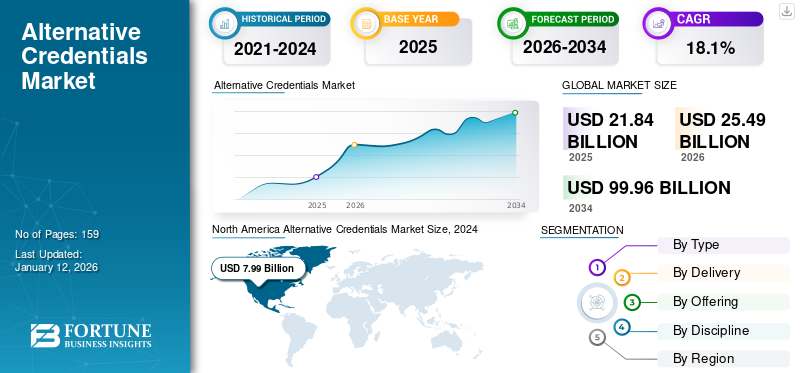

Alternative Credentials Market Size, Share & Industry Analysis, By Type (Professional Certificates, Graduate Certificates, Undergraduate Certificates, Badges, Coding Bootcamps, and Others), By Delivery (On-campus, Off-campus, and Online/Hybrid), By Offering (Credit Bearing, Non-credit Bearing, and Both), By Discipline (Computer Science, Engineering, Language, Arts & Designs, Health and Life Sciences, Business, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global alternative credentials market size was valued at USD 18.83 billion in 2025 and is projected to grow from USD 21.84 billion in 2026 to USD 69.88 billion by 2034, exhibiting a CAGR of 18.60% during the forecast period. The North America dominated global market with a share of 43.10% in 2025.

This market refers to the education and training sectors, which provide contemporary credentials that aim at developing specific skills and competencies outside the traditional degree programs. This market consists of various credentials, such as certificates, micro-credentials, digital badges, nanodegrees, professional certifications, and bootcamps. The global market is emerging as a catalyst for change in the education as well as professional development landscape. On the contrary, to traditional degrees, alternative credentials offer a flexible, affordable, and skill-focused approach to learning. Owing to the need for continuous skill enhancement required in today’s job market, employers and educational institutions are increasingly recognizing these credentials.

Download Free sample to learn more about this report.

North America holds the largest alternative credential market share within the global market, mainly because of early adoption of alternative credential programs as well as the strong presence of key EdTech companies in the region. Europe and Asia Pacific are also notable markets, among which Asia Pacific is expected to witness a high growth rate due to growing internet penetration in the region and a burgeoning demand for skills-based education.

Major players in the alternative credential market include a mix of education technology companies, universities, as well as financial institutions collaborating to offer diverse, skills-based learning options outside traditional degrees. Key companies include 2U Inc., Coursera Inc., Pearson Plc, Credly Inc., Udemy Inc., and others.

IMPACT OF GENERATIVE AI

Generative AI Enhances Alternative Credentials by Personalizing Learning and Reducing Costs

Generative AI is changing the way alternative credentials are created and delivered by making learning more personalized and flexible. It helps develop customized course content and provides quick feedback, which keeps learners engaged and supports their progress. Many education providers are now using these tools to offer micro-credentials and digital badges that focus on the skills employers need, making it easier for people to gain relevant qualifications.

Further, generative AI is also lowering the cost of teaching and assessment, thus making quality education accessible for all. As a result, many people are opting for these programs, and alternative credentials are becoming widely accepted across fields. Hence, generative AI is helping education evolve to better cater to the demands of today’s job market.

ALTERNATIVE CREDENTIALS MARKET TRENDS

Growing Emphasis on Soft Skills to Drive Demand for Credential Validation

The increasing emphasis given to soft skills, along with technical expertise, shows a recognition of the holistic needs of modern workplaces. While technical skills are required to perform specific job tasks, soft skills such as leadership, communication, and teamwork are also increasingly acknowledged as fundamental for success in professional settings. Employers are also aware that effective collaboration, clear communication, along with strong leadership qualities are important for driving innovation, fostering teamwork, and navigating complex organizational dynamics. As a result, there is a growing demand for credential programs that validate and demonstrate proficiencies in these soft skills.

In addition, as remote work and virtual collaboration become more popular, the importance of soft skills in developing effective communication and interpersonal relationships will increase. Therefore, the focus on soft skills in credentialing mirrors a strategic response to the evolving needs of workplaces, where success usually depends to a large extent on interpersonal abilities and technical prowess.

MARKET DYNAMICS

Market Drivers

Flexibility and Accessibility of Alternative Credentials to Propel Market Growth

Many working professionals, as well as non-traditional students, are in need of educational options that fit into their busy schedules. Traditional degree programs that are offered in colleges often require a significant time commitment and adherence to rigid schedules, which can be restraining for those balancing work, family, along with other responsibilities.

On the contrary, alternative credentials, such as online courses, micro-credentials, and bootcamps, offer high flexibility to the learners. Such accreditation allows them to study at their own pace, at whatever time and location they want. It also provides the option to take individual courses or modules rather than committing to an entire program upfront. Additionally, these credentials cost less as compared to traditional degrees, which makes learning more accessible to a wider audience, including those who may not pursue higher education owing to financial constraints. Online platforms and digital learning tools further increase this accessibility, thus enabling learners around the globe to access high-quality education without any geographic constraints.

Market Restraints

Lack of Integration Hinders the Adoption of Alternative Credentials

Integrating alternative credentials with traditional education systems is a significant restraint for the global market. Traditional education routes, such as college degrees, have long-established structures and credit systems, which may not easily align with the more flexible as well as varied formats of alternative credentials. This misalignment leads to challenges for learners who wish to combine or transition between different types of education. For example, a student who obtains a series of micro-credentials or certificates might find it difficult to transfer these credits into a traditional degree program owing to differences in curriculum design, accreditation standards, and institutional recognition.

In addition, traditional institutions are slow to adopt or acknowledge alternative credentials, viewing them as supplementary courses rather than analogous to formal education. This resistance hinders the potential of alternative accreditation to be fully integrated into a learner's broader educational and career trajectory, therefore constraining the market growth of alternative credentials.

Market Opportunities

Rising Skill Gaps Create Lucrative Opportunity for Alternative Credentials

As employers are increasingly prioritizing skills over traditional degrees, owing to rapid technological advancements and evolving job needs, this has created a significant opportunity for the global market.

This competition for skills creates a need for learning that is flexible, economical, and more focused (i.e., on the work that individual jobs demand), such as professional certificates, badges, or boot camps, especially in fast-growing fields such as IT and healthcare.

SEGMENTATION ANALYSIS

By Type

Professional Certificates to Dominate Global Market Due to Their Widespread Recognition

Based on type, the market is segmented into professional certificates, graduate certificates, undergraduate certificates, badges, coding bootcamps, and others.

Professional certificates segment is expected to lead the market, contributing 31.31% globally in 2026. Employers usually favor candidates with professional certificates, as they portray specialized knowledge and skills that are required for specific job roles.

As per Fortune Business Insights, coding bootcamps will display the largest CAGR over the forecast period owing to the rising demand for software developers and IT professionals in the market.

Graduate certificates are postgraduate-level qualifications that provide learners with advanced knowledge in a specific field. Many employers sponsor graduate certificate programs for their employees as part of professional development, leading to the segment's growth.

Undergraduate certificates also hold a substantial share due to a larger target audience. Badges are digital portrayals of skills and achievements that one can earn through various online platforms. The rise of micro credentials, along with the flexibility that badges offer, has resulted in the growth of this segment.

To know how our report can help streamline your business, Speak to Analyst

By Delivery

Online/Hybrid Delivery Methods to Capture Highest Market Share Owing to Their Flexibility and Accessibility

Based on delivery, the market is segmented into on-campus, off-campus, and online/hybrid.

In 2026, the Online/hybrid segment is projected to lead the market with a 46.33% share. The flexibility, accessibility, and technological advancements are some of the major factors driving the growth of this segment.

Off-campus delivery holds the second-highest share of the global market. This segment includes programs/workshops conducted at various locations other than the main campus, such as corporate training centers, community centers, or partner institutions. It caters to a niche audience that wants convenience and localized learning options.

On-campus delivery of alternative credentials also holds a substantial market share, catering primarily to individuals who prefer face-to-face interactions and a structured learning environment.

By Offering

Non-Credit-Bearing Programs, Owing to Their Affordability and Accessibility, Dominate Global Market

Based on offering, the market is segmented into credit bearing, non-credit bearing, and both.

Non-credit bearing segment is projected to dominate the market with a share of 51.47% in 2026. This makes them affordable and accessible to a wide audience, contributing to their high market share.

Credit bearing programs, on the other hand, are expected to display higher CAGR over the forecast period owing to the growing recognition of alternative accreditation by universities and employers.

Programs offering both credit and non-credit options cater to a niche customer segment. These programs enable learners to choose whether they want to obtain credits or just acquire skills and knowledge.

By Discipline

Computer Science Discipline Leads Global Market Due to High Demand

Based on discipline, the market is studied across computer science, engineering, language, arts & designs, health and life sciences, business, and others.

Computer science segment will account for 22.52% market share in 2026, along with increasing demand for digital skills.

Engineering also holds a substantial share of the global market. This segment offers courses for various specializations, including mechanical, electrical, civil, and chemical engineering.

Language programs in the alternative credential market are also gaining traction due to the rising need for multilingual communication in global business and multicultural environments.

In addition, art & design is also a vibrant segment of the alternative credentials market, which caters to creative professionals and enthusiasts.

Health and life sciences is another crucial segment. The growth of this segment is mainly because of the growing demand for healthcare professionals as well as advancements in medical research and biotechnology.

The business segment also holds a considerable share of the global market. The segment consists of a wide range of disciplines, including management, finance, marketing, and entrepreneurship, that mainly caters to individuals seeking to develop business acumen.

ALTERNATIVE CREDENTIALS MARKET REGIONAL OUTLOOK

In terms of geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Alternative Credentials Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 9.41 billion in 2025 and USD 11.18 billion in 2026. The region’s robust education infrastructure and notable investment in employee development by corporate companies have contributed to the market’s growth in the region. The matured education system, high adoption of online learning technologies, and a focus on professional development have contributed to the region’s dominance.

The U.S. is a key player in the global alternative credential market and the leading country in the North American region. The country is characterized by a high adoption rate of various non-traditional educational pathways. Coding bootcamps are experiencing speedy growth in the country owing to increasing demand for technical skills. Further, the large-scale presence of major alternative credential providers such as Udemy and Coursera in the country has resulted in a healthy competition, which, in turn, has driven innovation and diversity in the types of credentials that are being offered. The U.S. market is estimated to reach USD 8.78 billion by 2026.

Europe

Europe also holds a substantial share of the alternative credential market. The region is characterized by a very diverse educational landscape, along with a strong emphasis given to lifelong learning. The large-scale presence of leading universities and vocational training centers has significantly contributed to the region's market share. However, regional disparities in educational program standards as well as access to technology can hinder market uniformity in the region. The UK market is expected to reach USD 1.41 billion by 2026, while the Germany market is projected to reach USD 1.35 billion by 2026.

Asia Pacific

The Asia Pacific region is experiencing rapid growth in the alternative credentials market, fueled by the rising population, an expanding middle class, and increasing internet penetration. China, India, and Australia are the frontrunners with significant investments in education technology and online learning platforms. These countries are focusing on enhancing employability through skills development in areas such as computer science, engineering, and business, which is further driving the alternative credentials market growth. However, challenges, such as varying educational quality across the region and access to technology in rural parts, may hinder the growth potential. The Japan market is projected to reach USD 0.99 billion by 2026, the China market is expected to reach USD 2.08 billion by 2026, and the India market is estimated to reach USD 1.49 billion by 2026.

Middle East and Africa

The Middle East & Africa region has also slowly started embracing the alternative credential, with an objective to develop its workforce and build up skills. Governments and the private sectors are continuously making investments in education and training initiatives to fill the skill gaps and decrease unemployment. Online and hybrid learning is gaining traction, particularly in urban areas of the region, thus making education more accessible.

South America

South America has a relatively smaller market share. However, the region shows promising potential in the alternative credentials market, which is mainly driven by a young population that needs educational and professional advancement. Brazil and Argentina are the frontrunners in adopting online learning platforms and alternative credentialing to bridge the skill gap. The governments in the region are focusing on improving employability and fostering economic growth through education. Economic instability, limited access to quality education, along with technological disparities in some parts, are impeding market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Diversifying and Expanding their Portfolio through Partnerships

Major players in the global alternative credential market are collaborating with top colleges, universities, companies, and industry experts with the objective of offering a wide range of online courses, professional certificates, and specialized programs. Top companies are also focused on providing flexible, accessible, as well as affordable education to everyone. They are also trying to cater to the demand for upskilling and reskilling in various fields, especially in technology, business, and professional development.

Long List of Companies Studied (including but not limited to

- 2U Inc. (U.S.)

- Coursera, Inc. (U.S.)

- FutureLearn (U.K.)

- General Assembly (AdeccoGroup) (U.S.)

- Pearson (Credly) (U.K.)

- Pluralsight LLC. (U.S.)

- Simplilearn Solutions (India)

- Strategic Education, Inc. (U.S.)

- Udacity, Inc. (U.S.)

- Udemy, Inc. (U.S.)

- Skillshare (U.S.)

- edX (U.S.)

- LinkedIn Learning (U.S.)

- Khan Academy (U.S.)

- Alison (Ireland)

- DataCamp (U.S.)

- Codecademy (U.S.)

- Saylor Academy (U.S.)

- Great Learning (India)

- Iversity (Springer Nature) (U.K.)

- Galvanize (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2024: 2U and Pepperdine University collaborated in order to launch six new online degree programs in the field of education and healthcare, which include a Master of Science in Education, a Master of Arts in Teaching, three doctoral programs in education, and a Master of Science in Speech-Language Pathology.

- November 2023: Udemy announced a partnership with Google Cloud, thus becoming an inaugural member of its new Cloud Learning Services Program. The objective of this partnership is to provide learners with access to high-quality cloud skills training, which is essential due to the growing demand for cloud computing expertise in today's workforce.

- November 2023: 2U signed agreements with six universities to launch 50 new online degree programs, under its 'flex' degree partnership model. Albany College of Pharmacy and Health Sciences, Hawai’i Pacific University, King’s College London, and Maryville University are new partners. Emerson College and the University of Cape Town are existing partners who are also introducing new programs. These additions, which began in 2024, are aimed at the growing demand for flexible higher education.

- October 2023: Udemy and Docker came together to start "Upskill Next." This collaboration’s objective is to provide learners with access to Docker's expertise in containerization as well as Udemy's extensive course library, thus helping individuals upskill and reskill in technologies related to Docker, which, in turn, assists them in advancing their careers in the rapidly evolving tech landscape.

- May 2023: Devmountain announced its plans to expand its in-person coding bootcamps located at Strayer University facilities. This expansion is focused on providing students with hands-on experience in coding, thus catering to the growing demand for skilled professionals in the tech industry.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, credential types, and leading offerings and disciplines of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 18.60% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Type

By Delivery

By Offering

By Discipline

By Region

|

|

|

Companies Profiled in the Report |

2U Inc. (U.S.), Coursera, Inc. (U.S.), FutureLearn (U.K.), General Assembly (AdeccoGroup) (U.S.), Pearson (Credly) (U.K.), Pluralsight LLC. (U.S.), Simplilearn Solutions (India), Strategic Education, Inc. (U.S.), Udacity, Inc. (U.S.), and Udemy, Inc. (U.S.)

|

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 99.96 billion by 2034.

In 2025, the market was valued at USD 21.84 billion.

The market is projected to grow at a CAGR of 18.60% during the forecast period of 2026-2034.

The professional certificates segment is leading the market in terms of share.

Flexibility and accessibility are crucial factors driving market growth.

2U Inc., Coursera, Inc., FutureLearn, General Assembly (AdeccoGroup), Pearson (Credly), Pluralsight LLC., Simplilearn Solutions, Strategic Education, Inc., Udacity, Inc., and Udemy, Inc. are the top players in the market.

The North America region generated the maximum revenue in 2025.

Computer science is expected to grow at the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us