Zero Turn Mowers Market Size, Share & Industry Analysis, By Product Type (Less than 50 inches, 50-60 inches, and More than 60 inches), By Horsepower (Less than 25 HP and More than 25 HP), By Application (Commercial and Residential), and Regional Forecast, 2026 – 2034

Zero Turn Mowers Market Size

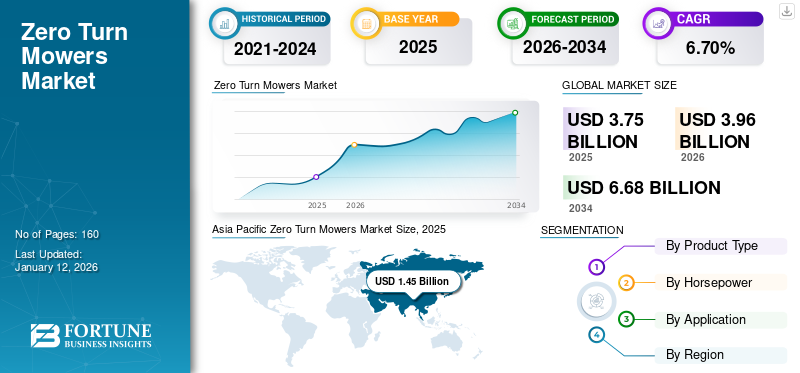

The global zero turn mowers market size was valued at USD 3.75 billion in 2025 and is projected to grow from USD 3.96 billion in 2026 to USD 6.68 billion by 2034, exhibiting a CAGR of 6.70% during the forecast period. Asia Pacific dominated the global market with a share of 38.70% in 2025. The zero turn mowers market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.39 billion by 2032, owing to maneuverability range & reduced mowing time with the zero-turn mowers is likely to fuel the market.

Zero turn mowers are riding lawnmowers with an effectively zero turning radius. This allows them to turn them within their footprint, making them highly maneuverable and efficient for mowing flower beds and trees. They are popular for both residential and commercial use due to their speed and agility. It offers several advantages, such as efficiency, comfort, convenience, durability, ease of operation, and time-saving capability. Additionally, zero turn mowers can be used instead of tractor mowers.

Global Zero Turn Mowers Market Overview

Market Size:

- 2025 Value: USD 3.75 billion

- 2026 Value: USD 3.96 billion

- 2034 Forecast Value: USD 6.68 billion

- CAGR (2025–2032): 6.70%

Market Share:

- Regional Leader: Asia Pacific held approximately 38.70% market share in 2025

- Fastest-Growing Region: Asia Pacific, driven by urbanization, landscaping, and construction

- Top Application Segment: Commercial segment leads, with strong growth in residential landscaping

Industry Trends:

- Technological Advancements: Introduction of battery-powered, AI-enabled, GPS, and robotic zero turn mowers

- Green Infrastructure: Rising demand for eco-friendly, zero-emission, and low-noise mowers

- Smart Features: Integration of telematics, smartphone connectivity, and automation for enhanced user experience

- Product Diversification: Launch of models with various deck sizes and horsepower for different applications

Driving Factors:

- Urbanization & Construction: Increased investment in residential and commercial spaces boosts demand for landscaping equipment

- Landscaping Services Growth: Rising focus on outdoor aesthetics and green building services

- Efficiency & Maneuverability: Zero turn mowers offer time-saving, high-performance mowing for large areas

- Disposable Income: Higher consumer spending on home and garden care in developed and emerging markets

They are much easier to maneuver around and can reduce the need for a string trimmer when used skillfully due to their close-quarters capability. These are most effective in large lawn areas, and a small, average-sized city lawn will not benefit from them. A conventional push mower is also cost-effective and practical for smaller grassy spaces.

The rising construction of new commercial and residential activities across Germany, France, Italy, and other countries creates the demand for such products and drives market growth. For instance, in August 2023, Germany’s government invested around USD 65.7 billion for the construction and renovation of new residential and commercial buildings.

However, the COVID-19 pandemic accelerated the demand for such products for performing landscaping and improving green infrastructure. During this period, more people spent time at home, and the rising demand for maintenance and commercial gardening activities resulted in positive market growth.

Zero Turn Mowers Market Trends

Technological Advancement in Products to Fuel Market Growth

Key players, such as Deere & Company, Husqvarna Group, Toro Company, and MTD Products Inc, are engaged in introducing new technological advancements, such as battery-powered zero turn mowers, Artificial Intelligence (AI), GPS, telematics, smartphone connectivity, and robotic enabled systems in the product portfolio. For instance, in October 2023, Honda Global launched a new all-electric prototype zero turn mower. It is an automatic lawn mower, an environment-friendly device with net zero emissions. This machine, designed to help improve the efficiency of landscaping and lawn care applications across residential and commercial spaces, drives market growth.

