Drilling Fluid Market Size, Share & Industry Analysis, By Type (Water-based, Oil-based, Synthetic-based, and Others), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

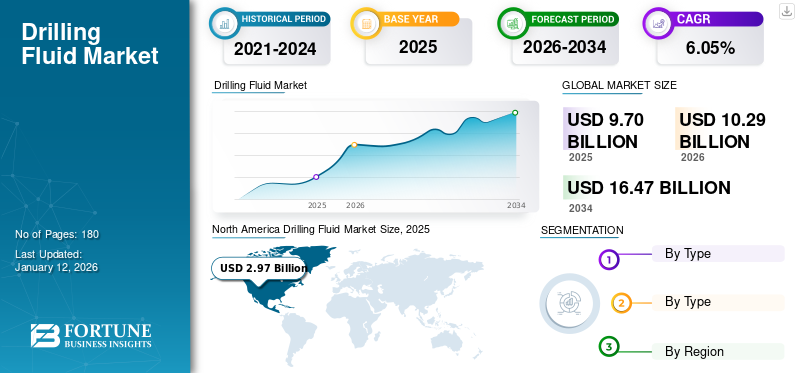

The global drilling fluid market size was valued at USD 9.70 billion in 2025 and is projected to grow from USD 10.29 billion in 2026 to USD 16.47 billion by 2034, exhibiting a CAGR of 6.05% during the forecast period. The North America dominated the Drilling Fluid Market with a share of 30.56% in 2024. Drilling Fluid Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 5.24 billion by 2032.

Drilling fluids are essential in the drilling of wells, serving as the primary method for controlling subsurface pressures. This control is achieved through a combination of the fluid’s density and any additional pressure applied to the fluid column. Drilling fluids are typically circulated down the drill string, out through the bit, and back up the annulus, effectively transporting drill cuttings out of the wellbore.

Halliburton is one of the leading players in the drilling fluid market. The company designs and provides specialized drilling chemicals for operations and solutions tailored to meet the unique temperature, pressure, and operational requirements of each well. A strong product portfolio and global presence are drivers of its revenue growth.

MARKET DYNAMICS

MARKET DRIVERS

Robust Oil and Gas Sector to Drive Market Growth

The strong growth in the oil & gas sector has created major opportunities for well-drilling activities across the globe, which, in turn, drive the drilling fluid market. North America has the highest production rate for crude oil on offshore resources, followed by Russia and the Kingdom of Saudi Arabia. Furthermore, many countries across the globe are investing in finding new resources for the oil & gas sector. For instance, on April 14, 2021, GOM announced two new crude oil production projects with a combined capacity of 200,000 barrels per day, representing 12% of the total oil production in the Gulf of Mexico. This major development is projected to contribute to crude oil production growth in the U.S. Federal Gulf of Mexico (GOM).

Increasing Demand for Shale Gas to Fuel Market Growth

Various factors are driving the global drilling fluid market growth including the rising demand for gas-fired power generation technology and the increasing focus on reducing carbon emissions. Many countries worldwide, including Canada, India, and Germany, are focusing on developing shale gas exploration resources. As per the International Energy Agency (IEA), the share of natural gas in the global energy mix could rise from the present levels of 23% to 25% by 2035, overtaking coal (24%), to become the second-largest primary energy source after oil (27%). In the U.S., shale gas-fired power generation is increasing owing to its several benefits. In the U.S., gas-fired generation increased 3% in 2020. In July 2020, shale gas reached 45% of electricity generation in the U.S. This increasing reliance on shale gas is likely to drive the growth of the shale gas market, which, in turn, is expected to positively drive the global drilling fluid market.

MARKET RESTRAINTS

Fluctuation in Oil & Gas Prices to Obstruct Market Growth

The oil & gas sector is highly volatile owing to the global fluctuation in oil & gas prices. This instability leads to investment instability from foreign and domestic investors, which directly impacts overall operations, including the drilling fluid market. Moreover, crude oil prices in the international market continue to fluctuate due to socio-political scenarios and economic slowdown. For example, oil prices triggered due to the Russia-Ukraine conflict significantly reduced investments in the oil and gas sector. Such instability can hamper drilling activities and hinder market growth globally.

MARKET OPPORTUNITIES

Rising Demand for Oil & Gas Operations to Create New Opportunities

Businesses are more focused on oil & gas operations owing to the rising consumption of oil & gas-based products. Hence, investment in this sector is growing steadily, driven by both private and government bodies. In addition, key companies are forming strategic partnerships with each other to achieve their operational goals. For instance, GA Drilling, a well service provider, declared a partnership with Petrobras- an energy company, to boost the advancement of next-generation deep geothermal drilling technology along with tubing, casing, and cementing. Such initiatives are expected to boost market growth during the forecast period.

