Commercial Aircraft Disassembly, Dismantling and Recycling Market Size, Share & COVID-19 Impact Analysis, By Application (Disassembly & Dismantling, Recycling & Storage, USM, and Rotable Parts), By Aircraft Type (Narrow Body, Wide Body, and Regional Jet), and Regional Forecast, 2023-2033

KEY MARKET INSIGHTS

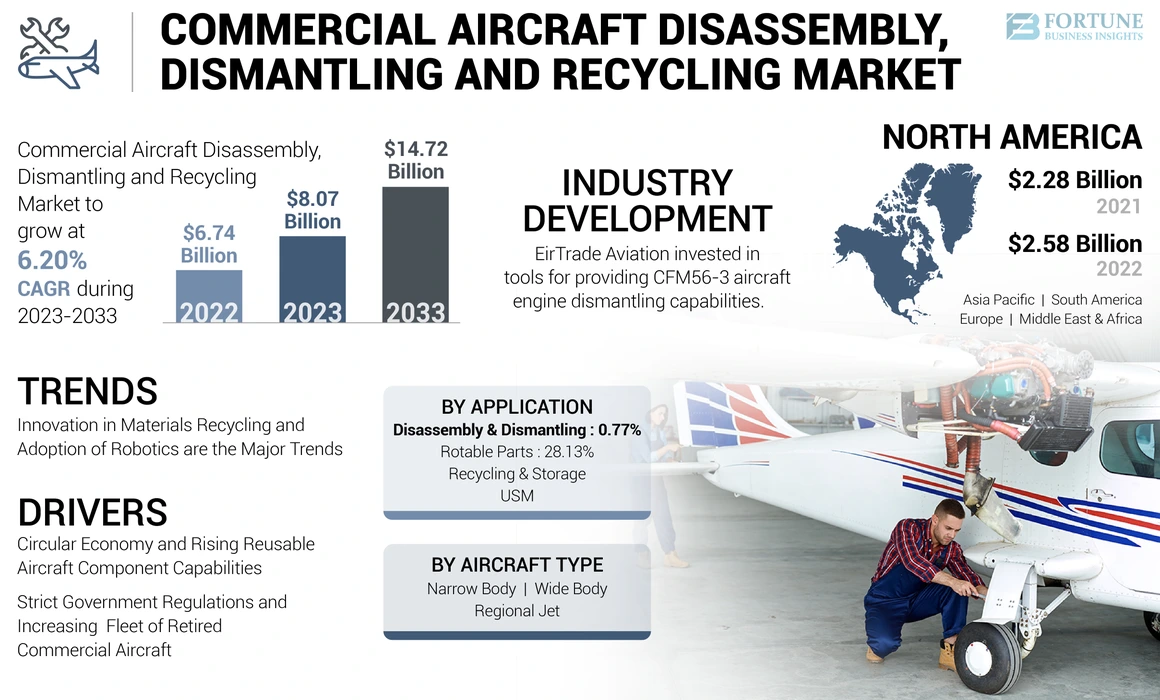

The global commercial aircraft disassembly, dismantling and recycling market size was valued at USD 6.74 billion in 2022 and is projected to grow from USD 8.07 billion in 2023 to USD 14.72 billion by 2033, exhibiting a CAGR of 6.20% during the forecast period. North America dominated the commercial aircraft disassembly, dismantling & recycling market with a market share of 38.28% in 2022.

Commercial aircraft disassembly, dismantling and recycling is the process of removing and dismantling decommissioned aircraft and reusing their parts as spare parts or scrap metal. The planes are made from approximately 800 to 1,000 recyclable parts, the majority of which are made from metal alloys and composite materials. Commercial aircrafts are dismantled at aircraft recycling centers, where non-metallic parts with no recycling value are discarded, major components are dismantled, and metal alloy parts are sorted based on their composition.

Commercial aircraft disassembly, dismantling & recycling involves carefully removing and categorizing all components, both interior and exterior, ensuring that each part is properly identified and processed. Disassembly involves the physical act of taking the aircraft apart, whereas dismantling involves detailed component separation, often with the intention to reuse or recycle certain parts. It is estimated that approximately 400 to 450 aircraft are dismantled and recycled each year. Circular economy and growing reusable capabilities of aircraft component are expected to drive the growth of the global market size from 2023 to 2033.

