Cloud Video Storage Market Size, Share & Industry Analysis, By Deployment (Public, Private, and Hybrid), By Application (BFSI, IT & Telecom, Government and Public Sector, Manufacturing, Healthcare and Life Science, Retail and Consumer Goods, Media and Entertainment, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

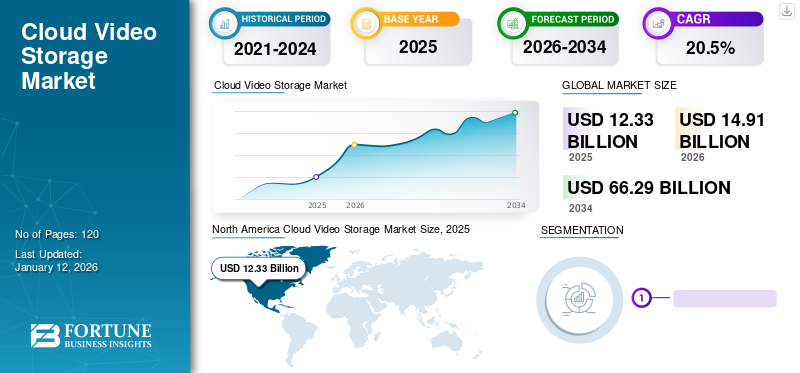

The global cloud video storage market size was valued at USD 12.33 billion in 2025 and is projected to grow from USD 14.91 billion in 2026 to USD 66.29 billion by 2034, exhibiting a CAGR of 20.5% during the forecast period. North America dominated the global market with a share of 33.6% in 2025. Additionally, the U.S. cloud video storage market is predicted to grow significantly, reaching an estimated value of USD 6,969.0 Million by 2032.

In the scope of work, we have included companies such as Amazon Web Services, Inc. (Amazon, Inc.), Google LLC, Oracle Corporation, IBM Corporation, and Microsoft Corporation. These players are focused on offering unique, flexible, scalable, and multiple cloud video storage options to cater to the changing requirements of the user. Similarly, to overcome issues such as security, data safety, disaster recovery or backup options, efficient data mobility and more, key players are integrating key security solutions.

Global Cloud Video Storage Market Overview

Market Size:

- 2025 Value: USD 12.33 billion

- 2026 Value: USD 14.91 billion

- 2034 Forecast Value: USD 66.29 billion

- CAGR (2026–2034): 20.5%

Market Share:

- Regional Leader: North America held around 33.6% share in 2025.

- Fastest-Growing Region: Asia Pacific is projected to record the highest growth rate during the forecast period.

Industry Trends:

- Rising adoption across IT & Telecom, media & entertainment, healthcare, retail, BFSI, and government sectors.

- Hybrid cloud deployment models dominate due to scalability, compliance, and performance needs.

- Increasing integration of AI-powered video analytics, advanced compression technologies, and seamless CDN/VMS solutions.

Driving Factors:

- Rapid growth in video content from streaming, surveillance, and enterprise collaboration.

- Shift from on‑premises storage to cloud-based solutions for cost savings, scalability, and accessibility.

- Increasing need for AI‑driven video indexing, tagging, and analytics to extract actionable insights.

- Growing adoption of hybrid cloud storage to address compliance, data sovereignty, and latency concerns.

Cloud video storage is a form of online data storage where digital files are stored in the cloud instead of physical hardware. The cloud consists of remote servers hosted by third parties. It allows users to store and manage their data from any device with an internet connection. This makes cloud video storage ideal for people who need to access content in multiple locations or on the go.

The COVID-19 pandemic had a significant positive impact on the market, and it is expected to grow post-COVID-19. The significant growth is attributed to the rise in the migration toward cloud architecture due to its ability to replace traditional data centers and manage more workloads during the pandemic.

IMPACT OF GENERATIVE AI

Integration of Artificial Intelligence in Cloud Video Storage Fuelled Market Growth

The adoption of generative AI in cloud video storage is gaining momentum, offering innovative solutions and transforming the way video content is processed, analyzed, and delivered. This technology enhances video compression algorithms, enabling more efficient storage by reducing file sizes without compromising quality. This efficiency translates to cost savings and improved performance for cloud video storage platforms. Moreover, generative AI can be used to create synthetic or augmented content. This is slated to lead to an increase in the variety of video content stored in the cloud, ranging from personalized AI-generated videos to enhanced versions of existing content. It also plays a vital role in video analytics for security and surveillance applications. By automatically detecting and categorizing objects, events, or anomalies in video footage, the demand for storing relevant security-related content worldwide is poised to increase in the coming years.

