Carboxymethyl Cellulose (CMC) Market Size, Share & Industry Analysis, By Application (Food & Beverages, Oilfield, Paper & Pulp, Detergents, Coatings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

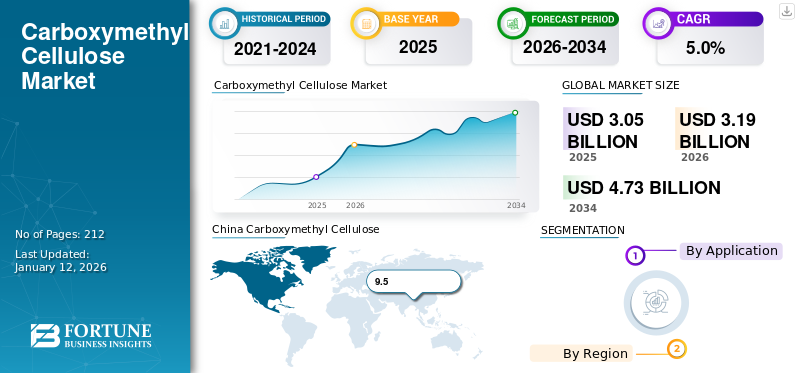

The global carboxymethyl cellulose (CMC) market size was valued at USD 3.05 billion in 2025. The market is projected to grow from USD 3.19 billion in 2026 to USD 4.73 billion by 2034, exhibiting a CAGR of 5.0% during the forecast period. Asia Pacific dominated the carboxymethyl cellulose market with a market share of 49% in 2025. Tate & Lyle, Nippon Paper Industries Co., Ltd, Ashland Inc., DKS Co., Ltd., and Nouryon are key players operating in the industry.

Carboxymethyl Cellulose (CMC) is a versatile, water-soluble polymer derived from cellulose, Earth's most abundant organic compound. It's produced by reacting alkali cellulose with sodium monochloroacetate, resulting in a modified cellulose with carboxymethyl groups (-CH2-COOH) bound to some hydroxyl groups. This modification gives CMC unique properties, including high viscosity in aqueous solutions, film-forming ability, and binding capacity. It is widely used as a thickener, stabilizer, and emulsifier in various industries, including food and beverages, paper & pulp, detergents, coatings, and others. Its non-toxic, biodegradable nature makes it an environmentally friendly choice for many applications.

Carboxymethyl Cellulose (CMC) Market Trends

Increasing Demand for Gluten-Free Food Products is a Key Market Trend

Carboxymethyl cellulose is a sodium salt derivative of cellulose. It is highly employed in gluten-free baking due to its thickening and stabilizing properties. CMC provides the dough with the viscosity and volume of the bread originally provided by gluten. Most of the population can tolerate gluten; however, some of them can have health conditions such as gluten intolerance or allergy, which can further cause celiac disease. Increasing awareness regarding gluten intolerance and adopting gluten-free products and foods is a prime factor that could serve as an opportunity for the market. Moreover, gluten-free choices are considered healthier food choices, which can aid weight loss. This is expected to boost demand for gluten-free products, further driving the market.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Demand for Food Additives to Propel Market Growth

CMC is used as a thickening agent, stabilizer, and emulsifying agent in the food and beverage industry. For example, in dairy products such as ice cream, it prevents the separation of ingredients, enhances texture, and prevents ice crystal formation, thereby improving the quality and stability of the product.

In the production of low-fat foods, it can serve as a fat substitute, reducing fat content while maintaining the desired texture and mouthfeel of the product. In gluten-free products, it helps improve the dough's rheological properties, enhancing the final product's quality and stability. The rising consumer demand for healthy and specialty foods drives the carboxymethyl cellulose (CMC) market growth.

The modern fast-paced lifestyle has led to a continuous expansion of the food processing and convenience food markets. Ready-to-eat meals, instant noodles, premixed baking products, and other convenient foods require additives to improve texture and stability. CMC, with its excellent properties, is widely used in these products. For instance, in instant noodles, CMC helps achieve the desired dough consistency and improves the noodles' resilience and texture.

As food safety awareness grows, consumers are increasingly preferring natural additives. CMC is recognized as a safe and natural additive. It meets regulatory standards and aligns with consumer expectations, contributing to its widespread adoption in the food additive market.

Growing Demand for Detergent Manufacturing to Drive Market Prospects

The sodium derivative of carboxymethyl cellulose is widely used in detergent production due to its remarkable anti-soil redeposition properties. It is a skin and texture protector, homogenizer, stabilizer, particulate suspender, and color retention agent in detergents.

CMC's excellent thickening, emulsifying, and dispersing effects enable detergents to absorb oils and dirt effectively, preventing oils from reattaching to cleaned surfaces. This enhances the cleaning performance of detergents and meets consumer expectations for high-efficiency cleaning products.

With the development of the detergent market, consumer demand for detergent products has increasingly diversified. In addition to traditional laundry detergents, there is a growing demand for specialized detergents such as those for delicate fabrics, baby clothes, and sports apparel.

Environmental awareness has led to the growing popularity of eco-friendly detergents. CMC is a biodegradable polymer that aligns with the environmental goals of eco-friendly detergents. Its use in detergent formulations reduces environmental pollution, making it a preferred choice for eco-friendly detergent manufacturers. As the eco-friendly detergent market expands, the demand is expected to grow.

Market Restraints

Raw Material Price Volatility and Competition from Substitutes to Impede Market Growth

Raw material price volatility and competition from substitutes are two significant factors restricting the market growth. Raw material price fluctuation has a direct impact on manufacturing costs. CMC is typically derived from wood, pulp, or cotton linters, both of which fluctuate in price according to various factors such as weather, harvest yields, and global demand.

Higher prices lead to lower demand, particularly in price-sensitive businesses or locations, limiting market expansion. Furthermore, variable raw material costs make it difficult for producers to plan long-term investments and expansions, restricting market growth potential.

Competition from substitutes also poses a significant challenge to market growth. Alternative thickeners and stabilizers such as xanthan gum, guar gum, and various synthetic polymers can often perform similar functions in many applications. In certain situations, these substitutes may offer cost, performance, or availability advantages.

For instance, xanthan gum is often preferred in some food applications due to its superior stabilizing properties, while some synthetic polymers may be more cost-effective in industrial uses. As end-users continually seek to optimize their formulations and reduce costs, they may switch to these alternatives if they provide comparable or better performance at lower price points. This substitution effect can erode CMC's market share and limit its growth potential across some industries.

Market Opportunities

Implementing Sustainable Production Methods to Create an Opportunity in Market

With increasing consumer awareness of environmental protection, the demand for eco-friendly products is rising. CMC produced through sustainable methods can be marketed as a green additive, appealing to environmentally aware consumers in food, cosmetics, and detergents.

For instance, products labeled with "natural" and "eco-friendly" ingredients are gaining popularity in the cosmetics industry. The product produced using sustainable practices can be used as a natural thickening and stabilizing agent in organic skincare and hair care products, meeting consumer expectations for environmentally friendly alternatives.

Sustainable production methods often optimize resource utilization, reduce waste, and improve energy efficiency. Manufacturers can reduce raw material costs while achieving efficient resource recycling by adopting advanced biotechnological processes to produce CMC from agricultural waste such as cotton linters and wood pulp.

Implementing sustainable production methods opens up opportunities for collaboration with other stakeholders in the supply chain. For example, CMC manufacturers can partner with raw material suppliers to develop sustainable sourcing strategies for cellulose-based feedstocks, ensuring the supply of high-quality and eco-friendly raw materials.

Market Challenges

Raw Material Constraints and Supply Chain Issues Posing a Challenge to Market Expansion

Despite its steady growth, the global market faces several challenges that could impact its trajectory. Economic uncertainties, including inflation and potential recessions in key markets, dampen consumer spending on renovation and construction projects, impacting demand.

Geopolitical instability and trade barriers continue to disrupt supply chains, increasing manufacturers' material costs and pricing pressures. Fluctuating energy prices, particularly impacting energy-intensive production processes, add to these concerns.

Environmental regulations are also becoming stricter, demanding greater investment in sustainable manufacturing practices and eco-friendly products. This necessitates innovation and adaptation to remain competitive, further straining resources, especially for smaller players.

Segmentation Analysis

By Application

To know how our report can help streamline your business, Speak to Analyst

Food & Beverages Segment Led Market Owing to Rising Product Demand

In terms of application, the global market is segmented into food & beverages, oilfield, paper & pulp, detergents, coatings, and others.

The food & beverages segment accounted for the largest carboxymethyl cellulose (CMC) with a share of 35.74% in 2026. CMC acts as a valuable thickening and stabilizing agent. It prevents ice crystal formation in frozen desserts, enhances the texture of sauces and dressings, and provides structure to baked goods, extending shelf life and improving mouthfeel. Its water-binding capabilities are particularly useful in low-fat and reduced-calorie foods. High demand for baked goods, ice cream, and packaged food will drive the segment's growth.

The oilfield segment accounted for the second-largest share. The oilfield industry relies on CMC for its rheology control properties. It is used in drilling fluids to increase viscosity, suspend drill cuttings, and reduce fluid loss into the formation. It is also used in fracturing fluids that help carry proppants into fractures and maintain well integrity.

Other segments include textiles, pharmaceuticals, and personal care, and are expected to grow with a significant CAGR.

Carboxymethyl Cellulose (CMC) Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Carboxymethyl Cellulose (CMC) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest share in terms of value and volume. The region accounted for a value of USD 0.76 billion in 2026. The Asia Pacific region represents a high-growth market for CMC, fueled by rapid industrialization, rising disposable incomes, and a large population base. The food and beverage industry is a primary driver, as it is used extensively in noodles, sauces, and processed foods.

China accounted for the largest share of the market in 2023. CMC is widely used in China's food industry as a stabilizer and thickener in dairy, sauces, and beverages. It stabilizes emulsions, suspensions, and dispersions in food products. It helps maintain uniformity and prevents ingredients from separating over time. the China market is projected to reach USD 3 billion by 2026.

In Japan, the food and beverage industry is a major consumer, where it is used in products ranging from dairy items to processed foods for its ability to improve texture, stability, and shelf life.

The market in India is witnessing substantial growth due to various industrial applications and the expansion of end-user sectors. Additionally, the increasing population in India significantly influences the rising demand, subsequently leading to growth in industries such as food and beverages, pharmaceuticals, and personal care products. the India market is projected to reach USD 0.53 billion by 2026.

Furthermore, the region's expanding energy industry, particularly in countries such as Malaysia, Indonesia, and Vietnam, stimulates the demand for CMC in oil drilling fluids. It regulates viscosity, suspends solids, and minimizes fluid loss during drilling activities, improving drilling efficiency and wellbore stability.

China Carboxymethyl Cellulose (CMC) Market Share, By Application, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

The food and beverage industry drives the North American market, particularly in products such as baked goods and sauces, where CMC acts as a thickener and stabilizer. The growing demand for processed foods and convenience items contributes significantly. Strong regulatory standards for food safety and quality support product adoption, ensuring consistency and reliability. A growing awareness of gluten-free products, where CMC aids texture improvement, is a key factor driving market growth.

The U.S. leads the North American market. The country generated a value of USD 1.36 billion in 2026. The U.S. market thrives due to its advanced industrial and consumer sectors. CMC’s versatility as a thickener and stabilizer drives demand in food and beverages for processed and gluten-free products.

Resource industries and consumer trends drive Canada’s market. The oil and gas sector, which is focused on oil sands and drilling, relies on CMC to drill fluids. Food and beverages grow with demand for packaged, health-focused products.

Europe

In Europe, the market is propelled by stringent regulations regarding food additives and a focus on natural and sustainable ingredients. Significant demand originates from the food sector (dairy, processed foods), where CMC is a stabilizer and viscosity modifier. Moreover, pharmaceutical applications, particularly in OTC medications and personal care products, are also crucial.

The United Kingdom market is projected to reach USD 0.19 billion by 2026.

Germany’s market is robust, driven by its industrial strength. Food and beverages lead as CMC in premium dairy and processed food, meeting clean-label demand. Sustainable paper, detergents, and coatings thrive on eco-friendly trends. Pharmaceuticals and cosmetics grow with the preferences for natural ingredients. Germany’s innovation and strict regulations make it a strong market. The Germany market is projected to reach USD 0.48 billion by 2026.

The U.K. market grows with food and beverage demand for processed and gluten-free products. Sustainable paper and packaging, detergents, and coatings align with eco-conscious trends.

The France market is driven by premium food and beverage products, with CMC ensuring quality in dairy and bakery. Cosmetics and pharmaceuticals grow with natural ingredient trends. Sustainable paper, detergents, and coatings benefit from eco-friendly demand.

Latin America

The Latin American market experiences growth, primarily driven by the food & beverage industry. Increasing urbanization and changing dietary habits contribute to greater consumption of processed foods. The overall market growth is influenced by economic fluctuations and government policies related to food safety and import regulations.

Brazil dominated the market in 2024 and is expected to continue its dominance by the end of the forecast period. Its robust Food & Beverages sector, a major consumer of CMC as a thickener, stabilizer, and emulsifier, fuels significant demand. The country's agricultural advancements and increasing disposable income further bolster the consumption of CMC-enhanced products.