COVID-19 IMPACT

COVID-19 Pandemic Had a Positive Impact on the Market Owing to Restructuring Airline Fleets and Decommissioning of Airplanes

In the year 2020, governments in different regions declared the total shutdown and temporary closure of the industry. This impacted the entire process of aircraft disassembly, dismantling and recycling and to some extent disrupting the market worldwide. Throughout the year 2020, new aircraft deliveries also experienced a decrease of almost 43.5% compared to the previous year.

However, in 2021, the market exhibited signs of recovery, already surpassing the revenue generation and demand in the first six months compared to 2020. The industry was back on track with the revival of affiliated facilities. As the COVID-19 pandemic continued to keep numerous airline fleets grounded, airlines were expediting the retirement of airplanes, resulting in a rise in the disassembling and exchanging of aircraft components. The aviation sector was striving to enhance its environmental friendliness in response to increasing demands from advocates of climate change.

The quantity of planes in storage globally reached to nearly 6,300 in August 2021, an increase from 2,100 prior to the COVID-19 pandemic. The global crisis and subsequent decline in air travel demand persisted, leaving approximately 25% of the world's commercial passenger planes inactive. Air carriers globally were undergoing significant reorganization of their fleets and decommissioning airplanes as a result of the COVID-19 outbreak and the subsequent decline in air travel requirements. Consequently, there has been a notable increase in the stockpile of airplane components and parts.

Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Overview

Market Size & Forecast

- 2022 Market Size: USD 6.74 billion

- 2023 Market Size: USD 8.07 billion

- 2033 Forecast Market Size: USD 14.72 billion

- CAGR: 6.20% from 2023–2033

Market Share

- North America held the largest share at 38.28% in 2022, driven by major fleet retirements and strong MRO activity across the U.S. and Canada.

- By application, USM (Used Serviceable Material) is the leading segment due to rising demand for cost-effective aftermarket parts and components.

Key Country Highlights

- United States: Fleet renewal programs by airlines like United Airlines (110 new aircraft orders in 2023) and rising decommissioning of aging aircraft boost recycling demand.

- China: Increasing aircraft retirements and rapid expansion in aviation hubs under Belt and Road projects support high recycling activity.

- India: Growth led by new dismantling facilities (e.g., Nano Aviation’s site in Chennai) and access to skilled labor and ports.

- Europe: Strong presence of players like EirTrade Aviation and Ecube with growing aircraft teardown activity for sustainable aviation initiatives.

LATEST TRENDS

Innovation in Materials Recycling and Adoption of Robotics are the Prominent Trends in Commercial Aircraft Disassembly, Dismantling & Recycling Market

Research and development in materials science are enabling the recycling of advanced materials used in aircraft manufacturing, such as composites and alloys. Innovations in recycling methods can lead to higher efficiency and lower costs. As per the reports, during March 2023, the aviation industry dumped more than 40,000 tons of end-of-life (EOL) composite material waste into landfills. HELACS (Holistic methods for the economical and environmentally friendly handling of the End of Life of Aircraft Composite Structures) is a Horizon 2020 – Clean Sky 2 project led by Aitiip, aimed at developing and demonstrating a comprehensive approach and new robotic platform for dismantling, aimed at recycling and reusing large composite parts from EOL aircraft.

Scheduled for completion in December 2023, HELACS announced initial results from the welding and dismantling of thermoplastic composites using induction and ultrasonic welding. Moreover, the company reported positive results in welding and disassembly using resistance welding.

- North America witnessed commercial aircraft disassembly, dismantling and recycling market growth from USD 2.28 Billion in 2021 to USD 2.58 Billion in 2022.

Many companies are focusing on developing new sustainable techniques for recycling composite materials in aircraft. For instance, in March 2022, SUSTAINair integrates two essential facilitating technologies for the upcycling of aerospace-quality materials. The initial involves hybrid repurposed laminate materials, allowing for extremely effective varying thickness. Such developments propels the commercial aircraft recycling and scrapping market across globe.

Download Free sample to learn more about this report.