Cloud Video Storage Market Trends

Increased Adoption of Hybrid Multi-Cloud in Major Organizations to Boost Market Growth

The organizations are adopting a hybrid multi-cloud approach for data storage to improve data mobility between the public, private cloud, and on-premises. Hybrid cloud allows enterprises to collect, isolate, and store data as per their choice, on public, private, hybrid cloud or on-premise. It allows organizations to connect several storage options, such as object storage, file storage, backup systems, and block storage. Thus, organizations adopt hybrid cloud storage due to data security, flexibility, and agility. For instance, as per IDC, by 2022, more than 90 % of organizations depended on multiple public cloud, private cloud legacy platforms, and on-premises to fulfill the infrastructure needs. The hybrid multi-cloud provides control and visibility over the infrastructure, which helps access and secure video files efficiently.

Download Free sample to learn more about this report.

Cloud Video Storage Market Growth Factors

Growing Demand for Digital Video Streaming to Boost Market Growth

The rising adoption of smartphones and increased network connectivity enables consumers to watch digital content or media, be it entertainment, information, and others, as per their preferences, from anywhere and anytime. Today’s consumers expect the availability of streamed audio or video content. Increasing number of video streaming subscribers is likely to drive the adoption of cloud video storage. The streaming service providers focus on adopting cloud storage to deliver high-resolution and low-latency video content to users. The pay-as-per-use pricing model helps service providers reduce infrastructure costs. Cloud storage providers offer backup of video files, which allows for retaining deleted files.

Hence, the growing demand for streaming services across Netflix, Netflix, Hulu, Video, Amazon Prime Video, and others is likely to foster the demand for cloud video storage to deliver digital media content as per consumer choice.

RESTRAINING FACTORS

Data Privacy Concerns May Restrain Market Growth

Cloud storage reduces the IT infrastructure cost, flexibility, and on-demand services. Despite these advantages of cloud storage, customers face several challenges while storing videos over the cloud, such as security, data leakage, performance and bandwidth limit, video uploading, downloading speeds, and synchronization speed. Data leakage, data security and privacy concerns, and limited network bandwidth restrict the cloud video storage market growth. However, major market players such as Box Inc., Dropbox Inc., Sync.com, and OpenDrive offer unlimited storage to users, which is expected to overcome these limitations and increase the demand for cloud storage in the coming years.

Cloud Video Storage Market Segmentation Analysis

By Deployment Analysis

Growing End-User Spending in the Public Cloud to Accelerate Segment Growth

Based on deployment, the market is divided into public, private, and hybrid.

Among these, the public segment is expected to account for a major market with a share of 66.06% in 2026 during the forecast period owing to growing spending on the public cloud.

The private segment is anticipated to witness steady growth during the forecast period on account of the enhanced security offering and confidential data protection.

The hybrid segment is projected to gain considerable growth during the forecast period. Organizations implementing hybrid cloud can gain benefits from both public and private deployments. Enterprises can use public clouds for low-security needs and high volumes of data.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Digitalization of Telecom Services to Foster the IT & Telecom Segment Growth

Based on application, the market is classified into BFSI, IT & telecom, government and public sector, manufacturing, healthcare and life science, retail and consumer goods, media and entertainment, and others.

The IT & telecom segment held a major market share in 2024 owing to the digitalization of telecom services such as software-defined networking, visualized network function, and others.

The manufacturing segment is expected to grow at the highest CAGR during the forecast period owing to an increase in the number of smart factory video surveillance solutions that include real-time notifications, motion detection, remote monitoring, cloud storage, single dashboard, and unlimited camera additions. These factors contribute to the segmental growth. The Manufacturing segment will account for 14.49% market share in 2026.

The healthcare and life science segment is anticipated to grow at a considerable CAGR during the forecast period. Cloud services enable healthcare providers to accomplish real-time data insights and reduce IT complexities with cloud storage solutions.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Cloud Video Storage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 4.24 billion in 2025 and USD 4.83 billion in 2026. North America market for cloud video storage holds a major cloud video storage market share. According to IDC, the U.S. was expected to generate the most cloud traffic among other regions in 2024 and account for more than half of global public cloud spending. Many consumers of cloud computing in this region include government departments and businesses. The federal government's current fiscal constraints are driving a rapid transition to cloud computing. North American governments are interested in cost-effectively integrating cloud solutions, from developing "cloud-first" IT policies to moving all programs to the cloud. The U.S. market is projected to reach USD 2.83 billion by 2026.