Mexico is expected to show considerable growth. The food and beverage sector, encompassing everything from baked goods to dairy and sauces, relies heavily on CMC for texture and stability. Mexico's established industrial base, including its textile and paper production, also contributes to consistent consumption. The nation's expanding middle class and increasing adoption of processed foods are expected to sustain market growth.

Middle East & Africa

The Middle East & Africa region's CMC market is primarily driven by the food and beverage sector, boosted by a growing population and increasing demand for convenience foods. CMC is used in dairy products, beverages, and processed foods to improve texture and shelf life. The oil and gas industry utilizes CMC in drilling fluids, especially in countries with significant oil reserves. Regional economic factors and infrastructure development influence the market's development.

The GCC region is witnessing a steady rise in demand for Carboxymethyl Cellulose, a versatile cellulose derivative. Primarily driven by the burgeoning food and beverage industry. The personal care and pharmaceutical industries also present growing application areas, with carboxymethyl cellulose found in toothpaste, cosmetics, and drug formulations.

South Africa represents a mature market within the Middle East & Africa, with established demand across its mining (oil and gas drilling fluids), food and beverage, and pharmaceutical sectors. The country's significant agricultural output also contributes to animal feed usage. South Africa's advanced manufacturing capabilities suggest a potential for increased domestic production.

Key Market Players in Carboxymethyl Cellulose (CMC) Market

Competitive Landscape

Key Industry Players

Leading Companies Adopted an Acquisition Strategy to Gain Market Share

Tate & Lyle, Nippon Paper Industries Co., Ltd, Ashland Inc., DKS Co., Ltd., and Nouryon are among the leading companies in the industry. The ongoing pursuit of cost efficiencies, quality enhancements, and customer service improvements impacts pricing strategies and profit margins. Additionally, firms seek strategic partnerships, mergers, or acquisitions to enhance their competitive positioning, further intensifying market dynamics. The global market is partially consolidated, with the top 4 players accounting for around 45.0% of the market share.

LIST OF KEY CARBOXYMETHYL CELLULOSE (CMC) COMPANIES PROFILED

- Tate & Lyle (U.K.)

- Nippon Paper Industries Co., Ltd (Japan)

- Ashland Inc. (U.S.)

- Daicel Corporation (Japan)

- Lamberti S.P.A. (Italy)

- DKS Co., Ltd (Japan)

- Amtex S.A. (Colombia)

- Nouryon (Netherlands)

KEY INDUSTRY DEVELOPMENTS

- November 2025 -Tate & Lyle acquired CP Kelco from J.M. Huber, forming a global leader in specialty food ingredients. The deal is expected to expand innovation and global reach and significantly strengthen their presence in the market through enhanced R&D, scale, and clean-label formulation capabilities.

- May 2025- Nippon Paper Industries Co., Ltd., announced the completion of a new LiB CMC lithium-ion battery grade carboxymethyl cellulose factory in Hungary, strengthening its production capacity to support battery manufacturing and sustainable technologies.

- February 2023- Nippon Paper Industries Co., Ltd. announced the establishment of a sales and manufacturing subsidiary in Hungary for SUNROSE MAC (carboxymethyl cellulose), which is utilized in lithium-ion battery (LiB) anodes for electric vehicles (EVs), to cater to the significantly increasing supply chain system in Europe.

- August 2020- Nouryon announced plans to expand the production of Monochloroacetic acid as a response to the increasing demand for MCA in carboxymethyl cellulose production.

- March 2019 – Nippon Paper announced the construction of a new facility for the production of a functional cellulose product, carboxymethyl cellulose, at the Gotsu Mill.

REPORT COVERAGE

The market research report provides a detailed analysis and focuses on crucial aspects such as leading companies and applications. Additionally, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years. This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.0% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 3.19 billion in 2026 and is projected to reach USD 4.73 billion by 2034.

In 2026, the Asia Pacific market size stood at USD 1.56 billion.

Growing at a CAGR of 5.0%, the market will exhibit steady growth during the forecast period (2026-2034).

The food & beverages segment led the market in 2025.

The increasing demand for food additives is a key factor driving market growth.

Tate & Lyle, Nippon Paper Industries Co., Ltd, Ashland Inc., DKS Co., Ltd., and Nouryon are key players operating in the industry.

Rising demand for gluten-free products is expected to drive the adoption of carboxymethyl cellulose products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us