DRIVING FACTORS

Circular Economy and Growing Reusable Capabilities of Aircraft Component to Boost the Market Growth

Circular economy is a production and consumption model that shares, leases, reuses, repairs, refurbishes, and recycles existing materials and products for as long as possible. This extends the product lifecycle. In practice, this means minimizing waste. At an aircraft’s end of life, its materials are maintained as economically as possible through recycling. These can be used productively several times, creating further added value for commercial aircraft disassembly, dismantling & recycling.

For instance, in June 2023, Capgemini and Amazon Web Services (AWS) announced the launch of Lifecycle Optimization for Aerospace. The platform aims to accelerate the adoption of “Circular Economy” practices in the aviation industry by automating inspection processes, optimizing lifecycle analysis of aircraft components, and guiding decisions to extend their lifespan. Several major companies in the aviation sector, including Air France and Safran, have participated in the development and will be among the first users of the platform.

The Aerospace Lifecycle Optimization Platform was developed by Capgemini and built on the AWS Cloud. Artificial intelligence and machine learning (natural language processing) services have been specifically developed and trained on data models, based on the ASD standard (Aerospace and Defense Industries Association of Europe). The platform consolidates historical operational data and rebuilds complete traceability of all aircraft component parts.

Such initiatives catalyze the market expansion across the globe.

Stringent Government Regulations and Growing Fleet of Retired Commercial Aircraft to Propel the Market Growth

Stringent regulations from governments are one of the key driving factors for commercial aircraft disassembly, dismantling and recycling as the pressure to convert to more environmentally friendly aircraft increases. The COVID-19 crisis led to the gradual retirement of relatively young aircraft, while older aircraft may remain in storage until they can be scrapped.

For instance, in August 2020, IndiGo, the biggest Indian domestic airline, successfully fulfilled the obligatory substitution of Pratt & Whitney (PW) engines with altered engines ahead of the 31st August cutoff date mandated by the aviation authority. The PW engines provide propulsion for the company’s Airbus A320neo group of aircraft.

IndiGo has 106 A320neo aircraft equipped with PW engines in its fleet, while GoAir has 43 such aircraft in its fleet. Each A320neo aircraft is equipped with twin engines. After a series of problems with the PW engines powering the Airbus A320neo, aviation regulator DGAC ordered IndiGo in October 2019 to replace 16 A320neo aircraft with PW engines. The deadline was further extended to the end of January, after the DGCA asked IndiGo to replace the engines of 97 Airbus A320neos in its fleet with modified engines, otherwise the PW-powered Airbus A320neos would be suspended by the regulatory body. Such regulations and safety concerns propel the global commercial aircraft disassembly, dismantling & recycling market growth.

RESTRAINING FACTORS

Composite Materials and Hazardous Materials Utilized in Aircrafts to Hamper the Market Growth

Composite materials such as carbon fiber reinforced plastics (CFRP) and also thermoplastics formidable pose a new obstacle for the recycling of aircraft. Thermoplastics are more efficient as the resins in thermoplastics are infinitely reusable as it is a reversible process. In thermosets, they are not easily recycled. These current technologies can be expensive and have restrictions on the capabilities to recycle composite materials.

For instance, composite materials from aircraft, automobiles, and industry are frequently burned or interred in landfills which are not feasible long-term options for the disposal of significant airframe components. For instance, according to Boeing, the tiniest of the Dreamliner family of aircraft, 787-8 measures 57m (186ft) from nose to tail and has a wingspan of 60m. Moreover, this type of material poses challenges in terms of recycling.

According to the Aircraft Fleet Recycling Association (AFRA) optimal methods for reusing and repurposing sophisticated materials utilized in constructing future-generation large aircraft such as the 787 and Airbus A350 have not yet been determined. Dealing with sophisticated aircraft materials removed from future-generation jets is a dilemma that has captured the focus of prominent aviation corporations.

SEGMENTATION

By Application Analysis

USM Segment Dominates the Market Due to Increasing Demand for Low-Cost Aircraft Aftermarket Parts and Components

By application, this market is categorized into disassembly & dismantling, recycling & storage, USM, and rotable parts.

The USM segment dominates the market share and is estimated to be fastest growing segment during the forecast period due to the increasing demand for low-cost aircraft aftermarket parts and components. USM (Used Serviceable Material) refers to aircraft parts and components that have been removed from an aircraft during maintenance, yet are still in a condition to be reused. These parts are thoroughly inspected, repaired if necessary, and certified for use in other aircraft. USM reduces the demand for new parts, offering a cost-effective solution for airlines and maintenance providers while contributing to sustainable practices within the aviation industry.

- The disassembly & dismantling segment is expected to hold a 0.77% share in 2022.

Rotable parts are components of an aircraft that are designed to be reused multiple times. Unlike expendable parts (which are replaced after a single use), rotable parts are removed, overhauled, and then reinstalled in aircraft during their operational life. These parts include items such as avionics, landing gear, and certain engine teardown components. The increasing demand for MRO services is anticipated to boost the market for this segment.

- The rotable parts segment is expected to hold a 28.13% share in 2022.

To know how our report can help streamline your business, Speak to Analyst

By Aircraft Type Analysis

Narrow Body Segment Dominates the Market Owing to Rising Aircraft Component Demand from Low-Cost Carriers

By aircraft type, the market for commercial aircraft disassembly, dismantling & recycling is segmented into narrow body, wide body, and regional jet.

Narrow body aircraft are commercial airplanes with a single aisle, typically seating passengers in a 3-3 configuration. These aircrafts are ideal for short to medium-haul flights and are widely used by low-cost carriers. This segment dominates the market and expected to be fastest growing during the forecast period owing to the growing demand for aircraft components from low-cost carriers.

Wide-body aircraft are larger commercial airplanes with multiple aisles and a significantly higher passenger capacity. These planes are used for long-haul flights and can accommodate a larger number of passengers. This segment is expected to register a significant growth due to the increasing demand for long-haul flights.

REGIONAL INSIGHTS

In terms of geography, this market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Commercial Aircraft Disassembly, Dismantling and Recycling Market Size, 2022 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market and was valued at USD 2.58 billion in 2022. This growth is attributed to the retirement of major fleet in this region. For instance, in October 2023, United Airlines, a U.S.-based airline, placed new order for 110 planes from Airbus and Boeing. The agreement orders 60 Airbus A321neos and 50 Boeing 787-9s, which would be delivered between 2028 and 2031. These orders are motivated by the United Airline's need to replace older aircraft by the end of the decade and to expand its operations at airports worldwide that are currently operating at full capacity.

Europe captured the second-largest market share in 2022. The regional market growth is owing to the presence of major players. For instance, in March 2023, EirTrade Aviation, an aviation asset management and trading company based in Dublin, will manage the dismantling and consignment of the aircraft. The two 10-year-old aircraft will be dismantled simultaneously off-site and parts are expected to be available by the end of 2023. The company has not disclosed the identity of the previous operator of the two dreamliners. Such developments across the region catalyze the growth of the Europe market.

Asia Pacific is the fastest growing region over the forecast period and held a significant share in 2022. This growth is due to the expansion of fleet by commercial airlines. For instance, in May 2022, Nano Aviation India Pvt. Limited inaugurated a first dismantling process at Chennai in India. Accessibility to ports and skilled workforce are the two major factor behind site selection at Chennai, India.

The Middle East and Africa market for commercial aircraft disassembly, dismantling and recycling is anticipated to witness significant growth in the global market during the forecast period. The regional growth is due to the increasing retirement rate of aircraft. For instance, in November 2021, Emirates signed a contract with UAE-based Falcon Aircraft Recycling in a pioneering initiative in which the airline's first retired aircraft A380 will be recycled and reprocessed. Extensive material recovery and reuse activities will be carried out entirely in the UAE, the airline's headquarters, further reducing the project's environmental impact.

The South American market is anticipated to witness moderate growth during the forecast period. The growing MRO spending and increased capabilities in aviation are expected to lead the market growth in this region.

