Advanced Ceramics Market Size, Share & Industry Analysis By Product (Alumina, Zirconia, Titanate, Silicon Carbide, & Silicon Nitride/Sialon), By Application (Automotive {Engine Parts, Exhaust Systems, Automotive Electronics, & Braking Systems}, Electronic Components {Substrates, Functional Components, & Micro Components}, Semiconductors {Structural & Optical Components, Plasma-Resistant Wear Parts, & Precision Machined Tools}, Medical/Healthcare {Dental Application, Orthopedic Application, & Surgical Instruments}, & Machinery/Processing), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

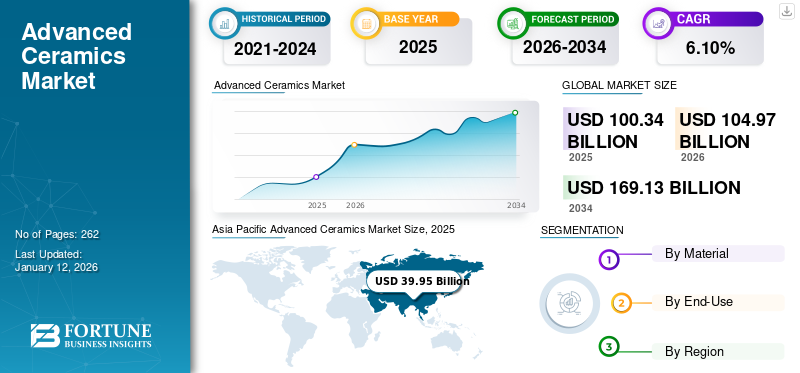

The global advanced ceramics market size was valued at USD 100.34 billion in 2025. The market is projected to grow from USD 104.97 billion in 2026 to USD 169.13 billion by 2034, exhibiting a CAGR of 6.10% during the forecast period of 2026-2034. Asia Pacific dominated the advanced ceramics market with a market share of 40% in 2025.

Advanced ceramics are referred to as high-tech ceramics, technical ceramics, high-performance ceramics, and engineered ceramics. They have superior properties compared to traditional ceramics and are characterized by enhanced mechanical and thermal properties. These materials offer exceptional hardness, corrosion resistance, thermal stability, and electrical insulation or conductivity, manufactured through sophisticated processing techniques for high-performance applications across various industries requiring exceptional durability and reliability.

Technologies such as hydraulic pressing, injection molding, isostatic pressing, tape casting, and pressure casting are used to provide better quality ceramic products. These ceramics range from monolithic ceramics to ceramic matrix composites to ceramic coatings. The rising consumption of ceramics in the medical industry, coupled with increasing product adoption as a substitute for metals and plastics in the automotive industry, will boost the market growth during the forecast period. KYOCERA, COORSTEK, CeramTec GmbH, Morgan Advanced Materials, and SAINT-GOBAIN are the key players operating in the market.

Advanced Ceramics Market Trends

Electric Vehicle (EV) Revolution to Bolster the Market Growth

The automotive industry is a major force behind the global advanced ceramic market growth, driven by its embrace of cutting-edge technologies and eco-friendly goals. Advanced ceramics such as silicon carbide, alumina, and zirconia are prized for their heat resistance, durability, and lightweight nature. These qualities make them perfect for electric vehicles (EVs), traditional engines, and advanced driver assistance systems (ADAS). The global rise in EV popularity, spurred by strict environmental rules and the demand for zero-emission cars, boosts the need for ceramics in battery parts, thermal management, and power electronics. Silicon carbide, for example, improves energy efficiency in EV high-voltage systems.

Ceramics are employed in engine components, brakes, and exhaust systems for EVs and traditional vehicles. They reduce vehicle weight, improve fuel efficiency, and withstand extreme conditions effortlessly.

Ceramics are increasingly vital in the automotive sector, driven by the emergence of connected and autonomous vehicles. These vehicles rely on ceramics for crucial components such as sensors and electronic systems, essential for safety and optimal performance. Furthermore, innovative production methods such as 3D printing make intricate ceramic parts easier and more affordable. This expanded accessibility and cost effectiveness are broadening the appeal of ceramics across the entire automotive industry.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Surging Electronics and Semiconductor Demand to Drive Advanced Ceramic Adoption

The electronics and semiconductors sector is a key market driver, propelled by the material’s exceptional properties that meet the rigorous demand for cutting-edge technology. Advanced ceramics, such as alumina, aluminum nitride, and silicon carbide, provide outstanding electrical insulation, high thermal conductivity, and durability in extreme environments, making them vital for substrates, insulators, and electronic components. Semiconductors are crucial for smartphones, 5G infrastructure, and IoT technology. According to the Semiconductor Industry Association (SIA), the global semiconductor sales reached USD 627.6 billion in 2024, a 19.1% rise from USD 526.8 billion in 2023.

Innovations such as additive manufacturing and nanotechnology, supported by the U.S. government, are anticipated to drive market growth. The semiconductor manufacturing industry depicted a 9.8% increase between 2020 and 2021, reaching USD 47.4 billion in 2021, according to the National Science Foundation (NSF), enhancing ceramic application, enabling precise, cost-effective production. Industry leaders are expanding facilities, particularly in China and Japan, where electronics manufacturing thrives. As industries prioritize high-performance, sustainable materials, this sector drives the global advanced ceramics market growth, aligning with global connectivity trends.

Market Restraints

High Costs and Brittleness to Stifle Market Growth

The market faces several constraints that hinder its growth. High production costs are a primary barrier, as manufacturing ceramics involves complex processes such as high-temperature sintering and specialized equipment. These expenses make ceramics less competitive in cost-sensitive applications, limiting their adoption in automotive or medical/healthcare industries.

The inherent brittleness of ceramics also restricts their use. Despite advancements such as zirconia-toughened alumina, ceramics remain prone to cracking under mechanical stress, posing challenges in applications requiring high impact resistance, such as heavy machinery or certain automotive components. This limits their versatility compared to metals or polymers.

Additionally, limited awareness and expertise in handling it restrict market expansion. Many industries lack the technical know-how to integrate ceramics into their processes and the high initial investment in training and infrastructure can be a deterrent. These challenges collectively limit growth despite its strong potential in high-performance applications. Toxic substances can also result in delays in product development and market entry.

Market Opportunities

Nanotechnology Integration to Drive Advanced Ceramics Innovation and Expand Market Opportunities

Integrating nanotechnology creates diverse market opportunities by enhancing its properties for specialized applications across various industries. In aerospace, nanoceramics enable the production of lightweight, heat-resistant components such as turbine blades, addressing the industry’s need for durable, fuel-efficient materials. These advanced materials withstand extreme conditions, making them ideal for high-performance systems.

In automotive applications, nanotechnology drives the development of biocompatible nanoceramics, such as zirconia, for dental and orthopedic implants. These materials offer exceptional durability and a natural appearance, meeting the rising demand for advanced medical solutions that improve patient outcomes. In electronics, nanoceramics such as aluminum nitride enhance thermal management and conductivity, supporting the growth of emerging technologies.

Increased research, backed by government initiatives, accelerates the commercialization of these materials, expanding their adoption in high-tech sectors. By tailoring ceramics properties at the nanoscale, nanotechnology fosters innovation, enabling the market to meet evolving industry demand and create new market opportunities.

Market Challenges

High Production Costs of Advanced Ceramics to Impede Market Growth

The production is characterized by several factors that contribute to high manufacturing expenses. This includes using costly, high-purity raw materials, often sourced from specific locations, alongside complex and energy-intensive processing methods. These intricate steps, including precise mixing, forming, high-temperature sintering, and diamond grinding, demand specialized equipment and machinery, increasing production costs. The difficulty in controlling dimensional tolerances during these processes also adds to the expense.

These elevated manufacturing costs result in higher end-product prices, a significant market restraint. Industries in price-sensitive sectors such as mass consumer electronics may find it too expensive compared to alternative materials, hindering widespread adoption. This cost sensitivity restricts the market's growth, despite the superior performance benefits these materials offer.

Segmentation Analysis

By Product

Alumina Segment Dominated the Market Owing to Increasing Use in Electronics & Medical Industry

Based on product, the market is classified into alumina, zirconia, titanate, silicon carbide, silicon nitride/sialon, and others.

The alumina segment held the largest advanced ceramics market share 37.68% in 2026 and is expected to experience substantial growth due to its affordability, hardness, wear resistance, and ability to withstand high temperatures and electrical currents. Alumina is widely used in electronics for insulating substrates, medical applications for implants, and industrial settings for coatings and tools.

The zirconia segment accounted for the second largest share in 2024 and is projected to experience significant growth in the coming years. Zirconia offers exceptional strength, toughness, and biocompatibility, making it ideal for electronics, medical implants, and automotive sensors. Its durability supports dental and orthopedic applications, particularly in advanced manufacturing regions.

By Application

To know how our report can help streamline your business, Speak to Analyst

Electronics Component Segment Dominated the Market Due to Exceptional Properties of Ceramics

In terms of application, the market is segmented into automotive, electronic components, semiconductors, medical/healthcare, machinery/processing, and others.

The electronics component segment dominated the market share 38.50% in 2025. Advanced ceramics are vital in electrical components due to excellent insulation, thermal stability, and dielectric properties. Materials such as alumina and aluminium nitride are used in substrates, capacitors, and insulators, enabling the miniaturization of consumer electronics and telecommunications devices. The rise of advanced technologies, such as high-speed connectivity and smart devices, fuels the demand for ceramics in high-performance components such as piezoelectric actuators.

The semiconductor industry is the second fastest-growing segment and is a key application area for advanced ceramics, driven by the need for materials that support high-performance electronics. Alumina and silicon carbide are used as substrates and insulators in chip manufacturing, valued for their dielectric properties and high temperature resistance. The demand is strong in regions with advanced semiconductor industries, particularly where innovation in chip technology is accelerating.

Advanced Ceramics Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Advanced Ceramics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in the Asia Pacific stood at USD 41.92 billion in 2026. It dominated the market in 2026 and is expected to grow at the highest CAGR over the forecast period. The Asia Pacific region is a major market due to its rapid industrialization, urbanization, and a growing middle class that boosts consumer electronics and automotive sales. The region's manufacturing capabilities and cost-effective labor support production and export. Government initiatives promoting clean energy and sustainability also contribute to demand in related sectors. Countries such as China, Japan, South Korea, and Taiwan are key players in semiconductor manufacturing, driving the demand for related ceramic components. China's manufacturing hub status and Japan's ceramic technology innovation further strengthen the region's position. The Japan market is projected to reach USD 6.06 billion by 2026, the China market is projected to reach USD 23.31 billion by 2026, and the India market is projected to reach USD 4.27 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The market size in the North America stood at USD 29.54 billion in 2026. North America is a mature market with strong industrial infrastructure and high technology adoption. The demand is driven by the electrical equipment and electronic device manufacturing sectors. Moreover, increased healthcare awareness and growth in the electronics industry contribute to the rising demand. The region, especially the U.S., is a leader in aerospace, defense, and medical applications. The U.S. advanced ceramics market stood at USD 22.04 billion in 2026.

Europe

The market size in the Europe stood at USD 20.27 billion in 2026. Europe is a mature market with steady growth for advanced ceramics. The automotive industry, particularly with the rise of EVs, is a key driver, utilizing ceramics in various components. The region's focus on sustainability and energy efficiency also increases the demand for ceramics in renewable energy systems. Germany is notable for its R&D activities and the product application in automotive and industrial machinery. The healthcare sector contributes significantly to the demand for bioceramics due to an aging population and medical advancements. The UK market is projected to reach USD 2.05 billion by 2026, while the Germany market is projected to reach USD 6.09 billion by 2026.

South America

South America's market is growing due to industrialization, infrastructure development, and technology adoption. Due to their superior properties, the demand for high-performance materials is increasing in electronics, automotive, healthcare, and energy sectors. Additionally, the rising use of silicon carbide and silicon nitride in the chemicals and electronics industries is driving product demand. Countries such as Brazil, with its diverse industrial base, further contribute significantly to this demand.

Middle East & Africa

The market size in the Middle East & Africa stood at USD 8.67 billion in 2026. The Middle East & Africa region is experiencing strong growth in product demand driven by urbanization and industrialization. High demand from electronics, automotive, aerospace, and medical devices is supporting market growth. Government investments in manufacturing and defense are further contributing to market expansion. Furthermore, a growing focus on sustainability drives the adoption of lightweight and durable ceramic alternatives.

Competitive Landscape

Key Market Players

Leading Advanced Ceramics Players Emphasize Innovation to Increase Market Share

Major market players primarily focus on innovation and sustainability to fuel growth and remain competitive. This involves substantial investment in research and development to create materials with enhanced properties. New ceramic materials and advanced manufacturing technologies such as 3D printing are also being explored. Companies such as Kyocera Corporation, Morgan Advanced Materials, and CoorsTek lead these efforts. Simultaneously, a growing emphasis on sustainable practices is driven by increasing environmental regulations and a focus on energy efficiency. This includes developing eco-friendly ceramics, optimizing manufacturing processes to minimize waste and energy consumption and recycling ceramic materials. Additionally, these companies are strategically expanding their presence in key industries, including electronics, automotive, and medical, where it is vital for high-performance applications such as semiconductors, batteries, and medical implants.

List of Top Advanced Ceramics Companies Profiled

- International Syalons (Newcastle) Limited (Europe)

- KYOCERA (Japan)

- S&S Advance Ceramics Pvt Ltd. (India)

- Advanced Ceramics Manufacturing (U.S.)

- Nishimura Advanced Ceramics Co., Ltd. (Japan)

- CeramTec GmbH (Germany)

- COORSTEK (U.S.)

- SAINT-GOBAIN (France)

- Morgan Advanced Materials (Europe)

- Technocera (India)

KEY INDUSTRY DEVELOPMENTS

- February 2025 – COORSTEK installed an on-site power system at its Thailand manufacturing facility, supporting its sustainability goals by reducing carbon emissions and energy costs while enhancing clean energy use in advanced ceramics production.

- October 2024 – Kyocera began constructing its new medical ceramics facility in Germany, focusing on producing ceramic ball heads for hip implants. The plant emphasizes automation, sustainability, and will support Kyocera’s expansion in the European healthcare market, with production starting in early 2026.

- September 2024 – Kyocera invested in building a new fine ceramics and semiconductor component plant in Japan. The new facility will support 5G, AI, and EV demand, with production starting in 2026.

- August 2024 – COORSTEK completed the construction of its third advanced ceramics factory in Gumi, South Korea, enhancing its global manufacturing capacity. The facility will support the growing semiconductor, automotive, and energy demand, focusing on high-performance ceramic components.

- August 2024 – Saint-Gobain Performance Ceramics & Refractories acquired Ceramco’s industrial ceramics assets, including carbon-bonded and silicon nitride technology for non-ferrous metals industries. This strengthens their presence in the areas of zinc, copper, and aluminum processing ceramic solutions.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, products, compositions used to manufacture these products, and product applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.10% from 2026 to 2034 |

|

Segmentation |

By Product

|

|

By Applications

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 104.97 billion in 2025 and is projected to record a valuation of USD 169.13 billion by 2034.

In 2026, the Asia Pacific market value stood at USD 41.92 billion.

Recording a CAGR of 6.10%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2026, the electronic component segment was the leading segment in the market in terms of application.

The surging demand for electronics & semiconductors is a key factor driving the market.

Asia Pacific dominated the advanced ceramics market with a market share of 40% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us