MARKET CHALLENGES

High Operational Costs in Operations to Create Challenges

Oil & gas operations require huge investments, particularly in major activities such as drilling wells. Drilling a well involves multiple complex processes, such as suspending rock cuttings, stabilizing exposed rock formations, controlling pressure, and providing buoyancy. Due to the technical complexity of these operations, they need expensive technical support. Operational targets become challenging when not supported with equipment and techniques.

DRILLING FLUID MARKET TREND

Upsurge in Offshore Drilling Services to Set New Market Trends

Many nations are focusing on offshore drilling operations due to easy accessibility, ongoing geopolitical tensions, and supply issues within OPEC+. This shift is contributing to the growing number of offshore oil rigs across several countries. Upcoming exploration projects will positively impact the drilling fluid activities worldwide. For instance, in November 2024, India’s offshore exploration potential remains untapped, particularly in sedimentary basins. Under the Open Acreage Licensing Policy (OALP) the company aims to increase operation by 16% in 2025. Furthermore, by 2030, the Indian government intends to expand the nation’s survey land to 1 million square kilometers, further boosting India’s energy security.

Download Free sample to learn more about this report.

IMPACT of COVID-19 ON

The COVID-19 pandemic negatively impacted global drilling fluid services and its related sectors owing to several factors such as unavailability of raw materials, disruptions in manufacturing units, and border closers. The negative impact on global demand and supply is also a key factor hindering product demand. Moreover, the gap in oil and gas activities in multiple regions led to low oil production, requiring less service demand.

SEGMENTATION ANALYSIS

By Type

Water Based Segment Dominates Market Share Owing to its Cost-Effectiveness and Lower Environmental Impact

Based on type, the global market is classified into water-based, oil-based, synthetic-based, and others. The water-based segment accounted for the major global drilling fluid market share of 49.48% in 2026, owing to its cost-effectiveness and lower environmental impact, in terms of discharge cuttings and mud.

The synthetic-based segment is expected to grow rapidly due to their ability to provide excellent thermal stability, borehole control, penetration rates, and lubricity.

The oil-based segment is expected to grow slower during the forecast period, owing to environmental concerns associated with their use.

The other segment comprises foams, mist, gas, dust, aerated liquid, and nitrogen membrane.

To know how our report can help streamline your business, Speak to Analyst

By Application

Onshore Segment Leads with Growing Energy Demand and Rise in Drilling Activities

Based on application, the market is classified into onshore and offshore.

The onshore segment accounted for the highest market share of 80.53% in 2026 and is anticipated to maintain its dominance during the forecast period, driven by the rising global demand for energy and the growth in drilling activities.

The offshore segment is expected to grow fastest during the forecast period. Offshore oil exploration activities have increased as oil prices recovered. For example, operating offshore rigs witnessed a yearly increase of 23.0% in January 2019, compared to a 2.0% increase for onshore rigs during the same period. Furthermore, rising demand for drilling fluids for offshore applications is being driven by rising demand for mud in deep water, harsh environments, and remote locations.

DRILLING FLUID MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Drilling Fluid Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rising Shale Gas Exploration Fuels Market Growth

North America dominated the market with a valuation of USD 2.97 billion in 2025 and USD 3.14 billion in 2026. The drilling fluid market in North America is considered dominant, driven by multiple factors, such as the availability of service providers, growth in shale gas exploration and fracking operations, among others. These factors are expected to fuel the market growth as extensive drilling operations are required for exploration as well as fracking activities. Thus, rise in drilling operations augments the demand for drilling fluids that play a crucial role in assisting safe and efficient drilling operations.

U.S.

Rapid Oil and Gas Activities Boosts Market Growth

The U.S. is the dominant country in North America owing to the rise in oil & gas activities. The government offers incentives, such as tax reductions and other investment-friendly policies. In addition, businesses are ramping up oil production by injecting significant capital, further boosting market growth. The U.S. market is projected to reach USD 2.77 billion by 2026.

Europe

Increasing Energy Demand to Influence Drilling Fluid Services

Europe is growing slowly owing to the instability of geopolitics. A major factor is the war between Russia and Ukraine, which has disrupted the overall supply and demand of crude oil across the region, resulting in increasing energy demand. To satisfy such a surge in demand, countries such as Norway, and the U.K. are accelerating the oil and gas production activities which is anticipated to give rise to drilling activities and thereby support market growth. The UK market is projected to reach USD 0.08 billion by 2026, and the Germany market is projected to reach USD 0.08 billion by 2026.

Asia Pacific

Asia Pacific is the Fastest-Growing Region Driven by High Investment from International and Domestic Investors

Asia Pacific is one of the fastest-emerging markets globally fueled by rapid economic growth in key countries such as India and China. This has witnessed high investment from international and domestic investors to boost industrial applications. The China market is projected to reach USD 1.34 billion by 2026

In addition, the paradigm shift from traditional processes to technologically advanced methods is significantly contributing to market growth. This trend is likely to drive increased oil and gas consumption across different industry verticals, such as transportation, manufacturing, seaborne trade, and aviation. Consequently, prominent oil and gas companies are extensively increasing CAPEX in exploration and production activities across the region.

Latin America

Exploration in Oil & Gas Sector to Influence Market Development

Latin America's market is mainly driven by the surge in discovering untapped oil and gas reserves. Drilling activities in the area are expected to increase during the forecast period due to large deposits of unconventional hydrocarbon reserves such as shale gas, tight oil, and oil sands. Large investments from multinational oil and gas companies is another factor bolstering the growth of the market.

Middle East & Africa

Growing Uptake of Innovative Technologies in MEA Boosts Market Growth

The Middle East & Africa demonstrated robust growth due to the adoption of advanced technologies. UAE, Saudi Arabia, and Qatar are already in a race to develop new technologies, with drilling fluid playing an important role in enhancing drilling operations. The Middle East is also a major crude oil exporter, making it a leader in good oilfield services.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Partnerships and Collaborative Efforts by Market Player for Drilling Projects to Drive Market Growth

Renowned oilfield service companies dominate the market due to their global presence. U.S.-based players constitute a larger market share due to the extensive adoption of drilling fluid practices in North America. Such companies emphasize partnerships and collaborative efforts in order to undertake drilling projects across various regions and thereby expand their market presence. For instance, in March 2021, Schlumberger, U.S.-based player, partnered with ENGIE Solutions, and SMP Drilling and delivered a 1,600-meter-deep geothermal drilling project in Vélizy-Villacoublay, France. The multilateral well was drilled using the PowerDrive Archer high build rate rotary steerable system and AxeBlade ridged diamond element bit.

List of Key Drilling Fluid Market Companies Profiled

- Schlumberger (U.S.)

- Halliburton (U.S.)

- Newpark (U.S.)

- Baker Hughes (U.S.)

- TETRA Technologies, Inc. (U.S.)

- Canadian Energy Services (Canada)

- NOV (U.S.)

- Secure Energy (Canada)

- Weatherford (U.S.)

- Q’Max Solutions Inc. (U.S.)

- Global Drilling Fluids and Chemical Limited (India)

- Sagemines

- Scomi Group Bhd (Malaysia)

- Catalyst Middle East (Dubai)

- Flotek Industries, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: The Norwegian Offshore Directorate (NOD) permitted Equinor to drill two wildcat wells in the North Sea. The permit covers wells 34/6-8 A and 34/6-8 S located in production license 554, where Equinor holds 40% of the drilling operation and is partnering with Aker BP and Vår Energi for the project.

- December 2024: QatarEnergy acquired a 27.5% stake in the petroleum exploration license and petroleum agreement for Block 2813B (PEL0090) offshore Namibia. Harmattan Energy, a secondary subsidiary of Chevron, will retain a 52.5% operated interest.

- September 2024: SCF Partners, Inc., acquired Newpark Fluids Systems business from Newpark Resources Inc. Newpark Fluids Systems offers a comprehensive selection of drilling and completion products, along with associated technical services, enhanced by a cutting-edge digital modeling software suite, a global supply chain, and infrastructure designed to improve the efficiency and productivity of clients' operations.

- April 2021: Halliburton Company launched StrataXaminer, a new wireline logging service designed to help operators acquire more accurate well data for better evaluation of production potential. With increased accuracy, the tool delivers high-resolution images of oil or synthetic-based fluid systems of the reservoir structure to identify bedding, fracture patterns, fault zones, and potential flow barriers.

- February 2020: Saipem secured multiple EPCI contracts across various countries valued at worth over USD 500 million. The first EPCI contract was awarded by Saudi Aramco in the Kingdom of Saudi Arabia as a part of a long-term agreement. In addition, Saipem secured a contract with Eni Angola S.p.A. that was concerned with Cabaca and Agogo's early phase 1 development.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.05% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 9.70 billion in 2025.

The market is likely to grow at a CAGR of 6.05% during the forecast period (2026-2034)

By application, the onshore segment led the market.

The market size of North America stood at USD 2.97 billion in 2025.

Increasing demand for shale gas is a key factor fueling market growth.

Some of the top major players in the market are Schlumberger, Halliburton, and Baker Hughes.

The global market size is expected to reach USD 16.47 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us