Conversational AI Market Size, Share & Industry Analysis, By Type (Intelligent Virtual Assistant & AI Chatbots), By Technology (Machine Learning, Deep Learning, Natural Language Processing, Automatic Speech Recognition), By Deployment (On-premises and Cloud), By Business Function (Sales & Marketing, Operations & Supply Chain, Finance and Accounting, Human Resources, IT Service Management), By Industry (BFSI, IT and Telecom, Retail and e-Commerce, Education, Healthcare) & Regional Forecast, 2026-2034

Conversational AI Market Overview

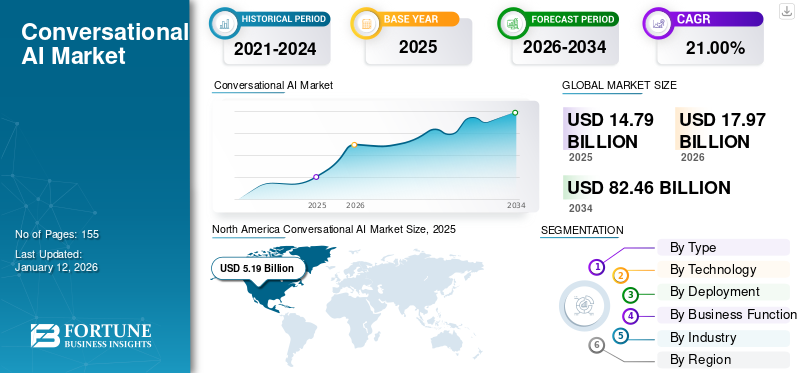

The global conversational AI market size was valued at USD 14.79 billion in 2025 and is projected to grow from USD 17.97 billion in 2026 to USD 82.46 billion by 2034, exhibiting a CAGR of 21.00% during the forecast period. North America dominated the conversational AI market with a market share of 35.10% in 2025.

Conversational Artificial Intelligence (AI) refers to a technology that enables machines to engage in natural, human-like conversations with users through text or speech interfaces. At its core, Conversational AI leverages various techniques, including Natural Language Processing (NLP), Machine Learning (ML), and deep learning to understand user inputs, generate appropriate responses, and mimic human conversation patterns.

The major factors influencing the growth of global conversational AI market include AI-powered customer support services, omnichannel deployment, and reduced chatbot development costs. AI-powered messaging and speech-based apps are rapidly replacing traditional mobile and web applications and expected to become a new mode of communication. Industry experts predict that by 2023, over 70% of white-collar workers will regularly interact with conversational AI platforms.

- According to the IBM Global AI Adoption Index 2022, approximately 40% of large companies are leveraging AI to enhance customer service, agent productivity, and create more personalized experiences for customers and employees.

The COVID-19 pandemic significantly accelerated the adoption of conversational AI. According to an industry study, 52% of companies increased their use of artificial intelligence in 2020 as a direct result of the pandemic. Globally, key players and government agencies started investing in conversational AI to make it compatible with various industrial platforms. For example, in April 2020, the French government launched AlloCovid, an AI-powered voice assistant service, across the country to help COVID-19 patients experiencing potential coronavirus symptoms. This initiative boosted the global conversational AI market share.

Download Free sample to learn more about this report.

GENERATIVE AI IMPACT

Generative AI to Aid Conversational AI Market Growth with More Human-like Interactions

The rising acceptance of generative AI presents major growth opportunities for conversational AI providers across the globe, enabling them to offer more personalized, efficient, and human-like interactions. Generative AI technologies, such as Generative Pre-Trained Transformers (GPT) models have demonstrated remarkable progress in understanding and generating natural language, enabling conversational AI to engage users in more contextually relevant and dynamic conversations. For instance, OpenAI’s GPT-3 model, with 175 billion parameters, has displayed the ability to generate human-like texts for a wide range of topics and contexts.

- October 2023: Rasa, a provider of conversational AI technology, announced the launch of its innovative Generative AI-based enterprise conversational platform. Rasa aims to minimize the complexity of building AI assistants while ensuring ease of use throughout the organization with an intuitive user interface.

Conversational AI Market Trends

Incorporating Emotional Intelligence into Conversational AI Solutions to Propel Conversational AI Market Growth

One major trend in conversational AI is the development of chatbots with emotional intelligence. These chatbots will be capable of recognizing human emotions and responding in a more empathetic manner. Chatbots with emotional intelligence will be able to understand complex human emotions, such as dissatisfaction, anger, and frustration, and adjust their responses to effectively handle challenging customer interactions.

Therefore, improving user satisfaction with these technologies is imperative for their successful integration. Researchers have been leveraging Artificial Intelligence (AI) and Natural Language Processing (NLP) techniques to impart emotional intelligence capabilities in chatbots. More recently, chatbots are also being used to provide social and emotional support in healthcare and personal lives.

