Asia Pacific Vehicle Embedded Software Market Size, Share & Industry Analysis, By Mobility Type (Shared Mobility and Personal Mobility), By Engine Type (Fuel-based and Electric-based), By Vehicle Type (Hatchback, SUV, Sedan, and Others (Coupe and Luxury Cars)), By Layer Type (Application, Middleware, Operating System, Hardware Abstraction, and Others (Presentation)), and Regional Forecast 2025 – 2032

KEY MARKET INSIGHTS

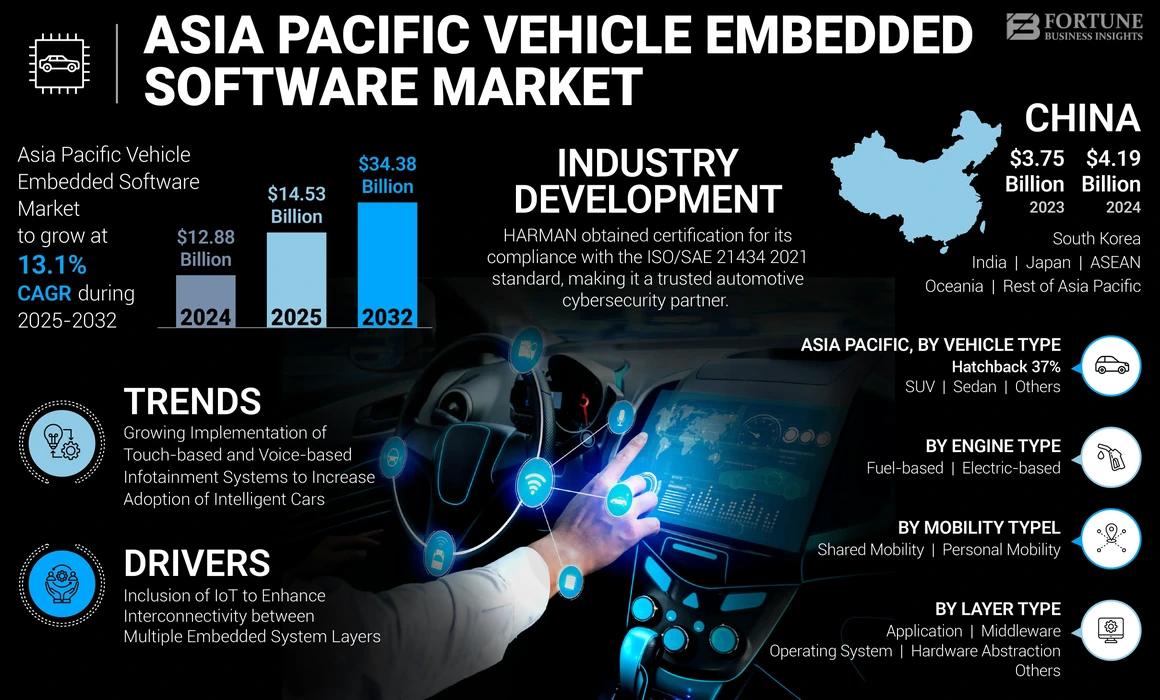

The Asia Pacific vehicle embedded software market size was valued at USD 12.88 billion in 2024. The market is projected to grow from USD 14.53 billion in 2025 to USD 34.38 billion by 2032, exhibiting a CAGR of 13.1% during the forecast period.

Vehicle embedded software refers to specialized computer programs and codes integrated into a vehicle body’s Electronic Control Units (ECUs) and systems. This software is crucial in controlling and managing various aspects of modern automobiles, including engine control, safety features, multimedia & integrated systems, and navigation. It is a dynamic sector that continues to evolve with advancements in automotive technology, such as connected vehicles, autonomous driving, and electric vehicles. Artificial Intelligence (AI) and machine learning are also crucial in reshaping the electric vehicles industry and enhancing the vehicle embedded software's capabilities. For instance,

In Japan, Toyota’s development of autonomous vehicles is an example of the integration of AI in embedded systems. This trend is expected to grow as AI-driven features, such as autonomous driving and predictive maintenance are being increasingly implemented in vehicles to enhance the driving experience and increase driver safety.

COVID-19 IMPACT

Supply Chain Disruptions amid Pandemic Initially Hampered Market Growth

The COVID-19 pandemic had a significant impact on the Asia Pacific vehicle embedded software market growth. In the early stages of the pandemic, automobile manufacturing and sales witnessed a sharp decline due to supply chain disruptions, lockdowns, and reduced consumer spending.

According to data from the Asian Development Outlook 2021, the sales of new vehicles in the region dropped by approximately 10%, with several countries imposing restrictions on production and labor movement. This resulted in delayed installation of embedded software in new vehicles.

However, amid these challenges, the pandemic also accelerated specific trends in the autonomous vehicle industry. The demand for contactless and connected features in vehicles surged. For instance, remote diagnostics and Over-the-Air (OTA) software updates gained prominence as consumers sought ways to minimize in-person interactions for vehicle maintenance. The pandemic highlighted the importance of advanced vehicle software for a driver's safety and convenience. As a result, despite the initial setbacks, the vehicle embedded software market in the region continued to recover, focusing on innovative features to meet varying consumer preferences.

Asia Pacific Vehicle Embedded Software Market Trends

Growing Implementation of Touch-based and Voice-based Infotainment Systems to Increase Adoption of Intelligent Cars

The automotive industry has witnessed a significant surge in the implementation of touch-based and voice-based infotainment systems, contributing to the growing adoption of intelligent cars. This trend is driven by several factors, including high consumer demand for enhanced in-car entertainment and connectivity features. Voice-based infotainment systems have gained prominence due to the convenience they offer. With voice commands, drivers can control navigation, make phone calls, send messages, and access information without taking their hands off the steering wheel, thereby promoting safer driving practices. The adoption of AI and Natural Language Processing (NLP) technologies has improved the accuracy and responsiveness of voice-controlled systems, making them an essential inclusion in the vehicle embedded software. For instance,

In October 2023, SoundHound AI introduced a Vehicle Intelligence domain which enabled its users to use its in-vehicle voice AI platform to access the car manual through natural speech.

Download Free sample to learn more about this report.

Asia Pacific Vehicle Embedded Software Market Growth Factors

Inclusion of IoT to Enhance Interconnectivity Between Multiple Embedded System Layers

The Asia Pacific market is experiencing a significant transformation with the inclusion of IoT technology, which aims to enhance the interconnectivity between multiple embedded layers in the ECU system, such as application layer, hardware abstraction layer, and OS layer. This transformation is driven by several factors, including the region’s growing automotive industry, increased demand for connected vehicles, and adoption of Advanced Driver Assistance System (ADAS) and automated driving solutions. For instance,

According to Fourin, in 2023, the automotive sales in 12 Asian countries, excluding China and Japan, increased by 4.5% year-on-year. This growth was primarily driven by economic recovery and improved vehicle supply, although rising interest rates and stricter loan screening processes since the second half of 2022 have slowed the market expansion. Compared to the first half of 2019, the increase was 7.9%, with India surpassing the 2019 level by over 20%. Furthermore, the automobile production in 10 countries grew by 13.3% compared to the same period last year, with only Myanmar and Pakistan showing a significant decline, while the remaining countries increased production. In terms of automobile exports, India saw a slight decrease of 13%, compared to the same period last year, while the other four countries achieved double digit growth.

RESTRAINING FACTORS

Lack of Standardized Data and Early Software Failures to Hamper Market Proliferation

The lack of standardized data and early software failures pose significant threats to the proliferation of the market in Asia Pacific. The absence of a uniform data standard hinders interoperability between several vehicle system layers, leading to complications in data sharing processing and communication. This results in variations in data formats, protocols, and interfaces adopted by different automakers and technology providers.

Early software failures have also emerged as a critical concern for the automotive industry as they can lead to safety risks and system malfunctions. These failures can occur due to software bugs, glitches, or vulnerabilities that may not become apparent until the software is deployed in real-world driving conditions.

Asia Pacific Vehicle Embedded Software Market Segmentation Analysis

By Mobility Type Analysis

Growing Sales of Passenger Vehicles to Propel Adoption of Personal Mobility Vehicles

Based on mobility type, the market is bifurcated into shared mobility and personal mobility.