Growing demand for green building services, commercial infrastructure real estate, and the expansion of lawns are expected to support the market's growth. The mandate for zero-turn lawnmowers is expected to rise due to the rapidly growing residential and commercial construction industry, especially in developing countries. All such aforementioned factors drive the growth of the market.

Download Free sample to learn more about this report.

Zero Turn Mowers Market Growth Factors

Increasing Demand from Residential and Commercial Spaces to Drive Market Growth

There is a rising demand for zero turn mower in residential and commercial spaces owing to increased demand for landscaping and lawn care maintenance applications. The increasing demand for landscaping services, driven by urbanization and a growing focus on outdoor aesthetics, is fueling the demand for high-performance mowing equipment, such as zero-turn mowers. Rising urbanization, investment in residential and commercial spaces, and increasing disposable income of end-users, which creates the demand for zero turn mowers, drive market growth. For instance, according to Trading Economics, the disposable income of the population in France is projected to grow by 2.5% in 2025 compared to 2023. For instance, according to the OECD, the urbanization rate in China increased to 65% in 2022 and is expected to be 80% by 2035.

RESTRAINING FACTORS

Concerns Regarding Roll Over and Increasing Emphasis on Air Pollution May Impede Market Growth

Zero turn mowers, with their ability to make sharp turns and navigate tight spaces, can be prone to rollovers if not operated correctly. Manufacturers have been addressing this concern by implementing safety features, such as roll bars and seat belts. However, the perception of risk could still impact market growth, particularly in regions with stringent safety regulations. Regardless of the many applications that z-t mowers provide, definite disadvantages are affecting the growth of this market. Additionally, there is a need for specialized technicians to assemble machines that can add overall ownership costs.

Zero Turn Mowers Market Segmentation Analysis

By Product Type Analysis

50 to 60 Inches Segment to Dominate Due to Increase in Gardening-Related Activities

By product type, the market is categorized into less than 50 inches, 50-60 inches, and more than 60 inches.

Based on our analysis, the 50 to 60 inches segment dominated the market in 2026, accounting for 41.67% of the total revenue market share. Growing consumer interest in gardening activities, including backyard landscaping. Additionally, growing consumer awareness and the need for large cutting widths for more significant areas or stricter vegetation.

The more than 60 inches segment is projected to grow moderately during the forecast period, owing to various benefits associated with such products, such as faster speed, shortened cutting time, and rising demand from commercial spaces such as hospitals, and hotels, boosting the market growth. Moreover the rising demand in commercial and industrial settings is projected to drive the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Horsepower Analysis

Less than 25 HP Set to Dominate with Rising Demand from Residential and Commercial Settings

By horsepower, the market is categorized into less than 25 HP and more than 25 HP.

Based on our analysis,the less than 25 HP segment dominated the market in 2026, accounting for 59.09% of the total revenue market share, driven by its widespread applications across residential and commercial spaces.This type of mower has higher ground speeds than other types of mowers. It has several advantages associated with this product, such as being efficiently maneuverable, having a smaller cutting deck, and being cost-efficient compared to other models.

The more than 25 HP segment is projected to grow with moderate growth over the forecast period, owing to these types of mowers being large, powerful, designed for commercial usage, and larger properties. It has features such as more advanced controls, a higher cutting deck, and extended durability. Rising demand from professional landscaping, golf courses, and municipalities’ areas creates the demand for more mowers for lawn-care maintenance applications to drive the global zero turn mowers market growth.

By Application Analysis

Commercial Application Segment to Lead Due to Increasing Investments in Infrastructural Development

By application, the market is categorized into residential and commercial.

As per our estimates, in 2023, the commercial segment dominated the market in 2026, accounting for 57.32% of the total revenue market share. The same segment is projected to grow significantly during the forecast period, owing to increasing investments by public and government bodies in the renovation and expansion of public spaces, increasing the global zero turn mowers market share.

The residential segment is expected to witness potential growth during the forecast period due to the rising propensity of homeowners for gardening, which is observed as a lawn care maintenance activity. Additionally, rising urbanization, rising disposable income of end-users, and changing lifestyles are the key factors driving the segment’s growth.

REGIONAL INSIGHTS

The global zero turn mowers market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific Zero Turn Mowers Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market, with the market size valued at USD 1.45 billion in 2025 and increasing to USD 1.54 billion in 2026 due to surging demand for green building solutions and aesthetic landscaping applications, which created the demand for such products. Moreover, China and India are dense countries with rising investment to construct new residential and commercial spaces, boosting the demand for landscaping activities.