Conversational AI Market Growth Factors

Rising Demand for AI-Powered Customer Support and Integration with Messaging Services to Boost Market Growth

The growing use of AI chatbots in messaging services is a major factor driving the demand for conversational AI solutions. With messaging platforms becoming the primary communication channels globally, businesses are realizing the potential of deploying AI-powered chatbots to interact effectively with customers. As of 2023, over 2.7 billion people worldwide use messaging apps, highlighting the extensive reach and significant impact of using these platforms for customer interactions.

Furthermore, integrating AI chatbots into messaging services allows businesses to connect with customers wherever they are, offering immediate and personalized assistance directly through their preferred messaging apps. According to IBM research, conversational AI can decrease customer service costs by up to 30%, showcasing the tangible economic advantages of incorporating conversational AI solutions into messaging services.

RESTRAINING FACTORS

Data Privacy Concerns and Lack of Awareness Regarding Benefits of Conversational AI Likely to Hamper Market Growth

It is important for businesses and consumers to understand the capabilities and benefits of conversational AI. Many are hesitant to accept these technologies due to a lack of awareness. Users often have privacy concerns as they are unaware of how conversational AI systems operate and handle their data. Furthermore, businesses may not realize the potential of conversational AI to improve customer experiences and operational efficiencies as they do not fully understand its capabilities.

Some businesses may believe that using conversational AI is too complex or expensive, while others may be concerned about job displacement or the loss of human touch in customer interactions. These misunderstandings prevent companies from realizing the full benefits of conversational AI.

Conversational AI Market Segmentation Analysis

By Type Analysis

Advancements in ML and NLP Technologies Boosted Demand for AI Chatbot Solutions

Based on type, the conversational AI market is bifurcated into Intelligent Virtual Assistant (IVA) and AI chatbots.

In 2024, the AI chatbots segment captured the largest conversational AI market share. Prominent developments in Machine Learning (ML) and NLP in chatbots is augmenting the segment’s growth. Chatbots are primarily used for gathering data. In addition, customers can interact with them to obtain information about products or services or to schedule appointments. Thanks to advancements in NLP (Natural Language Processing) technology, chatbots are now capable of understanding and generating language similar to humans. Machine learning algorithms and deep learning models have been essential in improving chatbot accuracy and contextual awareness. The AI chatbots segment is expected to lead the market, contributing 62.23% globally in 2026.

The IVA type segment is expected to experience the highest CAGR over the forecast period. Many conversational AI service providers are operating in the market and creating chatbots and virtual assistants. These assistants and chatbots come with limited user-personalized characteristics. For example, in September 2021, a new and innovative robot Astro was unveiled in the market. It is designed to assist customers in daily activities, such as monitoring the environment at home and keeping in touch with family members.

- In November 2022, Google LLC had expanded its AI chatbot Bard across Europe and Brazil, marking its biggest expansion since its launch in February. Bard now competes with Microsoft's ChatGPT.

By Technology Analysis

Demand for Automatic Speech Recognition (ASR) to Rise to Enhance Transcription Results

By technology, the conversational AI market has been classified into Machine Learning (ML), deep learning, Natural Language Processing (NLP), Automatic Speech Recognition (ASR), and others.

The automatic speech recognition technology segment is expected to witness the highest growth rate during the forecast period. Automatic Speech Recognition (ASR) facilitates the development of speech user interfaces for conversational AI. ASR solutions convert spoken inputs into text, enabling natural and intuitive interactions and providing hands-free and eyes-free experiences for users. However, variations in pronunciation, background noise, and other factors can lead to inaccuracies in transcriptions. To improve accuracy and determine the level of confidence in the recognized speech, mistake correction algorithms and confidence scores are utilized.

In 2024, Natural Language Processing (NLP) gained the highest market share. NLP involves processing large amounts of natural language data and streamlining documentation processes to improve efficiency and accuracy. For example, SAP SE developed applications with enhanced automated capabilities, such as automatic translation and the Incident Solution Matching (ISM) service based on machine learning and AI advancements. NLP also includes speech recognition systems that can translate spoken words into written text and enable voice-based interactions with users through conversational AI systems. The natural language processing (NLP) segment will account for 38.5% market share in 2026.

By Deployment Analysis

Adoption of Cloud-based Solutions Increased Owing to Regular Improvements in Them

By deployment, the conversational AI market has been classified into on-premises and cloud. The cloud deployment segment dominated the conversational AI market share in 2024 and is expected to witness the highest growth rate during the forecast period. The segment’s growth is due to the increasing importance of cloud-based technologies and services in businesses across the world. Cloud conversational AI platforms are regularly updated with new features, improvements, and advancements in machine learning and natural language processing. The global availability of cloud conversational AI technologies allows companies to support clients in different time zones and geographical locations, expanding their impact and reach. The cloud segment is anticipated to hold a dominant market share of 59.19% in 2026.

The on-premises segment held a decent market share in 2024 due to the flexibility this deployment model provides customers, as transactions are only done once. Costs are relatively lower compared to cloud expenditures. Some sectors, such as healthcare, banking, or government have strict rules and concerns about data privacy and security. Organizations can have complete control over their data and reduce the risk of data breaches or unauthorized access by using on-premises conversational AI, which is driving the growth in this segment.

By Business Function Analysis

Improved Customer Experience Increased Acceptance of Conversational AI among Sales & Marketing Teams

Based on business function, the conversational AI market is categorized into sales & marketing, operations & supply chain, finance and accounting, Human Resources (HR), and IT Service Management (ITSM). The sales & marketing segment accounted for the largest conversational AI market share in 2024. Given the rapid advancements in AI, the industry can no longer afford to ignore or delay AI education and training across every marketing and sales function. By harnessing natural language processing and machine learning, conversational AI enables sales teams to engage with customers more effectively, resulting in more personalized and impactful AI sales conversations.

- In October 2023, Invoca, a provider of conversation Intelligence AI for sales and marketing, had introduced Signal AI Studio and announced enhancements to its Signal AI suite. This solution empowers businesses to quickly build custom AI models that automatically unlock insights from phone conversations. Invoca AI enables contact center and digital marketing teams to collaborate in generating revenue growth for businesses that acquire members, patients, or customers over the phone.

It is projected that the human resources segment is likely to experience the highest growth rate in the coming years. AI technologies present significant opportunities to enhance HR functions, including recruiting & talent acquisition, self-service transactions, reporting, access policies & procedures, and payroll. For example, the HR cloud solution SuccessFactors (SF) incorporates conversational AI capabilities through SAP Leonardo ML Foundation, Recast.AI, ServiceNow, Microsoft Azure/Skype, and IBM Watson, showcasing how cognitive engines can assist employees in making crucial day-to-day decisions in the workplace.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Importance of Patient Engagement in Healthcare Sector to Augment Demand for Conversational AI

Based on industry, the conversational AI market is segmented into BFSI, IT and telecom, retail and e-commerce, education, healthcare, media & entertainment, automotive, and others. The healthcare segment is likely to record the highest CAGR over the forecast period. This industry is currently undergoing exponential growth, thereby revolutionizing patient care and administrative processes. According to industry studies, AI in healthcare could potentially save the U.S. healthcare economy around USD 150 billion annually by 2026. By enhancing human capabilities and activities, conversational AI for healthcare has the potential to bring significant improvements in healthcare accessibility, costs, and quality.

- According to industry experts, the global annual cost savings by using chatbots in healthcare reached USD 3.6 billion in 2023. This showcased their potential to significantly reduce the workload on medical staff and improve operational efficiency.

The retail and e-commerce segment held the major conversational AI market share in 2024. Conversational AI allows companies to offer chatbots and virtual assistants for 24/7 customer service. According to Tovie.ai, a provider of chatbots and conversational AI solutions, the global spending on conversational e-commerce channels is expected to increase to about USD 290 billion by 2025. Conversational AI helps reduce response time and enhance customer satisfaction by delivering immediate and personalized support.

REGIONAL INSIGHTS

The global conversational AI market scope is classified across five regions, namely North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Conversational AI Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2024, North America held the highest conversational AI market share driven by the widespread adoption of emerging technologies and increasing need for customer support services powered by AI. Most organizations in North America are investing in technological advancements to meet their customers' requirements. The growing health consciousness among the population is also fueling the demand for conversational AI. Additionally, the region’s healthcare industry is expanding to implement Augmented Reality (AR), Virtual Reality (VR), robotics, and AI. The U.S. market is estimated to reach USD 4.28 billion by 2026.

- In 2023, there was a significant increase in the number of regulations related to AI in the U.S. as compared to the last five years. 25 new AI-related regulations were introduced in 2023, a rise from just one in 2016. In that year alone, the total number of AI-related regulations grew by 56.3%.

Asia Pacific

Asia Pacific is expected to experience the highest CAGR fueled by the increasing awareness among organizations about innovative customer support services and technologies. Additionally, there is rising acceptance of conversational AI in the retail industry, surging development in the e-commerce sector, technological advancements in consulting & healthcare, and progressing internet penetration in this region. 2023 witnessed a surge in AI usage for customer support, characterized by trends, such as generative AI, intelligent routing, proactive support, and social media chatbots. The Japan market is forecast to reach USD 0.77 billion by 2026, the China market is set to reach USD 0.93 billion by 2026, and the India market is likely to reach USD 0.62 billion by 2026.

Europe

Europe’s conversational AI market share is being driven by the expansion of industry 4.0 and IoT. The conversational AI market is expected to experience significant growth due to the increasing use of omnichannel methods. Additionally, engaging customers through social media platforms is projected to create lucrative opportunities for key players in the conversational AI market during the forecast period. The UK market is expected to reach USD 0.96 billion by 2026, while the Germany market is anticipated to reach USD 1.07 billion by 2026.

- In April 2024, Russian bank Sberbank introduced its own conversational Artificial Intelligence (AI) platform called GigaChat. This move is part of Sberbank's efforts to reduce Russia's dependence on imports and expand its services beyond traditional banking. GigaChat is positioned to compete with OpenAI's ChatGPT.

Middle East & Africa

The Middle East & Africa is experiencing continuous growth in the use of conversational AI. The region has a young and tech-savvy population, and rise of digital banking and e-commerce has created a demand for quick and efficient customer service. Furthermore, Brazil, Argentina, and Chile are developing new AI regulations and organized plans to improve the use of advanced technologies in the region.

Competitive Landscape and Key Developments

Strategic Collaborations and New Product Launches/Enhancements by Key Players to Increase Their Market Presence

The global conversational AI market is fragmented, with the presence of several Small and Medium-sized Enterprises (SMEs) and large companies, such as Microsoft, Google, Cognigy, Amelia, and IBM. These players are adopting various strategies including contracts, agreements, acquisitions, and mergers. They are also focusing on implementing more advanced technologies in conversational AI applications and creating, testing, and launching new and improved solutions.

- In March 2023, Nuance Communications, Inc., a Microsoft company, announced Dragon Ambient eXperience (DAX) Express, a fully automated, workflow-integrated clinical documentation application that combines ambient and conversational AI with OpenAI's GPT-4 model.

List of Top Conversational AI Companies:

- Google LLC (U.S.)

- Microsoft Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Cognigy (Germany)

- Amelia US LLC (U.S.)

- Avaamo (U.S.)

- Omilia Natural Language Solutions Ltd. (Cyprus)

- Kore.ai Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2025 – Humain, a Saudi-based technology company, launched Humain Chat, a conversational platform powered by the Allam language model. The app, built around Islamic values, supports both Arabic and English, including multiple regional dialects, and is currently available only in Saudi Arabia.

- July 2025 – xAI rolled out Grok 4 and Grok 4 Heavy, upgraded versions of its conversational platform. The release included performance improvements and new anime-style “Companions.” Grok 4 was made available with unlimited free access for a limited time, while free users were restricted to two prompts every two hours.

- June 2025 – Ola Krutrim introduced Kruti, a multilingual assistant designed to handle everyday tasks such as booking taxis and ordering food. Kruti works with both text and voice, supports several Indian languages, and integrates with popular services like Blinkit, Swiggy, and Uber.

- May 2025 – SoundHound launched Amelia 7.0, allowing businesses to deploy more advanced voice-driven assistants. In the same month, the company partnered with Allina Health to improve patient engagement and worked with Acrelec to introduce a conversational drive-thru ordering system.

- February 2025 – Tesla partnered with DeepSeek and ByteDance to launch Hey Tesla, a voice assistant for its electric vehicles in China. The assistant helps drivers with navigation, entertainment, and in-car functions.

- April 2024 – Amazon Web Services announced the general availability of Amazon Q, a generative Artificial Intelligence (AI)-powered assistant designed to utilize internal company data and accelerate software development. Amazon Q brings its advanced generative AI technology to Amazon QuickSight, AWS’ unified Business Intelligence (BI) service built for the cloud.

- February 2024 – Amazon had introduced Rufus, an AI-based shopping assistant, to revolutionize user interaction with its platform, providing a conversational and personalized shopping companion.

REPORT COVERAGE

The research report includes the analysis of prominent regions to get a better knowledge of the industry. Furthermore, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes on the market’s drivers and restrictions, allowing the reader to obtain a thorough understanding of the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 21.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Technology

By Deployment

By Business Function

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 14.79 billion in 2025.

Fortune Business Insights says that the market is expected to reach a valuation of USD 82.46 billion by 2034.

A CAGR of 21.00% will be observed in the market during the forecast period of 2026-2034.

By type, the AI chatbots segment dominated the market share in 2025.

Rising demand for AI-powered customer support and integration with messaging services are accelerating the growth of the market.

Google, Microsoft, Amazon Web Services, IBM, and Cognigy, among others, are the top players in the market.

Asia Pacific is expected to record the highest CAGR.

By industry, the healthcare sector is likely to register the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us