Animal Protein Market Size, Share & COVID-19 Impact Analysis, By Type (Whey, Egg Protein, Gelatin, and Caseinate), By End-Use (Pharmaceutical, Food & Beverage, Cosmetics, and Animal Feed), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

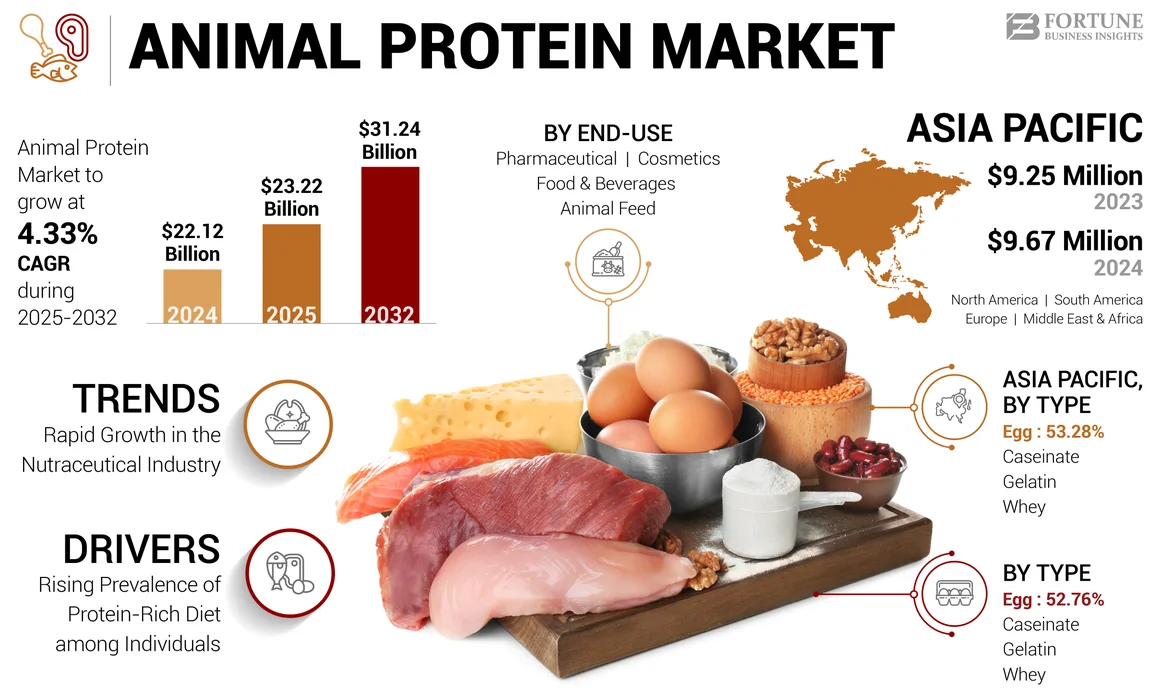

The global animal protein market size was USD 22.12 billion in 2024. The market size is expected to grow from USD 23.22 billion in 2025 to USD 31.24 billion by 2032, exhibiting a CAGR of 4.33% during the forecast period. Asia Pacific dominated the animal protein market with a market share of 43.72% in 2024.

Proteins are large biomolecules and macromolecules that are made up of long chains of amino acids residues and are vital in building muscles. Animal protein is used in various industries such as pharmaceuticals, food & beverage, cosmetics, and animal feed.

The global market is segmented by type, including whey, egg protein, gelatin, and caseinate. Whey is likely to experience a higher growth rate in the forecast period owing to the rising demand for these products in emerging markets such as India and China. The food & beverage industry has the highest growth rate during the forecast period owing to the rising global population and demand for protein-centric diets among individuals.

The Asia Pacific and Europe regions hold a significant market share due to high demand in countries such as Germany, India, China, and others. The leading two regions are followed by North America owing to the rising demand for nutraceutical products in the U.S. Furthermore, animal protein products have shown rapid growth in the forecast period, driven by the urbanization trend in countries across the Asia Pacific region.

COVID-19 IMPACT

Supply Chain Constraints caused by the COVID-19 Pandemic had a Significant Impact on The Global Market

The global pandemic caused governments to implement several restrictions, regulations, and lockdowns to control the rapid spread of the virus. The measures significantly restrained the global supply chain of animal protein products due to labor shortages. In addition, border closures had a detrimental impact on global trade, leading to increased global prices and a negative effect on profitability. For instance, as per Chuck Grassley, U.S. Senator, Iowa, the pandemic disrupted the supply chains for egg, resulting in a decline in the prices of liquid eggs and an increase in retail and farm gate prices.

The pandemic severely impacted the sales of cosmetic products. Although the food and beverages sales saw a sudden spike owing to consumers stockpiling amid the rising fear of lockdown, the focus of stockpiling inclined more toward necessary food products. Thus, there was a notable decline in demand for protein products such as whey.

However, post-pandemic, owing to the rising awareness of protein consumption and a healthy diet, the demand for nutraceutical and protein-based products saw significant growth, resulting in an increase in the global market value. For instance, as per the Food and Agriculture Organization (FAO), there has been a significant shift in consumption trend among individuals toward healthy food post-pandemic.

Animal Protein Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 22.12 billion

- 2025 Market Size: USD 23.22 billion

- 2032 Forecast Market Size: USD 31.24 billion

- CAGR: 4.33% from 2025–2032

Market Share:

- Asia Pacific dominated the animal protein market with a 43.72% share in 2024, driven by major dairy and poultry markets, a growing urban population, and rising spending capacity in countries like India and China.

Key Country Highlights:

- India: Held around 22% share in global milk production, contributing significantly to animal protein demand.

- U.S.: Strong nutraceutical demand and high consumption of sports nutrition products support market growth.

- Germany & France: High protein consumption and demand for bakery and dietary products sustain Europe's market position.

- China: Rapid urbanization and increasing demand for protein-centric diets fuel growth.

- Brazil & South Africa: Rising food and beverage consumption and health-conscious trends boost regional market potential.

Animal Protein Market Trends

Rapid Growth in the Nutraceutical Industry to Fuel the Growth in the Animal Protein Market

The nutraceutical industry has shown significant growth in recent years owing to the rising awareness of the potential benefits of dietary supplements among individuals. Nutraceutical products are known for assisting in managing health issues such as diabetes, obesity, cardiovascular diseases, cholesterol, authorities, and others.

For instance, in 2021, as per the International Trade Administration, dietary supplements hold around 65% of the nutraceutical industry, which has grown more than 15% and is expected to grow at 22% Y-o-Y in India.

In addition, the increasing participation in sports, athletics, and recreational activities among millennial and geriatric populations is one of the prominent factors fueling the growth in the consumption of nutraceutical products. Furthermore, the rapid growth in urban population and increasing spending capacity among individuals contribute to the rising demand for protein supplements.

Download Free sample to learn more about this report.

Animal Protein Market Growth Factors

Rising Prevalence of Protein-Rich Diet among Individuals to Drive Market Growth

Animal proteins such as whey, egg white powder, and others have significantly gained traction among food beverage manufacturers owing to the increasing consumption of protein-rich diets among individuals. The global demand for a protein-rich diet has been rising over the years owing to the increase in awareness of the benefits associated with protein consumption.

In addition, the rising prevalence of protein among the geriatric population and the increasing geriatric population fuels the demand for animal protein in the food and beverage industry.

For instance, as per the U.S. Census Bureau, in 2023, around 10.1% of the total population globally is aged 65 and above, expected to grow to 20% by 2050. Furthermore, increasing awareness of the benefits offered by protein supplements and food products among the geriatric population contributes to increasing demand in the global market.

RESTRAINING FACTORS

Rapid growth in Plant-based Protein Market to Restraint Animal Protein Market Growth

The demand for plant-based protein has grown significantly due to changing consumer preferences toward plant-based foods. The negative impact of red meat consumption is one of the prevalent factors causing the rapid change in consumer behavior. For instance, in 2022, as per the Plant-Based Food Association, around 6 in 10 households in the U.S. are now purchasing plant-based food products.

In addition, rising awareness of the negative impact of the poultry and animal husbandry industry on the environment has restrained the consumption of animal protein among individuals who are more inclined toward sustainable products. Furthermore, there has been a rising awareness about the harmful practices carried out by the poultry and animal husbandry industry on animals, leading to significant decline in the demand for animal products in the market. Thus, the increase in the prevalence of plant-based food products is restraining the growth of this market.

Animal Protein Market Segmentation Analysis

By Type Analysis

Whey Segment To Have Fastest CAGR Due to Increasing Demand Amongst Individuals

Based on type, the market is segmented into whey, egg protein, gelatin, and caseinate.

Whey exhibits the highest growth rate during the forecast period owing to the increasing participation in sports, athletics, and fitness regimes among individuals which is fueling the demand for whey protein.

Furthermore, the increasing adoption of gelatin in the food and beverage industry is one of the significant factors driving the growth of global market in the forecast period. The rising awareness of protein consumption in animals and its benefits has also fueled the demand for such products among animal feed producers.

The egg protein segment holds the significant share in the global market owing to its higher consumption rate in dietary supplements, sports drinks, and baked goods owing to its ability to enhance bone strength and high digestibility. The increasing consumption of food products such as bakery, snacks, confectionaries, and others further contributes to its prominence.

Thus, the rapid advancement in technology, new product launches, and increasing awareness regarding the benefits of whey, egg protein, caseinate (Type of Milk Protein), and gelatin consumption, is driving growth in the global market.

