Botanical Supplements Market Size, Share & Industry Analysis, By Source (Spices, Herbs, Flowers, Leaves, and Others), By Functionality (Energy & Weight Management, General Health, Bone & Joint Health, Gastrointestinal Health, Immunity, Anti-Cancer, and Others), By Form (Powder, Liquid, Tablets, Capsules, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail, and Others), and Regional Forecast, 2025-2032

Botanical Supplements Market Size

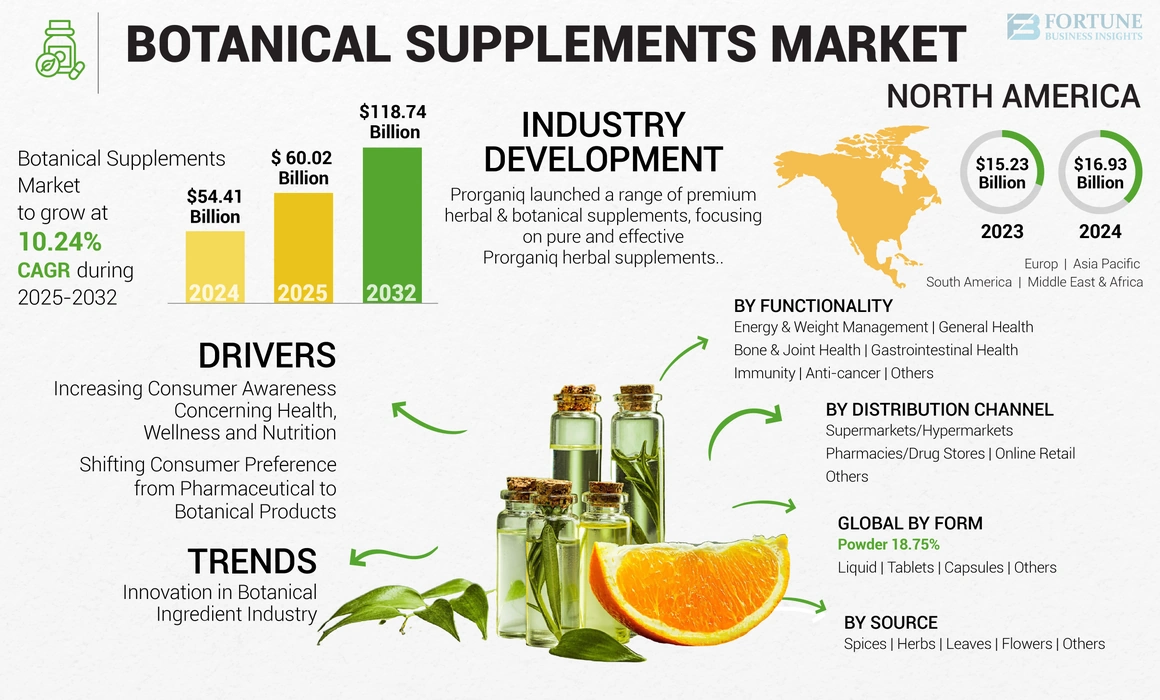

The global botanical supplements market size was USD 54.41 billion in 2024. The market is projected to grow from USD 60.02 billion in 2025 to USD 118.74 billion by 2032, exhibiting a CAGR of 10.24% during the forecast period (2025-2032). Asia Pacific dominated the botanical supplements market with a market share of 31.12% in 2024.

The expansion of the dietary supplements industry, owing to rising disposable income and increased health consciousness, is projected to benefit this market. The product formulated using botanical ingredients is related to obesity, joint health, vascular system, and anxiety.

The outbreak of the COVID-19 pandemic in developing countries, such as India, Brazil, and China, has severely affected the dynamics of the international spice trade. However, retail sales of food & beverages witnessed considerable growth in the second quarter of 2020. Consumers preferred to maintain a stock of essential products in anticipation of lockdowns due to COVID-19. These key factors further led to a sudden increase in demand for botanical ingredients, including spices.

Global Botanical Supplements Market Overview

Market Size:

- 2024 Value: USD 54.41 billion

- 2025 Value: USD 60.02 billion

- 2032 Forecast Value: USD 118.74 billion, with a CAGR of 10.24% from 2025–2032

Market Share:

- Asia Pacific dominated the botanical supplements market with a market share of 31.12% in 2024 and is expected to maintain its lead, supported by rising awareness regarding consumption of nutritional products.

- The pharmacies/drug stores segment is expected to hold a 40% share in 2025.

Key Country Highlights:

- Japan: The botanical supplements market in Japan is expected to reach USD 3.91 billion by 2025.

- India: Projected to witness a strong CAGR of 12.83% during the forecast period.

- Europe: Anticipated to grow at a CAGR of 10.58% during the forecast period.

Botanical Supplements Market Trends

Innovation in Botanical Ingredient Industry to Augment Market Volume

The consumption pattern of consumers seeking natural flavors instead of synthetic has significantly increased over the past few years, owing to growing health awareness among consumers across the world. According to Dr. Miguel Florido, medical affairs and scientific marketing director at Nektium, several botanical extracts are known to be rich in bioactive compounds, such as flavonoids, polyphenols, and phytonutrients. Moreover, the ongoing research activities further validate their efficacy and safety. Consumers are on the lookout for options offering health & wellness benefits in the products they consume. Innovation in health supplements resulting in new flavors is projected to boost the market. The presence of branded products and private-labeled products, coupled with the growth in retail channels, is expected to fuel the demand for botanical-based supplements in the country. The use and promotion of botanical ingredients to develop these botanical type of supplements will support the market growth over the forecast period.

Download Free sample to learn more about this report.

Botanical Supplements Market Growth Factors

Rising Consumer Awareness Concerning Health, Wellness, and Nutrition to Bolster Market Growth

Numerous awareness campaigns introduced by government as well as non-government organizations have increased consumer awareness towards dietary supplements and their benefits. Furthermore, the consumption of high-quality nutrition-infused products symbolizes one’s social status in several countries. Some companies’ manufacturing dietary supplements include organic and natural products, further driving the market growth. The use of attractive packaging techniques has led to growing consumer awareness, which, in turn, has triggered the spending on botanical supplements.

Several consumers are now becoming health conscious and prefer products that contain minimal synthetic chemicals. Increasing preference for healthy food and willingness to pay a premium price for such products (with better nutritional value) are also significant factors expected to propel the demand for the product. For instance, in March 2023, Novella, a nutri-tech startup, leveraged proprietary technology to grow nutritious botanical ingredients. The new platform would boost global accessibility to high-value nutraceuticals and address the growing demand for botanical micronutrients.

Shift from Pharmaceutical to Botanical Products to Increase Market Volume

The botanical industry is an evolving and dynamic sector, which offers novel opportunities to collaborate scientific discovery with increasing consumer interest in health-enhancing foods. It follows and observes consumer trends and relationships with mass distributors; therefore, the products designed in this industry respond to direct demand. It may be used to increase health, prevent chronic diseases, delay the aging process, raise life expectancy, and help the structuring and functioning of the body. Consumers' awareness of health and wellness is changing the "prevention is better than cure" ideology. These factors have resulted in more consumers relying on nutraceuticals and botanical supplements to lead a healthy & disease-free life.

RESTRAINING FACTORS

Availability of Substitutes and Complexity Related With Assessment of Active Ingredients to Limit Growth

Botanical ingredients are being extensively used in various end-use industries ranging from food & beverage to supplements for their functional and medicinal benefits. Besides, their clean label source and minimal or no side effects compared to synthetic ingredients also augment their distribution channel in end-use industries. For instance, glucosamine compounds are extensively used in the dietary supplements industry to prepare supplements associated with osteoarthritis, glaucoma, weight loss, and joint pain.

Supplements made from botanicals are complex mixtures and can display a high degree of variability in the composition of active ingredients and associated impact on biological activity. This variability in the quality of botanical ingredients mainly arises from the plant material's location, climate, time & stages of harvesting, and the manufacturing process undertaken by the ingredient producer.

Besides, data from exploratory clinical trials and studies of natural products such as botanical dietary supplements have been highly inconsistent. Medical practitioners and consumers prefer or opt for chemically derived products. Therefore, the threat of substitution from animal and synthetic ingredients and the unavailability of robust processes to assess bioactive response and components of botanical supplements are expected to hamper their penetration.

Botanical Supplements Market Segmentation Analysis

By Form Analysis

Tablets Hold Largest Botanical Supplements Market Share on Account of Easy Dosage Patterns

By form, the market is divided into powder, liquid, tablets, capsules, and others.

Tablets are the most commonly used botanical supplements due to their cost-effectiveness. Manufacturers can pack the most amount in a given space in tablet form, and tablets have a longer shelf life than capsules. High-quality supplements use excipients that assist in tablet absorption and disintegration. Although the natural coating provides better finish, other factors regulate the absorption based on efficacy and quality. All these factors are expected to surge the demand for natural health supplements in the form of tablets in the coming years.

To know how our report can help streamline your business, Speak to Analyst

High-quality supplements make use of excipients which help in the disintegration and absorption of tablets. However, natural coatings offer better dissolution, other factors determine the absorption based on efficacy and quality. All such aspects are likely to surge the demand for natural health supplements in the form of tablets over the forecast period. Tablets are the most commonly used these supplements due to their cost-effectiveness. Producers can pack the most amount in a given space in tablet form and tablets have a longer shelf life than capsules.

By Source Analysis

Spices Sector to hold Largest Market Share due to Increasing Concern of Obesity Disorders

By source, the market is segmented into spices, herbs, flowers, leaves, and others

The spice segment led the market and is expected to witness substantial gain over the forecast period on account of changing lifestyles coupled with an increase in the trend of experiencing novel foods that have led to the growth in the popularity of spices. Botanical ingredients are obtained using this raw material through the solvent extraction process. They are herbal and can exist in liquid, solid, and semi-solid states. Such ingredients fuel high demand for the production of cosmetics to enhance their quality. Furthermore, spices are also gaining traction from the processed food & beverages industry to boost the nutritional value of their products. For instance, in May 2022, Leaven Essentials, an Indian startup, planned to offer scientific and effective herbal solutions by manufacturing herbal extracts, phytonutrients, and specialty fine chemicals that cater to food and beverage, food supplements, nutraceuticals, and cosmetics companies. Products, such as boswellia, curcumin, ashwagandha, green tea, and bacopa are under development for the launch. The flowers segment is projected to generate USD 15.42 billion in revenue by 2025.

By Functionality Analysis

Energy & Weight Management Sector to hold Largest Market Share due to Increasing Concern of Obesity Disorders

By functionality, the market is segmented across energy & weight management, general health, bone & joint health, gastrointestinal health, immunity, anti-cancer, and others.

Sports enthusiasts widely influence the product demand containing proteins and vitamins. These products help athletics restore energy, improve muscular endurance, and minimize body wear & tear. In 2018, nearly 6 in 10 adults used a sports nutrition product. Moreover, combined consumer sale of nutrition bars, sports nutrition supplements, and energy drinks are expected to fuel energy nutrition demand.

Vitamin B and D are used as weight management supplements due to their metabolizing fats, carbohydrates, and proteins. Rising awareness regarding weight management among working professionals, on account of increasing concerns over obesity disorders, is projected to amplify the utilization of botanical supplements.

By Distribution Channel Analysis

Pharmacies Sector to hold Largest Market Share, Owing to Convenience of Direct Purchase and Cost-Effectiveness

By distribution channel, the market is broken down into supermarkets/hypermarkets, pharmacies/drug stores, online retail, and others.

The pharmacies and drug store industry comprises operators that provide a range of over-the-counter and prescription medication. The industry is anticipated to grow significantly despite the difficulties caused by external competition and regulating agencies. The upsurge in the geriatric population and increase in prescribed supplements by medical practitioners are expected to create opportunities for pharmacies and drug stores in the near future. The pharmacies/drug stores segment is expected to hold a 40% share in 2025.

Convenience stores are gaining popularity as people spend more time in offices and create less time for shopping.

REGIONAL INSIGHTS

Asia Pacific Botanical Supplements Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific to Exhibit Highest Growth on Account of Rising Awareness Regarding Consumption of Nutritional Products

In terms of geography, the market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Growing technological innovation in the botanical ingredients sector offers new opportunities for the botanical supplements market growth in Europe. The Federation of European Nutrition Societies (FENS) funds and invests in various nutritional foods businesses. The federation operates and nurtures such business growth in 26 countries in the region. The European Society for Clinical Nutrition and Metabolism (ESPEN) governs and offers grants for businesses in the nutrition sector and accolades the industry's best-performing organizations. Such initiatives have encouraged participants to develop highly beneficial and new innovative products, thereby boosting the industry growth. Europe is anticipated to grow at a CAGR of 10.58% during the forecast period.

North America has a vast population facing increased obesity levels and lifestyle-related diseases due to dietary habits, high disposable income, and availability of several processed & ready-to-eat foods, which are not necessarily good for consumer health. Fibers & specialty carbohydrates emerged as a significant ingredient segment in the North American market for botanical supplements, owing to increasing awareness about their benefits in overall health & bodily maintenance. Fibers promote easy bowel movement while providing critical cleansing of internal organs and minerals, promoting high retention and passage of nutrients into cells, and helping blood flow and circulation.

The Asia Pacific market is anticipated to hold a major share of the global market and is witnessing increasing demand for botanical supplements as key participants are adopting strategies such as introducing their brands in untapped economies of Southeast Asian countries. Japan and Australia have heightened awareness of the product's health benefits over the years, which is projected to strengthen regional growth over the forecast period.

- The botanical supplements market in Japan is expected to reach USD 3.91 billion by 2025.

- India is projected to witness a strong CAGR of 12.83% during the forecast period.

Key Industry Players

Companies to Focus on Growth in their Production Capacity to Meet Global Demand

The botanical supplements market is consolidated owing to a limited number of established and regional players. Key companies, such as Dabur India, NBTY Inc., and BASF SE, are prominent or major players in this market. These key players are focusing on increasing their production capacity to meet the global demand.

List of Top Botanical Supplements Companies:

- Dabur India (Ghaziabad, India)

- NBTY Inc. (New York, U.S)

- Ricola AG (Laufen, Switzerland)

- Procter and Gamble (Ohio, U.S.)

- Nutraceutical International Company (Utah, U.S.)

- BASF SE (Ludwigshafen, Germany)

- The Himalaya Drug Company (Bengaluru, India)

- Glanbia Nutritionals (Wisconsin, U.S.)

- Botanicalife International of America, Inc. (California, U.S.)

- Proganiq (Tamil Nadu, India)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Groupe Berkem, a French biochemistry and plant extraction specialist, launched a new range of gut health ingredients, Biombalance. The flagship product of this new range, Symgrape, is derived from grape seed polyphenols.

- November 2022: Lemme, a Kourtney Kardashian brand, launched a new line of botanical supplements and vitamins in the U.S. The new product line includes Lemme Matcha, Lemme Chill, and Lemme Focus, which are vegan, non-GMO, gluten-free, and free from artificial sweeteners, synthetic colors, corn syrup, gelatin, and sugar alcohols.

- April 2022: Kerry, one of the world’s leading taste and nutrition companies, acquired Natreon, Inc., one of the leading suppliers of branded Ayurvedic botanical ingredients. The acquisition led Kerry to expand its leadership position in botanical supplements.

- January 2021: Prorganiq launched a range of premium herbal and botanical supplements. This novel launch of pure and effective Prorganiq herbal supplements focuses on empowering people’s total health and supporting them to build a better body through all-natural means.

- July 2020: Oregon Health & Science University (OHSU) collaborated with the University of Mississippi, Oregon State University, and Redmond-based Oregon’s Wild Harvest to establish a research center for botanical dietary supplements.

- March 2019: Martin Bauer Group completed the acquisition of BI Nutraceuticals, Inc., a United States-based company that manufactures and supplies plant-based ingredients. With this acquisition, the company expands its portfolio of botanical ingredients, strengthening its foothold in the market.

REPORT COVERAGE

The market report provides qualitative and quantitative insights into the market. It also offers a detailed analysis of the market size and growth rate for all possible segments in the market. Various key insights presented in the report are an overview of related markets and recent industry developments such as mergers & acquisitions, regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.24% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Source

By Form

By Functionality

By Distribution Channel

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 54.41 billion in 2024 and is projected to grow to USD 118.74 billion by 2032.

Registering a CAGR of 10.24%, the market will exhibit steady growth during the forecast period (2025-2032).

The tablets segment is expected to be the leading segment based on type in the global market during the forecast period.

Rising consumer awareness concerning health, wellness, and nutrition to support the growth driving the market growth

BASF SE, NBTY, Inc., and Procter and Gamble are the key players in the market.

Asia Pacific dominated the market in terms of share in 2024.

The pharmacies segment is set to lead the global market based on distribution channel.

Innovation in the botanical ingredients industry to expected to meet the global market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us