Biophotonics Market Size, Share & Industry Analysis, By Products (Imaging Systems, Lasers, Fiber Optics, Others (Spectrometer)), By Application (Biological sensing & process, Live Cell Imaging, Optical Sensing & Detection, Photosynthesis Evaluation, and others (intracellular cAMP, and Scanner, etc.)), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

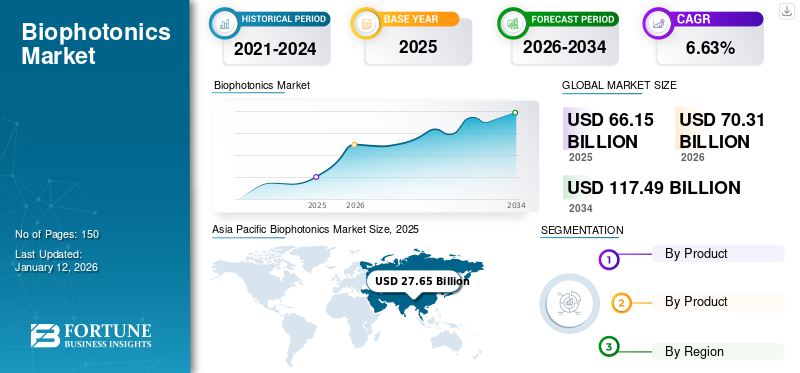

The global biophotonics market size was valued at USD 66.15 billion in 2025. and is projected to grow from USD 70.31 billion in 2026 to USD 117.49 billion by 2034, exhibiting a CAGR of 6.63% during the forecast period. Asia-specific dominated the global biophotonics market with a share of 41.79% in 2025.

Biophotonics is an interdisciplinary branch of photonics that embraces the applications of photonics in biology and the medical industry. The biophotonics industry's products include imaging systems, lasers, fiber optics, and other measuring instruments, such as spectrometers. The growing adoption and growth in extensive research on biophotonics help expand developments in the field of biology and medicine. The dominant development and comprehensive application of the biological sensor for the early detection of cancer or other critical diseases helps to grow & expand the potential in the long term.

Further, the COVID-19 phase initially impacted businesses due to a lack of infrastructure and less knowledge of the spread of communal diseases among consumers, restraining growth in the long term. However, extensive research during the post-pandemic period and the demand for handheld quick monitoring and sensing devices will help businesses sustain themselves in the long term.

Biophotonics Market Trends

Integration of AI & ML into Lifesciences to Leverage Market Trends

Globally, Artificial Intelligence (AI) and Machine Learning (ML) have taken over the technology industry. They offer easy development and predictability with big data technologies and machine learning models, which are trained to get more accurate and precise test results. The market is leveraging the applications of AI/ML in biophotonics to a fair extent by coupling the advanced sensor with AI/ML software that can accurately detect the syndromes and provide instant results for users. Also, the growing dominant application of biophotonics in miniature health monitoring systems will extend the potential of biophotonics in the long term.

Download Free sample to learn more about this report.

Biophotonics Market Growth Factors

Technological Advancements and Demand for Safe Products to Drive Market Progress

Healthcare spending is growing at a rapid pace, promoting continuous technological advancements, such as imaging, microscopy, and spectroscopy. This factor is supporting the growth of the biophotonics industry. Additionally, there is an increasing demand for non-invasive and real-time monitoring devices across personal and commercial healthcare sectors, which will bolster the biophotonics market growth during the forecast period.

- For instance, in January 2024, Carl Zeiss AG, a prominent optical instrument and equipment manufacturer, launched its superresolution microscopes Lattice SIM 3 and Lattice SIM 5. These microscope use illumination microscopy (SIM) to overcome the limitations of light microscopy.

RESTRAINING FACTORS

High Costs and Regulatory Challenges in Life Science Industry to Restrain Market Growth

The complex structure and manufacturing operations demand higher initial and post-set-up costs, which restrict the existing small players from diversifying their business. Also, manufacturing healthcare products demands more ergonomically compliant and certified products that are easy to use and operate. However, they require high capital investment. Furthermore, the entrance of start-up players in the market has been restraining crucial players from diversifying their product portfolios, which can restrain the biophotonics market growth in the long term.

- For instance, in May 2024, Hamamatsu Photonics, a global leader in biophotonics, sold its 100% owned subsidiary NKT Photonics to Photonics Management Europe S.r.l. to restructure and operate.

Biophotonics Market Segmentation Analysis

By Products Analysis

Use of Lasers in Life Science Industry to Propel the Dominance of Product Segment

Based on products, the market is researched for the following categories: imaging systems, lasers, fiber optics, and others (spectrometers).

The laser segment holds the maximum biophotonics market with a share of 35.87% in 2026 owing to its dominant use in the life science industry for the treatment of vulnerable diseases, such as cancer treatment, light therapy, and skin treatment.

Furthermore, imaging systems are forecasted to record the highest CAGR due to their growing application in monitoring and body scanning devices, as well as many imaging techniques that help healthcare practitioners detect disease in its early stages.

Additionally, fiber optics and other devices support the growth of biophotonics products, with steady demand for detecting pathogen exposures in agricultural food and analytics. Led grow lights in indoor farming and crop science has helped compile sensors and develop software for future agriculture analytics.

- For instance, in October 2024, Hamamatsu Photonics, a prominent photonics product manufacturer, launched its high-sensitivity UV-sensitive mini spectrometer.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Biological Sensor Application in Life Science and Crop Science to Grow Market

Based on application market is further segmented into biological sensing & process, live cell imaging, optical sensing & detection, photosynthesis evaluation, others (intracellular cAMP, and scanner)

The biological sensing & process segment accounted for the largest share of the market with a share of 37.73% in 2026. The growing investments in life science research have shaken the medical product industry, which will fuel the global biophotonics market size exponentially during the forecast period.

Furthermore, the growing application of live cell imaging in medicine manufacturing and research will strengthen the potential of biophotonics in the long term. Also, leveraging the potential of optical sensing and detection in healthcare monitoring and analytics is helping businesses generate high revenue.

Furthermore, the photosynthesis evaluation and other bioscience application segments are steadily growing due to increasing use of agriculture research and scanning in modern crop science analytics to sustain the market.

REGIONAL INSIGHTS

The global biophotonics market is studied for regions including North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Biophotonics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is set to lead the global market with its dominated the market with a valuation of USD 27.65 billion in 2025 and USD 29.89 billion in 2026. consumer base and demand for healthcare and agro revolution, changing the dynamics of the market. Also, growing investments across China, India, Japan, Malaysia, and South Korea in agro-IoT and life science research have progressively boosted the sales of biophotonic products.The Japan market is projected to reach USD 5.99 billion by 2026, the China market is projected to reach USD 14.57 billion by 2026, and the India market is projected to reach USD 4.29 billion by 2026.

China is set to lead the progress of the region owing to its strong consumer base and dominant presence of technological setups that allow mass manufacturing at a relatively low cost. India is also growing progressively with increasing investment in medicine and life science research and manufacturing. The increased focus on healthcare analytics and software development helps grow the business in Pacific countries, such as Indonesia, Taiwan, and Australia.

To know how our report can help streamline your business, Speak to Analyst

North America is forecasted to grow at a progressive pace due to the increasing presence of prominent players and startups researching more analytics-driven health products and technologies. Also, the extensive focus of government organizations and technology giants on expanding product portfolios with more precise medical equipment, helps grow their businesses.The U.S. market is projected to reach USD 4.9 billion by 2026.

Europe is projected to generate steady growth with a high emphasis on the development of precise and technological products that are compliant with stringent medical standards and energy standards. Also, growing life science research and treatment of medical complications such as cardiology, neurology, brain imaging, and oncology have helped regain market potential.The UK market is projected to reach USD 3.68 billion by 2026, while the Germany market is projected to reach USD 4.66 billion by 2026.

The Middle East & Africa region is showcasing substantial growth owing to the increasing investments by government organizations and private entities in crop and life science research and product development.

South America is growing substantially with the food and agro-industries increasingly focusing on developing more indigenous crop science and yield products.

KEY INDUSTRY PLAYERS

Increasing Investments in Developing More Indigenous and Advanced Products to Help Players Dominate Market

Global players operating in the biophotonic product development space have assumed that the technological gap is more significant and can be filled with new advanced products. Thus, they are focusing on increasing their research and development (R&D) expenses, helping brands position themselves on the top of the biophotonics landscape. Thus, rising efforts and investments by prime players will expand the market size exponentially during the forecast period.

List of Top Biophotonics Companies:

- Hamamatsu Photonics (Japan)

- Olympus Corporation (Japan)

- Affymetrix (thermo fisher scientific) (U.S.)

- Zeiss (Germany)

- Zecotek Photonics Inc. (Canada)

- BD (Becton, Dickinson, and Company) (U.K.)

- PerkinElmer Inc. (U.S.)

- Lumenis Ltd. (Israel)

- Bio-Rad Laboratories, Inc. (U.S.)

- Shimadzu (Japan)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Superlight Photonics BV, a prominent photonics product manufacturer, launched its high-powered and compact continuum laser SLP-1050, which is specially designed for industrial, medical, and research applications.

- April 2024: ArgusEye AB, a renowned medical products manufacturer, has developed a new sensor system, AugaOne, which is meant to solve and accelerate the downstream monoclonal antibody process development. It provides specific in-line, real-time, and automated sensitivity.

- March 2024: Power Technology Inc. has launched its new advance 380 nm laser module, which provides a continuous wave of high power for high-end research and scientific applications such as fluorescence, bioanalysis, and Raman spectroscopy.

- March 2024: Menlo Systems GmBH, a prominent photonic product manufacturer, has developed an industry-grade high-power laser that delivers more than 1W average output. It is designed for various applications such as 3D Nano printing and multi-photon microscopy.

- January 2024: Cytek Bisciences Inc., a prominent life science and medical research equipment manufacturer has launched its Cytek Orion, an automated cocktail preparation system. It eliminates the need for technicians to prepare multicolor antibody cocktails.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.63% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Products

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 117.49 billion by 2034.

In 2025, the market was valued at USD 66.15 billion.

The market is projected to record a CAGR of 6.63% during the forecast period.

The laser product segment is leading the market, attaining the highest share.

Technological advancements and demand for safe products will drive the market growth.

Hamamatsu Photonics, Olympus Corporation, Affymetrix, Zeiss, Zecotek Photonics Inc., BD (Becton, Dickinson, and Company), PerkinElmer Inc., Lumenis Ltd., Bio-Rad Laboratories, Inc., and Shimadzu are the top players in the market.

Asia Pacific generated the maximum revenue in 2025.

The biological sensor & process application segment is projected to experience the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us