Fiber Optics Market Size, Share & Industry Analysis, By Fiber Type (Plastic and Glass), By Type (Single-mode and Multimode), By Application (Telecom, Automobile, Medical Equipment, Power Utilities, Aerospace & Defense, Industrial Automation & Control, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

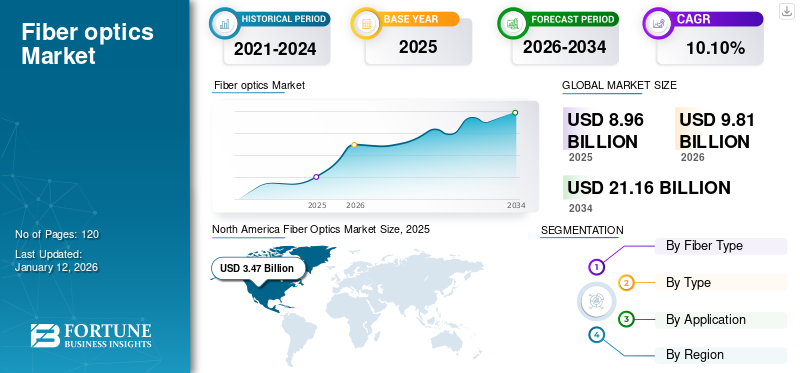

The global fiber optics market size was valued at USD 8.96 billion in 2025 and is projected to grow from USD 9.81 billion in 2026 to USD 21.16 billion by 2034, exhibiting a CAGR of 10.10% during the forecast period. North America dominated the global market with a share of 38.70% in 2025. Fiber optic technology makes use of light for transmitting data and is one of the most important advances in telecommunications. Fiber optic networks are considerably faster, with a range of 5 Mbps to 100 Gbps, than copper internet connections, which have the highest speed.

The scenario of bandwidth people need in their homes has changed, and people have started to look for better options. This enormous shift has pointed to the need for constantly growing the capacity of the network and investing in technologies, including fiber to the home, 5G, and cloud computing, driving demand for networks based on optical fiber technology. According to industry experts, by 2024, there will be around 1.9 billion 5G subscriptions globally, and fiber optics will be crucial in meeting those demands with the ever-growing surge for high-bandwidth data. Also, expansion of smart city initiatives globally to boost the demand for fiber optic networks and government initiatives and subsidies towards broadband setups to accelerate the expansion of fiber optics.

Demand for stable internet connection has increased from the COVID-19 pandemic as companies have adopted remote working policies, and technology has provided people with a means to stay connected for the safety of their homes. An increase in digital meetings and movie streaming parties required a more stable connection, and due to that, the in-demand video app Zoom witnessed a surge in users from 10 billion users to 200 billion in a few months. Also, Netflix gained 15 billion subscribers during the early months of the COVID-19 crisis.

Fiber Optics Market Trends

Surge in Implementation of Fiber-based Medical Imaging and Telemedicine to Increase Adoption of Optical Fiber

The escalating demand for cutting-edge and high-definition imaging technologies in medical sectors, particularly within telemedicine and diagnostic imaging applications, is driving a significant surge in the adoption of fiber optic solutions. Leveraging fiber optic bundles, healthcare enterprises seamlessly transmit intricate visual data captured by endoscopic cameras, confocal microscopes, and other diagnostic imaging equipment to remote locations for real-time analysis. Moreover, the inherent flexibility and robustness of optics make them indispensable for minimally invasive surgical procedures, enabling precise maneuverability of imaging probes within confined anatomical spaces without sacrificing image quality or reliability.

Furthermore, the incorporation of fiber optic technology into telemedicine platforms revolutionizes remote patient care by facilitating high-definition video conferencing and seamless streaming of medical images across expansive geographic areas. Through fiber optic-enabled telemedicine solutions, healthcare organizations can conduct comprehensive virtual consultations, provide prompt diagnoses, and remotely monitor patient conditions with higher clarity and detail.

Therefore, the above factors are boosting the fiber optics market share.

Download Free sample to learn more about this report.

Fiber Optics Market Growth Factors

Expansion of Data Centers to Augment Fiber Optics Deployments

The exponential growth of digital content and the pervasive adoption of cloud services have catalyzed an unprecedented surge in the establishment and expansion of data centers on a global scale. This proliferation is underpinned by the ongoing generation, storage, and dissemination of vast datasets, necessitating robust infrastructure to accommodate the burgeoning digital ecosystem. As data centers evolve into intricate hubs of computational prowess, the demand for high-speed connectivity has become paramount to facilitate seamless data transfer, access, and processing. This product, with its inherent advantages in terms of data transmission speed, bandwidth, and reliability, has emerged as the quintessential solution to meet the growing demand for interconnectivity within the data giants.

The deployment of optics within the data center ecosystem not only future-proofs the infrastructure but also aligns with the industry's trajectory toward higher data rates and lower latency. As data centers continue to be the nerve centers of the digital era, the reliance on high-speed connectivity is not just a technological necessity but a strategic imperative in ensuring the competitiveness and resilience of these vital computational hubs.

Therefore, the above factors are driving the fiber optics market growth.

RESTRAINING FACTORS

Limited Infrastructure Investments and Alternative Technologies to Hamper Market Growth

In emerging economies, the insufficient allocation of financial resources toward building robust telecommunications infrastructure acts as a significant impediment to the widespread adoption of optics. The limited investment in laying the groundwork for fiber optic networks results in a constrained expansion of high-speed internet connectivity. Fiber optic technology demands substantial upfront investments for the deployment of the necessary physical infrastructure, including the installation of cables and associated equipment. Without adequate financial backing, these emerging economies struggle to keep pace with the global shift toward optical fiber, leaving them reliant on less efficient and outdated connectivity solutions.

Furthermore, the competitive landscape, characterized by the presence of wireless technologies, such as satellite networking, has complicated the market dynamics. Wireless technologies, with their flexibility and ease of deployment, present a compelling alternative for providing high-speed internet access. Therefore, the market faces resistance to gaining dominance, especially in regions where the lure of wireless solutions diverts attention and investment away from the more infrastructure-intensive fiber optic networks.

Fiber Optics Market Segmentation Analysis

By Fiber Type Analysis

Usage of Glass Fiber Optics for Long Distance and High Speed Communication to Boost Segment Growth

By fiber type, the market is segmented into plastic and glass.

The glass segment dominated the market with share of 69.67% in 2026 and is estimated to grow with the highest growth rate during the forecast period, as glass has a larger numerical aperture than plastic, allowing more light into the system. Also, glass fiber is used in more extreme temperatures and is able to handle wet and corrosive environments without degrading. Due to high transmissivity and low loss factor, glass optical fiber is mostly used for long-distance and high-speed communication applications.

The plastic segment is estimated to grow substantially as plastic optics have a narrower aperture than glass, and they are not able to withstand harsh environments easily. Due to these features, plastic fibers are more preferred for decorative and illumination applications, including backlighting and trim lighting.

By Type Analysis

Increasing Adoption of Multimode Optical Fiber for Data Center Networks to Aid Segment Growth

By type, the market is segmented into single-mode and multimode.

The multimode segment generated the maximum share of 51.65% in terms of revenue in 2026 and is expected to register the highest CAGR during the forecast period, as the multimode is the cost-effective choice for shorter-reach applications over single-mode. Also, the multimode has less power consumption feature, which is important specifically when considering the cost of powering and cooling a data center. Multimode optics provide considerable cost savings for large data center, from both a transceiver and power/cooling perspective. Thereby, multimode is the best fiber choice for enterprise and data center applications that have a range between 500 to 600 meters.

The single-mode segment is estimated to grow steadily over the forecast period. Single-mode optics are costlier to install and control as the laser-based tools generate more heat. The reliance on lasers makes single-mode cables less versatile and more limited in their applications.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Usage of Fiber Optics for Medical Practices to Drive the Medical Equipment Segment Growth

By application, the market is segmented into telecom, automobile, medical equipments, power utilities, aerospace & defense, industrial automation & control, and others.

The medical equipment segment is estimated to grow with the highest CAGR during the forecast period as these products are used in medical and are safe for monitoring health and are stable and biocompatible. Optical medical sensors have been recognized for various applications in medical practice, including cardiovascular exams, ophthalmology, angiology, and dentistry. The glass fiber, being an inert material, resists many chemicals, so it is suitable for use in in-vivo and in-vitro applications. As the surgical rooms have various kinds of tools that produce electromagnetic interference (EMI), the usage of fiber is trustworthy for life-support and mission-critical in this situation, as it is immune to EMI.

The telecom segment dominated the market with share of 43.73% in 2026, owing to the surge in data traffic from various sources, including e-commerce, internet, multimedia, and computer networks that requires a transmission medium, which is capable of handling higher bandwidth used to manage the huge amount of data, and this is propelling the demand for fiber optic cables in the telecom infrastructure.

REGIONAL INSIGHTS

The fiber optics market is studied across regions, including North America, South America, Europe, Middle East & Africa, and Asia Pacific. These regions are further classified into leading countries.

North America

North America Fiber Optics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America generated maximum revenue with valuation of USD 3.47 billion in 2025, owing to increasing deployments of optical fiber in the region. The government is taking steps to promote and fund the expansion of fiber infrastructure by recognizing the importance of optical products for economic growth and global competitiveness. In North America, the U.S. exhibits a larger market share in terms of revenue owing to increasing demand for high-speed internet access. The U.S. market is projected to reach USD 2.36 billion by 2026. The government in the U.S. have started some initiatives for expanding its fiber infrastructure that includes,

- The Connect America Fund: The Connect America Fund (CAF) is a federal program administered by the Federal Communications Commission (FCC) in 2019 to expand broadband access to underserved areas in the U.S. The CAF has allocated billions of dollars in funding to support the deployment of fiber optic networks in rural and remote regions, helping to bridge the digital divide and ensure that all Americans have access to high-speed internet.

