Calcined Bauxite Market Size, Share & Industry Analysis, By Grade (Refractory Grade, Abrasive Grade, and Others), By Application (Refractory Materials, Cement, Abrasives, Pavement & Flooring, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

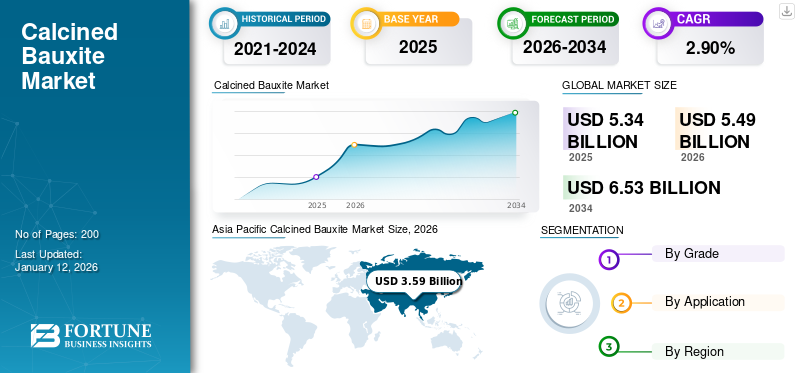

The global calcined bauxite market size was valued at USD 5.34 billion in 2025. The market is expected to grow from USD 5.49 billion in 2026 to USD 6.53 billion by 2034, recording a CAGR of 2.90% during the forecast period. Asia Pacific dominated the calcined bauxite market with a market share of 3.59% in 2025.

Calcined bauxite is produced by sintering raw bauxite minerals at high temperatures, i.e., more than 1500o C. As a result, it is formed with high aluminum content and reduced impurities, which makes it highly resistant to high-temperature ranges. Ability to offer high thermal stability and exceptional mechanical strength, this material is used as a raw material in many applications, including cement, abrasive, and other applications that require such exceptional properties. In addition to these features, its resistance to molten slag makes it an ideal raw material for refractory applications. Growing demand for refractory materials and calcined bauxite's unique set of properties are anticipated to drive the global calcined bauxite market growth during the forecast period. Moreover, its high usage as an abrasive for grinding and sandpaper polishing applications will further fuel its demand in the future.

The COVID-19 pandemic had a negative impact on the market due to the imposition of lockdowns, which put a pause on import-export activities across the world. In addition to this, economic instability and travel restrictions posed challenges to the smooth functioning of the global supply chain. Moreover, delays in key industries, such as cement decreased market players’ revenues in 2020. Furthermore, the total steel production contracted by nearly 1% in 2020, and the steel industry being a significant consumer of refractory materials, saw a decline in its demand during the pandemic.

GLOBAL CALCINED BAUXITE MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 5.34 billion

- 2026 Market Size: USD 5.49 billion

- 2034 Forecast Market Size: USD 6.53 billion

- CAGR: 2.90% from 2026–2034

Market Share:

- Asia Pacific led the market in 2025 with a 3.59 % share.

- By grade, refractory grade held the largest share due to high adoption in steel, glass, and petrochemical furnaces.

- By application, refractory materials dominated in 2024 for their high alumina content and heat resistance.

- The cement segment is projected to hold a 29.8% share globally in 2024.

- In China, the cement application alone is expected to account for 30.2% share in 2024.

Key Country Highlights:

- China: Strong demand from steel and cement industries drives calcined bauxite usage; top consumer in Asia Pacific.

- India & Japan: Support Asia Pacific’s dominance through growing industrial and refractory product demand.

- United States: Steel production (80.7 million tons in 2023) and infrastructure spending support moderate market growth.

- Germany, France, UK: Manufacturing strength and steel industry reliance on refractories sustain EU market share.

- Middle East & Africa & Latin America: Industrial expansion in Brazil, Mexico, UAE, and South Africa fuels steady growth.

Calcined Bauxite Market Trends

Increasing Production of Wave Green Steel to Create New Lucrative Market Opportunities

Wave green steel, also known as sustainable steel or low-carbon steel, refers to steel production processes that minimize carbon emissions and environmental impact. The emergence of the green steel trend represents a significant opportunity for the market as it is mainly used as a raw material in refractory applications. As steelmakers strive to reduce their carbon footprint and adopt more sustainable practices, there is a growing demand for refractories that can withstand high temperatures while minimizing energy consumption and emissions. Calcined bauxite, known for its high alumina content and heat-resistant properties, is a vital ingredient in the production of refractories used in steelmaking furnaces and other high-temperature applications. In addition, one of the critical strategies in green steel production is the use of renewable energy sources and sustainable raw materials. This material can play a crucial role in the green steel movement through its application in refractories. Asia Pacific witnessed a calcined bauxite market growth from USD 3.30 billion in 2023 to USD 3.39 billion in 2024.

Download Free sample to learn more about this report.

Calcined Bauxite Market Growth Factors

Refractories and Abrasives to Remain Driving Force for Global Market Growth Due to High Consumption

Calcined bauxite is utilized in refractory products, such as bricks and castables due to its high-temperature resistance. It is also used as an abrasive material in applications, such as sandblasting and grinding. High demand in these sectors contributes to the overall demand for this material. Refractories made from this form of bauxite are essential for lining high-temperature industrial furnaces, such as those used in steel production, cement manufacturing, glassmaking, and petrochemical refining. The steady demand for refractories in these industries, driven by the ongoing global infrastructure development, urbanization, and industrialization trends, will drive the global market growth.

In addition, calcined bauxite is utilized as an abrasive material in various industries, such as metal fabrication, automotive, aerospace, and electronics manufacturing. The superior hardness, toughness, and abrasive properties of calcined bauxite make it an ideal material for surface preparation, finishing, and shaping of metal, wood, and other materials. The above-mentioned applications are significant consumers of this mineral, and growing demand from these two application areas will act as a driving force for the market growth.

RESTRAINING FACTORS

Presence of Potential Substitutes May Restrict Market Growth

Though calcined bauxite is one of the essential minerals in various application areas, the presence of potential substitutes may restrict the market growth. For instance, in refractory applications, other raw materials, such as magnesia, silica, and zirconia can sometimes substitute this material, especially if they become more cost-effective or offer superior properties. In addition, environmental regulations related to the mining, processing, and transportation of bauxite and its derivatives can pose challenges to the calcined bauxite market growth. Stricter regulations regarding emissions, waste disposal, and energy consumption can increase operational costs and limit production capacity. The above-mentioned factors can influence the market’s overall dynamics and may hamper the market growth during the forecast period.

Calcined Bauxite Market Segmentation Analysis

By Grade Analysis

Refractory Grade Segment Held Largest Market Share Owing to its Wide Adoption in Furnace Lining

Based on grade, the market is segmented into refractory grade, abrasive grade, and others.

The refractory grade segment is projected to dominate the market with a share of 64.48% in 2026. Refractory grade minerals have specific qualities, such as their high alumina content. This makes them ideal for use in refractory applications, such as lining high-temperature furnaces for industries, such as steel, cement, glass, and petrochemicals. Also, this grade is often processed to minimize iron content, ensuring optimal refractory performance.

The abrasive grade segment will showcase moderate growth during the forecast period. Abrasive grade calcined bauxite has a wide range of applications, including sandblasting, grinding & polishing, anti-skid & traction control, and production of other abrasive products. It serves as a crucial material due to its exceptional hardness, toughness, and abrasive properties.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Refractory Materials Held Majority Market Share Owing to Their High Alumina Content

Based on application, the market is classified into refractory materials, cement, abrasives, pavement & flooring, and others.

The refractory materials segment is projected to dominate the market with a share of 34.79% in 2026. Calcined bauxite has high alumina content, which is as high as 85-90% or higher, and is largely consumed in refractory materials. The refractory application requires materials with a unique set of properties, such as high density, hardness, and resistance to thermal shock. This mineral aligns with the required physical properties for refractory applications, and thus, this application will drive its demand during the forecast period.

In addition to refractory material applications, this form of bauxite is used in the production of specialized cement products tailored for specific applications which require high-alumina cement (HAC) and calcium aluminate phosphate cement (CAP). As a result, the cement segment is poised to experience moderate growth during the forecast period.

The others segment consists of various applications, including chemicals, ceramics, aluminum production, and others. The wide array of applications and growing demand from niche industries will drive the segment’s growth during the forecast period. The cement segment is expected to hold a 29.8% share in 2024.

REGIONAL INSIGHTS

Based on region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Calcined Bauxite Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific is emerging as the biggest consumer in the market owing to the rising presence of leading countries, such as India, China, and Japan. China has become the top consumer of calcined bauxite in the region. The humongous demand for this material is mainly due to the presence of a well-established steel production base and a vast metal manufacturing industry. The widespread usage of this mineral in these industries makes China the leader in the region. The Japan market is projected to reach USD 0.26 billion by 2026, the China market is projected to reach USD 2.64 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The U.S. market is projected to reach USD 0.46 billion by 2026.

A report by the World Economic Forum states that the U.S. is the second-biggest production superpower after China. In addition, the country has a vast steel production capacity, with the total production reaching 80.7 million tons in 2023 alone. The ongoing trend of green steel and growing investment in highway maintenance and building & construction activities will drive the product’s regional sales moderately during the forecast period.

Europe

Europe has recorded exponential demand for calcined bauxite owing to the presence of prominent countries, such as France, Germany, and the U.K. These economies rank among the top 10 manufacturing powerhouses. According to the European Commission, in addition to a large production base, Europe’s steel industry contributes nearly 1.3% to the EU’s total GDP. As this form of bauxite is widely used in refractory applications, which is further used in the steel industry, the region will grow at a significant rate. The Germany market is projected to reach USD 0.21 billion by 2026.

The Middle East & Africa and Latin America markets might showcase moderate growth during the forecast period. Robust industrialization in leading countries, such as Mexico, Brazil, the U.A.E., Saudi Arabia, and South Africa is expected to boost the market’s growth in these regions.

KEY INDUSTRY PLAYERS

Market Players to Increase Focus On Niche Applications to Remain Competitive

Alchemy Mineral LLC, Bosai Minerals Group, EKC.AG, First Bauxite LLC, Great Lakes Minerals, LLC, and Mineracao Curimbaba are the top producers in the global market. These companies have not made any significant investments. They are mainly observing the product’s growing use in specialized or niche applications, such as environment, high-performance concrete, artificial bone grafts, and others. In addition, a few companies are focusing on expanding their domestic market presence, such as First Bauxite and Bautek Minerais Industriais Ltd.

List of Top Calcined Bauxite Companies:

- Alchemy Mineral LLC (U.S.)

- Bosai Minerals Group (China)

- Boud Minerals Limited (U.K.)

- EKC.AG (Germany)

- First Bauxite LLC (U.S.)

- Great Lakes Minerals, LLC (U.S.)

- LKAB (Sweden)

- Mineracao Curimbaba (Brazil)

- SCABAL (India)

- Sinocean Industrial Limited (China)

KEY INDUSTRY DEVELOPMENTS:

- May 2022: First Bauxite acquired calcination plants of US Ceramics LLC (USC). The acquisition included USC's two manufacturing facilities located in Wrens and Andersonville, Georgia, with production capacities of 250 kilotons and 100 kilotons, respectively.

- October 2021: Bautek Minerais Industriais Ltda. announced its partnership with the Cofermin Group-owned MINERALS to meet the growing demand for downstream support on the marketing and distribution side.

REPORT COVERAGE

The report provides detailed market analysis and focuses on crucial aspects, such as leading companies, grades, and applications. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, and insights into market trends and highlights vital industry developments and competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Growth Rate |

CAGR of 2.90% during 2026-2034 |

|

Segmentation |

By Grade

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 5.20 billion in 2025 and is projected to reach USD 6.53 billion by 2034.

Recording a CAGR of 2.90%, the market is expected to exhibit rapid growth during the forecast period.

By application, the refractory materials segment dominated the market in 2024.

Growing demand from refractory and abrasive applications is the key factor driving the global market growth.

China held the highest share of the market in 2025.

Bosai Minerals Group, Boud Minerals Limited, EKC.AG, First Bauxite LLC, and Sinocean Industrial Limited are the top players in the market.

Increasing production of wave green steel will create new opportunities for the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us