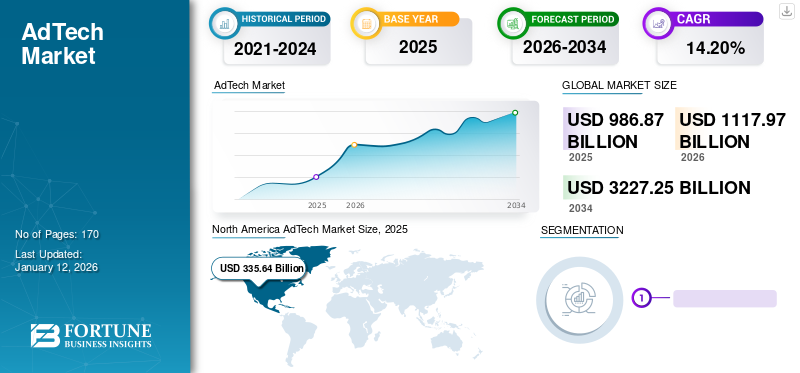

AdTech Market Size, Share & Industry Analysis, By Solution (Demand-Side Platform, Supply-Side Platform, Ad Networks, Data Management Platforms, Ad Exchange Platforms, Agency Trading Desks), By Advertising Type (Search Advertising, Programmatic Advertising, Mobile Advertising, Display Advertising, Email Advertising), By Deployment (On-premise & Cloud), By Enterprise Type (Small, Mid-sized & Large Enterprises), By Device (Mobile, Web), By Advertising Channel (Radio, Television, Print, Outdoor & Digital Advertising), By Industry (Media & Entertainment, IT & Telecom), Regional Forecast 2026-2034

KEY MARKET INSIGHTS

The global AdTech market size was valued at USD 986.87 billion in 2025 and is projected to grow from USD 1,117.97 billion in 2026 to USD 3,227.25 billion by 2034, exhibiting a CAGR of 14.20% during the forecast period. North America dominated the global AdTech market with a share of 34.00% in 2025.

The market growth is driven by increased AR/VR adoption for immersive ads, vast data availability, AI-driven insights, personalized ad experiences & precise targeting.

AdTech, or advertising technology, refers to the software and tools that advertisers use to reach target audiences deliver, and measure digital advertising campaigns. Moreover, AdTech software platforms help publishers with the pricing and sale of their ad inventory and also assist brands and agencies in acquiring advertising space.

The advertising technology market has experienced significant growth in recent years, fueled by the widespread use of digital devices and the Internet. As more people embrace smartphones and social media, digital advertising has become a crucial aspect of global business marketing strategies. The ongoing transition from traditional to online advertising is the primary factor driving the market growth. The widespread availability of the Internet and the growing number of Internet users have enabled businesses to reach a broader audience through digital ads.

- According to industry experts, ad spending in the digital advertising sector is projected to reach USD 1.08 billion in 2024, with its biggest market being search advertising.

The COVID-19 pandemic caused major changes in the advertising industry, and many of these changes are expected to have a lasting impact. The retail and travel sectors were hit the hardest, while there was increased attention on technology, hobbies, sports, and beauty. Additionally, there was a significant growth in videos, gaming, and career-related content.

There was a significant increase in digital advertising spending as people spent more time at home and engaged with digital media. This trend is expected to continue even after the pandemic as more people become familiar with e-commerce and digital channels. The pandemic accelerated the industry's move toward a more data-driven approach and digital advertising, with lasting effects on the sector's future.

IMPACT OF GENERATIVE AI ON AdTech Market

Adoption of Generative AI Tools for Scalable Implementation of Ads Likely to Boost Market Growth

AdTech companies can enhance their offerings by developing generative AI-based advertising solutions. This allows them to provide innovative products and services, transforming the way they operate. Generative AI enables the creation of personalized content on a large scale, empowering AdTech companies to customize ads based on the unique preferences and behaviors of their target audience. Surveys within the industry indicate that as many as 40% of C-suite executives intend to boost their investments in generative AI.

- November 2023: RTB House, a digital marketing firm, introduced ContentGPT. ContentGPT utilizes Large Language Models (LLMs) and Generative Pre-trained Transformers (GPT) to gain valuable insights into the specific intentions and interests of webpage readers across the Open Internet.

Latest AdTech Market Trends

Widespread Demand for AR and VR Technologies for more Interactive and Immersive Ad Experiences to Drive Market Expansion

The demand for immersive experiences is driving the growth of Augmented Reality (AR) and Virtual Reality (VR). Industry experts predict that global spending on AR and VR will increase more than sixfold to reach USD 72.8 billion in 2024 from about USD 12 billion in 2020. As competition intensifies, retailers are finding new ways to engage customers during the shopping process. Augmented reality provides retailers with the opportunity to deliver a unique customer experience, leading to higher sales and increased customer satisfaction.

Virtual reality (VR) experiences, interactive ads, and augmented reality (AR) ads are no longer limited to traditional banner ads. Advancements in Display and Video 360 and seasonally-themed video ad templates are enhancing user engagement and providing advertisers with powerful tools for managing campaigns. These trends are expected to generate a growing demand for advertisement technology in the coming years.

Download Free sample to learn more about this report.

AdTech Market Growth Drivers

Increasing Availability and Accessibility of Vast Amounts of Data Are Propelling the Market Growth

AdTech platforms use data from different sources, including browsing behavior, purchase history, and audience demographics, to build detailed consumer profiles and enable precise targeting. This data-driven approach helps advertisers deliver personalized and relevant ads, leading to better engagement and conversion rates.

In addition, businesses and websites are collecting increasing amounts of data on customers. With the help of big data platforms, algorithms, and marketing techniques, it is becoming easier to uncover trends and consumer information. This helps in the better identification of prospects and leads. AdTech companies are using data analytics, AI-driven insights, and consumer behavior patterns to create personalized ad experiences that match individual preferences.

RESTRAINING FACTORS

Stringent Privacy Regulations and Security Concerns Likely to Hamper Market Growth

Privacy regulations and security concerns are hindering the adtech market growth. Regulations, such as GDPR and CCPA, require strict data collection and usage limitations, including explicit user consent and restricted available data for targeted advertising. At the same time, security vulnerabilities pose significant risks, requiring increased efforts and costs to secure sensitive user information.

High-profile data breaches reduce user trust and damage brand reputation, making the AdTech environment more complex. Advertisers and AdTech providers need to find a balance between following regulations, ensuring data security, and maintaining effective advertising strategies to support the industry's long-term growth. Privacy regulations and security concerns are inhibiting the expansion of the market share by imposing strict compliance requirements, limiting access to user data, and requiring enhanced security measures.

AdTech Market Segmentation

By Solution Analysis

Advancements in Audience Specific Advertisements Propelled the Demand for Demand-side Platforms

Based on solution, the market is segmented into demand-side platform (DSP), supply-side platform (SSP), Ad networks, data management platforms (DMPs), Ad exchange platforms, agency trading desks, and others.

In 2026, the demand-side platform (DSP) segment held the largest market with a 22.43% share. DSPs simplify the process of purchasing advertising inventory, making it more efficient and effective. They also offer advanced targeting capabilities, making them an appealing choice for advertisers seeking to reach specific audiences and improve campaign performance.

The ad exchange platforms segment is projected to experience the highest CAGR during the forecast period, driven by the increasing demand for data-driven and automated programmatic advertising, which has boosted its growth and popularity.

- In April 2024, TeqBlaze, a company that develops advertising technology solutions, announced the release of version 2.5 of its SSP + Ad Exchange platform. The SSP+ADX 2.5 release includes four significant upgrades. This demonstrates TeqBlaze's commitment to improving the programmatic experience for clients and enhancing the digital advertising landscape by developing new optimization features within existing industry standards and solutions.

By Advertising Type Analysis

Rising Usage of Mobile Apps Have Compelled the Advertisers to Shift to Mobile Advertising

By advertising type, the market has been classified into search advertising, programmatic advertising, mobile advertising, display advertising, email advertising, and others.

The mobile advertising segment is expected to experience the highest growth rate during the forecast period. Over the last several years, there has been a general trend of people spending more and more of their time on mobile apps rather than using a web browser to visit websites.

- According to industry sources, U.S. mobile ad spending is projected to exceed USD 200 billion in 2024, accounting for over half (51.2%) of total media expenditure in the U.S. and nearly two-thirds (66.0%) of digital advertising dollars.

In 2026, the programmatic advertising segment achieved the highest market with a 26.89% share. Programmatic advertising uses algorithms to simplify the buying and selling of ad placements, eliminating manual negotiations. This provides advantages for both advertisers and publishers. As marketers prioritize data-driven targeting and campaign management, programmatic platforms offer a powerful solution, making it a dominant force in the rapidly evolving market.

By Deployment Analysis

Surging Cloud-based Collaboration to Aid Segment Expansion

By deployment, the market has been classified into on-premise and cloud.

The cloud segment dominated the market share with a share of 58.99% in 2026. and is expected to witness the highest growth rate during the forecast period. The growth is attributed to the growing significance of cloud-based technologies and services in businesses globally. Third-party advertising technology vendors are transforming into service providers that develop their solutions using cloud infrastructure. This typically involves platforms, such as the Google Cloud Platform (GCP), Amazon Web Services (AWS), Microsoft Azure, and Snowflake. This trend has led to the widespread adoption of cloud AdTech solutions among major advertisers and ad buyers.