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR during the forecast period as the region is undergoing a technological transformation, Internet of Things (IoT) integration, emphasizing smart cities, and advancements in healthcare systems. The region is witnessing growth due to the increasing adoption of cutting-edge technologies, including Dense Wavelength Division Multiplexing (DWDM) and Wavelength Division Multiplexing. These technologies improve the data capacity by transmitting multiple light wavelengths over a single fiber. The Japan market is projected to reach USD 0.41 billion by 2026, the China market is projected to reach USD 0.82 billion by 2026, and the India market is projected to reach USD 0.28 billion by 2026.

Increasing use of fiber optics beneath the sea in the region has improved the connectivity between countries. The undersea fiber optic cables deployment demonstrated by the Asia-Africa-Europe 1 (AAE-1) submarine cable system covers around 25,000 kilometers that connects multiple countries across Asia, Europe, and the Middle East & Africa.

Europe

As the adoption of various technologies is increasing and the needs of a connected world are surging, fiber optics has become the ultimate option for commercial and residential users in Europe. Also, ultra-fast internet connections enable working from home, surge the demand for e-commerce and growth in the tourism sector and transform education and healthcare facilities. For local authorities in countries, including France, Germany, and others, high-speed broadband is becoming a center of attraction that is providing momentum to their local economy and enhancing their competitiveness. The UK market is projected to reach USD 0.56 billion by 2026, and the Germany market is projected to reach USD 0.68 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa are experiencing significant growth as governments in countries, such as UAE, Brazil, and others are heavily investing in the expansion and modernization of their telecom infrastructure with a particular focus on optics networks. Leading telecom companies and internet service providers are investing in optical fiber cable networks to meet the growing bandwidth requirements and deliver enhanced services.

List of Key Companies in Fiber Optics Market

Major Players Focus on Adopting Advanced Technologies to Strengthen Market Positions to Enhance their Presence

Players in the market for fiber optics are leveraging edge computing, AI, IoT, and cloud analytics trends to launch and deploy their latest high-bandwidth fiber optic cables. The implementation of optical fiber cables into the data centers has enabled market players to expand their core business capabilities, generate additional revenue and promote greater reliability and scalability. Key players, such as Heraeus Group, Corning Incorporated, Prysmian Group, CommScope Holding Company, Inc., OFS Fitel, LLC, and Rosendahl Nextrom GmbH are substantially integrating next-generation faster technologies to provide additional efficiency and reduce carbon footprint.

List of Key Companies Profiled:

- Heraeus Group (Germany)

- Corning Incorporated (U.S.)

- Prysmian Group (Italy)

- Shin-Etsu Chemical Co, Ltd (Japan)

- Nokia Corporation (Finland)

- Rosendahl Nextrom GmbH (Austria)

- FOLAN (France)

- CommScope Holding Company, Inc. (U.S.)

- PI (Physik Instrumente) L.P. (Germany)

- OFS Fitel, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In January 2024, PI expanded its range of mechanical alignment systems to enhance the support for quality assurance, assembly, and packaging of Silicon Photonics (SiPh) chips. The company also showcased new solutions, such as air-bearing stages and entry-level systems, at Photonics West 2024 to assist global customers in enhancing alignment requirements for optical integrated circuits, fiber optics, and lenses.

- In January 2024, Nokia collaborated with Zayo, and set a new North American record for an 800Gb/s speed transmission over 1866 km using a single wavelength on a live network, utilizing the company’s sixth-generation Photonic Service Engine super-coherent optics. The successful field trial highlighted the capability to address the growing demand for high-capacity solutions in response to the digitalization of the world.

- In July 2023, OFS and Heraeus Comvance jointly announced that Comvance has acquired a part of the OFS Fitel ApS plant in Denmark, to manufacture customary optical telecommunication fibers for the EMEA market. The company maintained its global presence by continuing to provide several fiber types from draw towers in the U.S.In May 2023, CommScope launched its latest HomeVantage line of fiber gateways and optical network units (ONUs) at ANGA COM. The fiber gateways, such as HomeVantage NVG578M2 and NVG578M1, provided cost-effective solutions for service providers to deliver high-speed broadband around the home, supporting data, voice-over-IP (VoIP), and streaming video.

- In March 2023, Ribbon Communication entered into collaboration with Bharti Airtel to expand the Dense Wavelength Division Multiplexing (DWDM) network for supporting the application, including cloud computing, 5G and others.

- In March 2023, Corning inaugurated its optical cable manufacturing campus in North Carolina, aiming to support the expansion of high-speed fiber broadband networks and enhance connectivity in underserved communities. The new facilities are part of a series of investments exceeding USD 500 million since 2020.

REPORT COVERAGE

An Infographic Representation of Fiber optics Market

To get information on various segments, share your queries with us

The fiber optics market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights the competitive landscape. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Fiber Type

By Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 21.16 billion by 2034.

In 2025, the market was valued at USD 8.96 billion.

The market is projected to grow at a CAGR of 10.10% during the forecast period.

The glass segment is expected to lead the market in terms of market share.

The expansion of data centers to augment market growth

Corning Incorporated, Heraeus Group, Prysmian Group, OFS Fitel, LLC, and Nokia Corporation are the top players in the market.

North America held the highest market share.

By application, the medical equipment segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic