Plasma Fractionation Market Size, Share & Industry Analysis, By Product (Albumin, Immunoglobulin [Intravenous Immunoglobulin {IVIG}, and Subcutaneous Immunoglobulin {SCIG}], Coagulation Factors [Factor IX, Factor VIII, Prothrombin Complex Concentrates, Fibrinogen Concentrates, and Others], Protease Inhibitors, and Others), By Application (Immunology & Neurology, Hematology, Critical Care, Pulmonology, and Others), By End-user (Hospitals & Clinics, Clinical Research Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

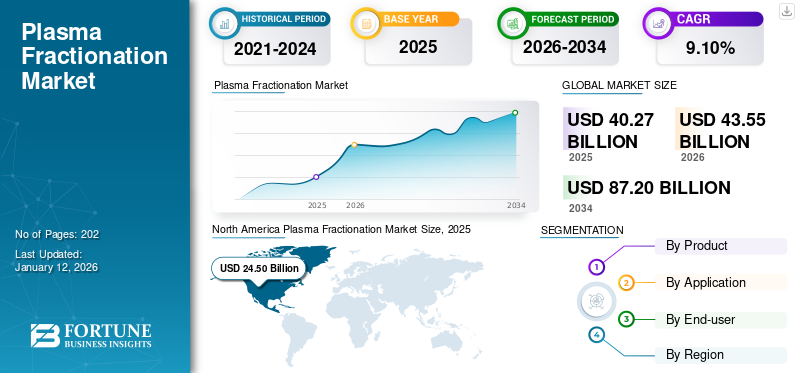

The global plasma fractionation market size was valued at USD 40.27 billion in 2025 & is projected to grow from USD 43.55 billion in 2026 to USD 87.20 billion by 2034, exhibiting a CAGR of 9.10% during the forecast period. North America dominated the plasma fractionation market with a market share of 56.21% in 2025.

Plasma fractionation is a method that separates human plasma into its component proteins for various therapeutic uses. This technique is important for producing plasma-derived therapies, including immunoglobulins (Ig), albumin, coagulation factors, and protease inhibitors, which are essential in treating a wide range of medical conditions such as immune disorders, blood clotting disorders, metabolic deficiencies, and other life-threatening disorders.

The market is consolidated with the presence of key players, such as CSL Behring (CSL) and Takeda Pharmaceutical Company Limited, Grifols, S.A., Octapharma AG, and Kedrion S.p.A., among others. The majority of market players are undergoing strategic initiatives to expand their plasma collection networks. Additionally, market players are increasing their focus on receiving regulatory approvals for the launch of effective therapeutics for the treatment of immunodeficiency disorders.

- For instance, in December 2022, Kedrion S.p.A. acquired UNICAplasma s.r.o. and UNICAplasma Morava s.r.o. to operate five plasma collection centers in the Czech Republic. The aim is to collect high-quality plasma and produce plasma-derived products to treat rare medical conditions.

The growing prevalence of chronic diseases, such as autoimmune disorders and bleeding disorders, along with advancements in plasma fractionation technologies, boosts market growth. Moreover, the growing burden of various disorders associated with immune deficiencies and the rising demand for plasma-derived therapies to prevent shock following burns and traumatic injuries are some of the important factors driving the market growth throughout the forecast period.

Moreover, to cater to the rising demand, many prominent players operating in the market are investing heavily in R&D activities and expanding manufacturing capabilities to launch new plasma-derived products. Therefore, major companies' strategic efforts are expected to drive market growth.

Global Plasma Fractionation Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 40.27 billion

- 2026 Market Size: USD 43.55 billion

- 2034 Forecast Market Size: USD 87.20 billion

- CAGR: 9.10% from 2026–2034

Market Share:

- North America dominated the plasma fractionation market with a 56.18% share in 2024, driven by a well-established healthcare infrastructure, a high number of plasma collection centers, and the presence of key industry players focusing on new product launches and facility expansions.

- By product, the Immunoglobulin segment is expected to retain its largest market share owing to the increasing demand for immunoglobulin therapies in immunodeficiency and autoimmune diseases, supported by regulatory approvals and advancements in therapeutic development.

Key Country Highlights:

- United States: Market growth is fueled by the expanding network of plasma donation centers and a strong pipeline of plasma-derived therapies by leading manufacturers.

- Europe: Growth is driven by rising awareness of immunodeficiency and bleeding disorders, increased plasma collection initiatives, and strategic acquisitions to strengthen plasma fractionation capabilities.

- China: Rapid advancements in healthcare infrastructure, increasing demand for plasma-based treatments, and establishment of new manufacturing facilities are supporting market expansion.

- Japan: Focus on innovation in plasma-derived therapies and growing collaborations with global players to address the rising burden of chronic and rare diseases is enhancing market growth.

MARKET DYNAMICS

PLASMA FRACTIONATION MARKET TRENDS

Launch of New Technologies by Key Players to Augment Market Growth

The plasma fractionation process involves breaking down plasma into various individual proteins, such as albumin, immunoglobulin, coagulation factors, and protease inhibitors for clinical use. Major market players operate specialized fractionation centers to extract these plasma proteins. The growing demand for plasma-derived therapies has led to the launch of various technologies aimed at accelerating the process.

- For instance, in April 2021, GEA delivered a new separator technology to Biopharma S.A. in its new plant in Bila Tserkva, Ukraine.

Moreover, the increasing focus of market players on gaining regulatory approval for the launch of technologically advanced fractionation systems is considered a significant market trend.

- For instance, in March 2022, the U.S. Food and Drug Administration (FDA) approved Terumo Corporation's BCT collection system to address the growing demand for plasma-derived therapies. The Rika Plasma Donation System is said to be a next-generation automated technology designed to meet this demand. On average, the device can complete plasma collection within 35 minutes, ensuring that no more than 200 milliliters of blood are outside the donor's body at one time.

Advancements in plasma fractionation technologies, such as the development of more efficient and economical methods, are enhancing the yield and quality of plasma-derived products. Automation and advancements in protein purification are also key trends in this market.

- For example, in October 2021, Plasma Technologies LLC revealed that its innovative human plasma fractionation method had demonstrated a yield of highly purified immunoglobulin G (IgG) exceeding 74.0% of the initial IgG content in donor plasma.

Various market players' constant efforts to launch novel technologies for the plasma fractionation process will drive market growth during the forecast period.

Development of Biological Products from Plasma-derived Proteins is Considered a Significant Market Trend.

The development and launch of biologics and biosimilars derived from plasma proteins is an emerging trend in the plasma fractionation industry. Biosimilars are anticipated to offer economical substitutes for current plasma-derived treatments, enhancing accessibility and affordability.

- North America witnessed a plasma fractionation market growth from USD 24.50 Billion in 2025 to USD 26.57 Billion in 2026.

Download Free sample to learn more about this report.

MARKET DRIVERS

High Burden of Immunodeficiency and Rare Disorders to Boost Market Growth

Plasma-derived therapeutics are commonly used to substitute for deficient proteins in individuals, making them essential for managing rare disorders that impact a comparatively smaller proportion of the population. The increasing need for these products is primarily attributed to a rise in the incidence of immunodeficiency disorders and other severe health conditions such as acquired immunodeficiency syndrome (AIDS), Sjögren's syndrome, and numerous others.

- For instance, as per the data provided by the U.S. Department of Health & Human Services in December 2024, there were 39.9 million individuals worldwide living with human immunodeficiency virus (HIV) in 2023. Among these, 38.6 million were adults (aged over 15 years), while 1.4 million were children (under 15 years).

Bleeding disorders, including von Willebrand disease (VWD), Hemophilia A and B, and many others, are rare genetic conditions caused by a deficiency of specific clotting factors, such as factor IX and factor VIII. The high burden of bleeding disorders worldwide is a main factor contributing to the growing demand for plasma-fractionated products.

- For instance, as per the data provided by the World Federation of Hemophilia Report 2022 published in October 2023, around 208,957 people were living with hemophilia A, and 42,203 people were living with hemophilia B in 2022. Additionally, as per the same source, in 2022, 100,505 people across the globe were living with VWD.

Thus, the increasing prevalence of rare genetic disorders and different immunodeficiency disorders are driving the demand for plasma-derived products, which in turn is fueling the growth of the plasma fractionation market.

Increasing Government Efforts to Support the Manufacturing of Plasma-Derived Products to Drive Market Expansion

Plasma-derived medicinal products (PDMPs) are industrially manufactured using human plasma. These products include albumin, immunoglobulins, and coagulation factors.

The World Health Organization (WHO) has added various PDMP products to its model list of essential medicines, recognizing them as efficient and safe treatments for critical healthcare needs, thereby boosting their demand. Moreover, governments are implementing strategies to enhance the availability of plasma-derived products in different areas worldwide.

- For instance, as per the data provided by Health Canada in June 2024, to support the blood system in Canada, the Canadian Government allocates USD 5.0 million annually to Canadian Blood Services (CBS) for research and development for blood and related components.

- In July 2023, the Medicines and Healthcare Products Regulatory Agency (MHRA) lifted the ban on manufacturing life-saving albumin treatments. Additionally, as per the same source, the chief scientists at the Independent Commission on Human Medicines (CHM) confirmed that albumin is a critically important medicine for the National Health Service (NHS), which can be safely derived from U.K. plasma donors.

- Additionally, in March 2021, the World Health Organization (WHO) published guidance on increasing the supplies of plasma-derived medicinal products in low- and middle-income countries through fractionation of domestically collected plasma.

In addition, several companies are entering the market to meet the growing demand for plasma-derived therapeutic products. For example, in November 2022, Sinovac Biotech initiated the manufacturing of plasma-derived medical products (PDMP) in Bangladesh with an investment of USD 450.8 million.

MARKET RESTRAINTS

Emergence of Recombinant Therapies as an Alternative Option to Plasma-Derived Therapeutics Impedes Market Growth

In recent years, many recombinant alternatives have been developed for various plasma-driven therapies. Recombinant products are utilized for prevention and tend to be less immunogenic than products derived from plasma. In addition, various other longer-acting replacement factors are in development, providing significant benefits, such as less frequent administration, and are more effective in prophylactic use. The rising application of recombinant factors and their expanded use in prophylactic treatments is, therefore, a significant factor hindering the adoption of plasma products.

The recombinant variant of plasma-derived products is manufactured through the expression of similar proteins sourced from genetically modified cells. It provides a safer alternative to plasma-derived products, as it eliminates the risk of blood-borne transmission of infectious diseases. As a result, the benefits linked to these products are more reliable than plasma-derived options, thereby limiting market growth. Additionally, companies are creating and introducing recombinant plasma products, restricting the use of plasma-derived products and consequently hindering market expansion.

- For example, in February 2023, Sanofi announced that it had received the U.S. Food and Drug Administration (FDA) approval for ALTUVIIIO Antihemophilic Factor (Recombinant), a factor VIII replacement therapy for patients suffering from hemophilia A.

MARKET OPPORTUNITIES

Growing R&D Activities of Plasma-derived Products to Provide Substantial Market Growth Opportunity

The ongoing research for uncovering new uses of plasma-derived therapies is considered a substantial opportunity for market players throughout the forecast period.

- For example, in July 2023, Grifols, S.A. announced topline data from its phase 3 PRECIOSA clinical trial, which evaluated the long-term use of Grifols Albutein for treating patients with decompensated cirrhosis and ascites.

Moreover, the increased focus of key players on strategic collaborations with biopharmaceutical companies and research institutes to investigate plasma-based solutions for advanced therapy applications is projected to present growth opportunities for the market.

- For instance, in June 2024, Dyadic International, Inc. announced it had formed a development and commercialization partnership with Proliant Health and Biologicals (PHB), a provider of purified proteins for the diagnostic, nutrition, and cell culture sectors.

There is a growth opportunity for market players to expand their business in the plasma fraction market in untapped regions such as Latin America, Asia Pacific, and the Middle East and Africa.

MARKET CHALLENGES

High Cost of the Plasma Fractionation Process is Limiting its Accessibility, and Affordability is Considered a Major Challenge for Market Expansion

Plasma fractionation is a highly technical and resource-demanding procedure, resulting in higher production costs. Extracting and purifying plasma proteins requires sophisticated machinery and skilled labor, potentially limiting cost-effectiveness and availability.

Regulatory Barriers and Supply Chain Constraints are Considered Significant Challenges for Market Players

Strict regulations on the safety and effectiveness of plasma-derived products may postpone market entry and raise operational expenses due to challenges in terms of raw materials. Various nations possess different regulatory systems, posing challenges for companies seeking market expansion.

- For example, in Canada, all plasma collection facilities, whether sourced from volunteer or paid donors, are strictly regulated and must adhere to the Food and Drugs Act and Blood Regulations. Plasma products available in Canada are produced in accordance with stringent safety regulations, irrespective of donor compensation or plasma origin.

Plasma is a biological substance obtained from human donors. A consistent and safe supply of plasma is crucial for production, and any interruptions in the supply chain caused by donor shortages or logistical issues can affect the accessibility of plasma-derived treatments.

Impact of COVID-19

The plasma fractionation market witnessed positive growth during the COVID-19 pandemic, driven by rising research and development initiatives exploring the effects of immunoglobulins and albumin in COVID-19 patients. Key players operating in the market experienced growth in their revenues due to the increased demand for their products.

- For instance, CSL generated a revenue of USD 8,574.0 million in 2020 from its CSL Behring business segment, which experienced an increase of 9.2% from the prior year.

In fiscal year 2021, the market experienced slow growth owing to interruptions in plasma collection caused by the pandemic. However, in 2022, the market experienced rapid growth due to an enhanced supply of plasma and new product launches in the market. Furthermore, in 2023 and 2024, companies experienced a significant increase in their plasma collection volume, and revenue and market accomplished steady growth.

SEGMENTATION ANALYSIS

By Product

Immunoglobulin Segment Dominated the Market Due to High Product Demand for Immunodeficiency Diseases

Based on product, the market is divided into albumin, immunoglobulin (IG), coagulation factors (CF), protease inhibitors, and others. The immunoglobulin segment is sub-segmented into intravenous immunoglobulin (IVIG) and subcutaneous immunoglobulin (SCIG).

The immunoglobulin (IG) segment held a dominating share of the market by 53.76% in 2026 and is expected to maintain its dominance throughout the forecast period. The dominance is largely attributed to the increasing demand for immunoglobulin therapies for various primary and secondary immunodeficiency disorders. Additionally, the increasing incidence of autoimmune diseases and increasing regulatory approvals for the launch of immunoglobulin products for the treatment of various immunodeficiency disorders are some of the additional factors driving the growth of the segment during the forecast period.

- For example, in September 2023, Biotest AG announced that its intravenous immunoglobulin Yimmugo (IgG Next Generation) received approval in the U.K. for the treatment of patients with congenital and acquired immunodeficiency, following prior approvals in Germany and Austria.

- The Albumin segment is expected to hold a 17.3% share in 2024.

Moreover, the albumin segment held the second-largest share of the global market in 2024 and is projected to grow at a moderate CAGR during the forecast period. The growing initiatives by market players for the development and launch of plasma-derived albumin products due to the high demand for these products in various clinical applications such as sepsis, hypoalbuminemia, and cirrhosis are some of the main factors driving the growth of the segment during the forecast period. Additionally, the growing use of albumin for critical care and metabolic disorders is further driving segment growth.

- For instance, in December 2024, Grifols, S.A. announced topline phase 3 data on long-term Albutein (albumin [human] U.S.P.) therapy for decompensated cirrhosis with ascites.

The coagulation factors segment is further divided into factor IX, factor VIII, prothrombin complex concentrates, fibrinogen concentrates, and others. The coagulation factors segment is expected to grow at the second-highest CAGR from 2025-2032. The growth of the segment is primarily attributed to the rise in hemophilia cases globally and the growing usage of plasma-based clotting factors for the treatment of bleeding disorders.

- For example, as per the data provided by the National Institute for Health and Care Excellence (NICE) in March 2024, in 2023, around 9,316 people were living with hemophilia A, including 2,230 with severe disease in the U.K. Also, as per the same source, there were 2,069 people in the U.K. living with hemophilia B in 2023, of whom 374 had severe and 351 had moderate disease.

The protease inhibitor segment is anticipated to grow at a comparatively limited CAGR during the forecast period. The growth of this segment is mainly attributed to the fact that, the protease inhibitors have extensive applications in the diagnosis and treatment of various bacterial, viral, and parasitic infections. Additionally, protease inhibitors are being utilized more frequently to address immunological issues, cancers, and cardiovascular and neurodegenerative diseases.

The growing prevalence of viral infections, such as human immunodeficiency virus (HIV) and other chronic conditions, is expected to boost the need for protease inhibitors. Moreover, manufacturers are directing their focus toward research and development of novel protease inhibitor-based drugs, driving the growth of the segment.

- For example, in May 2023, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) approved its medication PAXLOVID, a 3CI protease inhibitor, for the treatment of adults with mild to moderate COVID-19 who are at risk of developing severe infection.

To know how our report can help streamline your business, Speak to Analyst

By Application

Immunology & Neurology Segmental Dominated due to Regulatory Approvals & R&D Advancements

Based on application, the market is segmented into immunology & neurology, hematology, critical care, pulmonology, and others.

The immunology & neurology segment held the dominant global plasma fractionation market share in 2024 and is anticipated to grow at the highest CAGR during the forecast period. The increasing burden of immunodeficiency and autoimmune diseases led to strong global demand for these products. Combined with this, numerous plasma-based proteins are under development or undergoing clinical trials for neurology and immunology applications, leading to segment growth. Moreover, the growing initiatives by market players to receive regulatory approvals for the launch of effective therapeutics in the market is an additional factor boosting the growth of the segment throughout the forecast period. The segment is expected to dominate the market share of 70.50% in 2026.

- For instance, in June 2024, Kedrion Biopharma Inc. announced that it had received the U.S. Food and Drug Administration (FDA) approval for immunoglobulin therapy Yimmugo for the management of primary immunodeficiency (PID) diseases.

On the other hand, the hematology segment held the second-largest market share in 2024 and is expected to grow at the second-highest CAGR of 8.77% from 2025-2032. This is mainly due to advancements in several hemostasis technologies, leading to its global adoption and growth of the hematology segment. Furthermore, the prevalence of bleeding disorders, including hemophilia, positively drives market growth.

- For instance, as per the data provided by BioMed Central Ltd in August 2024, in 2022, hemophilia affected nearly 13,000 individuals in Brazil.

The critical care segment held the third-largest market share in 2024 and is projected to grow at the third-largest CAGR throughout the forecast period. The increasing number of trauma cases and accidents across the world has led to increasing demand for plasma-derived products such as coagulation factors, therefore driving market growth.

- For example, as per the data provided by the Istituto Nazionale di Statistica in July 2024, around 224,634 injuries and 166,525 road accidents occurred in Italy in 2023.

The pulmonology segment is anticipated to grow at moderate CAGR throughout the forecast period. The growth of the segment is mainly attributed to the use of intravenous immunoglobulins (IVIG) in different lung diseases. Additionally, the growing emphasis of market players on gaining approval for various plasma-derived therapies to address pulmonology conditions enhances the growth of the segment.

- For example, in May 2023, Kamada Pharmaceuticals announced that Swissmedic had granted marketing authorization for Glassia [Alpha-1 Proteinase Inhibitor (Human)] in Switzerland for chronic augmentation and maintenance therapy in adults with clinically evident emphysema due to severe hereditary Alpha-1 antitrypsin deficiency (AATD).

The others segment is expected to grow at lower CAGR during the forecast period owing to increasing cases of chronic diseases, including liver disorders, cardiovascular diseases, and many others.

By End-user

Strong Demand for Plasma Products in Hospitals & Clinics Enables Them to Be in a Leading Position

In terms of end-user, the market is categorized into hospitals & clinics, clinical research laboratories, and others.

The hospitals & clinics segment held the highest revenue share of the global plasma fractionation market in 2024. This segment is expected to grow at the highest CAGR during the forecast period, owing to the increasing number of people opting for plasma-derived therapies across the globe. The segment is expected to dominate the market share of 86.67% in 2026.

Several hospitals with developed infrastructure and advanced technology have adopted plasma-derived therapies and are recommending them to patients suffering from immunodeficiency disorders.

- For instance, in June 2023, Grifols, S.A. and Egypt's National Service Projects Organization (NSPO) revealed the introduction of the first plasma-derived medicines for use in hospitals for Egyptian patients.

The clinical research laboratories segment is anticipated to grow at the second-highest CAGR of 8.00% from 2025-2032. The rising demand for plasma-derived protein therapies for rare diseases and growing R&D activities to develop more plasma-derived products for clinical applications are some of the major factors contributing to the growth of the segment throughout the forecast period.

The others segment constitutes organizations, such as academic institutes and specialized treatment centers, and is projected to grow at lower CAGR throughout the forecast period. Currently, plasma samples are preferred over serum samples as they contain higher concentrations of blood components and thus, are often used in proteomic and metabolic studies. Moreover, plasma retains clotting factors, unlike serum, which makes it an ideal sample for analyzing blood clotting diseases and developing anticoagulant therapies. Thus, the factors mentioned above are augmenting the segment's growth.

PLASMA FRACTIONATION MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Plasma Fractionation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America stood at USD 26.57 billion in 2026 and is estimated to dominate the global market during the forecast period. This region also acquired USD 24.50 billion in 2025. The highest plasma fractionation market share of this region is attributed to the presence of a well-established healthcare infrastructure. Some factors include the presence of major companies developing and launching technologically advanced plasma-derived therapies and products, contributing positively to the region's growth. The increasing number of plasma collection centers across the U.S. is an additional factor responsible for the growth of the market in this region. The U.S. market is projected to hit USD 22.66 billion in 2026.

- For instance, in March 2023, BioLife Plasma Services, a division of the global biopharmaceutical company Takeda, announced the opening of its 200th plasma donation center in the U.S., with new locations in West Springfield, Massachusetts, and Pearland, Texas. Such launches are expected to propel the growth of the market in the country.

Europe

Europe is anticipated to account for the second-highest market size of USD 9.78 billion in 2026, exhibiting the second-fastest growing CAGR of 7.79% during the forecast period. Europe held the second-largest share of the global market in 2024, owing to the rising prevalence of immunodeficiency and bleeding disorders and increasing focus on plasma collection and plasma donation initiatives alongside advances in treatments. Moreover, the growing strategic initiatives by market players for the expansion of the plasma fractionation network are an additional factor supplementing market growth in the region. The market in U.K. is estimated to be USD 1.46 billion in 2026.

The Germany’s market size is estimated to be valued at USD 1.90 billion and France is likely to stand at USD 1.62 billion in 2026.

- For example, in September 2024, Kedrion S.p.A. announced the acquisition of Plasmafera s.r.o. to expand their plasma collection network by operating three plasma collection centers of Plasmafera s.r.o in the Czech Republic.

Asia Pacific

The Asia Pacific region is to be anticipated the third-largest market with USD 9.27 billion in 2026.

Increased expenditure on pharmaceutical products and evolving healthcare research infrastructure in India and China led to increasing demand for plasma-derived products, thus driving the plasma fractionation market growth in Asia Pacific. Furthermore, the increasing incidences of chronic diseases in Asian countries, improving healthcare access, and the launch of new facilities for manufacturing plasma-based products are the key drivers anticipated to positively affect market growth in the Asia Pacific region. The market in China is estimated to be USD 4.15 billion in 2026.

The Japanese market size is estimated to be valued at USD 2.29 billion and India is likely to stand at USD 1.14 billion in 2026.

- For instance, in May 2023, Plasma Gen Biosciences opened a new, state-of-the-art manufacturing facility for blood plasma products in Bangalore to fulfill the growing demand for plasma-based products at affordable prices.

Latin America and the Middle East & Africa

Latin America is anticipated to hold the fourth-largest market size is valued at USD 1.04 billion in 2026 and the Middle East & Africa are estimated to register comparatively slower growth during the forecast period. However, the prevalence of autoimmune diseases in these regions and the growing demand for critical care treatments are some of the main factors contributing to market growth. Moreover, the increasing plasma collection capabilities and growing partnerships among plasma-derived product manufacturers are expected to boost market growth in both regions. The GCC market is expected to stand at USD 0.20 billion in 2025.

- For example, in July 2023, GC Biopharma Corp. signed a USD 90.48 million supply contract with Blau Farmacêutica, a Brazilian pharmaceutical company, for IVIG-SN 5.0% blood products over five-year period. Such partnerships are expected to boost the growth prospects of the plasma fractionation market in Latin America.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Focus of Market Players on Strategic Initiatives to Strengthen their Footprints in the Market

The global plasma fractionation market is consolidated in nature with the presence of market players, such as CSL Behring (CSL) and Takeda Pharmaceutical Company Limited, which held the majority of the market share in 2024. High expenditure in research and development, a growing focus on establishing new plasma collection centers, and an increasing emphasis on collaborations and partnerships to strengthen brand presence are a few factors contributing to their high share.

- For instance, in December 2022, CSL Behring (CSL) established a plasma manufacturing facility in Victoria, Australia. The new facility can process up to 9.2 million plasma equivalent liters per year, increasing the current capacity by ninefold. Through this investment, the company aimed to meet the rising demand for plasma-based products globally.

Other players, including Grifols, S.A, Octapharma AG, Kedrion S.p.A, and Sartorius AG, etc., have increased their emphasis on strategic collaborations and new product launches to strengthen their presence in the global market.

- For example, in June 2023, Sartorius AG collaborated with Cell and Gene Therapy Catapult (CGT Catapult) to investigate the use of Albumedix albumin-based solutions for advanced therapy applications, including viral vector manufacturing.

LIST OF KEY PLASMA FRACTIONATION COMPANIES PROFILED:

- CSL Behring (CSL) (U.S.)

- Grifols, S.A (Spain)

- Takeda Pharmaceutical Company Limited (Japan)

- Kedrion S.p.A (Italy)

- Octapharma (Switzerland)

- ADMA Biologics, Inc. (U.S.)

- Sartorius AG (Germany)

- LFB (France)

KEY INDUSTRY DEVELOPMENTS

- July 2024 – Kedrion S.p.A. announced that it had established the framework for a long-term agreement with Biotest AG for the full commercialization and distribution of the immunoglobulin therapy Yimmugo in the U.S. market.

- March 2024 – argenx announced the approval of VYVGART (efgartigimod alfa) in Japan for the treatment of primary immune thrombocytopenia.

- December 2023 – Octapharma AG received extended approval from the U.S. FDA for its plasma-based product, wilate (von Willebrand Factor/Coagulation Factor VIII Complex). The new extended approval label comprises routine prophylaxis aimed to reduce the frequency of bleeding episodes in adults and children aged six years and above.

- November 2023 – Grifols, S.A. received the U.S. FDA approval for its new immunoglobulin (Ig) purification and filling facility in North Carolina. Through this facility, the company was able to manufacture an additional 16 million grams of plasma therapy annually.

- March 2023 – Takeda Pharmaceutical Company Limited invested USD 764.6 million to build a new plasma-derived therapy production site in Osaka, Japan. The facility will be operational by 2030 and will expand the company's manufacturing capacity in Japan fivefold.

- March 2023 – Grifols, S.A. established a manufacturing facility in Marburg, Germany, with an expanded manufacturing capacity for human plasma therapies.

REPORT COVERAGE

The global plasma fractionation market report provides detailed market analysis. It focuses on key aspects, such as the overview of the types of plasma fractionated products, regulatory scenario by key countries, reimbursement scenario by key countries, pipeline analysis, number of plasma collection centers for key countries, prevalence of chronic diseases by key countries, pricing analysis of plasma products, and distribution of the product (volume) by region. In addition to the global plasma fractionation market forecast and size, it offers insights into the market trends and highlights key industry developments. Also, it includes an overview of new product launches/approvals, global market forecast, and the impact of COVID-19 on the global market. Besides these, the report offers insights into market trends and highlights key strategies by market players. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that, the market is projected to reach USD 87.20 billion by 2034, growing at a CAGR of 9.10%.

North America dominated the plasma fractionation market with a market share of 56.21% in 2025.

Registering a CAGR of 9.10%, the market will exhibit steady growth during the forecast period.

Rising cases of immunodeficiency disorders, growing demand for plasma-derived therapies, and technological advancements in fractionation techniques.

Major players include CSL Behring, Grifols, Takeda, Octapharma, and Kedrion, leading through capacity expansion and FDA approvals.

North America will lead with an over 56.21% share in 2025, driven by strong healthcare infrastructure and increasing plasma collection facilities.

Immunoglobulin, especially IVIG and SCIG, holds the largest share due to increasing usage in neurology and immunology treatments.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us