KEY INDUSTRY PLAYERS

Key Players Are Focusing On Geographical Expansion Through Mergers & Acquisitions To Increase The Market Share

The global market share is concentrated with key players such as Aircraft End-of-Life Solutions (AELS) BV, Air Salvage International Ltd, Aerocycle, CAVU Aerospace, China Aircraft Leasing Group, Ecube and others. Major players are focusing on geographical expansion, emerging markets, mergers & acquisitions, and technological advancements to increase their market share. For instance, in October 2022, eCube, a company specializing in dismantling aircraft parts, inaugurated its inaugural disassembly center in the U.S. at the Coolidge Municipal Airport in Arizona. This new center would complement the company's existing locations in Castellón, Spain, and its main office in St Athan, U.K.

LIST OF KEY COMPANIES PROFILED

- Aircraft End-of-Life Solutions (AELS) BV (Netherlands)

- Air Salvage International Ltd (Gloucestershire)

- Aerocycle (Canada)

- CAVU Aerospace (Germany)

- China Aircraft Leasing Group (China)

- Ecube (U.K.)

- Eirtrade Aviation (U.K.)

- GA Telesis LLC (U.S.)

- TARMAC Aerosave (France)

- Vallair (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 - EirTrade Aviation, a global aviation asset management and trading company headquartered in Dublin, Ireland, invested in tools to provide comprehensive CFM56-3 aircraft engine dismantling capabilities. The company could provide this service with the CFM56-5A, -5B, -7B, -7BE engines at its Dublin facilities.

- April 2023 - AELS purchased the first expired Boeing 777. The acquisition was made in partnership with MTU Maintenance Lease Services, which purchased the GE90-115B engine. The aircraft made its final landing at Twente Airport in Enschede, Netherlands and would be disassembled by a professional AELS team at the AELS facility.

- March 2023 - Block Aero Technologies, a leading Aerospace 4.0 solutions provider, announces the addition of CAVU Aerospace. The partnership with CAVU marks Block Aero's entry into the aircraft dismantling segment of the aviation aftermarket. CAVU Aerospace is a reputable partner specializing in providing aircraft disassembly, dismantling, and recycling services throughout the U.S.

- December 2022 - GA Telesis, LLC (GAT) announces the discontinuation of three additional CFM56-5B engines, one CF6-80C2 engine, and one PW4056-3 engine before the end of the year. The engines are part of a pool of lease interests from the company's Asset Trading Group and would be managed for dismantling and redistribution by GAT's Flight Solutions Group (FSG).

- October 2022 - Unical Aviation Inc., a prominent supplier of airplane parts and components to the worldwide commercial aerospace industry, revealed today the purchase of CAVU's component repair operations (CAVU Component Repair LLC) from CAVU Aerospace. This acquisition would enable Unical to enhance its abilities in the third-party repair sector of its business. CAVU Component Repair LLC is an FAA-approved Part 145 Repair Station located in Mesa, Arizona, with a cutting-edge facility spanning 80,000 square feet for the repair of aircraft components.

REPORT COVERAGE

The market statistics report provides a detailed analysis of the market. It comprises all major aspects, such as R&D capabilities and optimization of the operating services. Moreover, the market research and analysis report offers market insights into industry forecast, supply chain analysis, market dynamics, regional analysis, Porter’s five forces analysis, competitive landscape of various companies profiled with market competition, and primarily highlights the key industry developments. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the global market growth over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2033 |

|

Base Year |

2022 |

|

Estimated Year |

2023 |

|

Forecast Period |

2023-2033 |

|

Historical Period |

2019-2021 |

|

Growth Rate |

CAGR of 6.20% from 2023 to 2033 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Aircraft Type

By Geography

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 6.74 billion in 2022.

The market is likely to grow at a CAGR 6.20% over the forecast period (2023-2033).

By application, the USM segment leads the market due to increasing demand for low-cost aircraft aftermarket parts and components.

The market size in North America stood at USD 2.58 billion in 2022.

Circular economy & growing reusable capabilities of aircraft component stringent and government regulations and growing fleet of retired commercial aircrafts are expected to drive the market.

Some of the top players in the market are Aircraft End-of-Life Solutions (AELS) BV, Air Salvage International Ltd, Aerocycle, CAVU Aerospace, China Aircraft Leasing Group, Ecube, and others.

U.S. dominated the market in 2022.

The use of composite and hazardous materials in aircraft may hamper the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us