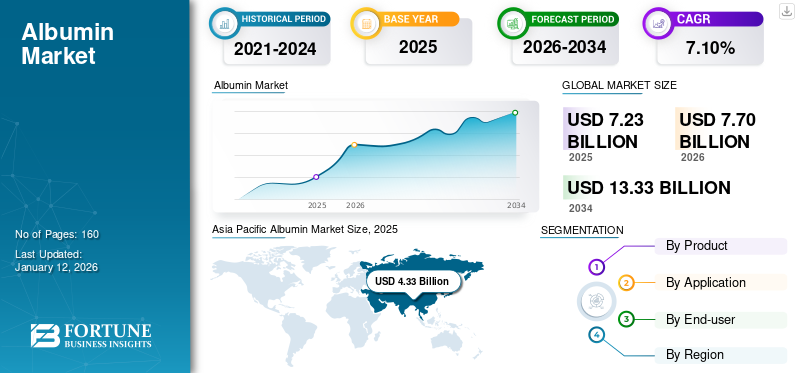

Albumin Market Size, Share & Industry Analysis, By Product (Human Serum Albumin, Recombinant Albumin, and Bovine Serum Albumin), By Application (Therapeutics, Diagnostics, and Research), By End-user (Hospitals & Clinics, Pharmaceutical & Biotechnology Industry, and Research Institutes), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global albumin market size was valued at USD 7.23 billion in 2025. The market is projected to grow from USD 7.70 billion in 2026 to USD 13.33 billion by 2034, exhibiting a CAGR of 7.10% during the forecast period. North america dominated the albumin market with a market share of 21.71% in 2025.

Albumin is a type of protein produced by the liver, with critical functions, including transporting nutrients in the body and preventing fluid leakage. There are various types of these products, including human serum, recombinant, and bovine serum. It is very useful in drug delivery, wound healing, and treating life-threatening diseases such as hypoalbuminemia. The increasing prevalence of these conditions is fueling demand for research development in this field, thereby fueling global market growth.

- For instance, in July 2023, Grifols S.A., a manufacturer of medicines derived from plasma, announced the completion of a phase 3 trial of PRECIOSA to determine the safety and efficacy of long-term albumin-based treatment with Grifols S.A.’s Albutein. With this study, the company aimed to improve its product’s efficacy in increasing the survival rates of the patients.

Moreover, the increasing focus of market players on investing in the development and commercialization of new products has also been fueling market growth.

- For instance, in September 2022, Takeda Pharmaceutical Company Limited invested around USD 300.0 million to set up a plasma fractionation plant in its Lessines site in Belgium.

Furthermore, market players such as CSL Behring (CSL), Grifols, S.A, and Takeda Pharmaceutical Company Limited have been focusing on partnerships to enhance their product offerings.

Albumin Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 7.23 billion

- 2026 Market Size: USD 7.70 billion

- 2034 Forecast Market Size: USD 13.33 billion

- CAGR: 7.10% from 2026–2034

Market Share:

- North America dominated the albumin market with a 21.71% share in 2025. This is driven by high demand in therapeutic and R&D applications, increased plasma collection, and significant pharmaceutical investments in the U.S.

- By product type, Human Serum Albumin led the market in 2024, supported by government approvals and new product launches targeting hypoalbuminemia treatment.

Key Country Highlights:

- Japan: Increasing investments in plasma fractionation plants and growing biopharmaceutical focus boost albumin market growth.

- United States: High prevalence of hypoalbuminemia and other albumin deficiency diseases, strong R&D spending, and regulatory approvals drive market leadership in North America.

- China: Rising adoption of plasma-derived therapies, expansion of private hospital infrastructure, and strategic initiatives by pharma companies propel regional growth.

- Europe: Growth supported by product launches, mergers & partnerships, and expansion of plasma fractionation centers; regulatory changes like lifting bans on domestically sourced plasma support production.

Market Dynamics

Market Drivers

Increased Prevalence of Hypoalbuminemia and Other Medical Conditions to Drive Market Growth

The burden of life threatening diseases, such as infections, special liver diseases, and cardiac surgeries, has been growing significantly. These diseases can lead to hypoalbuminemia, which occurs due to either decreased production of albumin in the body or extreme loss of protein through the gastrointestinal tract, skin, or extravascular space. It is the most common disorder in the critically ill and hospitalized patients. This has been fueling the demand for these products, thereby positively impacting albumin market growth.

- For instance, according to the data published by the American Liver Foundation, in 2022, around 100 million people suffered from some form of liver disease in the U.S., and the number is projected to grow during the forecast period. Albumin synthesis and secretion decrease due to liver failure, creating an increased demand for these therapies for these patients.

Moreover, the increasing awareness regarding the efficiency of these products has been fueling its demand, thereby positively impacting market growth.

- For instance, as per an article published by Critical Care in July 2023, the infusion of these products is an important therapeutic strategy for septic patients with liver cirrhosis. This therapy reduces the mortality rate in patients diagnosed with this condition.

- As per the data published by Healthline in February 2022, around 1 in 400 adults are living with cirrhosis in the U.S.

Therefore, the growing burden of albumin deficit diseases and the increasing awareness regarding effective medical treatment options have been fueling market growth.

Other Driving Factors

- Increasing Aging Population

Conditions such as cardiac diseases, liver diseases, and other infectious diseases are more common in the elderly population. Therefore, the increasing geriatric population has been fueling the burden of these diseases, thereby fueling the demand for effective treatment.

- Growing Biopharmaceutical Industry:

The growing biopharmaceutical industry has been fueling research and development for effective drug formulation in fields such as oncology and immunotherapy. This factor has fueled the need for these products as a stabilizing agent and carrier in biologics and monoclonal antibody development, fueling market growth. Moreover, the growing healthcare expenditure has also been fueling market growth.

Market Restraints

Stringent Government Regulations in Several Countries to Limit Product Adoption

The growing burden of hypoalbuminemia has been fueling market growth. However, certain factors, such as the limited therapeutic products and stringent government regulations, have been limiting the commercialization and adoption of these products.

- For instance, in the U.S., the FDA regulates the blood and plasma products collected, processed, and distributed by private companies under two national laws: the Public Health Service (PHS) Act and the Federal Food, Drug, and Cosmetic (FD & C) Act.

- The for-profit commercial blood establishment industry, which collects plasma from paid donors primarily, must adhere to the Source Plasma Standards and Regulations in the CFR (Code of Federal Regulations).

- In Canada, all establishments collecting plasma for plasma products, whether from volunteer or paid donors, are strictly regulated and must comply with the Food and Drugs Act and Blood Regulations. Plasma products sold in Canada must meet strict safety standards, regardless of the plasma or donor compensation.

Furthermore, government bodies do not accept plasma as a starting material unless it meets the safety and quality standards. This contributes to lengthy product approval processes and adds layers of complexity, which may hamper the market's growth to a certain extent.

Market Opportunities

Increasing R&D for Novel Albumin Products to Enhance its Availability in the Coming Years

The increasing prevalence of life-threatening disorders such as liver infections has fueled the demand for effective products. In order to fulfill this demand, market players have increased their focus on developing and launching novel and effective products.

- For instance, in August 2024, Shilpa Medicare Limited announced the successful completion of its Phase 1 clinical trial for its flagship product, sRbumin-recombinant human albumin 20% (rHA). The trial evaluated the safety, efficacy, and pharmacokinetics of rHA at different dose levels. The successful launch of these products are expected to fuel market growth in the forecast period.

Market Challenges

High Production Costs

The challenges in scaling up production due to the high costs involved in human plasma collection and recombinant protein production limit its adoption in emerging countries.

- Supply Chain Disruptions

Issues related to the sourcing of human plasma for albumin production and the limited number of suppliers limit the availability of these products.

To know how our report can help streamline your business, Speak to Analyst

Market Trends

Increased Presence of Recombinant Products in Diverse Application Areas Identified as Key Global Albumin Market Trends

The demand for recombinant albumin is increasing significantly due to its applications in restoring blood volume and replacing lost fluids during accidents, fetal erythroblastosis, serious burn injuries, hypoproteinemia, and surgeries. Compared to human or animal-derived products in terms of purity, recombinant human serum products are hydrophobic, offering excellent ligands-carrying capacity. This has increased their demand in drug delivery applications. Furthermore, prominent players in the global market are focused on several growth strategies, such as mergers and partnerships to strengthen their product portfolio to develop advanced therapies.

- For instance, in March 2021, Albumedix, Ltd. (Sartorius AG) partnered with FUJIFILM Wako Pure Chemical Corporation for the supply of recombinant human albumin in Japan and China. This partnership strengthened the Albumedix's portfolio of advanced therapies and biopharmaceutical offerings in the region.

In addition, several industry players have focused on the development of blood-free recombinant human serum albumin in recent years. InVitria is one of the companies involved in producing and developing blood-free recombinant human serum albumin. This product eliminates adventitious agents stemming from mammalian-derived serum and serum proteins, ultimately improving patient safety and treatment efficacy. Cellastim S, Exbumin, and Optibumin are some examples of blood-free albumin products manufactured by InVitria.

Furthermore, in disease conditions such as surgery, dialysis, pancreatitis, abdominal infections, liver failure, ovarian disorders caused by bypass surgery, fertility drugs, and other health disorders, recombinant albumin is very helpful in treating low albumin levels. Thus, these factors are expected to fuel market expansion in the coming years.

Other Trends

- Increasing Adoption of Albumin in Drug Delivery Systems

- Increasing Demand for Immunotherapy and Personalized Medicines has been Fueling the Demand for Albumin

- Emphasis on the Development of Sustainable and Cost-effective Production Techniques

Impact of COVID-19

The COVID-19 outbreak in 2020 positively impacted the global market. This was due to the increasing use of these products in R&D activities, given its ability to avoid surface adsorption, protect from sheer stress, and provide thermal stability to sensitive vaccines. Moreover, the growing R&D initiatives to investigate the effects of albumin on COVID-19 patients have further boosted market growth.

For instance, a study published by NCBI in April 2022 revealed that patients with low levels of albumin were more prone to COVID-19 infections. These patients faced a higher risk of severe respiratory failure, death, and longer hospital stays. Hence, there was a rising need for these injections to maintain adequate levels in the body, thereby driving market growth. However, in 2021, the market experienced slow growth due to limited plasma collection during the early stages of the pandemic. In 2022, the market grew significantly driven by the improved supply of plasma and new product launches

SEGMENTATION ANALYSIS

By Product

Human Serum Albumin Segment Dominated the Market due to the Increased Number of New Product launches

On the basis of product, the market is segmented into human serum albumin, recombinant albumin, and bovine serum albumin.

The human serum segment dominated the market share by 89.66% in 2026. The dominance is attributed to factors such as government approvals, new product launches, and increasing sales of drugs for treating hypoalbuminemia. Additionally, increasing government initiatives to promote the production of plasma-derived albumin are expected to propel the segment’s growth in the market.

- In June 2023, the Commission on Human Medicines (CHM) in the U.K. lifted the ban on domestically sourced plasma to manufacture albumin-derived products. This regulatory change is expected to boost the production of these products in the U.K., contributing to the growth of the segment.

The bovine serum albumin (BSA) segment held the second-largest market share in 2024. The growth is attributed to the low cost and stable nature of BSA as a protein standard. Additionally, increasing the number of product launches and commercialization initiatives by critical players will propel the segment's growth.

To know how our report can help streamline your business, Speak to Analyst

By Application

Increasing Number of New Product Launches is Responsible for the Therapeutic Segment’s Dominance

Based on application, the market is segmented into therapeutics, diagnostics, and research.

The therapeutics segment dominated the global albumin market share in 2025 due to the increased R&D for new product development, expanding therapeutic applications of albumin, and the growing number of new product launches. The therapeutics segment will likely to hold 65.17% of the market share in 2026.

- For instance, in July 2023, Kedrion Biopharma announced that China's National Institutes for Food and Drug Control (NIFDC) had approved BPL's human Albumin product for therapeutic use in the Chinese market.

The diagnostic segment is anticipated to experience significant CAGR of 5.13% during the forecast period. The segment's growth is due to the rising prevalence of chronic diseases and the growing need for early and accurate detection of diseases. Moreover, the establishment of new plasma donation and collection centers is expected to propel the manufacturing of albumin-based products, further propelling the growth of the segment in the market.

- For instance, in August 2022, Terumo Blood and Cell Technologies announced that its new Rika Plasma Donation System had successfully conducted its inaugural plasma donation at a CSL Plasma collection center in Aurora, Colorado. CSL Plasma is a leading global organization in plasma collection.

By End-user

Hospital & Clinics to be Major Product End-Users Due to Increased Prescription of Drugs from These Medical Centers

Based on end-user, the market is segmented into hospitals & clinics, pharmaceutical & biotechnology industry, and research institutes.

The hospital & clinics segment dominated the global market in 2025, accounting for the maximum share. The segment is expected to grow substantially during the forecast period, attributed to increased albumin-based treatments in hospital settings. The hospital & clinics segment is anticipated to dominate 54.56% of the market share in 2026.

- For instance, according to an article published by the NCBI in 2021, albumin-based products are mostly utilized for hypovolemia & hypotension, sepsis & septic shock, and intradialytic hypotension treatments in hospitals. These treatments are most frequently prescribed by nephrology, critical care, and surgical departments.

The pharmaceutical & biotechnology industry segment is anticipated to grow at the fastest CAGR of 8.31% during the forecast period. The segment’s growth in the coming years is attributed to the increasing adoption of these products in developing novel therapeutics. Additionally, biopharmaceutical companies are focusing on conducting clinical trials for the development of these products.

- For instance, in July 2023, Grifols announced the completion of enrollment for its phase-3 trial of Albutein (albumin-human injection) for the treatment of patients with decompensated cirrhosis.

The research institutes segment is expected to grow at a considerable CAGR during the forecast period. The segment’s growth is attributed to the increasing number of R&D to enhance the application of recombinant products.

Albumin Market Regional Outlook

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Albumin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the global market, generating a market value of USD 4.01 billion in 2025. In 2026, the regional market size stood at USD 4.33 billion. The market growth in the region is attributed to the growing adoption of plasma-derived therapies in private hospitals with improvements in infrastructure and technology for patients suffering from rare immunodeficiency diseases. The market in China is estimated to be USD 1.86 billion in 2026.

The Japan is estimated a market size of USD 0.85 billion and India is likely to be USD 0.46 billion in 2026.

- For instance, in June 2020, Biotest AG announced the first sales of human albumin in China to treat severe diseases such as burns and chronic diseases. Such strategic initiatives by pharma companies are projected to drive market growth in the region.

North America

North America is anticipated to account for the second-highest market size of USD 1.66 billion in 2026, exhibiting the second-fastest growing CAGR of 6.23% during the forecast period. This growth is fueled by higher use of these products in R&D activities, strong demand in the U.S., expanding non-therapeutic applications, rising product approvals, and rise in the plasma collection in the region.

The U.S. accounted for the maximum market share in the North America market in 2024. The U.S. market is projected to stand for USD 1.52 billion in 2026. The rising prevalence of diseases such as hypovolemia, hypoalbuminemia, cardiopulmonary bypass surgery, and hemolytic disease of newborns in the U.S. is projected to drive the growth of the therapeutic segment during the forecast period. In addition, heavy investments in R&D by pharmaceutical industries for various therapeutic applications are likely to drive market growth.

Europe

Europe region is to be anticipated the third-largest market with USD 1.08 billion in 2026.

Europe is projected to record considerable growth during the forecast period. The growth in the region is mainly attributed to the strategies adopted by key players, such as establishing plasma fractionation centers, expanding product portfolios, forming mergers & partnerships, and launching new products. The market in U.K. is estimated to be USD 0.18 billion in 2026.

The Germany’s market size is estimated to be valued at USD 0.28 billion in 2026 and France is likely to stand at USD 0.19 billion in 2025.

Latin America & Middle East & Africa

Latin America region is to be anticipated the fourth-largest market with USD 0.44 billion in 2026.

Furthermore, Latin America and the Middle East & Africa accounted for a considerable market share in 2024. The market is projected to grow during the forecast period due to the increased penetration of plasma fractionation facilities to promote product manufacturing and the initiation of R&D activities.

Competitive Landscape

Key Market Players

Major Players Focus on New Product Launches to Boost their Market Share

CSL Behring (CSL), Grifols, S.A, and Takeda Pharmaceutical Company Limited are among the major players in the global market, accounting for a maximum portion of the market share in 2024. The strong presence of these companies in the market is attributed to their increased emphasis on developing and launching novel therapeutics.

- For instance, in March 2021, CSL Behring (CSL) announced its partnership with Qingdao Baheal Medical Co. Ltd. ("Baheal Medical"). The two companies were focused on providing effective and accessible drug solutions, including human albumin products, to Chinese patients.

Moreover, other players in the market, such as Grifols, Kedrion S.p.A., Sartorius AG, and Octapharma AG, among others, have been focusing on getting regulatory approvals for the launch of their products in the market to expand their product portfolio.

- In June 2023, Sartorius AG collaborated with Cell and Gene Therapy Catapult (CGT Catapult) to explore the use of Albumedix’s albumin-based solutions for advanced therapy applications, including viral vector manufacturing. Such developments are expected to propel market growth.

LIST OF KEY ALBUMIN COMPANIES PROFILED

- CSL Behring (CSL), (U.S.)

- Kedrion S.p.A. (Italy)

- Takeda Pharmaceutical Company Limited (Japan)

- Lazuline Bio (India)

- InVitria (U.S.)

- Biorbyt Ltd. (U.K.)

- Grifols, S.A. (Spain)

- Octapharma AG (Switzerland)

- Albumin Bioscience (U.S.)

- Aspira Chemical (U.S.)

- ALBUMEDIX (Sartorius AG) (Germany)

- Cyagen Biosciences (U.S.)

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2024: Dyadic International, Inc. partnered with Proliant Health and Biologicals (PHB) to develop and commercialize advanced products.

- August 2023: Dyadic International, Inc., a biotechnology company, announced positive results from the third-party analytical testing of its animal-free recombinant serum albumin.

- April 2023: Takeda Pharmaceutical Company Limited received the U.S. Food and Drug Administration (FDA) approval for the expanded use of its product, HYQVIA, for treating primary immunodeficiency in children.

- July 2023: Kedrion Biopharma announced the expansion of its human serum albumin products to treat rare diseases in China.

- May 2023: American Regent, Inc. announced the launch of paclitaxel protein-bound particles for injectable suspension (Albumin-Bound), an alternative to Abraxane.

- July 2021: Octapharma AG received the U.S. Food and Drug Administration (FDA) approval to expand its production facility in Springe, Germany as an additional manufacturing site for Fraction II.

- May 2020: Bio Products Laboratory Ltd. announced the U.S. launch of ALBUMINEX 5% (human albumin) solution for injection and ALBUMINEX 25% solution for injection to treat hypovolemia, ascites, and hypoalbuminemia.

REPORT COVERAGE

The global albumin market analysis report offers a detailed market analysis and overview. The market research report focuses on key aspects, such as competitive landscape, key products, applications, end-users, and regions. Besides this, the global albumin market forecast also provides insights into the market drivers, trends, dynamics, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.70 billion in 2026 and is projected to reach USD 13.33 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 4.01 billion.

The market is expected to exhibit a CAGR of 7.10% during the forecast period of 2026-2034.

By product, the human serum albumin segment led the market.

Increased prevalence of hypoalbuminemia and other medical conditions, rise in the number of plasma fractionation facilities, and increase in plasma collection are some of the major factors driving the markets growth.

CSL Behring (CSL), Grifols, S.A, and Takeda Pharmaceutical Company Limited are the major players in the global market.

Asia Pacific dominated the market in 2025.

New product launches and strategic initiatives, such as mergers and acquisitions are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us