The on-premises segment had a decent market share in 2024. On-premise grants greater control and security over data and processes, which is crucial for industries with strict compliance requirements, such as advertising. It involves setting up servers, databases, and software on-site, enabling real-time ad serving, targeting, and analytics without reliance on external networks.

By Enterprise Type Analysis

High Investments in Advertisements by Large Enterprises to Drive the Segment Growth

Based on enterprise type, the market is bifurcated into small and mid-sized enterprises (SMEs) and large enterprises.

In 2026, the large enterprises segment had the largest market with a share of 53.57% in 2026. Large enterprises typically allocate a significant amount of resources to advertising. They utilize various ad formats and channels to target their audiences effectively. Additionally, these enterprises harness advanced technologies, such as DSPs, DMPs, AI, and ML, to gain insights, forecast user behavior, and enhance the effectiveness of their ad campaigns.

The SMEs segment is expected to experience the highest CAGR over the forecast period. Small online retailers, startups, and local businesses are typically classified as SMEs. These companies usually have limited resources and budgets and focus on cost-effective, targeted advertising solutions.

By Device Analysis

Mobile Devices to Witness High Demand for the Solutions

Based on the device, the market is bifurcated into mobile and web.

The mobile segment is expected to experience the highest CAGR over the forecast period. Modern marketing strategies that can empower firms and propel them into the fourth industrial revolution include mobile marketing and digital advertising. The rise of mobile advertising has led to the development of new technologies that allow businesses to target customers based on their geographic location. This is propelling the segment’s growth.

In 2024, the web segment had the largest market share. The web platform includes web browsers, websites, and web-based apps that deliver online advertisements to consumers. Companies can utilize tracking and web-based analytics tools to understand their target audiences and optimize ad campaigns.

By Advertising Channel Analysis

Television Advertisement Dominated the Market Owing to Rising Smart TV Connections

Based on advertising channel, the global market is categorized into radio advertising, television advertising, print advertising, outdoor advertising, and digital advertising.

The television advertising segment accounted for the largest market share in 2024. The increase in the use of connected television (CTV) globally can be attributed to various factors, such as more affordable pricing for smart TVs, the widespread availability of the Internet, and other important drivers. For instance, the recent FICCI-EY report (Federation of Indian Chambers of Commerce & Industry) revealed that the smart TV connections to the internet rose to 19-20 million per week in 2023, up from around 10 million in 2022.

Furthermore, it is projected that digital advertising is likely to experience the highest growth rate in the coming years. The digital advertising sector has witnessed remarkable growth over the past few years, with social media, online video, and paid search emerging as the driving forces behind digital media spending.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Importance of AdTech in the Retail & E-commerce Sector to Augment Segment Growth

Based on industry, the market is segmented into media & entertainment, IT & telecom, retail & E-commerce, BFSI, education, healthcare, travel & hospitality, food & beverages, and others.

The retail & e-commerce industry is likely to grow with the highest CAGR over the forecast period. Companies operating in the retail and E-commerce segment use AdTech to advertise their products and services, build brand awareness, and, thus, drive sales.

- According to industry experts, 92% of European advertisers are already collaborating with retailers, and by 2026, retail media spending could reach as high as USD 100 billion in the U.S.

The media & entertainment sector held the major market share in 2023. AdTech in the media and entertainment industry assists businesses in promoting content, building brand awareness, and increasing viewership and engagement. Video advertising in this industry targets consumers who actively watch or stream video content, leading to a growing demand for AdTech in the sector.

AdTech Market Regional Insights

The global market scope is classified across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America AdTech Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, North America held the highest market share with a revenue of USD 16.13 billion. The regional market is experiencing significant growth due to the widespread use of digital advertising. Businesses are leveraging data to gain a better understanding of their target audiences and to make their advertising spending more effective. This has led to an increase in the use of DMPs and marketing analytics platforms, enabling companies to gather, analyze, and utilize data for developing advertising strategies. The U.S. market is projected to reach USD 267.84 billion by 2026.

- In October 2023, Meta recently introduced its initial generative AI features for advertisers. These features enable advertisers to utilize AI to produce backgrounds, broaden images, and generate numerous variants of ad text from their original copy. The first of the three new features allows advertisers to personalize their creative assets by creating various backgrounds to alter the appearance of their product images.