China is set to dominate the market during the forecast period in terms of revenue market share, owing to factors such as residential and commercial landscaping needs and technological advancement in the product portfolio. Additionally, increasing demand for landscaping and beautification applications drives market growth. Moreover, major players, such as Deere & Company, Toro Company, and Textron Inc., have a strong presence in China to drive market growth. The Japan market is projected to reach USD 0.31 billion by 2026, the China market is projected to reach USD 0.52 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is projected to grow moderately due to increasing landscaping projects and rising investment in the construction of new residential and commercial spaces, creating the demand for zero turn mowers, which fuels the market's growth. The demand for zero-turn mowers in the commercial industry, along with the growing regular use of these mowers for lawn care in North America and the use of modern technologies to increase productivity, is driving the region’s growth. The US market is projected to reach USD 0.96 billion by 2026.

Europe is anticipated to grow at progressive market growth during the forecast period due to the rising tourism sector across France, Germany, Spain, and Italy, which fuels market growth. For instance, according to the International Trade Administration, tourism sector growth in Germany increased by 20% in 2023 compared to 2022. This requires more mowers to maintain tourist spots and landscapes. All the factors mentioned above drive the growth of the market. The UK market is projected to reach USD 0.11 billion by 2026, while the Germany market is projected to reach USD 0.26 billion by 2026.

The Middle East & Africa and South America are projected to grow moderately during the forecast period. This is due to the growth of green spaces and green roofs, which are increasingly turning to cutting-edge lawn mower solutions.

Key Industry Players

Major Players are Adopting Product Launch and Business Expansion as Key Strategic Moves for Improving Product Portfolio

Major players such as Deere & Company, The Toro Company, Husqvarna Group, Kubota Corporation, and Robert Bosch GmbH are engaged in adopting product launch, product development, and business expansion as crucial strategic moves for improving the product portfolio of zero turn mowers, and also to improve the product to diversified geographic locations. For instance, in October 2023, Michelin North America Inc. introduced a new Ferris series of Z-t mowers for commercial spaces. It offers advantages, such as a high-speed mower, long, durable, and easy to operate. All such factors drive the growth of the market.

List of Top Zero Turn Mowers Companies:

- Deere & Company (U.S.)

- The Toro Company (U.S.)

- Husqvarna Group (Sweden)

- MTD Products Inc (U.S.)

- Ariens Company (U.S.)

- Briggs & Stratton, LLC. (U.S.)

- Robert Bosch GmbH (Germany)

- Textron Inc. (U.S.)

- Altoz (U.S.)

- Brookfield Property Partners L.P. (STIGA SpA) (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Kubota Corporation launched a new Ze-421 z-t mower with zero emission. Its features include a low noise level and an efficient and durable machine, and has a cutting deck of 42 and 48 inches. It is designed for residential and commercial sectors.

- October 2023: Bobcat Company, a subsidiary of Doosan Corporation, introduced the ZT5000 z-t mower. It is a high-performance machine that works with good precision, is easy to use, and maintains accuracy while cutting grass. It offers advantages, such as being long and durable, having a 23.5 HP engine, and extremely powerful mowing performance.

- May 2023: AriensCo launched a new Ikon Onyx zero turn mower for residential and commercial sectors. It has features such as efficiency, cost efficiency, and extended durability. It has a 52 inch cutting deck used for gardening and landscaping applications.

- April 2023: Husqvarna Group introduced a new Z560LS z-t mower for the commercial sector. It delivers maximum power, rock-solid comfort, and operation productivity. It has a grass-cutting deck of 60 inches.

- May 2022: Stihl signed a collaboration agreement with Briggs & Stratton LLC based in the U.S. deals in z-t mowers. The primary aim of this agreement was that Stihl would launch a series of zero turn mowers for residential and commercial spaces and improve the geographical presence over diversified geographical locations.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2019 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Thousand Units) |

|

By Segmentation |

By Product Type

|

|

By Horsepower

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size will reach USD 6.68 billion by 2034.

The market is projected to grow at a CAGR of 6.70% over the forecast period (2026-2034).

The 50-60 inches segment is expected to hold the highest CAGR in the market over the forecast period.

Increasing demand from residential and commercial spaces drives market growth.

Deere & Company, the Toro Company, Husqvarna Group, MTD Products Inc, Ariens Company, Briggs & Stratton, LLC., Robert Bosch GmbH, Textron Inc., Altoz, and Brookfield Property Partners L.P. are the leading companies in the market.

Concerns regarding roll over and increasing emphasis on air pollution may restrain the deployment of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us