The personal mobility segment holds the maximum part in Asia Pacific vehicle embedded software market share due to increased deployment of personal mobility vehicles. According to reputable sources, there were approximately 23.6 million passenger vehicles and 3.4 million commercial vehicles sold in China in 2022. Shared mobility refers to the integration of technologies that facilitate collaborative and efficient use of vehicles among multiple users, often associated with services, such as ride-sharing or car-pooling platforms.

Alternatively, personal mobility involves vehicle-embedded software tailored for individual users, emphasizing on personalized features and preferences to enhance the driving experiences.

By Engine Type Analysis

Existing Infrastructure and Superior Reliability to Support Growth of Fuel-based Engines

Based on engine type, the market is bifurcated into fuel-based and electric-based.

The fuel-based engine type segment is projected to hold the maximum market share due to its existing infrastructure, established manufacturing processes, and longer driving range.

However, there is a gradual rise in the production of electric vehicles due to advancements in battery technology, resulting in improved driving ranges and faster charging times. Furthermore, growing environmental awareness and government initiatives for cleaner transportation options are encouraging the shift toward electric vehicles among consumers.

By Vehicle Type Analysis

Enhanced Practicality and Design Features of Hatchbacks to Increase Their Deployment

Based on vehicle type, the market is segregated into hatchback, SUV, sedan, and others.

The hatchback segment is anticipated to hold the largest market share due to its design features, such as maneuverability in urban environments, low price point, fuel efficiency, and suitability for daily use.

However, there has been a shift in consumer preference toward SUVs due to their commanding presence, greater utility, and lifestyle-oriented features. Such advancements have increased the adoption of SUVs as compared to other vehicle types.

By Layer Type Analysis

Innovations in ADAS and Automated Driving Features to Augment Utilization of Application Layer

Based on layer type, the market is segmented into application, middleware, operating system, hardware abstraction, and others.

The application layer segment is projected to hold the highest market share due to its involvement and functions in vehicle embedded software, such as in-car entertainment applications and customized user interfaces, among others. It also aids in the operation of Advanced Driver Assistance Systems (ADAS) and parking assistance systems.

The hardware abstraction layer segment will demonstrate the highest growth rate during the forecast period due to the implementation of innovative Internet of Things (IoT) systems and complex hardware in vehicles for increased safety and control.

To know how our report can help streamline your business, Speak to Analyst

Regional Asia Pacific Vehicle Embedded Software Market Analysis

The market research report is studied across the Asia Pacific and is further categorized into the key countries.

The Asia Pacific market is witnessing significant growth, driven by several key factors. The region, known for its automotive manufacturing expertise, has seen a major surge in the demand for smart and connected devices.

China dominated the market share and it stands out as the largest automotive market globally owing to the increasing adoption of Electric Vehicles (EVs) and hybrid vehicles. The Chinese government’s push for EV adoption has created a substantial market for embedded software in these vehicles.

For instance, According to Canalys, during the first half of 2023, BYD achieved significant success in the Electric Vehicle (EV) market, selling over 1.3 million units of Plug-in Hybrid Electric Vehicles (PHEVs) and Battery Electric Vehicles (BEVs) across the world. This marked a 104% increase in the company’s sales, effectively doubling their sales as compared to the previous year. BYD’s famous models, including Yuan PLUS, Dolphin, and Song Pro, collectively accounted for 9% of the global EV sales.

India’s market growth is characterized by its strong emphasis on technological innovation, particularly in the automotive industry, thereby strengthening its growth rate as compared to other countries. In India, a growing concern for environmental sustainability has led to an increased use of electric and hybrid vehicles, which require advanced embedded software solutions.

Tata Motors achieved a remarkable milestone in the Indian market by shipping over 30,000 units in the first half of 2023. Canalys anticipates substantial growth in India’s Electric Vehicle (EV) sector in the latter part of this decade. This is because multiple automotive companies are realigning their strategies with the government’s ambitious target of EVs constituting 30% of the total vehicle sales by 2030.

Japan has also projected a healthy growth in the market owing to the advances in research and development (R&D) activities for electric and hybrid vehicles (EVs). The country has a strong focus on reducing emissions and improving fuel efficiency, as several Japanese automakers are integrating embedded software to optimize the performance of these vehicles. The market also benefits from Japan’s commitment to safety and environmental sustainability. The country implemented stringent safety regulations for vehicles, encouraging the adoption of advanced safety features that rely on embedded software. For instance,

In March 2023, Japan’s Road Traffic Act improvement initiated passenger services utilizing Level 4 autonomous driving. This move reflects Japan’s embrace of autonomous vehicles on public roads, with the National Police Agency set to formalize Level 4 autonomous driving regulations in traffic law next April.

Key Industry Players

Key Players are Expanding Support for Solutions with Utilization of OTA and V2X Technologies

Key players in this market are actively extending their support and emphasizing on OTA support to cater to different customer demands. They are also focusing on multiple types of V2X (vehicle to everything) technologies, such as V2V (vehicle to vehicle), V2P (vehicle to pedestrian), V2I (vehicle to infrastructure), and V2N (vehicle to network), among others. These organizations are also proactively pursuing collaborations, acquisitions, and partnerships to bolster their product portfolios.

List of Top Asia Pacific Vehicle Embedded Software Companies:

- Amazon Web Services, Inc. (U.S.)

- Hitachi Vantara LLC (Japan)

- NVIDIA Corporation (U.S.)

- Qualcomm Incorporated (U.S.)

- KPIT Technologies Limited (India)

- BlackBerry Limited (Canada)

- Mobileye Global Inc. (Israel)

- ETAS GmbH (Germany)

- HARMAN International (U.S.)

- Airbiquity Inc. (U.S.)

- Elektrobit (Germany)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Elektrobit unveiled the Theming Engine, a powerful software tool that enables the flexible customization of a vehicle’s user interface throughout its lifespan, eliminating the need for software engineers. This innovation empowered automotive OEMs, fleet managers, rental car companies, and shared mobility service providers to instantly tailor a vehicle’s appearance and functionality. This also helped them offer opportunities for generating revenue, enhance customer satisfaction, and strengthen brand loyalty long after the initial purchase.

- October 2023: HARMAN obtained certification for its compliance with the ISO/SAE 21434 2021 standard, reinforcing its position as a trusted automotive cybersecurity partner. This certification ensured that cybersecurity is integrated into the vehicle design and also provided a framework for managing cybersecurity risks, thereby promoting standardized automotive cybersecurity practices.

- September 2023: Amazon Web Services was selected by BMW Group as the preferred cloud service provider for its upcoming Advanced Driver Assistance System (ADAS) in the ‘Nueu Klasse’ vehicles set to launch in 2025. BMW utilized AWS’ cloud resources including AI, machine learning, IoT, and data storage to expedite the development of its highly automated vehicles.

- September 2023: DENZA, a luxury electric vehicle brand, introduced new intelligent driving features across its N7 model lineup, powered by NVIDIA’s DRIVE Orin SoC. These features included assisted driving, speed-limit control, emergency lane-keeping aid, automatic energy braking, and automated parking assistance, enabled by the DRIVE Orin SoC.

- July 2023: Acura partnered with Harman to bring Bang & Olufsen’s premium audio experience to the 2024 Acura ZDX and future Acura models. This collaboration aimed to enhance the in-vehicle audio experience of Acura’s electrified era of vehicles, providing innovative audio systems from Bang & Olufsen.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors listed above, the report encompasses several other factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 13.1% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mobility Type

By Engine Type

By Vehicle Type

By Layer Type

By Country

|

Frequently Asked Questions

The market value is projected to reach USD 34.38 billion by 2032.

In 2024, the market was valued at USD 12.88 billion.

The market is projected to record a CAGR of 13.1% during the forecast period.

The hatchback segment is expected to be leading in the market.

Inclusion of IoT to enhance the interconnectivity between multiple embedded layers of the ECU system is the key factor driving the market growth.

Amazon Web Services, Inc., Hitachi Vantara LLC, NVIDIA Corporation, Qualcomm Incorporated, KPIT Technologies Limited, BlackBerry Limited, Mobileye Global Inc., HARMAN International, Elektrobit, ETAS GmbH, and Airbiquity Inc. are the top players in the market.

China is expected to hold the highest market share.

By vehicle type, the SUV segment is expected to record a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us