Asia Pacific is expected to experience the highest CAGR in the market over the forecast period. In recent years, China's economic growth and growing tech-savvy population have led to increased Internet and mobile device use. The expansion of social media has resulted in rapid growth of the advertising technology industry in the country. China is home to major tech companies, including Baidu, Tencent, and Alibaba. The preference for video-based platforms has also boosted the demand for different advertising formats in the region. The Japan market is projected to reach USD 47.48 billion by 2026, the China market is projected to reach USD 54.4 billion by 2026, and the India market is projected to reach USD 33.15 billion by 2026.

The AdTech market in Europe is growing due to the increasing use of programmatic advertising, which automates ad buying and placement through data-driven targeting. The digital out-of-home (DOOH) sector is also creating new advertising opportunities as digital displays are becoming more common in public spaces. Additionally, the increasing popularity of connected TV (CTV) and mobile internet usage is propelling the reach of video advertising, making it a powerful and engaging format. The UK market is projected to reach USD 61.42 billion by 2026, while the Germany market is projected to reach USD 67.79 billion by 2026.

- According to industry experts, the digital advertising opportunity in Europe is significant. It is projected to account for 71.6%, or USD 141.7 billion, of Western Europe's total ad spend in 2027. The total ad spend is expected to grow at a five-year compound annual growth rate (CAGR) of 4% to reach USD 198.1 billion by 2027.

The Middle East & Africa is experiencing continuous growth in the use of AdTech. The region has a young and tech-savvy population, and the rise of digital banking and e-commerce has created a demand for quick and efficient customer service.

Furthermore, countries in South America, such as Brazil, Argentina, and Chile are developing new AI regulations and organized plans to improve the use of advanced technology in the region.

AdTech KEY INDUSTRY PLAYERS

Strategic Collaborations and New Product Launches by Key Players to Boost Market Growth

The global market is fragmented, with the presence of several small and medium-sized enterprises (SMEs) and large companies, such as Adobe, Google LLC, AWS, Meta Platform Inc., and Quantcast. Players in the market are adopting strategies, such as partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

- In July 2023, Omnicom and Google formed a partnership to incorporate the latter’s generative AI models into Omnicom’s Adtech platform. This integration is aimed at enhancing the capabilities of Omnicom’s Adtech platform and offering impactful and personalized advertising opportunities.

List of Top AdTech Companies:

- Google LLC (U.S.)

- Meta Platforms Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Criteo S.A. (France)

- Alibaba Group Holding Limited (China)

- Microsoft Corporation (U.S.)

- Adobe Inc. (U.S.)

- Quantcast (U.S.)

- Zeta Global Holdings Corp. (U.S.)

- Adform (Denmark)

AdTech INDUSTRY DEVELOPMENTS

- July 2024 – Criteo, the commerce media company, announced a strategic partnership with Microsoft Advertising. This collaboration will allow Criteo to access Microsoft Advertising’s extensive demand and reach its global network of 225 retailers. The partnership is expected to generate new revenue for Criteo’s retail media network partners and expand the company’s longstanding relationship.

- October 2023 – Hivestack, a programmatic DOOH ad tech company, collaborated with Grupo Expansión, a Latin America-based omnichannel media owner that connects audiences with brands across various platforms, including events, magazines, podcasts, OOH, DOOH, and online display.

- July 2023 – Criteo S.A. announced its partnership with Integral Ad Science (IAS), a global media measurement platform. This collaboration aims to develop a product for measuring and optimizing retail media.

- May 2023 – Dentsu Africa launched a new Adtech solution called NightVision to mitigate the impact of power cuts on the advertising industry. The agency introduced NightVision as a solution designed specifically to utilize load-shedding schedules and activate media exposures in real-time.

- August 2022 – ArabyAds, a company based in the UAE that specializes in Adtech, secured USD 30 million in a pre-Series B funding round from Africinvest. ArabyAds will utilize the new financing to expand its reach, drive technological advancements, and facilitate talent acquisition in order to support its growth.

REPORT COVERAGE

The research report includes prominent regions across the globe to get a better knowledge of the industry. Furthermore, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes on the market’s drivers and restrictions, allowing the reader to obtain a thorough understanding of the industry.

An Infographic Representation of AdTech Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 14.20% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Solution

By Advertising Type

By Deployment

By Enterprise Type

By Device

By Advertising Channel

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 986.87 billion in 2025.

Fortune Business Insights says that the market is expected to reach USD 3,227.25 billion by 2034.

A CAGR of 14.20% will be observed in the market during the forecast period.

By advertising type, programmatic advertising dominated the market share in 2026.

The increasing availability and accessibility of vast amounts of data are propelling the growth of the market.

Google LLC, Meta Platform Inc., Amazon Web Services, Inc., Alibaba Group Holding Limited, and Quantcast are the top players in the market.

Asia Pacific is expected to record the highest CAGR over the forecast period.

By industry, the retail & e-commerce industry is likely to register the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic