Automotive Cybersecurity Market Size, Share & Industry Analysis, By Form (Embedded Security (In-vehicle) and Standalone Security (External), By Vehicle Type (Hatchback/Sedan, SUV, LCV, and HCV), By Propulsion (ICE and Electric), By Application (ADAS & Safety Systems, Body Control & Comfort Systems, Infotainment Systems, Powertrain Systems, and Telematics Systems), By Security Type (Network Security, Endpoint Security, Application Security, and Cloud Security), By Offering (Hardware Based Solutions and Software Based Solutions), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

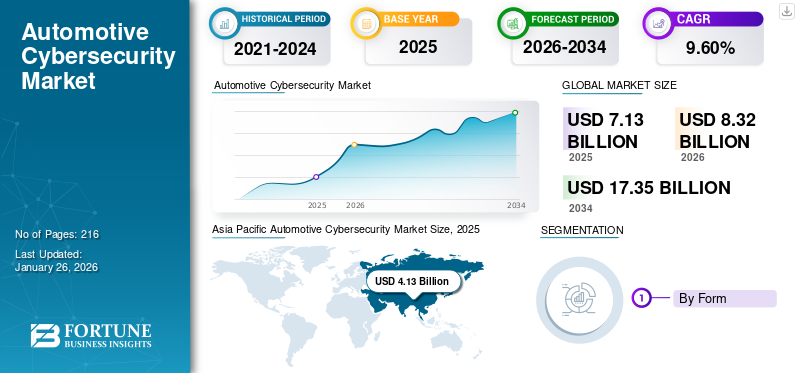

The global automotive cybersecurity market size was valued at USD 7.13 billion in 2025 and is projected to grow from USD 8.32 billion in 2026 to USD 17.35 billion by 2034, exhibiting a CAGR of 9.60% during the forecast period. Asia Pacific dominated the market with a market share of 57.97% in 2025.

Automotive cybersecurity protects vehicles’ electronic systems, software, and data from malicious attacks, ensuring safety, privacy, and functional integrity across ECUs, gateways, sensors, OTA updates, and vehicle-to-everything communications. The global market is driven by software-defined vehicle architectures, electrification, connectivity, and regulatory mandates that force OEMs and suppliers to embed security by design throughout the lifecycle. Solutions span hardware roots-of-trust (HSMs), secure elements, secure boot, IDS/IPS, secure gateways, OTA platforms, SBOM, and software-supply-chain tools.

Major players include Bosch/ESCRYPT, NXP, Infineon, Continental, Denso, Harman, Vector, Karamba, GuardKnox, Autotalks, and specialist firms providing firmware hardening, testing, and managed security services. Adoption spans OEMs, Tier 1 suppliers, telecoms, and mobility service providers worldwide.

The COVID-19 pandemic significantly impacted the market, accelerating the shift to digital and connected vehicle technologies. The increased reliance on remote work and digital services has elevated the risk of cyber threats, driving demand for robust cybersecurity solutions.

However, supply chain disruptions and reduced automotive production initially slowed the market growth. The renewed focus on cybersecurity fostered advancements and investments in secure automotive technologies post-pandemic. The automotive cybersecurity market is poised for significant growth in the post-pandemic era as the industry accelerates toward the software-defined vehicle. Connected cars, electrification, and autonomous driving systems demand continuous protection of critical electronic control units, vehicle networks, and cloud backends.

Automotive Cybersecurity Market Trends

Adoption of Advanced Artificial Intelligence Technologies Fuels Market Development

The use of artificial intelligence and machine learning is expected to drive the automotive cybersecurity market growth. These technologies enable advanced threat detection and response mechanisms, providing real-time analysis and mitigation of cyber threats. AI and ML algorithms can predict and identify anomalies, enabling proactive defense against potential attacks. They enhance the accuracy and efficiency of cybersecurity measures, reducing the reliance on manual monitoring and intervention.

In addition, the integration of AI and ML in cybersecurity solutions allows for continuous learning and adaptation to evolving threats, ensuring robust protection for connected and autonomous passenger vehicles. This trend is fostering innovation and enhancing vehicle safety, and is poised to drive demand for dedicated cybersecurity solutions in the automotive sector over the forecast period.

In November 2022, RISE (Research Institutes of Sweden), a state-owned organization, launched an advanced cybersecurity initiative focused on vehicle testing. The RISE Cyber Test Lab for Automotive allows the automotive industry to conduct vehicle testing utilizing cutting-edge cyber technology and the most rigorous testing methodologies globally.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Vehicle Connectivity and Digitalization of Mobility Ecosystem to Augment the Market Growth

The rapid integration of digital technologies into vehicles has become a defining factor for the automotive industry, fundamentally reshaping how cars are designed, manufactured, and operated. Modern vehicles are no longer isolated mechanical machines; they are increasingly sophisticated, software-defined platforms with constant connectivity to external networks. Features such as over-the-air (OTA) software updates, telematics, advanced infotainment systems, cloud-linked navigation, and vehicle-to-everything (V2X) communication have transformed vehicles into data hubs. This growing digital footprint brings convenience and efficiency, but it also opens multiple entry points for cyberattacks.

The automotive cybersecurity market demand is therefore being driven by the necessity to safeguard these expanding attack surfaces. For example, infotainment systems linked to smartphones, cloud servers, and payment gateways can be vulnerable to exploitation if not adequately protected. Similarly, telematics units collecting real-time vehicle and driver data are vulnerable to interception or manipulation. Hackers could potentially exploit weak encryption protocols or outdated firmware to gain unauthorized access to critical systems.

The possibility of remote intrusion, where attackers exploit a wireless interface to disrupt vehicle control, has raised significant alarm across the industry and among regulators. The expansion of shared mobility and fleet management services further intensifies the requirement for robust cybersecurity. With fleets of connected vehicles generating large volumes of sensitive operational and customer data, the risk of large-scale cyber incidents grows proportionally. Moreover, as electric vehicles (EVs) gain market share, their reliance on charging infrastructure and software ecosystems adds new layers of exposure.

A compromised charging network, for instance, could disrupt vehicle availability on a regional scale. The rising demand for enhanced connectivity is not expected to slow down. Instead, with 5G rollouts enabling ultra-low latency communication and autonomous driving technologies that depend heavily on constant data exchange, the reliance on secure digital infrastructure will become paramount. As a result, automotive cybersecurity has evolved from a supporting function to a core enabler of connected mobility. The industry recognizes that without reliable cybersecurity solutions, consumer trust in next-generation vehicles would be undermined, directly threatening adoption rates. Thus, rising vehicle connectivity and digitalization act as a primary driver of the global automotive cybersecurity market trends, ensuring that cyber protection is embedded at every stage of the mobility ecosystem.

In June 2023, Continental Automotive successfully achieved compliance with the ISO/SAE 21434:2021 certification audit and implemented a robust Cybersecurity Management System (CSMS) across the organization. ISO/SAE 21434:2021 establishes a globally recognized standard, offering a comprehensive framework for effectively managing cybersecurity risks throughout the lifecycle of automotive systems.

Market Restraints

Complexity of Integrating Cybersecurity Measures May Restrain Market Growth

Modern vehicles are intricate ecosystems of interconnected electronic components, each of which requires protection against cyber threats. Implementing effective cybersecurity involves understanding and securing numerous interfaces, protocols, and software layers, which are mostly technically challenging and time-consuming. Manufacturers have to navigate compatibility issues, ensure seamless operation with existing systems, and address potential performance impacts.

This complexity demands specialized expertise and resources, which are limited or costly for some companies. Moreover, the lively nature of cyber threats necessitates continuous updates and adaptations, further complicating integration efforts. These factors collectively slow down the adoption of robust cybersecurity solutions in the automotive industry despite the pressing need for enhanced vehicle security in an increasingly connected environment, thus hampering product adoption.

Market Opportunity

Integration of Artificial Intelligence and Predictive Threat Detection

Another promising opportunity lies in the application of artificial intelligence (AI) and machine learning to automotive cybersecurity. Traditional defense mechanisms such as firewalls and rule-based intrusion detection are limited in their ability to detect novel or sophisticated cyber threats.

AI-powered systems, however, can continuously analyze massive streams of vehicle and network data, identifying unusual patterns and predicting attacks before they cause harm. For example, predictive algorithms can detect subtle anomalies in communication between ECUs or spot unusual activity on telematics channels that would otherwise go unnoticed.

This enables automakers to respond proactively, patching vulnerabilities or isolating compromised systems in real time. Moreover, AI-based solutions can adapt as vehicles evolve, providing scalable protection across multiple models and geographies.

As vehicles increasingly resemble moving data centers, OEMs and fleet operators are actively seeking advanced, automated solutions that reduce dependence on manual monitoring. Vendors offering AI-driven platforms will not only differentiate themselves in the marketplace but also align closely with regulatory pushes for continuous monitoring and lifecycle protection.

This creates fertile ground for partnerships between cybersecurity specialists, OEMs, and software developers, positioning AI integration as a transformative opportunity in the global automotive cybersecurity landscape.

Segmentation Analysis

By Form

Innovations in Cybersecurity Technologies to Foster Embedded Security (In-vehicle) Segment Growth

By form, the market is segmented into embedded security (in-vehicle) and standalone security (external).

The embedded security (in-vehicle) segment dominated the market of 73.29% in 2026. Innovations in cybersecurity technologies, such as Hardware Security Modules (HSMs), secure boot, and Over-the-Air (OTA) updates, are driving the adoption of embedded security in vehicles. These technologies help in protecting critical vehicle systems from unauthorized access and cyberattacks.

The standalone security (external) segment is poised to emerge as the fastest-growing segment during the forecasted period. Governments and regulatory bodies are executing stringent cybersecurity regulations for the automotive industry. Compliance with these regulations often necessitates standalone security measures to safeguard vehicles against external threats.

In January 2024, SAE and ISO collaborated to create two new documents aimed at advancing cybersecurity in the automotive industry. These initiatives, spearheaded by the Vehicle Cybersecurity Systems Engineering Committee, introduce novel concepts and offer supplementary guidance related to the ISO/SAE 21434 standard on Cybersecurity Engineering for Road Vehicles. The documents will specifically address the Cybersecurity Assurance Level (CAL) and Targeted Attack Feasibility (TAF).

By Vehicle Type

SUV Holds Leading Segmental Position Driven by its Versatility and Higher Demand

In terms of vehicle type, the market is categorized into hatchback/sedan, SUV, LCV, and HCV.

The SUV segment held the principal share of the market contributing 43.86% globally in 2026. SUVs have become one of the most popular vehicle segments in passenger cars globally due to their versatility, spaciousness, and perceived safety. This popularity leads to higher sales volumes and a greater focus on ensuring their cybersecurity.

The HCV segment is poised to expand at a higher growth rate under commercial vehicles over the forecast period. Modern HCVs are integrated with advanced fleet management systems that track and optimize routes, monitor vehicle health, and manage logistics. Securing these systems is essential to prevent data breaches and ensure operational efficiency.

By Propulsion

Generation of Significant Data Amounts by Modern ICE Vehicles to Propel Segment Expansion

With respect to propulsion, the market is bifurcated into ICE and electric.

The ICE segment held the largest market share accounting for 66.50% in 2026. Modern ICE vehicles generate and transmit significant amounts of data, including operational, diagnostic, and personal information. Protecting this data from unsanctioned access and cyber threats is crucial, driving the need for effective cybersecurity solutions. This fuels the demand for the segment.

The electric segment is expected to grow at the fastest CAGR during the forecast period. EVs rely heavily on software and digital systems for battery management, energy efficiency, and autonomous driving capabilities. Protecting these critical systems from cyber threats is essential for ensuring vehicle safety and reliability. Thus, the increase in EV sales is expected to directly contribute to the market's growth during the forecast period.

In July 2022, DEKRA and VicOne, a subsidiary specializing in vehicle security within Trend Micro Incorporated, partnered to offer collaborative solutions. They aim to assist automotive manufacturers and suppliers in complying with new international regulations and standards related to vehicle security. Leveraging their technical expertise and certification services, they support suppliers transitioning into the electric vehicle industry, ensuring efficient implementation and compliance with global security standards.

By Application

Body Control & Comfort Systems Dominate the Market Due to the Incorporation of a Wide Range of Electronic Systems

Categorized by application, the market caters to ADAS & safety systems, body control & comfort systems, infotainment systems, powertrain systems, and telematics systems.

The body control & comfort systems segment grabbed the majority of the market share of 35.14% in 2026. Modern automobiles are equipped with a wide range of electronic systems for body control and comfort, including lighting, climate control, power windows, and seat adjustments. The complexity and integration of these systems necessitate robust security measures to guard against potential vulnerabilities. This factor is expected to drive the segment's growth over the forecast period.

The telematics systems segment is estimated to expand at the fastest-growing CAGR during the forecast period. The advancement and deployment of automated and connected vehicles rely heavily on telematics systems for communication and data exchange. Fortifying these systems against cyber threats is crucial to ensure the protection and reliability of autonomous and connected vehicles, which is expected to drive the segment's growth over the forecast period of 2024-2032.

By Security Type

Stringent Regulations for Vehicle Safety to Bolster Network Security Segment Growth

Classified by security type, the market encompasses network security, endpoint security, application security, and cloud security.

The network security segment dominated the market with the largest share in 2023. Stringent regulations and standards for vehicle safety and cybersecurity, such as those outlined in UNECE WP.29, mandate robust network security measures, encouraging automakers to invest in advanced solutions. The growth of remote diagnostics, Over-the-Air (OTA) updates, and fleet management services increases the need for secure network connections to prevent cyber intrusions.

In February 2023, SEGULA Technologies, a global leader in automotive engineering, and C2A Security, a specialist in cybersecurity for the automotive industry, joined forces to provide car manufacturers and mobility companies with an expanded array of cybersecurity services. This collaboration enables them to assess their vehicles' resilience against cyber threats and comply with emerging automotive security regulations and standards such as WP.29 and ISO/SAE 21434.

The application security segment is anticipated to register a high growth rate over the considered period. Modern vehicles are equipped with numerous applications for infotainment, navigation, diagnostics, and vehicle control. Protecting these applications from vulnerabilities and attacks is essential. This generates a need for cybersecurity solutions, which are expected to accelerate the segment's growth during the forecasted period.

To know how our report can help streamline your business, Speak to Analyst

By Offering

Hardware-Based Solutions Segment Led Due to Requirement for Robust Hardware-Based Security Measures

By offering, the market encompasses hardware-based solutions and software-based solutions.

The hardware-based solutions segment dominated the automotive cybersecurity market share in 2023. Compliance with automotive cybersecurity regulations and standards, such as UNECE WP.29 and ISO/SAE 21434, often requires robust hardware-based security measures to protect against cyber threats. This factor fuels the segment's growth.

The software-based solutions segment is anticipated to witness a high growth rate over the considered period. With the rise of connected vehicles, there is a mounting need for software solutions to secure communication channels, data exchange, and network interactions within and outside the vehicle. Therefore, modern vehicles are prone to cyber threats, which is expected to advance the growth of the segment during the forecast period.

In October 2024, ETAS GmbH, its cybersecurity division ESCRYPT, and Rambus, a prominent supplier of hardware security IP, revealed a strategic partnership. They aim to jointly develop and deliver a bundled security solution that merges Rambus' RT-640 embedded hardware security module (eHSM) IP with ETAS's SoC security software solution, ESCRYPT CycurSoC. This collaboration seeks to enhance integrated security offerings for their respective industries.

AUTOMOTIVE CYBERSECURITY MARKET REGIONAL OUTLOOK

Emergence of High-end System Integration into Automobiles Boosts Asia Pacific’s Market Development

By region, the market is studied across North America, Europe, the Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific held the largest market in 2024, which is attributed to developing at the fastest-growing CAGR during the forecast period. The region accounts for a dominant volume of automobiles on the street. These vehicles are almost equipped with at least an infotainment system and other electronic systems that are susceptible to cybersecurity threats. Additionally, logistics fleets with location-sharing and communication-based applications also contribute to market dominance. However, the emergence of high-end automated system integration and the embracement of electric vehicles are poised to contribute to the fast growth of the market in the Asia Pacific region over the forecast period. The Japan market is estimated to reach USD 0.24 billion by 2026, the China market is estimated to reach USD 1.68 billion by 2026, and the India market is estimated to reach USD 0.29 billion by 2026.

Asia Pacific Automotive Cybersecurity Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America held the second-largest market share in 2024. A high adoption rate of connected and autonomous vehicles in North America is expected to increase the demand for robust cybersecurity measures. Additionally, the region comprises several technology companies that are at the forefront of adopting advanced automotive technologies, which drives market growth. In April 2024, Argus Cyber Security, a global leader in automotive cybersecurity, unveiled the inauguration of its new penetration testing laboratory in Detroit, Michigan. This state-of-the-art facility is designed to address the increasing demand from North American OEMs and Tier 1 suppliers for localized cybersecurity penetration testing services under the National Highway Traffic Safety Administration NHTSA Act. The U.S. market is estimated to reach USD 1.3 billion by 2026.

Europe

Europe also significantly contributes to the market growth. Germany, the U.K., and others are home to major luxury car manufacturers that equip high-end technologies into their vehicles. This generates a need for cybersecurity solutions in the regional market, driving market growth over time. In November 2020, university researchers successfully breached and took control of a Tesla Model X in approximately two minutes. Using only a key fob, a Raspberry Pi, and a replacement engine control unit, they demonstrated the vulnerability, with the entire kit costing about USD 200. The UK market is estimated to reach USD 0.2 billion by 2026, while the Germany market is estimated to reach USD 0.31 billion by 2026.

Rest of the World

The rest of the world involves Latin America, the Middle East & African sub-regions. The expanding automotive industries in Brazil and Mexico boost demand for cybersecurity solutions to protect against cyber threats. The increasing adoption of connected and smart vehicles in the region is a significant driver for the market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Adaptive Software Platforms and Secure ECU Integration Strengthen Competitive Edge in Automotive Cybersecurity

The global automotive cybersecurity market is dominated by a group of firms, including BlackBerry, Infineon Technologies, NXP Semiconductors, Renesas Electronics, and Aptiv, which combine deep engineering expertise, hardware–software integration capabilities, and global delivery networks. These players provide embedded security, network security stacks, and lifecycle management systems to major automakers globally, enabling compliance with emerging standards and secure over-the-air updates. To address rising threats, firms continuously expand global service infrastructures, invest in real-time threat-detection and secure domain-controller solutions, and collaborate with OEMs. Regulatory demands for secure connected vehicles and V2X systems further consolidate their position. In April 2024, for instance, ETAS integrated ESCRYPT’s Cybersecurity Real-time Module into Infineon’s AURIX TC4X platform, illustrating vendor alignment to protect complex software-defined vehicles. This consolidation creates high entry barriers for smaller vendors and accelerates standardization across vehicle platforms, shaping a competitive landscape centered on technical depth, global reach, and compliance readiness.

LIST OF KEY AUTOMOTIVE CYBERSECURITY COMPANIES PROFILED

- Harman International (U.S.)

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- NXP Semiconductors (Netherlands)

- Aptiv PLC (Ireland)

- Karamba Security (Israel)

- GuardKnox (Israel)

- Trillium Secure (U.S.)

- ESCRYPT (Germany)

- Infineon Technologies AG (Germany)

- Autotalks (Qualcomm)

- Vector Informatik GmbH (Germany)

- Denso Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- In September 2025, the International Centre for Automotive Technology (ICAT), under the Union Ministry of Heavy Industries, is reportedly developing a cybersecurity certification process for cars. ICAT reportedly plans cybersecurity certification for cars to counter hacking risks, targeting M2M SIM vulnerabilities. The move could set global safety standards, boosting car security worldwide.

- In September 2025, Stellantis Joined GlobalPlatform to Advance Global Automotive Cybersecurity Standards. This will accelerate cross-industry collaboration on cybersecurity standardization for software-defined vehicles (SDVs).

- In October 2024, Panasonic Automotive Systems Co., Ltd. expanded its series of VERZEUSE, automotive cybersecurity innovations, to accommodate the security needs in each phase (design, implementation, evaluation, production, and operation) of the entire vehicle lifecycle, from development to operation (after vehicle shipment). This expansion offers efficiency and high-quality standardization for security measures throughout the entire vehicle lifecycle by introducing tools to automate cybersecurity work, which has often been performed manually, and to link input and output information in each phase.

- In March 2024, Bosch participated in the IPCEI-CIS/ CUBE-C Cyber-Physical Systems Cloud Continuum project, funded by the European Union. The project aims to develop edge-cloud infrastructure to support safety and real-time critical applications in software-defined vehicles. Bosch research and its subsidiary, ETAS, are involved in seeking low-latency, energy-efficient, and resource-efficient ways to support connected vehicle functions via the edge/cloud continuum.

- February 2024: AutoCrypt, a company specializing in automotive cybersecurity and smart mobility technology, introduced AutoCrypt CSTP, a comprehensive cybersecurity testing platform. This platform is specifically designed to facilitate integrated cybersecurity testing for vehicle type approval, in alignment with UNECE's Regulations 155/156 and SAC's GB and GB/T standards.

REPORT COVERAGE

The global automotive cybersecurity market analysis provides an in-depth study of the market size & forecast by all the market segments included in the report. It includes details on market dynamics and trends expected to drive the market during the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The Automotive Cybersecurity Market forecast offers a comprehensive competitive landscape, encompassing the largest market share, emerging opportunities, and profiles of key players in the automotive industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Form

|

|

Vehicle Type

|

|

|

Propulsion

|

|

|

Application

|

|

|

Security Type

|

|

|

Offering

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was valued at USD 7.13 billion in 2025.

The automotive cybersecurity market share is expected to grow at a CAGR of 9.60% over the forecast period (2026-2034).

By propulsion, the ICE segment held the largest market share in 2025.

In 2025, the Asia Pacific’s market size stood at USD 4.13 billion.

The increasing vehicle connectivity generates product demand, impelling market growth.

Major companies include Harman International, Aptiv, Karamba Security, Upstream Security, and Argus Cyber Security, among others.

The Asia Pacific region dominated the market in 2025.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us