To know how our report can help streamline your business, Speak to Analyst

By End-Use Analysis

Rising Advancement in the Food & Beverages Industry to Fuel the Growth in the Animal Proteins Industry

By end-use, the market is segregated into pharmaceuticals, food & beverages, cosmetics, and animal feed.

Food & beverages segment holds the highest share in the market owing to the higher demand for egg and whey among food and beverage manufacturers. Furthermore, food & beverages is expected to have the highest CAGR during the forecast period owing to the rapid growth in the consumption of sports bars and drinks owing to the increase in adoption of sports and recreational activities among individuals. For instance, in 2019, as per the European Commission, participation in sports and physical activities has shown significant growth in Europe and around 44% of the EU population practices at least one physical activity weekly.

Furthermore, the increasing inclination toward a healthy lifestyle, the preference for a protein-rich diet, and the demand for infant formula fuels the growth in the global market. Thus, pharmaceutical and food and beverage manufacturers are launching new products such as protein bars, drinks, supplements, and others to cater to the growing demand.

REGIONAL INSIGHTS

Based on geography, the market is studied across Europe, North America, the Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Animal Protein Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific Dominates The Market Due To Higher Coffee Consumption

The Asia Pacific region holds a dominant animal protein market share due to its higher population and major dairy and poultry markets. In addition, the rapid growth in the urban population and increase in the spending capacity of individuals in countries such as India and China further contribute to market growth. For instance, as per the Food and Agriculture Organization (FAO), India alone has around 22% share in global milk production.

The Asia Pacific region is followed by Europe and North America owing to the higher protein consumption in countries such as Germany, France, the U.S., Italy, and others.

The countries in North America and Europe have a higher consumption rate for food products such as bakery. In addition, the countries in this region, specifically the U.S., are one of the prominent nutraceutical markets with significant demand for sports nutrition products.

The South America and Middle East & Africa regions have shown significant growth over the years and is expected to witness rapid growth in the forecast period, driven by rising food and beverage consumption. In addition, the increasing inclination toward a healthy diet among consumers in the region is a key factor fueling the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Market Players are Focusing on New Product Launches to Meet the Rising Demand for Protein Products

Arla Foods, Cargill, Kerry Group, and others are the key players in the global market. These leading market players are inclined toward new product launches, regional expansion, mergers, acquisitions, partnerships, and technological advancements to meet the growing demand for these products in the global market. For instance, in October 2023, Cargill announced the launch of its all-new facility in France called the Protein Innovation Hub. The new facility would develop protein products to cater to the growing global demand.

LIST OF TOP ANIMAL PROTEIN COMPANIES:

- Arla Foods Inc. (Denmark)

- Nitta Gelatin Inc. (Japan)

- Shenzhen Taier Biotechnology Co. Ltd. (China)

- Kerry Group Plc. (Ireland)

- Peterlabs Holdings (Malaysia)

- Archer Daniels Midland Company (U.S.)

- Trobas Gelatine B.V. (Netherlands)

- Cargill Incorporated (U.S.)

- Kewpie Corporation (Japan)

- Darling Ingredients Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – FrieslandCampina Ingredients, one of the global leaders in protein and probiotics, announced that the company is doubling its whey production owing to the rising demand for such products globally.

- April 2023 – Arla Foods Ingredients announced the launch of its new line of whey protein products. These new products were based on the company’s patented microparticulation technology. The new launch would cater to the global market's rapidly growing demand for whey protein.

- November 2022 – Arla Foods, one of the significant ingredients companies, announced its partnership with First Milk, a British dairy co-operative. Together, they aimed to produce a specialty whey protein powder, targeting the enhancement of protein level in food and beverage products owing to the rise in demand for whey protein in the global market.

- October 2022 – Arla Foods Ingredients announced the launch of its all-new product, which combined whey protein and electrolytes to target two significant sports nutrition goals: rehydration and restoration. As per the company, customers participating in physical activities heavily focused on rehydration and restoration.

- September 2020 – DV Sadananda Gowda, Union Minister of Chemicals & Fertilizers, announced the launch of 8 new nutraceutical products under the Pradhan Mantri Bhartiya Janaushadhi Priyojana (PMBJP). These products were made available in the market through Janaushadhi Kendras across India.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, and end-uses. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.33% from 2025-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By End-Use

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 22.12 billion in 2024.

The market is likely to grow at a CAGR of 4.33% over the forecast period (2025-2032)

During the forecast period, the whey segment is set to exhibit the highest growth rate during the forecast period.

Increasing awareness of the benefits of protein consumption is a key factor driving the growth in the global market.

Arla Foods, Cargill Incorporated, Kerry Group, Nitta Gelatin Incorporation, and others are some major players in the market.

Asia Pacific dominated the market share in 2024.

Rising urbanization is expected to drive the adoption of animal protein globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us