

- For instance, according to data published by the Annals of the Royal College of Surgeons of England in April 2024, more than 60,000 laparoscopic cholecystectomies (LC) are performed every year in the U.K.

The cardiology segment accounted for the second-largest market share in 2024 and is expected to grow at the highest CAGR during the forecast period. The high burden of cardiovascular diseases and the rise in associated surgical procedures are some of the important factors driving the segment growth.

For example, as per data provided by the Mass General Brigham Incorporated in November 2024, the number of cardiac surgeries, including coronary bypass surgeries, performed every year in the U.S. is more than 900,000.

The orthopedics segment held the third-largest market share in 2024 and is projected to grow at the third-largest CAGR during the forecast period. The rise in trauma cases and bone replacement surgeries has been fueling the adoption of wound closure products, enhancing segmental growth.

- For example, as per data provided by Curvo Labs, Inc., in September 2024, around 737,503 hip replacement procedures were performed in the U.S. in 2021, which increased to 765,558 in 2022.

The gynecology and obstetrics segment is expected to grow moderately throughout the forecast period, owing to the increasing cesarean sections and bariatric surgeries worldwide.

The ophthalmology segment is expected to grow at a considerable CAGR during the forecast period, owing to the increasing number of ophthalmological procedures worldwide.

By End-User

Hospitals & ASCs Segment Led Market with Growing Number of Surgical Procedures

Based on end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment accounted for a dominant market with a share of 69.90% in 2026 and is anticipated to grow at the highest CAGR during the forecast period. The increasing number of inpatient admissions for surgeries is anticipated to augment the demand and adoption of wound closure products within these facilities. Furthermore, the presence of a large number of hospitals with advanced healthcare facilities and strong reimbursement policies augments the segment growth. For example, as per data provided by the American Hospital Association in April 2025, around 6,093 hospitals were present in the U.S. in 2023.

The specialty clinics segment accounted for a moderate market share in 2024 and is projected to grow at a moderate CAGR during the forecast period. The segment growth is due to certain benefits such as ease of accessibility, specialized care, and advanced facilities.

Furthermore, the presence of skilled healthcare professionals performing critical surgeries and the opening of specialty clinics in developing countries are important factors enhancing segmental growth.

- For instance, in May 2024, Belenus Champion Hospitals launched a state-of-the-art cardiology specialty clinic in Bengaluru, India. This new clinic provides advanced treatment options and comprehensive health packages.

WOUND CLOSURE MARKET REGIONAL OUTLOOK

In terms of region, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Wound Closure Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a value of USD 5.71 billion in 2025. The established healthcare infrastructure, higher healthcare expenditure, and increasing number of surgical procedures are some of the important factors contributing to the market growth in this region.

The market in the U.S. is characterized by rising demand for innovative products such as absorbable sutures, especially during general surgical procedures. This demand is further augmented by the increasing prevalence of chronic conditions and the rising number of surgical procedures performed in the U.S. This, along with the rising focus of leading players on new product launches, is one of the prominent factors supporting the market growth in the U.S. The U.S. market is projected to reach USD 5.59 billion by 2026.

- For example, in May 2024, Johnson & Johnson Services, Inc., announced the U.S. launch of the ECHELON LINEAR Cutter. It comprises 3D-Stapling Technology and Gripping Surface Technology (GST), enabling greater staple line security, reducing risks, and supporting patient outcomes.

Europe

The market in Europe is projected to grow at the second-largest CAGR during the forecast period. The segmental growth is due to the increasing prevalence of chronic diseases, resulting in the growing number of surgical procedures in Europe. In addition, the increasing awareness initiatives by government bodies regarding the usage of antibiotic-induced sutures to reduce surgical site infections (SSIs) are further contributing to the market growth. The UK market is projected to reach USD 0.97 billion by 2026, while the Germany market is projected to reach USD 0.84 billion by 2026.

- For example, in June 2021, the National Institute for Health and Care Excellence (NICE) issued new medical technologies guidance (MTG59) recommending the use of Plus Sutures in surgeries within the National Health Service to reduce the risk of SSIs.

Asia Pacific

The market in the Asia Pacific region is expected to register a comparatively higher CAGR during the forecast period. The market growth in this region is mainly due to the rising geriatric population and the growing incidence of diabetic foot ulcers, among others, resulting in a surge in the number of surgical procedures. Additionally, the rising market players' focus on receiving regulatory approvals to launch wound closure products across the Asia Pacific region is further likely to support the market growth. The Japan market is projected to reach USD 0.86 billion by 2026, the China market is projected to reach USD 0.98 billion by 2026, and the India market is projected to reach USD 0.68 billion by 2026.

- For example, in January 2025, Genesis Medtech received approval from the National Medical Products Administration (NMPA) for its product, iReach Omnia, for market release in China.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa is expected to grow considerably during the forecast period. The high burden of chronic diseases and the rising number of surgical procedures across these regions are some of the important factors enhancing market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Attending Medical Conferences to Create Brand Awareness Among Consumers

B. Braun SE, Medtronic, Baxter, and Johnson & Johnson Services, Inc., among others, are prominent players operating in the market. The increasing focus of these companies on participating in medical events is aimed at creating product awareness among consumers.

- For instance, in March 2025, Baxter participated in the Goldman Sachs 46th Annual Global Healthcare Conference 2025, which was held in Miami, U.S. During the conference, Baxter showcased all its medical products, including staplers and hemostatic agents, to create product awareness among consumers.

On the other hand, the increasing focus of players such as Stryker, Smith+Nephew, CooperSurgical, Inc., among others, on research and development activities to develop and introduce novel wound closure products, coupled with rising focus on receiving awards, among others, is likely to support their position in the market.

LIST OF KEY WOUND CLOSURE COMPANIES PROFILED:

- Johnson & Johnson Services, Inc. (U.S.)

- Baxter (U.S.)

- Medtronic (Ireland)

- Stryker (U.S.)

- Solventum (U.S.)

- Smith+Nephew (U.K.)

- B. Braun SE (Germany)

- Boston Scientific Corporation (U.S.)

- Frankenman International Ltd. (China)

- CooperSurgical Inc. (U.S.)

- Intuitive Surgical (U.S.)

- MANI, INC. (Japan)

- Artivion, Inc. (U.S.)

- CP Medical (Riverpoint Medical) (U.S.)

- CONMED Corporation (U.S.)

- Genesis Medtech (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2024 - Intuitive Surgical received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for da Vinci 5, the next-generation multiport robotic system.

- February 2024 - Boston Scientific Corporation announced positive results from the National Institute for Health and Clinical Excellence review on the safety and efficacy of endoscopic sleeve gastroplasty (ESG) with the OverStitch endoscopic suturing system. The results stated that the minimally invasive weight loss procedure is safe for bariatric surgery.

- August 2023 - Healthium Medtech Limited launched TRUMASTM, a range of synthetic absorbable sutures designed to address challenges faced during suturing in minimal access surgeries in the Indian market.

- May 2023 - Artivion, Inc., announced that its PERCLOT Absorbable Hemostatic System (PerClot) secured premarket application (PMA) approval from the U.S. Food and Drug Administration (FDA). The approval has been granted for product usage to control bleeding in certain open and laparoscopic surgical procedures.

- May 2023 - Baxter received the U.S. Food and Drug Administration (FDA) premarket application (PMA) approval for the PERCLOT absorbable hemostatic system.

- June 2022- Johnson & Johnson Services, Inc., launched the ECHELON 3000 Stapler in the U.S. market. It is a digitally enabled device that provides surgeons with simple, one-handed powered articulation.

REPORT COVERAGE

The global market report provides a detailed competitive landscape and market insights. It focuses on key aspects, such as market forecast and market segmentation based on product type, application, and end user. In addition to the global market size, it also gives an overview of technological developments and the number of key surgical procedures.

Besides, the report offers insights into the latest market dynamics, market statistics, market share analysis, and key industry developments. In addition to the above-mentioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.30% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 15.1 billion in 2025 and is projected to reach USD 28.34 billion by 2034.

In 2025, the North America market value stood at USD 5.71 billion.

The market is slated to exhibit a steady CAGR of 7.30% during the forecast period of 2026-2034.

By product type, the sutures segment led the market in 2026.

The key factors driving the market include the rising prevalence of chronic conditions and the escalating number of surgical procedures.

Johnson & Johnson Services, Inc., Medtronic, and Baxter are the leading players in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us