Cloud AI Market Size, Share & Industry Analysis, By Component (Solution and Services), By Technology (Machine Learning (ML), Deep Learning, and Natural Language Processing (NLP) and Others), By Function (Finance, Marketing & Sales, Supply Chain Management, Human Resources, and Others), By End-Users (BFSI, IT and Telecommunications, Healthcare, Retail and Consumer Goods, Media and Entertainment, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

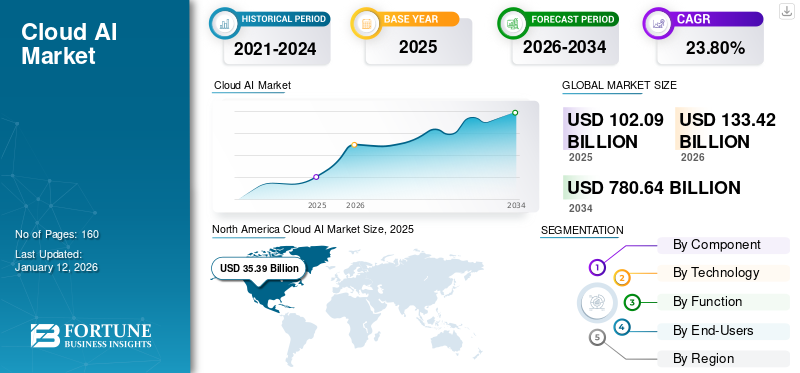

The global cloud AI market size was valued at USD 102.09 billion in 2025. The market is projected to grow from USD 133.42 billion in 2026 to USD 780.64 billion by 2034, exhibiting a CAGR of 23.80% during the forecast period. North America dominated the global market with a share of 34.70% in 2025.

The fusion of cloud computing and artificial intelligence (AI), known as cloud AI, represents a breakthrough in technology. By integrating AI with cloud computing, organizations can seamlessly align their day-to-day operational activities with AI tools, algorithms, and cloud services. AI Cloud allows companies to use the full potential of Artificial Intelligence, such as machine learning, natural language processing, and computer vision, thereby offering numerous benefits and enhancing competitiveness.

Cloud AI market growth can be attributed to factors such as the growing adoption of generative AI and machine learning among various industries. The rising trend in cognitive computing and intelligent automation also contributes to this growth. As the 5G network is rolled out and usage becomes more prevalent, there is an anticipated surge in cloud computing and web traffic, fostering a growing potential for cloud AI market share. This growth is due to technological developments and an increasing need for virtualization, storage, and analysis. According to Pluralsight’s 2022 report, all new products and features are being built by 75% of tech leaders in the cloud.

COVID-19 IMPACT

Increasing Data Volume and Private Cloud Networks during COVID-19 Pandemic Fueled Market Growth

At the time of COVID-19, the adoption of cloud AI received a positive response. The volume of data produced from various sources increased during the rapid spread of COVID-19 around the world. Cloud computing applications, crucial for efficient remote work, played a central role in the pandemic crisis, accelerating the market growth.

To improve internet connectivity and security of critical data, demand for private cloud networks increased. There was a sudden surge in the demand for collaboration solutions as large number of employees move to remote work. Additionally, lockdown initiatives in major economies around the world stimulated demand for online shopping and video streaming. Investment in cloud artificial intelligence by companies was also increased. For instance, in August 2020, Wiserfunding, a U.K. fintech firm announced the launch of cloud credit risk enhancement AI solutions in India. The company intended to invest approximately USD 5.0 million in developing specialized and accurate credit risk models to ensure the creditworthiness of potential borrowers to be higher than 80%.

Cloud AI Market Trends

Rising Cybersecurity Concerns and Strategic Embrace of Digital Transformation to Propel Market Growth

The three functions of cloud-based AI solutions and services are encryption, authentication, and disaster recovery are gaining heightened popularity among users amidst an increasingly complex cybersecurity threat landscape. As hackers develop new forms of AI based attacks, the frequency and severity of data theft and breaches continue to escalate. Any system accessible to humans will always face the risk of being attacked by social engineering.

Cloud AI can be used as a valuable tool in supplementing security analysis to fight well organized cyberattacks and breaches. To find the likely vulnerabilities in their systems or processes, more businesses invest heavily in AI and ML cloud security control applications. According to industry analysts, by 2024, more than 50% of all IT spending will be invested toward digital transformation and innovation of AI and cloud computing.

Download Free sample to learn more about this report.

Cloud AI Market Growth Factors

Increasing Advancements in Generative AI and Intelligent Automation to Aid Market Growth

Enterprises are taking advantage of AI and machine learning (ML) to streamline a wide range of repetitive and time consuming data engineering and analysis tasks. They can simplify processes such as data cleansing, transformations, and modeling processes through the incorporation of cloud computing automation in their workflows.

Organizations can streamline tasks such as data gathering, inventory management, customer service, and more using generative AI algorithms and machine learning capabilities. This releases staff from superfluous work, allowing them to focus on more value-enhancing strategic initiatives. Intelligent automation is saving time, minimizing errors, improving accuracy, and driving efficiency. By 2026, an industry analyst anticipates that over 80% of companies will use GenAI APIs, models, as well as applications in production environments.

RESTRAINING FACTORS

Scalability Issues to Hamper the Market Growth

The main test for market growth is the ability to scale cloud artificial intelligence. With an increase in network size and data transaction volumes, congestion issues can arise, leading to delays in processing times as well as augmented transaction costs. Addressing these scalability challenges is essential to foster a widespread uptake, particularly in high-volume sectors.

Cloud AI Market Segmentation Analysis

By Component Analysis

Investments by Large and Active Cloud AI Solution Providers Increased the Demand in Market

Based on the component, the market is segmented into solutions and services.

In terms of market share, the solution segment dominated the market with a share of 54.64% in 2026. The market is driven by the increasing availability of these solutions from major technology companies such as AWS, Microsoft, and Google. These companies are investing significantly in creating and providing cloud based AI solutions as a service to various enterprises, which makes it easier for businesses not to spend on costly equipment or human resources. According to Financial Times in 2023, the combined quarterly investment of USD 32.0 billion was increased by 50 % over the last three years from Google, Microsoft, and Amazon.

The services segment is expected to grow at the highest CAGR during the forecast period. The growth of the segment can be attributed to the flexible interface and scalability provided by cloud servers. As smart technology adoption increases substantially, the need to provide cloud Al services is expected to increase. These services allow companies to speed up their operations by using solution capabilities, leading to reduced operating costs and increased revenues. Businesses are using Artificial Intelligence as a Service (AIAAS), to compete with cloud AI services such as integration, maintenance, and support.

By Technology Analysis

Rising Usage of Machine Learning Technology in Providing Effective Management Capabilities Fueled the Segment Growth

Based on the technology, the market is segmented into machine learning (ML), deep learning, natural language processing (NLP), and others.

In terms of market share, the machine learning segment dominated the market with a share of 33.79% in 2026.. With the use of machine learning on the cloud, organizations can gain access to the computing resources to obtain deeper insights, create more innovative solutions, and enhance their efficiency. ML provides cloud computing with a broad set of data management capabilities, and it is flexible enough for the creation of a seamless environment.

Natural language processing (NLP) is expected to grow at the highest CAGR during the forecast period. This technology enhances user interfaces, making them more user-friendly and efficient by enabling them to comprehend and react to language input. With the recent advances in NLP, its models have been able to achieve a higher level of performance for tasks such as language translation and sentiment analysis. These models require a large amount of data and computing power, which can be provided by cloud artificial intelligence services.

By Function Analysis

Enhanced Customer Experience in Finance Domain Aided Finance Segment Growth

Based on function, the market is segmented into finance, marketing & sales, supply chain management, human resources, and others.

As per market share, the finance segment led the market with a share of 26.36% in 2026, leveraging Cloud AI as a financial management tool for extraordinary customer experiences, streamlined operations, and enhanced security measures due to abundant data and technological advancements. By using the power of AI in the cloud to provide intelligent classification and recognition, businesses are automating manual processes such as accounts payable.

Supply chain management is expected to significantly grow at the highest CAGR during the forecast period. The cost efficiency of cloud services with AI provides a significant advantage for businesses with limited resources. Additionally, reduction in the error risks and automation of manual processes improves efficiency and also speeds up the process of transaction.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

BFSI Segment Dominated Owing to Rising Demand for Exceptional Banking Features

Based on end-users, the market is categorized into BFSI, IT and telecommunications, healthcare, retail and consumer goods, media and entertainment, and others.

The BFSI segment led the market with a share of 25.49% in 2026. The BFSI industry is implementing cloud AI to provide transparent and auditable audits, allowing peer- to-peer transactions, streamline KYC processes, and ensure error-free insurance claims processing. The acceleration of the market is projected to be supported by its increasing deployment in the financial services industry for fraud identification, trading decisions, credit scoring software utilization, analysis of financial markets’ effects, and risk management.

Healthcare is set to have a significant growth with highest CAGR during the study period. The adoption of cloud AI in healthcare is anticipated to propel the demand for medical devices and medicines. Cloud artificial intelligence in healthcare offers several data management benefits, enabling automatic reports and metrics generation based on actual time data. This substantially reduces process and reaction times through secure and efficient information sharing among patients, the computerized processing of insurance claims, supply chain monitoring, and contract management.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into Asia Pacific, North America, Europe, Middle East & Africa, and South America.

North America Cloud AI Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025, with a market size of USD 35.39 billion.. The high growth in the region can be attributed to companies that are early users of AI and machine learning technologies across different sectors. A large and highly skilled workforce is present in North America, with the capacity to develop and implement AI solutions. Many universities and research centers in North America are at the forefront of AI research and development, which produces a continuous flow of talented individuals contributing to innovation on the market. The U.S. market is projected to reach USD 22.95 billion by 2026.

The UK market is projected to reach USD 5.93 billion by 2026, while the Germany market is projected to reach USD 4.51 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is anticipated to experience significant growth with the highest rate during the forecast period. To gain competitive advantage and increase their customer base, market players in the region are investing in product innovation. The Japan market is projected to reach USD 7.43 billion by 2026, the China market is projected to reach USD 7.47 billion by 2026, and the India market is projected to reach USD 4.88 billion by 2026.

Middle East & Africa is set to witness the second-highest CAGR in the market during the study period. This growth is fueled by advancements in cloud computing technologies supporting AI and digital transformation, contributing to market expansion in the region.

Key Industry Players

Market Players are Opting for Various Strategies to Expand their Business Reach

Key market participants operating in the market have been offering enhanced cloud computing integrated with AI services which provides businesses with growth and flexibility. These organizations are prioritizing on acquiring the other regional and small organizations to expand the reach of their business. Strategic initiatives such as leading investments, partnerships, and mergers & acquisitions have been contributing in increasing the demand for the product in the market.

List of Top Cloud AI Companies Profiled

- Microsoft Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Alibaba Cloud (China)

- H2O.ai (U.S.)

- Salesforce, Inc. (U.S.)

- Tencent (China)

- Dataiku (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Amazon Web Services, Inc. and NVIDIA announced the expansion of their strategic partnership to provide customers with the latest technology infrastructure, software, and services for generating intelligent AI innovations.

- May 2023: Tata Consultancy Services announced the expansion of its collaboration with Google Cloud and launched a new service, TCS Generative Artificial Intelligence. This service is part of Google Cloud's innovative artificial intelligence services, enabling clients to leverage this technology for accelerated growth and transformation through customized business solutions.

- May 2023: Google Cloud, a provider of enterprise cloud computing, and Cognizant, a professional services company, announced an extended partnership to fast-track the adoption of AI by businesses. This partnership helped clients to modernize, create, and migrate their AI journeys so that they can meet them where they are.

- November 2022: ToGL Technology and Huawei Technologies (Malaysia) Sdn Bhd entered into a collaboration for the development of cloud-based Digital Solutions in Malaysia. The partnership includes modern cloud services and artificial intelligence, as well as new digital experiences.

- October 2022: Oracle and Nvidia signed an expanded agreement at Cloud World, in support of the accelerated adoption of artificial intelligence by clients. Through this partnership, Oracle Cloud Infrastructure gained accessed to Nvidia complete computing stack, software, and GPUs.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, and leading end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Technology

By Function

By End-Users

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 780.64 billion by 2034.

In 2025, the market value stood at USD 102.09 billion.

The market is projected to grow at a CAGR of 23.80%.

In 2024, BFSI dominated the market.

Increasing advancements in generative ai and intelligent automation is a key factor driving market growth.

Microsoft Corporation, Amazon Web Services, Inc., Google LLC, IBM Corporation, Oracle Corporation, Alibaba Cloud, H2O.ai, Salesforce, Inc., Tencent, and Dataiku are the top players in the global market.

In 2025, North America recorded the largest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us