Europe

Europe is influenced by government initiatives such as cloud-first policy. A few years ago, the U.K. government adopted a cloud-first policy to improve citizen services, foster innovation, and enhance the agility of government agencies. Furthermore, the prominent players such as Dell Technologies Inc., Google LLC., Amazon.com Inc., Microsoft Corporation, pCloud AG, Box Inc., IBM Corporation, and Oracle Corporation in the region are focusing on developing highly reliable and cost-effective cloud video storage solution offerings to meet the customers’ and organizations’ needs, promoting regional growth. The UK market is projected to reach USD 0.73 billion by 2026, while the Germany market is projected to reach USD 0.64 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. Evolving economies such as China and India have made significant contributions to facilitating the region's adoption of cloud-driven technologies. For instance, organizations in the region are responding to the new normal and redesigning themselves to be more prepared for pandemics while also remaining competitive. Most businesses are developing new technology-enabled business models with the goal of regaining growth and achieving a technological advantage over competitors. The Japan market is projected to reach USD 1.1 billion by 2026, the China market is projected to reach USD 1.2 billion by 2026, and the India market is projected to reach USD 1.17 billion by 2026.

South America and the Middle East & Africa markets are influenced by the growing investment by Brazil, Argentina, Chile, and Columbia governments to improve digitalization across the countries. Moreover, the COVID-19 pandemic has surged the adoption of digital technologies, smartphones, and digital banking across both regions.

List of Key Companies in Cloud Video Storage Market

Market Players Are Focusing on Strategic Partnerships to Expand their Analytics Services Worldwide

The key players in the cloud video storage market are well-established and highly recognized brands offering unique storage solutions for their customers. These key players have global footprints across the regions, including Asia Pacific, the U.S., European Countries, and the Middle East & Africa. They are also aiming to expand their global footprint and maximize market dominance through strategic partnerships, acquisitions, and strong third-party networks.

List of Key Companies Profiled:

- Google LLC (U.S)

- Dropbox, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Oracle Corporation (U.S.)

- Microsoft Corporation (U.S.)

- pCloud AG (Switzerland)

- BOX, Inc. (U.S.)

- Dell Technologies, Inc. (U.S.)

- VMware, Inc. (U.S.)

- IBM Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Augmedix, a healthcare technology firm, announced that it has implemented Google Cloud's MedLM technology into its technology stack. The implementation of this technology leverages the up-to-date AI developments adapted to healthcare use cases and meets stringent requirements for AI compliance, security, and enterprise scalability.

- December 2023: Hitachi, Ltd. collaborated with long-time partner Google Cloud and introduced the Hitachi Unified Compute Platform for GKE Enterprise. Through Google Distributed Cloud Virtual (GDCV), the enterprise provides organizations with a unified platform to accomplish hybrid cloud operations, resulting in improved infrastructure and AI application efficiency, scalability, and flexibility.

- December 2023: Dell Technologies announced that it is helping clients achieve faster generative AI performance with original enterprise data storage advancements and validation with the NVIDIA DGX SuperPOD AI infrastructure. PowerScale's most recent execution propels clients to move forward with AI, demonstrating preparation and fine-tuning to create superior trade choices based on their information wherever it dwells with expanded speed and exactness.

- November 2023: Boombox announced the addition of new tools and services, positioning itself as an alternative to major cloud storage providers, including Google Drive and Dropbox, designed for the music industry. The goal is to save the users’ steps, time, and money.

- November 2023: AWS and NVIDIA announced a partnership to provide cutting-edge infrastructure, software, and services to accelerate customer innovation in generative artificial intelligence (AI). This expanded collaboration builds a longstanding commitment to advancing the era of generative AI by providing early machine learning (ML) pioneers with the computing power needed to advance the cutting edge of these technologies.

REPORT COVERAGE

An Infographic Representation of Cloud Video Storage Market

To get information on various segments, share your queries with us

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides this, it offers insights into the cloud video storage market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.5% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 66.29 billion by 2034.

In 2025, the market stood at USD 12.33 billion.

The market is projected to grow at a CAGR of 20.5% during the forecast period.

By application, the IT & telecom segment led the market in 2026.

The growing demand for digital video streaming is poised to boost market growth.

Amazon Web Services, Inc. (Amazon, Inc.), Google LLC, Oracle Corporation, IBM Corporation, and Microsoft Corporation are the top players in the market.

North America holds the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic