155mm Ammunition Market Size, Share & Industry Analysis, By Technology (Guided and Unguided), By Component (Projectiles, Primer, Propellant, and Fuze), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

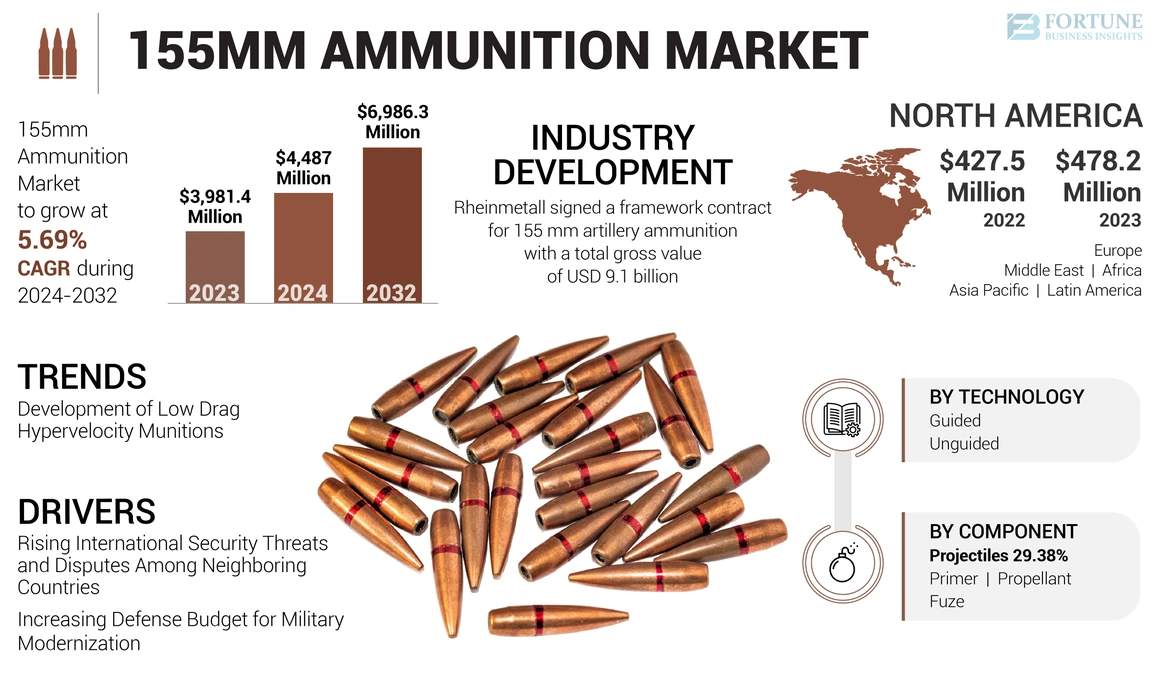

The global 155mm ammunition market size was valued at USD 3,981.4 million in 2023 and is projected to grow from USD 4,487 million in 2024 to USD 6,986.3 million by 2032, exhibiting a CAGR of 5.69%. North America dominated the 155mm ammunition market with a market share of 12.01% in 2023. Moreover, the 155mm Ammunition market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 667.9 million by 2032.

The 155mm ammunition market refers to the segment of the global ammunition industry that focuses specifically on artillery shells with a caliber of 155mm. This caliber is a NATO standard used primarily in howitzers and field guns, making it a critical component of modern artillery systems.

155mm ammunition is characterized by its larger size and is designed for deployment in howitzer systems. It contains explosive materials tailored for various combat scenarios. The market includes both guided and unguided variants, with guided munitions featuring advanced guidance systems that improve accuracy.

The COVID-19 pandemic prompted shifts in production strategies within the defense sector. This led to faster contracting processes and increased collaboration with private manufacturers to meet rising demands for military supplies, including 155mm ammunition. Learnings from the pandemic have allowed for more agile responses to production needs.

GLOBAL 155MM AMMUNITION MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2023 Market Size: USD 3,981.4 million

- 2024 Market Size: USD 4,487 million

- 2032 Forecast Market Size: USD 6,986.3 million

- CAGR: 5.69% from 2024–2032

Market Share:

- North America dominated the 155mm ammunition market with a 12.01% share in 2023. The U.S. market alone is projected to reach USD 667.9 million by 2032.

- By technology, the unguided segment held the largest share in 2023 due to widespread deployment of howitzers, while the guided segment is expected to grow fastest at a CAGR of 6.69% through 2032.

- By component, the propellant segment leads the market, driven by ongoing military modernization and demand for high-performance artillery. Projectiles are expected to be the fastest-growing segment during the forecast period, boosted by innovations in design and guidance systems.

Key Country Highlights:

- United States: The U.S. Army doubled monthly shell production to 80,000 in 2023, with plans to reach 100,000 shells per month by mid-2025. Contracts with Raytheon and new facilities reflect a major push to support Ukraine and strengthen U.S. stockpiles.

- Israel: In 2023 and 2024, Elbit Systems secured ammunition contracts worth over USD 820 million, including tens of thousands of 155mm shells for national security amidst regional tensions.

- Italy: In 2024, Leonardo and Agenzia Industrie Difesa (AID) partnered to co-develop conventional 155mm ammunition, while the Italian Army initiated FH70 howitzer upgrades to enhance artillery range and NATO compatibility.

- Germany & UK: Collaborations across Europe are enhancing joint procurement and scaling up production capabilities to meet growing demand and support Ukraine.

155mm Ammunition Market Trends

Development of Low Drag Hypervelocity Munitions for Extended Range Capabilities

In recent years, hypervelocity munitions have been widely demanded by major customers in the market. Hypervelocity munitions provide a next-generation multi-role, low drag, guided munition with high lethality and range, high precision, and penetration depth against the next-generation armor, and military surface and underground structures. Moreover, exchangeable enhancements can be utilized for land and naval platform firepower enhancement, which reduces its R&D, production, and ownership costs. BAE Systems has developed the Hypervelocity Projectile as a prime defense contractor of the U.S. Department of Defense for the U.S. Armed Forces and its allies. It has low drag, high lethality, and range that can be launched through naval guns & Army 155 mm artillery systems.

The shift toward automated and autonomous artillery systems is also influencing the market. This trend enhances operational efficiency and effectiveness, making 155mm ammunition more relevant in contemporary military strategies. Moreover, the demand for hypervelocity munitions, which offer extended range and high lethality, is on the rise. These next-generation munitions are designed for high precision and penetration capabilities against advanced military targets, further driving the growth of the market.

Download Free sample to learn more about this report.

155mm Ammunition Market Growth Factors

Rising International Security Threats and Disputes among Neighboring Countries to Boost Demand for Large Ammunition

The ongoing military conflicts and heightened geopolitical tensions globally are significant drivers of market growth. Countries are modernizing and upgrading their artillery systems to enhance their military capabilities, which includes adopting 155mm ammunition due to its effectiveness in warfare across various terrains. Rising terrorist activities, political unrest across the globe, and geopolitical tensions with neighboring countries have led to an increase in demand for next-generation ammunition and associated equipment to enhance national security. Considering the strong demand for large ammunition, the key manufacturers are increasing their spending on R&D activities to develop technically advanced, cost-effective, extended range and high-precision ammo. Therefore, the increased development and demand for howitzer and advanced ammunition by ARM forces to improve defense capabilities would drive the growth of the market.

- For instance, in May 2024, the Israeli Ministry of Defense ordered ammunition in a series of contracts throughout 2023, with the Israeli defense giant Elbit Systems. The total value of the contracts was around USD 760 million.

- For instance, in August 2023, Israel ordered tens of thousands of 155mm artillery shells through a USD 60 million contract with Elbit Systems amid tension on the country’s northern border.

The large caliber ammo is majorly used in defense forces for combat operations as it has a performance range between 20km to 40km. There is an increasing demand for long-range artillery capabilities, which 155mm ammunition provides. This demand is driven by military strategies that prioritize precision and effectiveness in targeting greater distances. The integration of smart and guided ammunition technologies is expected to propel market growth. Innovations in projectile design, propellant, and explosives technology, and advancements in fuzing and detonation systems are making 155mm ammunition more effective and precise. The development of next-generation propellants and the use of 3D printing for custom components are also notable trends.

- For instance, in July 2024, Leonardo announced a new collaboration with Agenzia Industrie Difesa (AID), which centers on the strengthening of technological and operational innovation in the defense and security sector. The focus of the partnership will be on the joint development of conventional 155 mm artillery ammunition, primarily for Italian defense.

Increasing Defense Budget for Military Modernization to Fuel Market Growth

Many countries are increasing their defense budgets, which allows for greater procurement of advanced military equipment, including 155mm ammunition. This trend is expected to continue as nations seek to bolster their military capabilities in response to evolving security threats. The escalation of terrorist activities worldwide necessitates enhanced military responses, including the use of 155mm ammunition. The increase in terrorist attacks has highlighted the need for more potent weaponry to effectively combat these threats, thereby driving demand for this caliber of ammunition.

- For instance, in September 2023, Raytheon signed a contract for an unspecified number of M982 Excalibur artillery ammunition. M928 Excalibur is a 155mm guided artillery ammunition with a range of up to 57km.

As countries modernize their artillery systems, there is a growing emphasis on integrating advanced technologies, including PGMs. Increased defense budgets, particularly in emerging economies, are facilitating the procurement of sophisticated 155mm ammunition. This trend reflects a broader military doctrine that emphasizes the importance of precision-guided munitions in achieving strategic superiority in modern warfare. The push for PGMs is driving technological advancements in the 155mm ammunition market growth. Emerging countries are collaborating with established defense contractors to develop and integrate new technologies into their artillery systems. This includes innovations in guidance systems, fuzing technologies, and materials that enhance the performance of 155mm munitions, making them more effective in modern combat scenarios.

Emerging nations are also focusing on interoperability with allied forces, particularly those within NATO. This need for compatibility drives the demand for standardized, technologically advanced 155mm ammunition that can be integrated into joint operations. As these countries enhance their artillery capabilities, the market for precision-guided munitions is expected to expand alongside their military modernization efforts.

- For instance, in January 2024, the Italian Army awarded two contracts to Aris SRL and Leonardo UK. The focus of these contracts is the upgrade of the FH70 155mm towed howitzer and associated systems currently in service. Its upgrade aligns with ambitious objectives set during its inception, including high towing speed, extended range with conventional and rocket-assisted ammunition, rapid firing capabilities, and compatibility with NATO 155mm ammunition.

RESTRAINING FACTORS

Difference in Legal and Political Regulations from Different Government Agencies to Impede Market Growth

The 155mm ammunition market is subject to stringent regulations and adherence to international standards. Complying with these regulations increases the complexity and cost of manufacturing, as manufacturers must invest in testing, certification, and documentation processes. The government rules and regulations regarding the ownership of guns and ammunition vary by country. Thus, the key large arms and ammunition Original Equipment Manufacturers (OEMs) encounter many challenges related to the stringent government norms and lengthy certification process.

These strict weapon laws affect the contract with key players and procurement processes for all European countries. Different regulatory authorities, such as law enforcement agencies and homeland security, highly restrict the international trade of large-caliber ammunition, thereby hampering the growth of the market. In addition, during the COVID-19 pandemic, sales tanked in most countries. The ammo manufacturing companies stopped production, which, in turn, resulted in a decrease in the howitzers, artillery guns, and ammo sales.

Furthermore, geopolitical tensions and conflicts can disrupt supply chains, affecting the timely availability of raw materials and components necessary for 155mm ammunition production. This uncertainty in supply can lead to production delays and increased costs. Moreover, the disposal and environmental impact of munitions residues are growing concerns that add to the challenges faced by manufacturers. Addressing these environmental issues requires additional investments in sustainable production methods and waste management systems.

155mm Ammunition Market Segmentation Analysis

By Technology Analysis

Unguided Segment Dominates Owing to Increasing Deployment of Howitzers for Military Operations

In terms of technology, the market is divided into guided and unguided. The unguided segment is expected to account for the largest market share in 2023. The presence of a large artillery fleet and increasing spending on the defense sector of major countries are driving market growth. For example, Leonardo Defense Systems offers OTO VULCANO, a family of 155mm and 152mm expanded ballistic (BER) unguided projectiles with multi-function programmable fuses.

The guided segment is expected to be the fastest-growing segment, with a CAGR of 6.69%. The growth of this segment is driven by the increasing use of guided ammunition to improve accuracy and allow 155mm guns to extend their operational range and accuracy beyond practical limits.

By Component Analysis

To know how our report can help streamline your business, Speak to Analyst

Propellant Components Lead Owing to their Use for Enhanced Artillery Performance

The market by component is segmented into projectiles, primer, propellant, and fuze. The propellant segment is the dominant component within the market, holding the largest market share throughout the forecast period. The propellant component in the market is critical for enhancing artillery performance and meeting modern military requirements. With ongoing innovations and increasing defense expenditures, the demand for propellants is expected to continue its upward trajectory, reflecting the broader trends in military modernization and geopolitical dynamics.

Projectiles are anticipated to be the fastest-growing segment in the forecast period of 2024-2032. The projectile component of 155mm ammunition is experiencing growing demand due to increased defense spending, emphasis on precision-guided munitions, modernization of military equipment, ongoing conflicts, and the development of advanced projectile technologies.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America.

North America 155mm Ammunition Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The demand for 155mm ammunition has surged in North America making it a leading region in 2023, particularly due to ongoing military conflicts, such as the war in Ukraine. The U.S. Army has responded by ramping up production capabilities. A new facility in Mesquite, Texas, aims to produce 100,000 shells per month by mid-2025, reflecting a significant increase from previous production levels. In 2023, the Army's production capabilities doubled to approximately 80,000 shells per month, with plans to further increase this output.

Europe is at a critical juncture, characterized by collaborative procurement efforts, increased production initiatives, and significant challenges in meeting demand. As the situation evolves, the focus remains on enhancing production capabilities to support both national defense and ongoing military assistance to Ukraine.

Asia Pacific is poised for robust growth, supported by increasing military investments and technological advancements. As countries in the region continue to modernize their defense capabilities, the demand for 155mm ammunition is expected to rise, reflecting broader trends in global defense spending and military strategy.

The Middle East market is expected to witness steady growth in the coming years, driven by factors such as increasing incidents of terrorist activities in the region. This factor underscores the necessity for enhanced and potent weaponry to combat terrorism effectively and rising defense budgets globally, allowing for increased procurement of sophisticated 155mm ammunition.

The African market is poised for growth, driven by increased defense spending, technological advancements, and the need for enhanced military capabilities in response to geopolitical dynamics.

The market in Latin America is estimated to grow, influenced by rising defense budgets and the push for modernization in military capabilities. As geopolitical tensions persist and nations seek to enhance their artillery systems, the demand for 155mm ammunition is expected to increase, contributing to the overall growth of the global market. In Latin America, Brazil and Mexico are likely to be key players in the market. These nations have been investing in their military capabilities and are expected to continue doing so in response to regional security challenges and the need for enhanced defense mechanisms.

KEY INDUSTRY PLAYERS

Integrating Advanced Technologies to Provide Additional Capabilities in Military Sector are Key Focus of Leading Players

The need for interoperability among NATO forces and ongoing military modernization programs influences the demand for 155mm ammunition. Companies are focusing on innovations in ammunition technology to improve effectiveness and reduce collateral damage in combat scenarios. The companies below are engaged in various aspects of ammunition production, including research and development to enhance technological capabilities, particularly in precision-guided munitions. Increasing defense budgets, geopolitical tensions, and the modernization of military capabilities across various nations drive the market's growth.

List of Top 155mm Ammunition Companies:

- BAE Systems Plc (U.K.)

- Elbit Systems Ltd. (Israel)

- General Dynamics Corporation (U.S.)

- MSM Group s.r.o. (Slovakia)

- Nammo AS (Norway)

- KNDS (KMW+NEXTER Defense System N.V.) (France)

- Northrop Grumman Corporation (U.S.)

- Rheinmetall AG (Germany)

- RUAG Group (Switzerland)

- ST Engineering (Singapore)

- Thales Group (France)

- China North Industries Corporation (China)

- Munitions India Limited (MIL) (India)

- Poongsan Corporation (South Korea)

- Rosoboronexport JSC (Russia)

- Israel Aerospace Industries (Israel)

- Raytheon Technologies Corporation (U.S.)

- Leonardo S.p.A. (Italy)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: ST Engineering announced its Land Systems business has secured contracts for NATO-standard 155 mm ammunition with new customers in Europe. The contract wins were a result of competitive tenders and marked a major expansion of ST Engineering’s footprint in the ammunition segment.

- June 2024: Germany will purchase 155mm artillery shells and 1500 military trucks following new Budget Committee decisions. The Budget Committee of the German Bundestag agreed to purchase 1,515 new military trucks worth USD 1 billion in total and an order of 155mm artillery ammunition.

- June 2024: Rheinmetall signed a framework contract for 155 mm artillery ammunition with a total gross value of USD 9.1 billion. Deliveries of the shells are due to begin at the start of 2025. The German government will provide part of the ammunition to Ukraine. Rheinmetall holds that the primary purchaser is the Federal Republic of Germany. Denmark, Estonia, and the Netherlands are also participating in the order.

- March 2024: Spain placed an order with Rheinmetall for 94,200 155mm rounds under a USD 228 million-framework agreement. The artillery rounds will be delivered to the Spanish Army between the end of 2024 and the end of 2025, with a two-year extension option. The artillery ordered is ER02A1 High-Explosive (HE) projectiles, which have a maximum range of 30km in the Boat-Tail (BT) variant and almost 40km in the Base-Bleed (BB) variant.

- November 2023: Hanwha Aerospace has been awarded a contract to supply 155mm artillery bi-modular charge systems to BAE Systems. BAE Systems is a long-term strategic supply partner to the U.K. Ministry of Defense. The contract is worth around USD 130M and provides critical components of the artillery operation.

REPORT COVERAGE

The research report provides a detailed analysis of the market, driven by technological advancements and rising defense expenditures in response to global security challenges. The demand for both guided and unguided munitions will likely shape market dynamics in the coming years, making it a critical segment within the broader ammunition market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.69% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Technology

|

|

By Component

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3,981.4 million in 2023.

The market is likely to grow at a CAGR of 5.69% during the forecast period of 2024-2032.

The market size in North America stood at USD 478.2 million in 2023.

Some of the top players in the market are BAE Systems Plc (U.K.), Elbit Systems Ltd. (Israel), General Dynamics Corporation (U.S.), MSM Group s.r.o. (Slovakia), Nammo AS (Norway), KNDS (KMW+NEXTER Defense System N.V.) (France), Northrop Grumman Corporation (U.S.), and Rheinmetall AG (Germany)

North America dominated the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us